Post-Fed Analysis: Technical Analysis on Major Pairs & How To Trade Them

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

Post-Fed Analysis: Technical Analysis on Major Pairs & How To Trade Them

Now that the Fed has made its move—holding rates steady—the focus shifts from policy to price. With the fundamental catalyst already in line, it's time to check out the charts to map potential directions. This is where traders stop reacting to headlines and start reading the structure.

Whether the dollar continues to rally or starts to fade, the path forward will be shaped by price movements.

USDJPY

After a sharp drop in early April, USDJPY has shown signs of stabilization. Price is now consolidating between 142.400 and 146.000, forming a potential accumulation zone for upside potential.

Daily

On the Daily, USDJPY is creating a bullish sequence with a new high in favor of the Dollar.

Dollar is currently testing the previous resistance for a potential support level for upside move.

4-Hour

USDJPY is approaching the equilibrium level with a potential bullish traction ahead, as long as we break out of the 50% line.

📈 Bullish Scenario

- Price holds above 144.00–145.00 and pushes toward 145.50, then 146.00.

- Break above 146.00 confirms continuation toward 147.00–148.00

- Bullish structure: higher lows + consolidation near the highs could pave way for a potential breakout.

📉 Bearish Scenario

- Clean break below 142.40 and failure to reclaim the range leads to a deeper drop.

- Key downside target: 140.80, then retest of the 139.577 low.

- Watch for lower high rejections around 144.50–145.00 to confirm bearish shift.

AUDUSD

The Aussie is currently at a key decision point. After breaking out of its prior range, price is now retesting the former resistance zone—potentially turning it into support. Momentum has stalled, and the next few candles will decide whether bulls reclaim control or bears drag price back into the range.

Daily

Aussie is currently testing the previous resistance level and is potentially turning into a support level resting at 0.64400 - 0.64500.

As of now, the level is trying to hold with fair value gap resting at 0.64271 - 0.64333 still intact.

4-Hour

If we don’t see a bullish sequence, price creating new higher highs and higher lows, we might see a continued downside for the Aussie.

📈 Bullish Scenario

- Price holds above 0.64400 and respects the FVG zone.

- Look for confirmation via higher highs and higher lows forming above 0.64650.

- Break and close above 0.65100 opens the door toward 0.65700.

📉 Bearish Scenario

- Failure to form a bullish sequence (HHs and HLs) from the FVG zone.

- Clean break below 0.64270 signals fading bullish momentum.

- Downside targets:

➤ First: 0.63700

➤ Deeper pullback: 0.62800 and 0.62200

NZDUSD

Daily

While the Australian Dollar has broken out of the range with potential new highs ahead, after a strong April rally, Kiwi has stalled into a consolidation phase. The pair is currently trapped between support and resistance, with neither side yet in control.

4-Hour

Still inside the broader consolidation but showing signs of temporary strength.

📈 Bullish Scenario

- A strong push above 0.59850–0.60000 with higher lows forming = early bullish signal.

- A break of resistance could pave way to new highs.

📉 Bearish Scenario

- Failure to reclaim 0.60000 + hold above equilibrium level = weak bullish conviction.

- Break below equilibrium with no signs of candle holding above flips the bias to an increased bearish scenario, aiming for 0.58900 → 0.58000 level.

EURUSD

Daily

Euro has been on a range-bound market since mid-April and, so far, has not given traders a sustained directional bias either to the upside or downside—making this a “wait-for-confirmation” environment.

4-Hour

4-hour clearly shows that Euro is not gaining traction as it trades below equilibrium for quite sometime already.

Despite dollar weakness, Euro has not able to exhibit a bullish momentum.

📈 Bullish Scenario

- Euro starts gaining traction and trade above the equilibrium.

- Reclaiming 1.1450–1.1500 with higher lows = potential breakout.

- Dollar weakness + Euro bullish catalyst = Euro upside traction

📉 Bearish Scenario

- The equilibrium holds

- No catalyst supporting Euro

- BoE Policy rate decision

GBPUSD

Daily

Cable is stuck inside a clean horizontal range between 1.32350 – 1.34450, following a strong upward impulse in early April. Price action is now coiling mid-range, waiting for a catalyst to break this compression.

