S&P 500: Post-ISM Wedge Compression Could Signal Retest of Prior Highs

Alchemy Markets - Zorrays Junaid

Alchemy Markets - Zorrays JunaidMarkets opened this week digesting softer-than-expected ISM data from both manufacturing and services. Under the surface, inflationary pressures remain sticky while growth continues to weaken. But you wouldn’t know it from looking at the index.

The Price Action Speaks

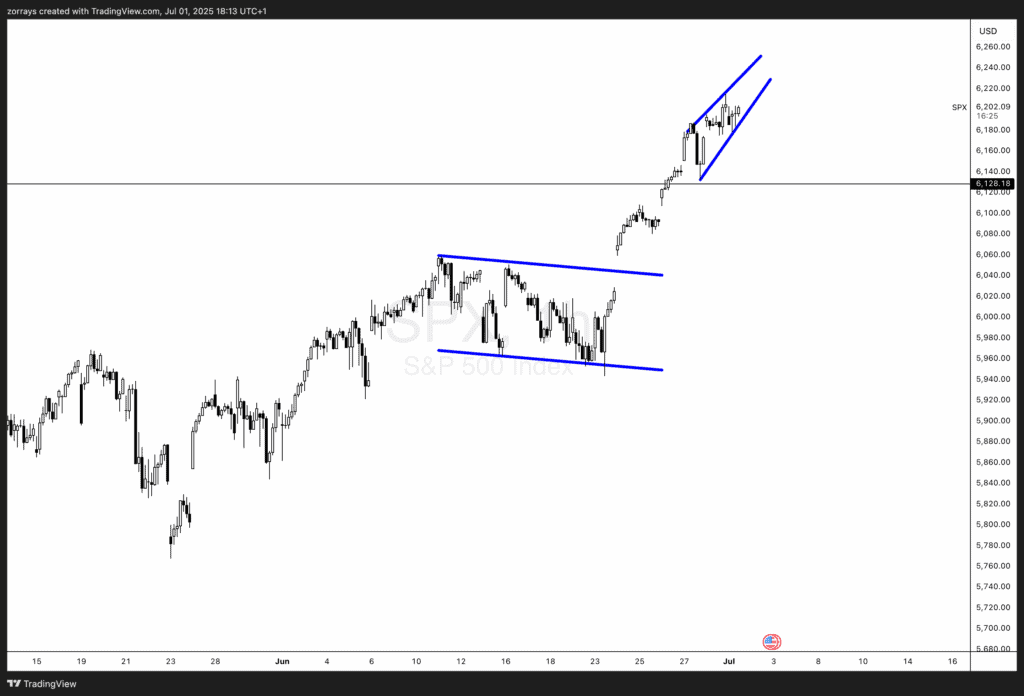

The S&P 500 has broken out of a textbook bull flag (falling channel) and extended sharply higher, pushing through former all-time highs. But what we’re seeing now is a tight rising wedge structure forming just above that breakout level.

This kind of wedge formation often signals a moment of compression — where bullish momentum begins to lose steam and price coils before a potential resolution.

What This Could Mean

- If the wedge breaks down, the most obvious target is a retest of the prior all-time high, which now acts as key support (around 6,128).

- If buyers defend that level, it would confirm a healthy breakout-retest structure — setting up the next leg higher.

- However, a failure to hold that support would raise the risk of a deeper correction, especially with macro headwinds building.

Trading Implications

- This is not the time to chase highs unless the wedge breaks to the upside with volume and confirmation.

- Instead, a more asymmetric setup may come on a pullback to former resistance — especially if price shows signs of reclaiming the level on intraday timeframes.

- Keep a close eye on bond yields, dollar strength, and gold to gauge risk appetite over the next few sessions.

Conclusion

The market is extended, sentiment is elevated, and macro is weakening. Technically, the S&P 500 is coiling in a rising wedge — a classic sign of short-term indecision. If it breaks lower, the retest of prior highs around 6,128 becomes key.

This is a spot where smart money likely shifts from chasing to waiting. Let price come to you.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.