PrimeXM Reports Volume Figures for December 2021

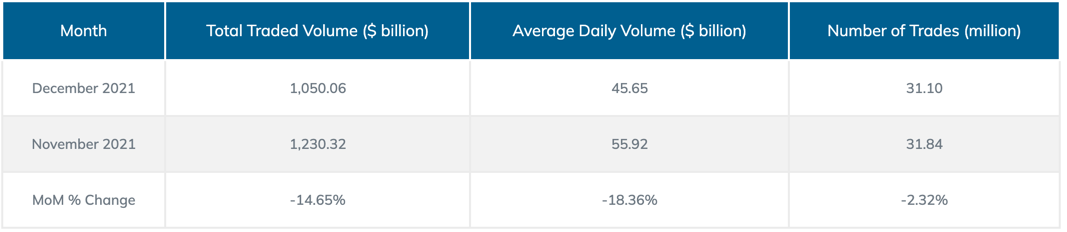

January 07, 2022 - FX Trading aggregator and bridge provider PrimeXM has reported its volume figures for December 2021, with a total of $1.05 trillion in monthly trading volume across its 4 Data Centres, a 21% Year on Year increase compared to December 2020's $866.46 billion.

The Average Daily Volume (ADV) in December was $45.65 billion. The highest daily trading volume of the month was recorded on 15th December with $66.34 billion in volume. The total number of trades in December was 31.10 million, an over 24% Year on Year increase on December 2020's 25.17 million trades.

More than 81% of the total monthly traded volume was recorded in PrimeXM's Data Center located in LD4 – $851.92 billion in notional value. Another $115.07 billion passed through NY4 and the data center in TY3 has processed $81.32 billion. PrimeXM's SG1 data center saw more than $1.75 billion in trading activity.

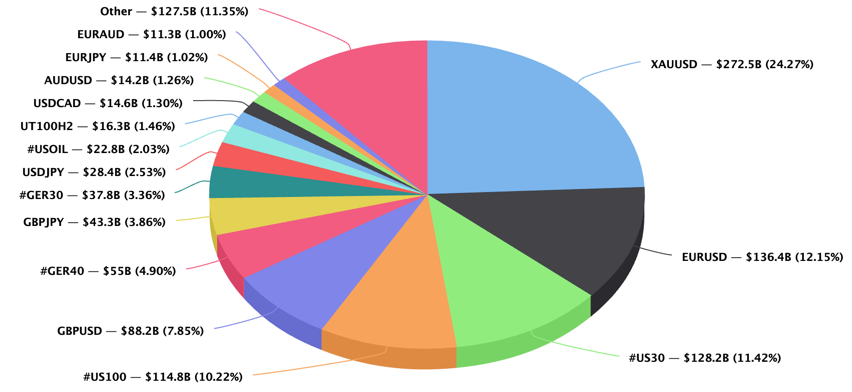

XAUUSD continued as the most actively traded instrument during December with $272.5 billion in notional value, approximately 24% of the overall monthly volume. (Seasonal trading conditions around the holiday period will largely account for December's $272.5 billion being a 25.9% reduction on the previous month of November, where trading in XAUUSD totalled $367.7 billion).

EURUSD remained in 2nd place with $136.4 billion and the US30 index has occupied 3rd place for the 2nd month in a row with $128.2 billion in volume.

To view PrimeXM's historical ADV as compared to other trading venues and platforms, please click here.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.