PrimeXM Reports Volume Figures For May 2022

June 03, 2022 - FX Trading aggregator and bridge provider PrimeXM has reported volume figures for May 20222, with its XCore Community marking 12 continuous months with volume above $1 trillion.

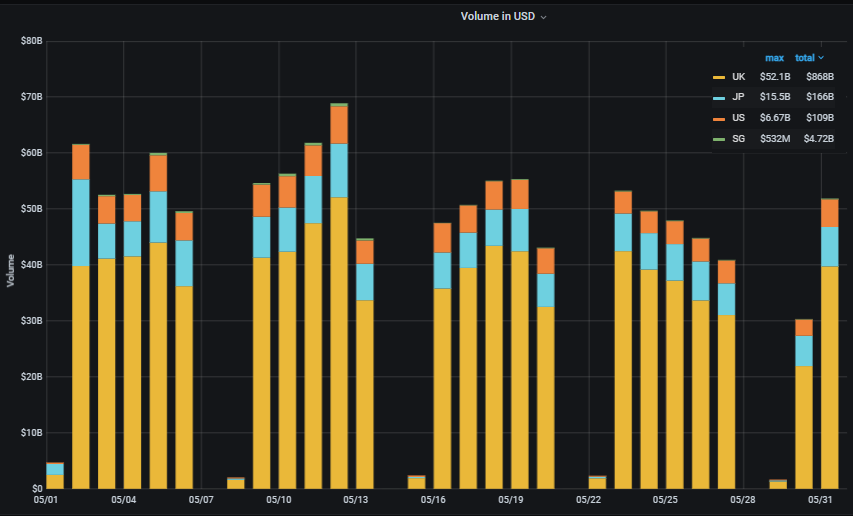

The total registered volume in May was $1.147.72 trillion across all 4 major Data Centres (LD4, NY4, TY3 and SG1). The Average Daily Volume (ADV) in April was $52.17 billion, a decrease of -4.87% Month on Month vs April 2022, and +21.89% Year on Year increase compared to May 2021.

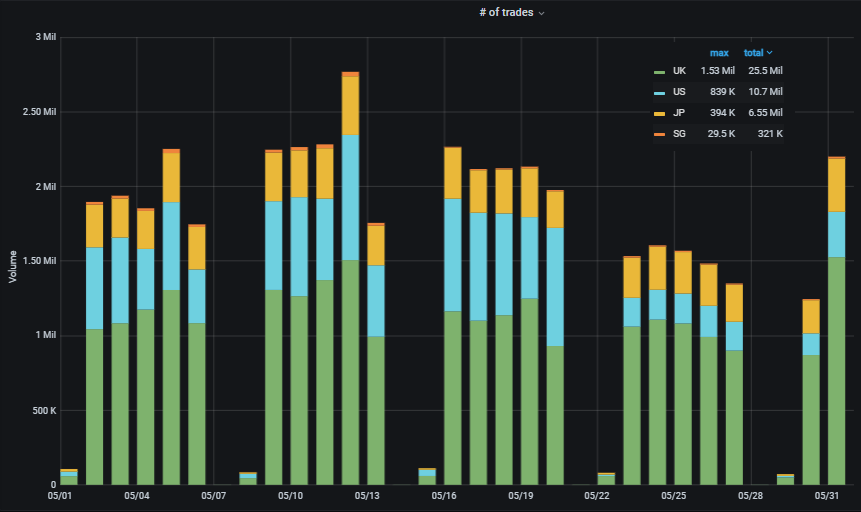

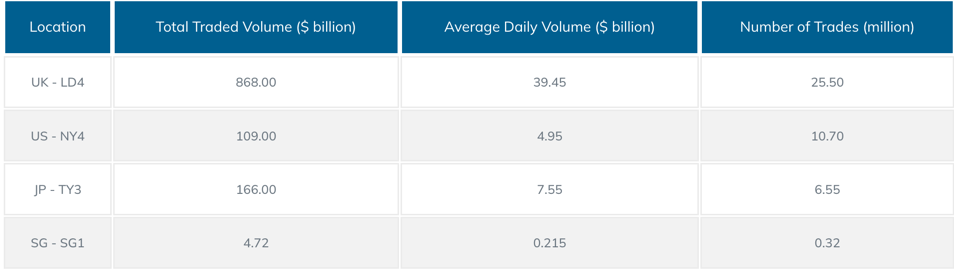

Total executed transactions by the Community in May were 43.07 million, +5.65% Month on Month and +56.22% Year on Year vs May 2021. London (LD4 data centre) continues to be the busiest, where $868 billion was transacted, Tokyo (TY3) comes in second with $166 billion, NY4 third with $109 billion and Singapore SG1 data center with $4.72 billion. (NB: Singapore volume seems to be down almost 45% compared to April, which was reported at $8.57 billion).

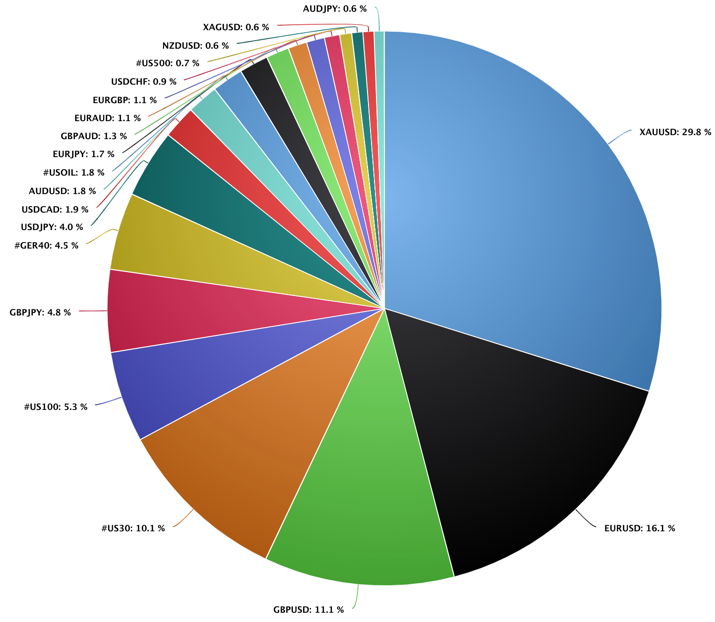

Again Gold continues to be the most actively traded instrument on the network, with almost 1/3 or all volume (29.8%). Next are EURUSD (16.1%), and then GBPUSD (11%). The three major equity indices #US30, #US100 and #Germany40 represent 20% of all transacted volumes.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.