PrimeXM Announces New Monthly Volume Record of $1.303 Trillion In March

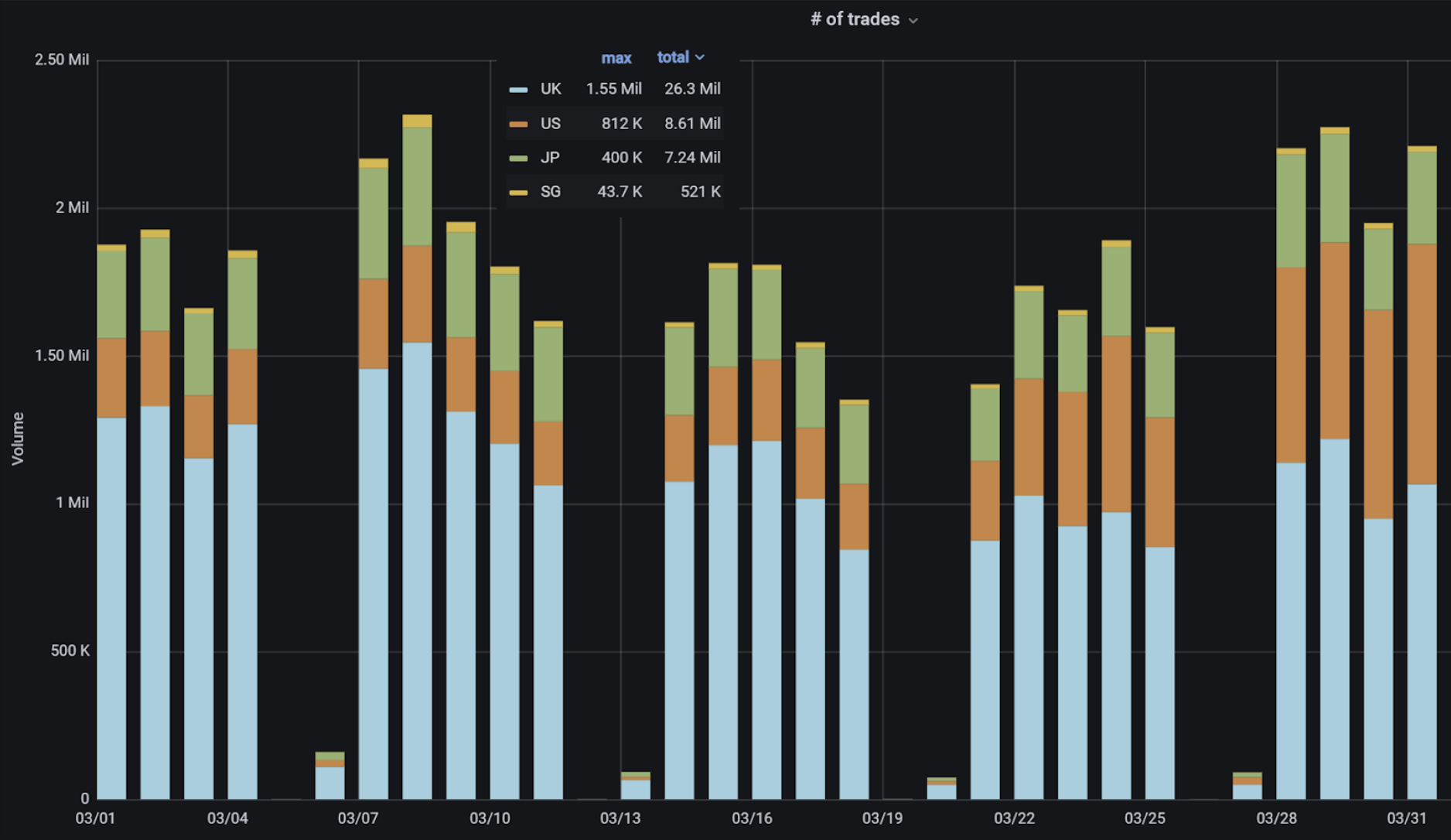

April 05, 2022 - FX Trading aggregator and bridge provider PrimeXM has registered a new monthly trading volume record of $1.303 trillion, and a total of 42.67 million processed trades in March 2022 across all 4 major Data Centers. This marks 7.46% MoM growth and strong 23.19% Year on Year increase compared to last year’s $1,058.17 billion.

