Oil Markets Open Asia Session with a 3% GAP as U.S. Strikes Iran Over the Weekend and Hormuz Closure Threat Emerges

ACY Securities - Luca Santos

ACY Securities - Luca Santos

The global financial system woke up to a new geopolitical reality on Monday 23/06/2025 after the United States launched targeted airstrikes on Iran’s nuclear infrastructure over the weekend.

In a direct escalation that now places global energy security at the centre of market concerns, Iran has threatened to close the Strait of Hormuz a narrow maritime passage responsible for approximately 20% of the world’s daily oil shipments.

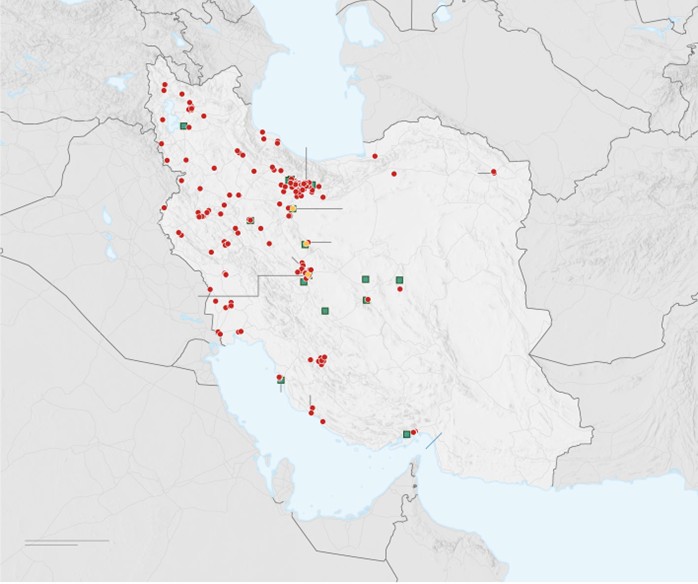

On Red is possible to see where Israel strikes Iran, on yellow we can see US strikes and in green we have the nuclear facilities

While tensions between the U.S. and Iran have simmered for years, this marks a dangerous turning point.

The strikes, reportedly ordered by President Trump, were focused on underground nuclear facilities including Fordow, Natanz, and Isfahan in what many analysts interpret as a pre-emptive effort to degrade Iran’s capacity to develop a nuclear weapon.

This was not a symbolic move; it was a calibrated strike, utilising bunker-buster munitions designed to penetrate deeply fortified installations.

For markets, the implications are immediate, but also deeply structural. WTI crude spiked over 2.5% in early Asian trade, and the FX market quickly shifted into risk-off mode, punishing risk-sensitive currencies and fuelling demand for safe havens like the U.S. dollar and the Swiss franc.

While the Strait of Hormuz remains open, Iran’s threats to close it have reintroduced a significant risk premium into the energy market a threat that global shipping and financial markets cannot afford to ignore.

Oil Supply Disruption Risk Grows as Iran Threatens Strait of Hormuz Closure

The Strait of Hormuz is a lifeline for global oil supply. Around 17–20 million barrels of oil pass through it daily, and while alternative routes exist, they are limited in capacity and higher in cost.

Iran’s political establishment particularly its parliament has called for closure in retaliation to the U.S. strike, though no formal action has been taken.

The Supreme National Security Council and Supreme Leader Ayatollah Khamenei would need to authorise any such move.

Still, the threat alone amounts to a major geopolitical shock. Even if no closure takes place, the mere possibility of disruption is enough to send shockwaves through the oil market.

Insurance costs on tankers rise, shipping routes may need adjustment, and futures traders begin to price in real supply constraints.

This shift comes at a time when the world’s spare production capacity is limited, and geopolitical tensions are already stretching the energy supply chain.

The market must now reprice oil based not only on the loss of barrels but on the risk premium associated with disruption to maritime transit a theme I previously explored in The Israel-Iran Conflict and Oil’s Price Shock.

How the Conflict with USA and Iran Are Impacting Currency Markets and the USD

Currency markets are reacting predictably to the rising geopolitical tensions between the U.S. and Iran.

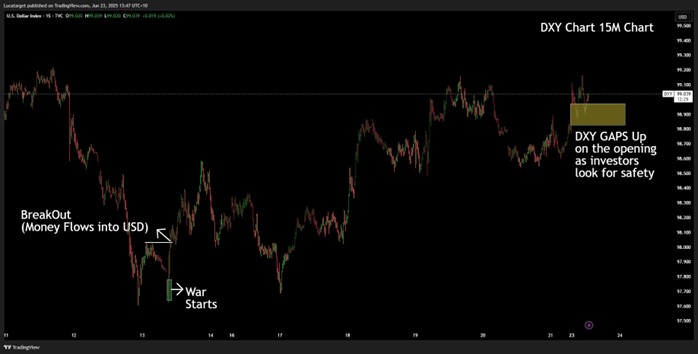

Following the weekend’s military strikes and Iran’s threat to close the Strait of Hormuz, safe haven flows have strengthened the U.S. dollar (DXY) , while risk-sensitive currencies like the Australian dollar (AUD) and New Zealand dollar (NZD) have come under pressure.

