Safe-Haven Surge: Why the Yen and Swiss Franc Are Dominating Dollar Flows

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

Overview

As volatility rises and confidence in the U.S. economic outlook fades, global investors are turning decisively toward traditional safe-haven currencies — particularly the Japanese yen (JPY) and Swiss franc (CHF).

USDJPY – Yen Strengthens on Risk-Off Flows and Policy Stability

The yen gains as investors seek refuge from U.S. stagflation risks and geopolitical uncertainty.

- Rising haven demand amid global trade tensions and U.S. macro deterioration.

- Stable Bank of Japan policy and strong capital inflows into JGBs support JPY.

USDCHF – Swiss Franc Outperforms on Capital Rotation and Policy Credibility

CHF attracts defensive flows as investors move away from U.S. assets toward surplus-driven economies.

- Strong Swiss fundamentals and SNB’s tolerance for a stronger franc.

- Capital exiting U.S. equities and bonds finds safety in Swiss financial markets.

Amid renewed trade risks, geopolitical stress, and central bank divergence, both currencies have seen strong inflows, pushing USDJPY and USDCHF sharply lower.

Japan: Renewed Investor Interest

Japan's market reforms and economic indicators are drawing investor attention:

- Japanese yen strengthened, driven by haven flows and investor rotation into stable JGBs (Japanese Government Bonds).

- BlackRock suggests that investors consider Japan as a potential market for stock returns, noting improved earnings outlooks due to corporate reforms and mild inflation, with corporate profitability reaching a four-decade high.

- Morgan Stanley highlights a significant shift among Japanese retail investors, with financial assets held by households expected to rise, presenting new opportunities for banks and the wealth management sector.

Key Drivers Behind Yen Strength

- Haven Demand: As stagflation risks rise in the U.S. and global markets grow wary of trade war escalation, the yen is benefiting from its status as a traditional safe-haven currency.

- Investor Capital Reallocation: Flows into Japanese Government Bonds (JGBs) have increased as investors seek more policy-stable environments.

- Stable BoJ Policy: The Bank of Japan is expected to keep rates steady at 0.50%, while also signaling it will allow gradual normalization. This predictability contrasts with the current uncertainty surrounding Fed policy.

Interestingly, even as U.S. Treasury yields remain elevated, JPY continues to strengthen, suggesting that capital preservation and geopolitical hedging are taking priority over yield differentials — a sign of deeper market caution.

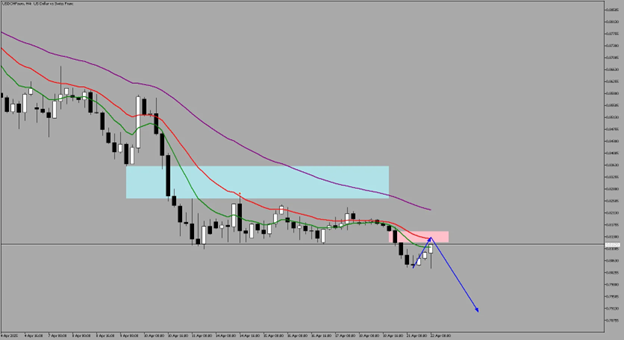

4-Hour

Technically, we can see an obvious downside of the US Dollar vs Yen, with USDJPY trading with more potential downside, with 139.577 on the horizon for a draw on liquidity.

139.577 Target Still Intact: For a reference on the previous forecast, checkout my blog: https://acy.com/en/market-news/market-analysis/aud-nzd-bounce-jpy-strengthens-dollar-retreat-j-o-04142025-151603/

Safe Haven Demand Surges Amid Global Uncertainty

| Commodity | Net Positions | Net Change | Long Positions | Change | Short Positions | Change |

|---|---|---|---|---|---|---|

| Japanese Yen | 171,855 | 24,788 | 198,560 | 22,005 | 26,705 | -2,783 |

Source: Barchart

Speculative traders are aggressively positioning into the yen, marking the strongest bullish shift among major currencies this week:

- Net Positions soared to 171,855, up a massive 24,788 contracts — the largest weekly jump across G10 currencies.