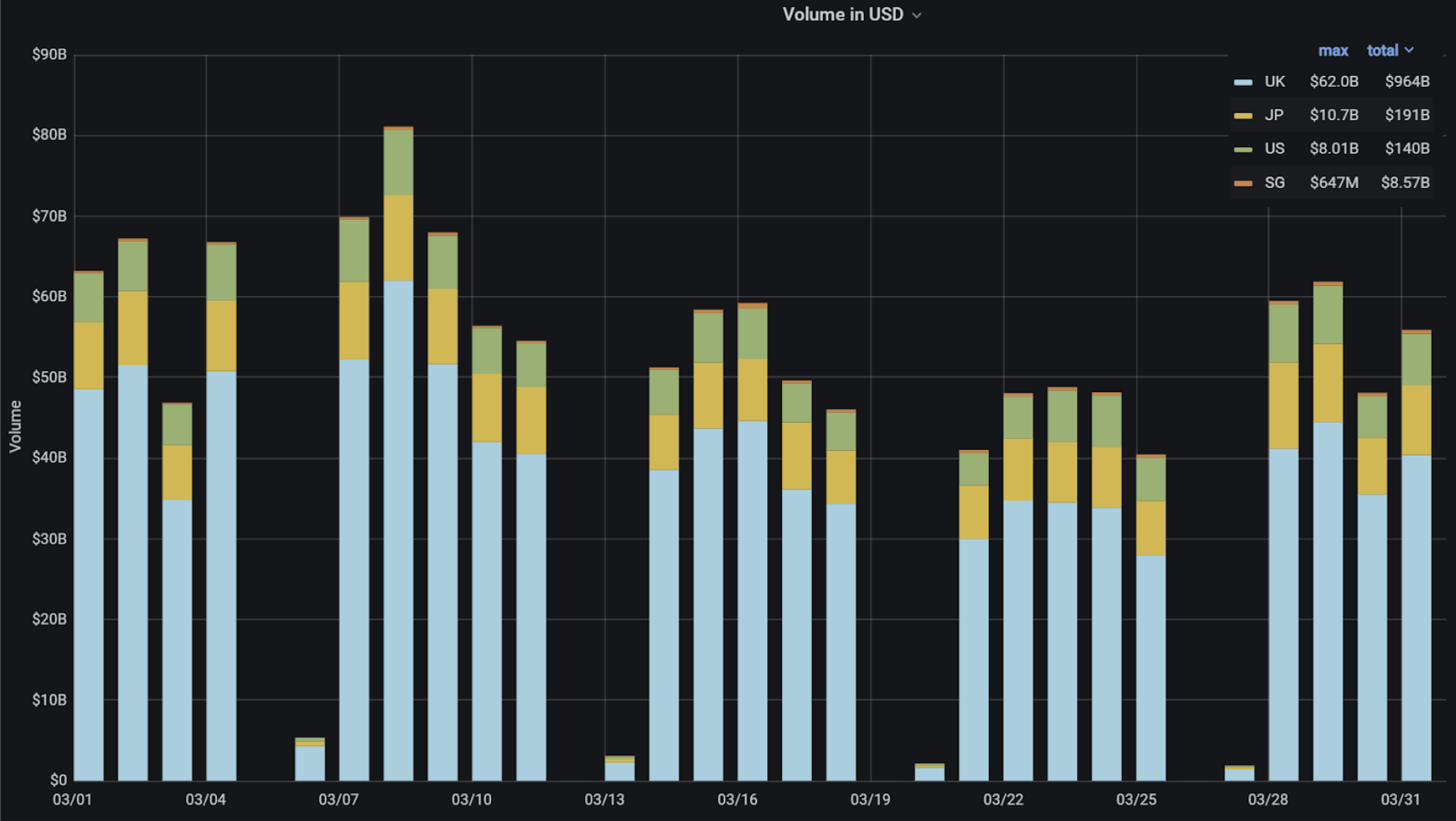

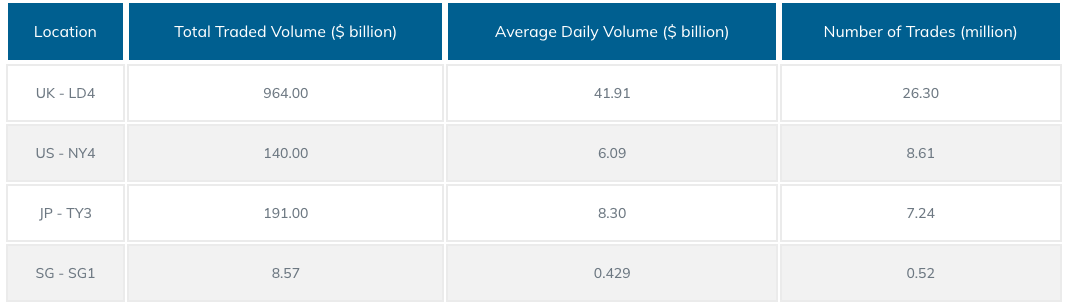

The Average Daily Volume (ADV) in March was $56.68 billion. The highest daily trading volume of the month was recorded on 8th of March with $81.36 billion in volume. London (LD4) continues to be the busiest data centre with $964 billion transacted. Tokyo (TY3) is in second place with $191 billion and NY4 with $140 billion in volume.

PrimeXM's business in the Singapore SG1 data center seems to be lifting-off with $8.57 billion in volume (a 184% increase on February) and half a million trades for the month. In