oneZero - Last Look and 'Data Democratisation'

A discussion with Andrew Ralich, CEO of oneZero, on Last Look data tools now available to oneZero's clients

October 04, 2021 - ‘Last Look’ has been in the headlines again as the FX industry’s self-regulatory body, the Global Foreign Exchange Committee (GFXC), published its most recent guidance on the practice in August. As part of this guidance, the GFXC also stated that it is, “strongly encouraging liquidity providers and platforms to provide information on their trading practices and operations, including for last look, by completing a Disclosure Cover Sheet." In other words, LPs are being asked to admit to their practices and to explain why.

The Global Code’s Principle 17 addresses the practice of Last Look and states, “Market Participants employing last look should be transparent regarding its use and provide appropriate disclosures to Clients........A Market Participant should be transparent regarding its last look practices in order for the Client to understand and to be able to make an informed decision as to the manner in which last look is applied to their trading.”

The closing paragraph of Principle 17 notes that, “It is good practice for Market Participants (LPs) to be available to engage in a dialogue with Clients (Liquidity Consumers – LCs) regarding how their trade requests have been handled, including the appropriate treatment of information associated with those trade requests. Such dialogue could include metrics that facilitate transparency around the pricing and execution of the Client’s trade requests and assist a Client in evaluating the handling of its trade requests in order to evaluate whether the execution methodology continues to meet its needs over time.” LPs have, until very recently, been the only party in the relationship with their Liquidity Consumers to have the detailed information to facilitate these conversations. The onus has been on them to produce the analytics around which these conversations take place.

Tools have now been made available to Liquidity Consumers to redress the balance. In September, FX and multi-asset technology provider oneZero announced analytics as part of its Data Source product that aids the implementation of the recommendations set out in last month’s GFXC Report on Last Look. These new tools aim to facilitate more bilateral, rather than one-sided, conversations, a process that oneZero calls "Data Democratisation".

The additional capabilities that are available to oneZero clients are the result of 18 months of focused R&D by the company into this area. I recently discussed the new analytical package with the joint Founder and CEO of oneZero, Andrew Ralich, to understand more about the drivers to produce it and how the user base may benefit from it. Also, perhaps critically, how LP and consumer behaviour may change as a result.

Sam Low (LiquidityFinder): Hi Andrew. Good to speak with you today. Can you please give a little background to LiquidityFinder’s readers on the new analytics package announced by oneZero recently and what drove this innovation?

Andrew Ralich (oneZero): Hi Sam. Yes sure. As a provider of real time hedging risk and added aggregation solutions for over a decade, to create data as a result of this platform is a natural aspect of building a software business in financial markets. Building a data ecosystem, having open and transparent ways to format data consistently across clients;, having frameworks that protect client data that allows them to engage partners beyond oneZero, and allowing them to tie data back into the real time decision making in the platform, these are all forefront concepts as we're looking to innovate with our legacy client franchise and as we're making massive strides in the institutional space. This is as a result of some of the hard work Phil Weisberg and his team have been doing.