- Long Positions surged by 22,005 contracts, now totaling 198,560, signaling a strong influx of bullish bets.

- Short Positions declined by 2,783, falling to 26,705, reinforcing the clear bullish tilt in sentiment.

Why Is the Yen Attracting Strong Flows?

- Safe Haven Appeal: With growing fears of U.S. stagflation, rising protectionism, and equity market volatility, the yen is regaining favor as a defensive asset.

- BOJ Policy Speculation: Market chatter is intensifying around the Bank of Japan potentially adjusting its yield curve control or stepping back from ultra-dovish policies — this adds tailwinds to the yen.

Among the major currencies, the yen has emerged as the strongest bullish play from the latest COT data. This aligns with broad risk-off behavior, where global investors are reducing U.S. exposure and rotating into currencies backed by perceived stability — notably the Japanese yen and the euro.

Trade Plan

USDJPY Strategy: Trade the Liquidity Draw with Risk Context

- Bias: Bearish

- Technical Focus: Price has broken below 142.00 and is showing signs of continuation toward 139.577, a clear liquidity target.

- Macro Context: Haven flows, COT positioning, and JGB demand all favor sustained yen strength.

Execution Plan:

- Look for retracements into the 141.80–142.20 zone to short with tight risk.

- Target 139.60–139.50, aligning with the draw on liquidity and prior support.

- Invalidate the setup if price reclaims and closes above 143.00 on a 4H basis.

Swiss Franc Reasserts Its Safe-Haven Role as USDCHF Breaks Down

Alongside the yen, the Swiss franc has surged, with USDCHF falling below 0.81, its lowest level since early 2023. The move is driven by renewed global risk aversion, a declining appetite for U.S. assets, and Switzerland’s reputation as a policy-stable and surplus-driven economy.

What’s Fueling CHF Strength?

- Capital Flight from USD Assets: Investors are rotating away from U.S. equities and long-duration Treasuries amid fears of prolonged stagflation and political gridlock.

- Strong Swiss Fundamentals: With inflation well contained and a healthy current account surplus, Switzerland continues to draw investors seeking stability and low volatility.

- Silent Endorsement from the SNB: Unlike in past years, the Swiss National Bank has not intervened verbally or physically to weaken the franc — signaling comfort with its strength as a check against imported inflation.

“The franc doesn’t need to offer high yields — it offers certainty. That’s what matters in volatile markets.”

— FX Strategist, Deutsche Bank

Trade Plan

USDCHF Ride the Macro Momentum with Guarded Entries

- Bias: Bearish

- Technical Focus: Price has broken structure below 0.8100, with next downside targets at 0.8000.

- Macro Context: CHF is being favored as capital rotates out of USD and into surplus economies with monetary discipline.

Execution Plan:

- Sell rallies into 0.81 pullback, where prior support may act as resistance.

- Target 0.8050 short-term, and 0.8000 as a macro-level extension.

Final Thought: Follow the Technicals, Not Just the Fundamentals

As uncertainty surrounding the U.S. economy deepens and global investors hunt for refuge, both the yen and the franc have reclaimed their historical leadership in times of stress. While fundamentals and central bank policy still matter, current market flows reflect deeper sentiment shifts — away from exposure to inflation risk, toward safety, predictability, and currency preservation.

What this means for you:

this means:

- Prioritizing short USDJPY and USDCHF setups betting against USD

- Watching for escalation in trade tensions or further weakness in U.S. data

- Using technical levels and positioning data (like COT) to track sentiment confirmation

With liquidity targets now drawing price lower in both pairs, it’s not just about the safe haven narrative — it’s about following where the capital is actually going.

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Want to learn how to trade like the Smart Money? Check out my new contents:

https://acy.com/en/market-news/education/smc-playbook-series-beginners-guide-j-o-04032025-155530/

Follow me on LinkedIn: https://www.linkedin.com/in/jasperosita/

Join me in Discord: https://discord.gg/G8f7a5RnaF

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.