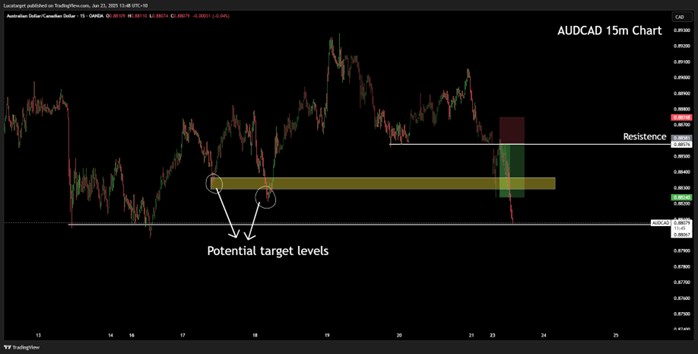

Meanwhile, the Canadian dollar (CAD) is finding support, reflecting its positive correlation to rising oil prices.as we can see against the AUD.

The USD is regaining strength as investors seek refuge in the world’s most liquid and secure currency amid global uncertainty.

This is a typical response to crisis events, as I’ve discussed in both USD Safe Haven: Middle East Tensions and The FX Truth About War and USD.

Despite the severity of the news, volatility remains contained at least for now. The market likely priced in some form of U.S. military response, given the clear signals from President Trump in the days prior.

What happens next including whether Iran follows through on its Hormuz threats or retaliates militarily will define whether this FX re-pricing deepens or stabilises.

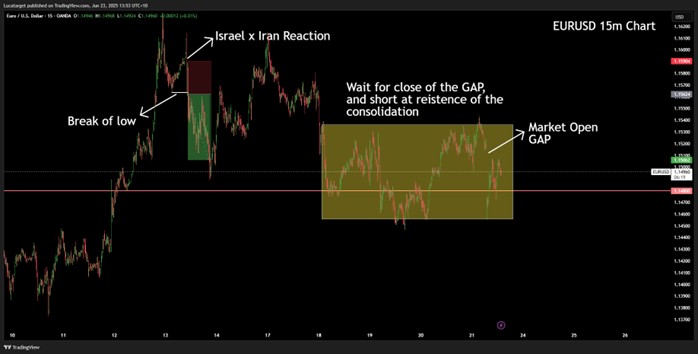

The euro is especially vulnerable. As an energy-dependent economy, Europe is exposed to both rising oil prices and slowing growth, a combination that could strain consumer spending and weigh on industrial output.

The European Central Bank’s policy options are constrained in this environment, which puts EURUSD under further pressure in the weeks ahead as the U.S. dollar continues to benefit from capital inflows and yield advantage.

Trade Ideas: Positioning for a Crisis-Driven Market

This environment calls for a momentum-based tactical approach. With energy markets tightening and risk appetite retreating, here are three core trading ideas that align with the evolving macro landscape:

1. Long WTI Crude Oil (WTI)

The most direct trade on supply risk is crude itself. Any pullback should be viewed as a buying opportunity, particularly if Iran escalates or the threat of Strait disruption remains in place. Even without full closure, the market is now pricing in physical risk which creates a fundamentally bullish environment for oil. There is a GAP that will have to be closed in the coming days, it’s a good opportunity to watch for longs when that happens.

2. Short AUDCAD / Short NZDCAD

Risk-off flows and oil-driven CAD strength create a favourable setup for these crosses. Australia and New Zealand are both sensitive to global growth risks and have limited geopolitical insulation. Meanwhile, the Canadian dollar benefits from the oil spike. Short AUD/CAD or NZD/CAD allows traders to capture the divergence between risk sentiment and commodity exposure.

3. Short EURUSD

This trade reflects the growing macro imbalance between the U.S. and Europe. The Eurozone is more vulnerable to rising energy costs and lacks the fiscal and monetary flexibility of the U.S. As oil prices rise and inflation pressures mount, the ECB faces a dilemma — while the USD continues to benefit from capital flows and yield differentials. This trade aligns with the themes discussed in USD Strength and Macro Divergence.

To be clear, the Strait of Hormuz has not been closed, but the risk of closure is credible and live. The market is no longer trading purely on fundamentals it’s reacting to the geopolitical risk premium, supply shock potential, and the fear of escalation.

As I outlined in Global Events Impacting Financial Markets, geopolitical catalysts don’t need to fully materialise to move markets the threat itself is often enough. With energy security once again in the spotlight and volatility elevated, traders should stay alert, maintain macro awareness, and approach the week with strategic flexibility.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.