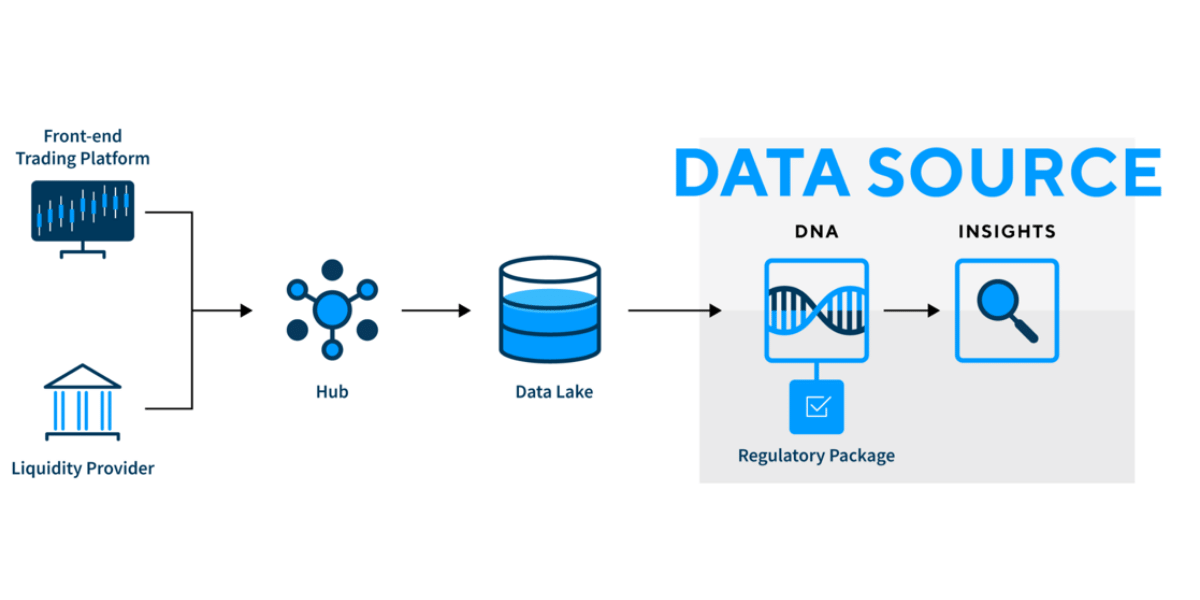

SL: What you have now is something a little more tangible than other basic reporting fill-rate type analytics in the sense that you can show the opportunity cost, and can add a monetary value, to the impact of last look and hold times. Could you describe a little bit more about what you are doing that is different?

AR: We record every tick that comes from every LP into our EcoSystem. And we're able to use that really complex and dense dataset to help drive some deep observations in terms of how customers can run their business and predict the future of their business. And then, the last piece of the puzzle, is tying that back into the real time system.

A real time understanding of how the markets are moving, how client behaviour is reflected against the market, are providing indicators to brokers, their LPs, and to their clients. All of this is seen in terms of how the broker can have open conversations to optimise their business across the board. This is how things are really changing.

Not all of these analytics in and of themselves are new. We didn't invent the concept of looking at things like cost of rejects, but the way we're able to present this data, the transparency that we are able to provide, how its laid out, how it's orchestrated, and then creating a level playing field for having a bilateral conversation, having an LP and a broker be able to look at the same data and understand and have a conversation. This is where we are breaking new ground.

I think a lot of how data has been used in the past has been, historically, a very one sided conversation. LPs and banks had the big quants and the big data systems to be able to look at mark-outs and things like that, and would often present that data to the broker for discussion. Now, by facilitating a bilateral conversation, it's much easier to look at these things from both sides and come to better conclusions about how to optimise these relationships.

SL: Are LPs now a little bit concerned about what they may be exposed to with this data?

AR: I think exactly the opposite. I think if I'm an LP and I now understand that a broker using oneZero’s aggregation and risk technology understands more about the impact of their client flow and their trading, and are able to use our real time tools to help segregate and identify the flow, they can actually provide more complex liquidity to the broker.

So rather than a one-size-fits-all stream, that's based on a one-sided data conversation, now this opens up the ability to say, hey, maybe this client who tends to trade larger size, tends to trade on this pattern, is better for a full amount stream - a specifically constructed vector of liquidity, and not necessarily our blended feed, for example.

So, it's about facilitating conversations around right-sizing the needs of the broker and their clients to appropriate liquidity. If I'm an LP, I'm going to be happier knowing that I don't have to assume the broker is going to blindly send any flow down a specific stream

SL: How detailed are your analytics? Does it allow analysis to the end-user level?

AR: We have a very configurable and highly adaptable system. So depending on what type of entity we're dealing with, we have all sorts of complex tagging that can go on. And obviously, anytime you talk about data confidentiality, and understanding where there is information that should be shared, and where there is information that shouldn't be shared, is a really important part of the conversation.

So we open up the opportunity for our brokers to be able to tag, to be able to tag anonymously, or to be able to not tag at all. These are all just components of the conversation that they can use to have a more open dialogue, but at the same time they also know that they're in control of their data.

SL: If a broker has a client whose flow is considered by an LP to be “toxic” (using the term broadly), and they are getting rejected, it's absolutely fair that an LP should use some sort of hold time as a defence mechanism against that kind of flow. If that flow is bundled up within a broker's volume towards an LP, then the rest of the clients of that broker will suffer. So the toxic clients are spoiling the conditions with which the LP can treat that broker. So, if the broker can segregate that more aggressive flow into another stream that fits them, then the LP is happy, the broker is happy, and maybe the client gets better fills on the type of stream that is appropriate to him. This is what your analytics package offers?

AR: That’s a perfectly astute way to look at it. I take it one step further and say, in 2021, we have the capabilities and horsepower in infrastructure and available data analytics platforms, to be able to talk a little bit more granularly than this binary concept of, “is a client toxic or not toxic?” I think that's a very antiquated concept, given there's so much variety and innovation happening in how liquidity can be constructed.

