Political Risk, Central Bank Ambiguity, and the Summer of Uncertainty

ACY Securities - Luca Santos

ACY Securities - Luca SantosThis week, the global currency markets are entering what could be a critical inflection point. A confluence of political instability, central bank opacity, and softening economic prints is forcing participants to reassess where risk is truly priced and where it’s simply presumed.

Yen in the Eye of a Political Storm

The Japanese yen began the week with renewed strength, driven not by economic momentum but by escalating political tension. Leadership challenges are destabilizing the status quo just as Tokyo enters crucial negotiations with Washington. The currency surged briefly on expectations of continuity, but those gains may prove short-lived if deeper fractures within the ruling coalition lead to a sudden leadership vacuum.

Political instability has a long history of amplifying volatility in yen crosses, particularly when coupled with uncertainty around fiscal commitments. With key government figures under pressure and confidence in policy direction wavering, the yen could remain reactive to headlines rather than macro data. Traders should remain alert to signs of broader shifts in fiscal stance, especially if a new leadership team emerges.

The Dollar’s Double Life: Soft Data, Strong Demand

In the U.S., the dollar faces an unusual paradox. Structurally, it continues to benefit from vast capital inflows especially from foreign buyers seeking relative yield stability and equity exposure. But tactically, the greenback is under pressure. Yields have softened, the equity rally shows signs of exhaustion, and political commentary is starting to inject noise into the policy narrative.

This week’s focus will be on Fed Chair Powell’s midweek remarks, which despite the blackout period could still stir markets if they touch on regulatory changes or macroprudential risk. Investors are also watching regional Fed surveys and any signs that manufacturing sentiment is starting to turn south. In the absence of clear direction from data or central bank guidance, dollar positioning may become more vulnerable to risk sentiment and flows.

Sterling’s Strength: A Positioning Play or Something More?

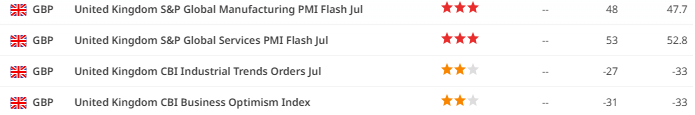

The British pound staged an impressive rally last week, fuelled in part by cleaner positioning and modest USD softness. However, upcoming releases particularly PMI data and testimony from the Bank of England Governor could quickly reverse momentum if they disappoint.

Underlying fundamentals remain mixed. The fiscal trajectory is becoming increasingly strained, and recent public finance figures have missed expectations. Yet for now, traders appear to be giving sterling the benefit of the doubt. A poor PMI print could change that calculus swiftly.

Commodity Currencies Hold Their Breath Ahead of Inflation Clarity

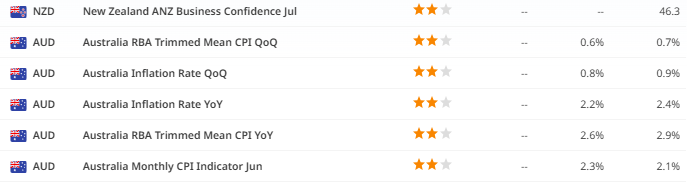

For AUD and NZD, the stakes are high. With commodity-linked currencies struggling to find sustained traction, attention now turns to next week’s quarterly inflation figures arguably the most important macro event for the region this month.

Expectations have shifted. What was once seen as a front-loaded cutting cycle now appears more nuanced. A soft inflation print may reignite dovish bets, while any upside surprise could push back the easing timeline. Given their beta to risk and rate expectations, both AUD and NZD may see outsized reactions to relatively minor data surprises.

The FX market is no longer just reacting to central banks it’s pre-empting them. As positioning cleans up and liquidity thins out in the dog days of summer, even modest surprises can trigger major repricing. Political risk, data fatigue, and silent shifts in capital flows are creating a landscape where narratives matter as much as numbers.

For traders, this is a moment to stay nimble. The catalysts may not be obvious, but the volatility will be real.

Q1: Why is the Japanese yen reacting to politics instead of economic data?

A: Political instability can create uncertainty around fiscal policy, trade negotiations, and central bank independence. In Japan’s case, questions about leadership continuity and potential fiscal changes make the yen highly sensitive to political headlines even more than economic prints.

Q2: If the Fed is in a blackout period, why does Powell’s speech still matter this week?

A: While Powell won’t comment on policy decisions, markets will parse his tone for clues about financial stability and regulatory sentiment. Even subtle shifts in language can influence rate expectations and market risk appetite.

Q3: What are traders watching most closely in the U.S. this week?

A: The Richmond Fed survey, Powell’s Tuesday speech, and broader equity sentiment. With positioning more neutral and capital flows strong, the dollar could swing in either direction on even minor surprises.

Q4: Is sterling’s recent strength sustainable?

A: Not necessarily. While cleaner positioning has supported GBP, weak fiscal data and softening PMIs could undercut confidence. Governor Bailey’s testimony and the PMI release will be key tests of trend durability.

Q5: Why are AUD and NZD in focus if there are no major central bank decisions this week?

A: Markets are front-running next week’s crucial inflation data for both economies. Any early signals or shifts in global risk sentiment could impact rate cut expectations and drive large FX moves in the short term.

Q6: What’s the biggest risk for traders this week?

A: Underestimating how quickly sentiment can shift in low-liquidity summer markets. With thinner volumes, political surprises and even second-tier data can produce exaggerated moves particularly in JPY, GBP, and high-beta currencies like AUD.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.