PrimeXM Releases Volume Figures For June 2021

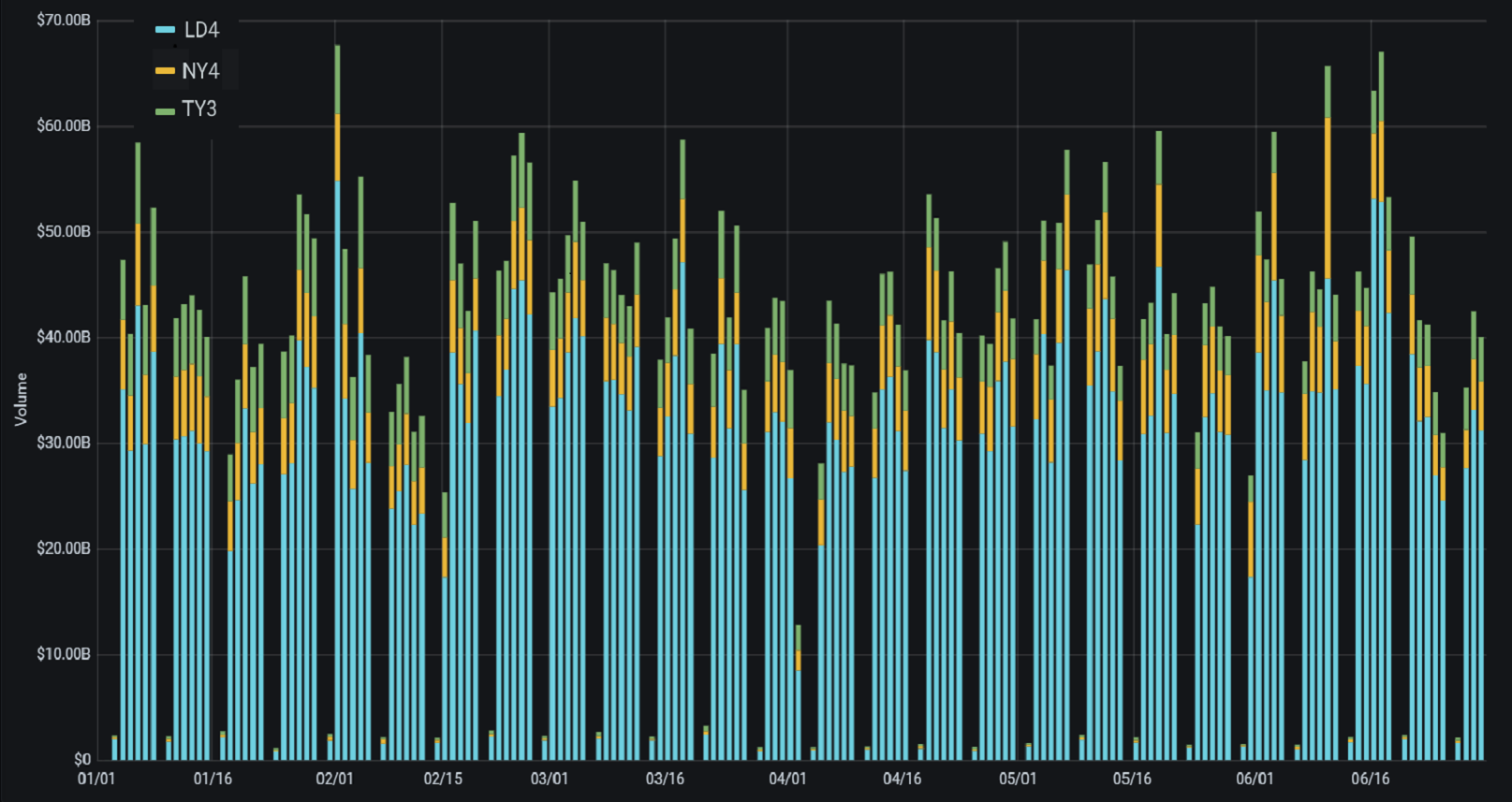

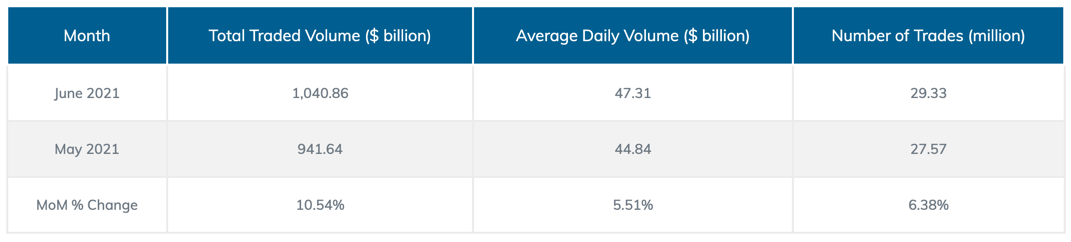

July 08, 2021 - FX Trading aggregator and bridge provider PrimeXM has registered a total of $1.04 trillion in monthly trading volume in June 2021 across the company's 3 major Data Center locations, representing a significant 19.67% Year on Year increase in trading activity comparing to June 2020, which recorded $869.77 billion.