So, within a stream designed for retail trading flow, large order tickets that are relatively benign, might appear to be, in a binary classification, “toxic”. It's not necessarily predatory flow - it's just not right-sized to certain types of stream.

The way our analytics are looking at things is not so much about “good”, “bad”, “toxic”, “not toxic”, but understanding the characteristics of flow and then facilitating a conversation about what ‘right-size’ is that flow.

It’s important to note that we are not a counterparty. We have never taken a risk-position in this space. And we don’t intend to. We are a market orchestrator and technology facilitator. We don't get into the conversation of hold times or last look. We get into the conversations around understanding that there's a variety of ways to manage risk. And that starts with how a stream is constructed and what the intended use of that stream is. And then building from there different market concepts and understanding what types of characteristics of flow exist within an incoming stream of orders.

If you're at oneZero, I say this a lot: I always think of things as a spectrum….it's not “toxic”/”non toxic”. There are varieties, in multiple dimensions, of interacting with a liquidity pool. And it's just all about having that information on the table and both sides and being able to have a conversation.

SL: So you are facilitating a longer lasting relationship between consumer and provider which is definitely something the industry needs. End clients often do feel misunderstood and it seems that your data tools can clear up misunderstandings and allow end consumers to be supplied with the right type of streams.

The press release mentions pre-aggregation adjustments. What it really implied to me was that if the track record of one LP is kind of worse than another, but everything else being equal, in terms of price, can you prioritise the order to one LP over another based on past performance?

AR: Phil Weisberg used an analogy where he said “it’s all about the blend”. If somebody doesn't like a certain type of wine, it might not be that the producer is bad, there's just some type of grape or tannin that made it into that batch that they didn't like.

And I think as testament to oneZero’s roots, as a technology company, and software with a very high efficiency, we actually have the capability to allow brokers to create many different blends within the system and combine different streams. Again, I like to not make it a one-sided thing. It's not that there's a ‘bad LP’ or a ‘good LP’ or ‘bad flow’ or ‘good flow’. I think there's a right combination of thoughtful and constructed streams coming from LPs that, blended together, can serve a certain need of a client.

And when you put something into a pool, that's not meant for that, it can create tension in the relationship. In some cases, or with some legacy approaches to this, there were technology and performance limitations that existed in incumbent providers in the industry that made it difficult to have too many blends. There's a computational complexity to each of those blends; and the more you add, the more strain you're putting on the system.

We've invested a lot in performance and helping brokers understand the performance characteristics of their system. Therefore, they can look, tune and create the right-sized amount of blends across their entire client base, and use data to drive decisions on not only who should be dealing with which blend of liquidity, but also, on the flip-side, brokers can constantly adapt and right-size those pools of liquidity to make sure they're constructed from the right constituent parts.

I think the concept is broader than just prioritising because of one dimension of last look or another. oneZero has the ability to add mark-up at various different stages of a quote or order’s journey through the system. And doing that pre-aggregation is often a way to weight the overall relationship with the LP.

This can be for a variety of factors. It can be based on their approach to execution; it can be based (and oftentimes is based) on the cost of clearing with that provider. You may have different prime broker routes to different LPs. So in an aggregator, priority is organising a book of liquidity by price and adjusting your reflection of an LPs price based on how you interact with them. All based on a data driven analysis.

SL: In your recent press release, there is the implication that there is dollar value given to the opportunity cost of rejects. How does that work? Is there actually a dollar -value that ticks alongside an LP’s reject history?

AR: That's a great question. And that gets back into this evolution of the data that we're able to store and use retroactively for these analytics. In the first generation of data and analytics for the FX aggregation space, a lot of the story was about trading. Everybody keeps trade records, they're necessary for regulatory purposes. But capturing the full time series, every quote that comes from the LP, was a high bar. You can't just stick that in an SQL database and run a query against it. It would make your infrastructure fall over

So what we are able to do is leverage the scale and elasticity of things like the cloud, and store that data in perpetuity, and be able to make retroactive decisions that understand exactly what happened in the market, following an event like a trade.

So the things like dollar figures, things like market impact, things like cost of rejects, all come from the simple ability to be able to look back and really understand, at any given point in time, what the context of a stream, a blend of liquidity mixed with incoming taker flow, would have resulted in. That gives us the power to present that data in a very transparent and inarguable way. “This is the data that was in the system”. We captured it. It’s a snapshot of time.