4-Hour

Unlike, Euro, Pound is trading nicely near equilibrium, displaying high volatility and momentum.

📈 Bullish Scenario

- Bullish sequence above equilibrium

- Break of 1.338 - 1.340

📉 Bearish Scenario

- Failure to hold mid-range and break below 1.32350

- Close below equilibrium with rejection on retest = confirmation of downside.

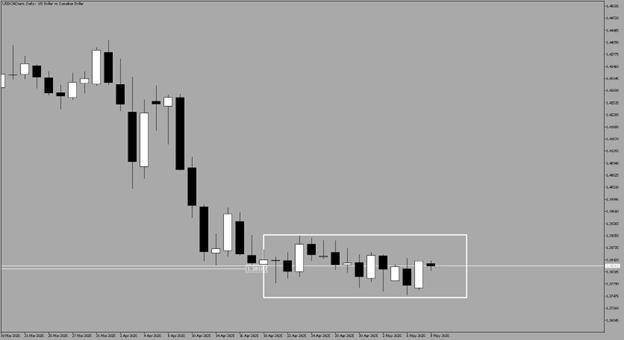

USDCAD

Daily

The pair remains firmly locked in a tight consolidation range after a sustained sell-off in early April. Bulls have failed to reclaim directional control, while bears are yet to push below key support. Momentum is clearly muted—and traders are waiting for a decisive breakout.

4-Hour

Several up and down ticks are obvious at both ends, hinting traps or failed break attempts. This also shows a sign of low liquidity and momentum.

📈 Bullish Scenario

- Clean break and close above 1.388-1.389 with follow-through.

- Ideal confirmation: structure shift (HH/HL) and hold near or above 1.3900.

- Strong catalyst for USD

📉 Bearish Scenario

- Trade below equilibrium

- Close below the rangee

- Loss of appeal on dollar

USDCHF

Daily

After a sharp drop in early April, USDCHF is currently stalling with signs of slowing down as ranges are developing with a bullish sequence pattern.

Price remains stuck in a sideways grind, hinting at potential distribution unless bulls can reclaim the upper region.

The daily FVG is also holding at 0.82582-0.83594 for a bearish bias.

4-Hour

On the 4-hour, USDCHF is in a tight spot with no clear signs of momentum trading between the 0.81817-0.83363 range.

📈 Bullish Scenario

- Daily reclaim above 0.83363 (top of range) invalidates bearish structure and reopens price into unfilled inefficiencies.

- Look for H4 higher low formation above 0.82500 followed by impulsive break above 0.83363.

- Clean break and close above 0.83594 confirms strength above the FVG.

📉 Bearish Scenario

- Rejection from 0.83363–0.83594 zone (Daily FVG) triggers sell-side interest.

- Failure to hold 0.82582 confirms return into mid-range; bearish confirmation follows with H4 candle closes below 0.81817.

- Lower highs forming on the 4H strengthen bearish momentum bias.

Final Thoughts & Trader's Caveat

While the Fed has paused, the market hasn't. From this point forward, price is the driver—and structure will define the opportunity.

Across major pairs, we're seeing a common theme: range-bound markets, key retests, and decision zones. This isn't the time to anchor bias. It's a time to stay flexible, read the levels, and let price confirm the next directional leg.

Universal Action Plan for Any Strategy:

- Define your key zones (support/resistance, FVGs, supply/demand, fibs, etc.) before the session starts.

- Use multiple timeframes to align context with execution—know the higher timeframe narrative and your trade’s place within it.

- Wait for confirmation based on your system—be it structure shifts, indicators, candlestick patterns, or volume cues.

- Don’t force trades in the middle of ranges or during uncertainty—let price reveal its intent.

- Be scenario-based, not outcome-fixed—have a bullish and bearish path in mind for every chart.

- Manage risk with clarity—reduce size in chop, step up only when structure confirms alignment.

Don't marry a bias. Marry your process.

Even the cleanest setup can flip if macro catalysts or liquidity flows shift. Ranges can expand, and false breakouts can trap the best plans. Patience and adaptability are the edge now.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.