February, SG1 volume came in at $3.02 billion, while in January total SG1 volume was $1.85 billion. Volume in SG1 in March was therefore 363% on January.

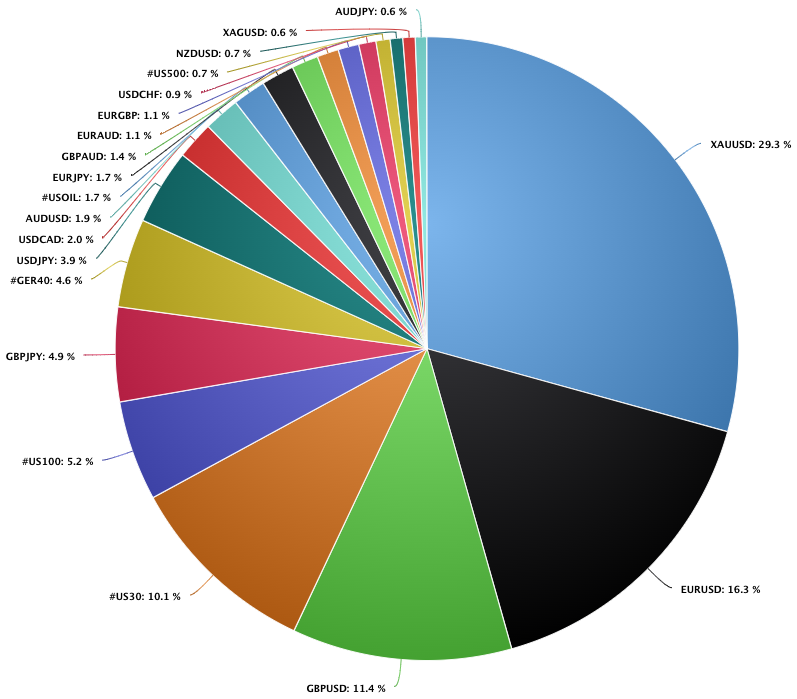

XAUUSD consistently remains the most popular trading instrument having ⅓ of all volume during March. EURSD (16%) and GBPUSD (11%) follow, while major 3 equity indices #US30, #US100 and #Germany40 represents ¼ of all transacted volumes by the XCore Community.

To view P{rimeXM's historical ADV data and to compare against other venues, please click here.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.