**SL: So you can actually give a dollar-value to the end-user? **

AR: Yes. The user can understand the dollar value in terms of how their trade would have done in the market over a period of time, and that could be looked at in a way that a position that wasn't done, has a dollar value in terms of a missed opportunity.

SL: What has been the reaction so far from consumers and LPs on this so far. What’s the feedback?

AR: What we continue to hear is that the democratisation of access to transparent, accurate and deep analytics on flow facilitates a better conversation and ends up as a better place for everybody. Being a neutral entity and a market orchestrator is a very different thing than being a venue, an exchange or a counterparty. We are not making decisions on behalf of our clients. We are not shifting parties, we're not moving feeds. All we're doing is bringing two parties to the table in a way that they can have an open conversation.

SL: In terms of cost for the service, is it an additional cost to have this analytics package?

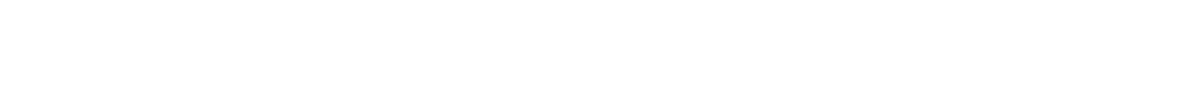

AR: So you have our real time system, which has various capabilities out of the box to blend and manage liquidity. And then on the data side, we have our Data Source product, which is made up of three categories.

We have access to the raw data, which is our DNA offering. If a broker wants to do their own analytics, they have the ability to get access to that data at its most granular form.

We have our Insights product, which are our analytics, and curated reports and conversation starters that come as a result of our own analytics from that data.

And then alongside that, we recognise that there's so much you can do with the scope of data, so we're building a partnership network with companies who can provide interesting and value add analytics on top of that same curated data. The framework we have put in place has a permissioning structure that allows clients to turn on access to whomever, from the accepted list, they like, knowing that they are from our list of trusted partners.

So it's kind of a three-fold approach that allows brokers to maximise the value of the data depending on exactly what they're looking for.

**SL: Is the target market for this the retail FX broker? I'm assuming you want to send this down to all of the institutional clients you've got as well. **

AR: That's a great question. When I use the word ‘democratisation’, I really do mean ‘everybody’. So, for the retail broker, it's a conversation around understanding some things that have existed in the institutional space for a long time. Having a retail broker capable of looking at mark-outs, and understanding them, and demystifying the concept of market impact is something that's innovative in this space.

In the institutional space, the innovation really comes when we're taking this a step further, allowing those insights to feed directly back into pool-construction and counterparty relationships. Retail doesn't tend to operate on a prime-brokerage basis. Their LPs also tend to be their credit providers. That doesn't mean the analytics aren't useful there. It means you’ve got to curate and orchestrate the conversation somewhat differently.

In the institutional arena, the complexity that exists as a result of dealing through a prime broker, and having a broader array of available liquidity, means you can have a more complex discussion. This necessitates and facilitates a more complex set of analytics. We are able to do both.

I think in both cases, everybody benefits. At the end of the day, putting the wrong flow down the wrong pipe, whether it's to a prime-of-prime (who's also your credit provider) or to 30 different bank streams in aggregation, that’s the same analytic capabilities you permutated slightly differently depending on the credit and liquidity combination has the same end result: the right flow goes down the right path, and everybody's happy - and there's no mismanaged expectations.

SL: Is there still a marketplace for this amongst the retail FX broker community?

AR: I think our position in the retail space is relatively ubiquitous and well established at this point, and it continues to be a market that's very important to us. But the real area where we're making the biggest strides these days in terms of innovation, in terms of new business, in terms of adoption of these technologies, is based on this injection of incredible experience and thoughtfulness that we've done at the top of the business over the last two or three years.

We've added Phil Weisberg, who's running that division. To build the team further, we've added Jamie Rose, who is forging deep relationships with existing clients so they can leverage our products effectively, Stuart Brock, leading institutional sales to expand our network, bringing experience both on the sell side and their vendors, and Mark Reider, who recently joined us from Refinitiv, has successfully built derivative trading, risk management and back office systems for Tier 1 banks and multi-dealer portals. We’ve been able to bring together expertise that understands the institutional market microstructure and oneZero technology that's always been known for being highly performant, resilient and efficient which is proving to be a very powerful platform for innovation at a rapid pace.

SL: Well thank you for your time today Andrew and for sharing more information about oneZero's analytics package.

AL: You are very welcome Sam. It's been a pleasure.

To request more information about oneZero's data product, please visit their website and book a demo, here.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.