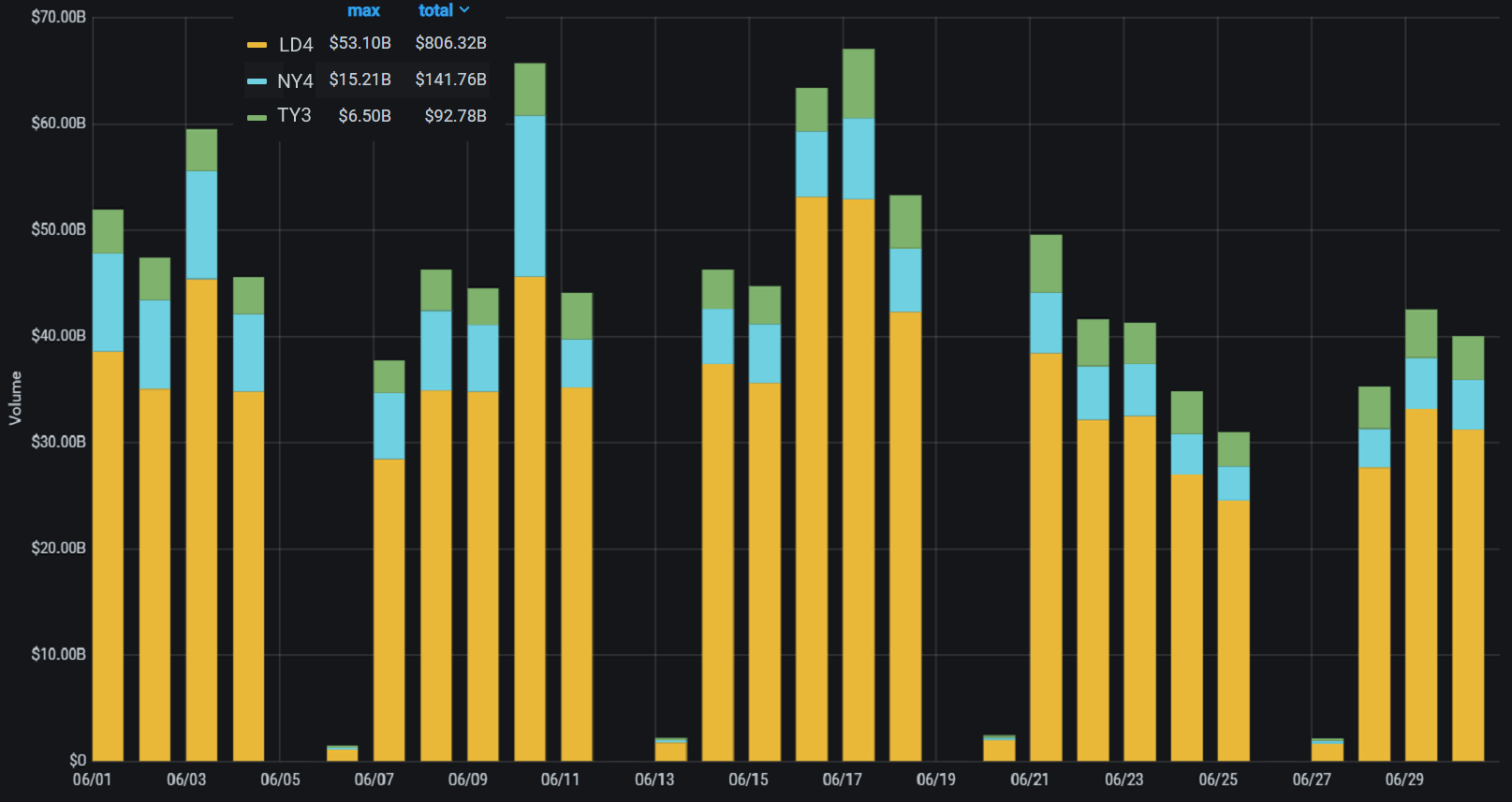

The Average Daily Volume (ADV) in June was $47.31 billion. The highest daily trading volume of the month was recorded on 17th June with $67 billion turnover. The total number of trades in June was 29.33 million, over 6% higher Month on Month than 27.57 million trades in May 2021.

PrimeXM's Data Center in LD4 recorded $806.32 billion in notional trading volume in June – 11% above May’s record. The Data Center in NY4 has officially become the 2nd largest data center location in terms of trading volume processed with $141.76 billion.

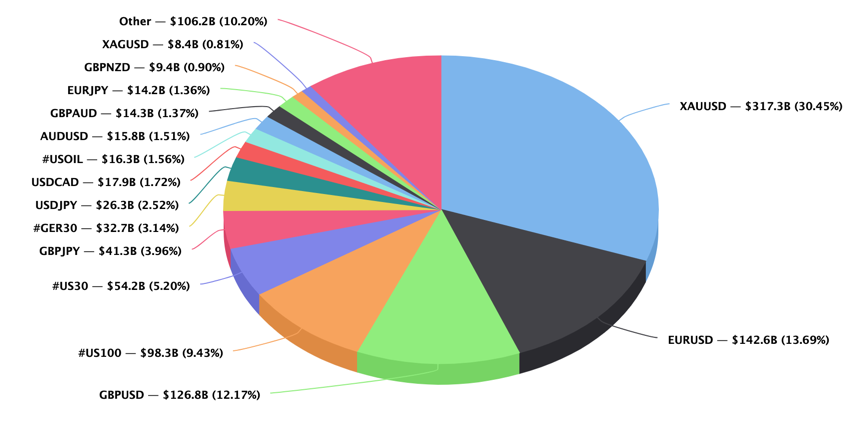

XAUUSD was again the most actively traded market on PrimeXM in June 2021, generating 30% of total monthly volume over PrimeXM's network, with $317.27 billion in notional value. Major FX pairs EURUSD and GBPUSD kept the 2nd and 3rd places with a combined trading volume of $269.40 billion.

See PrimeXM's Monthly ADV history and its relative performance against other venues by clicking here.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.