SGX Acquires MaxxTrader From FlexTrade

July 23, 2021 - Singapore Exchange (SGX), Asia’s most international multi-asset exchange and largest foreign exchange (FX) derivatives marketplace announced today that it will acquire FlexTrade Systems MaxxTrader FX trading platform, with the acquisition expected to be completed by December 2021. The purchase of MaxxTrader extends SGX's interest in the FX OTC space, after the exchange's acquisition of BidFX in June last year. SGX took a 20% stake in BidFX in March 2019 for $25 million, and purchased the remaining 80% of the platform in June 2020 for an additional $128 million.

The announcement today stated that the acquisition of the sell-side oriented MaxxTrader, will accelerate SGX’s plan to build an integrated FX ecosystem and marketplace that facilitates global access to OTC and on-exchange currency derivatives.

Headquartered in Singapore, MaxxTrader is a leading provider of FX pricing and risk solutions for sell-side institutions including banks and broker-dealers, as well as a multi-dealer platform for hedge funds. Since the company’s incorporation in 2008, MaxxTrader has built a strong, global client and dealer franchise with over 100 global banks, regional banks, broker-dealers and hedge funds currently connected to its platform. Its average daily volume (ADV) has also grown during this time to over US$17 billion.

MaxxTrader’s strong sell-side client base complements the buy-side clientele of BidFX, a leading cloud-based provider of electronic FX trading solutions which SGX acquired last year. Together, these acquisitions form part of SGX’s multi-phase strategy in building an integrated Asian FX marketplace for global investors.

Loh Boon Chye, Chief Executive Officer, SGX, said, “Since SGX expanded from FX futures to the global FX OTC market, we continue to cement our footprint in this fast-growing and sizeable US$6.6 trillion-a day global market. We are excited to acquire MaxxTrader, which further enhances our FX OTC offering and widens our customer base across the sell- and buy-side.”

Manish Kedia, designated Chief Executive Officer, MaxxTrader, said, “We share SGX’s FX vision to offer buy-side and sell-side clients a wide range of FX products and liquidity across OTC and futures globally. With SGX’s strong focus and investments in FX, we expect to accelerate innovation and deliver exciting new solutions for both our clients and liquidity providers. Moreover, as one of the first platforms to host banks, brokers, and hedge funds in Singapore’s SG1 Liquidity Hub, we also look forward to continue contributing to the success of Singapore as a central liquidity hub in Asia.”

Vijay Kedia, President and CEO of FlexTrade Systems, added, “It has been a true pleasure to see the success and growth of MaxxTrader over the past decade. SGX is committed to invest and innovate in the FX OTC marketplace which will benefit the MaxxTrader product, employees and client base, and enhance the momentum of the business. This transaction enables FlexTrade to singularly focus on its core business: the FlexTrade multi-asset EMS and OEMS for buy- and sell-side institutions through FlexTRADER, FlexONE, FlexFX, FlexFI, FlexOMS, ColorPalette, and Mottai as it continues to make strides and gain market share through product innovation and leadership.”

“Our next step is to offer clients a full suite of FX futures and OTC solutions, by building a primary FX OTC marketplace anchored in Singapore. In turn, this would accelerate our vision to create fungible and convenient access for diverse, global customers to different pools of liquidity under one integrated platform on SGX, and build Asia’s largest one-stop venue for international FX OTC and futures participants,” concluded Mr. Loh.

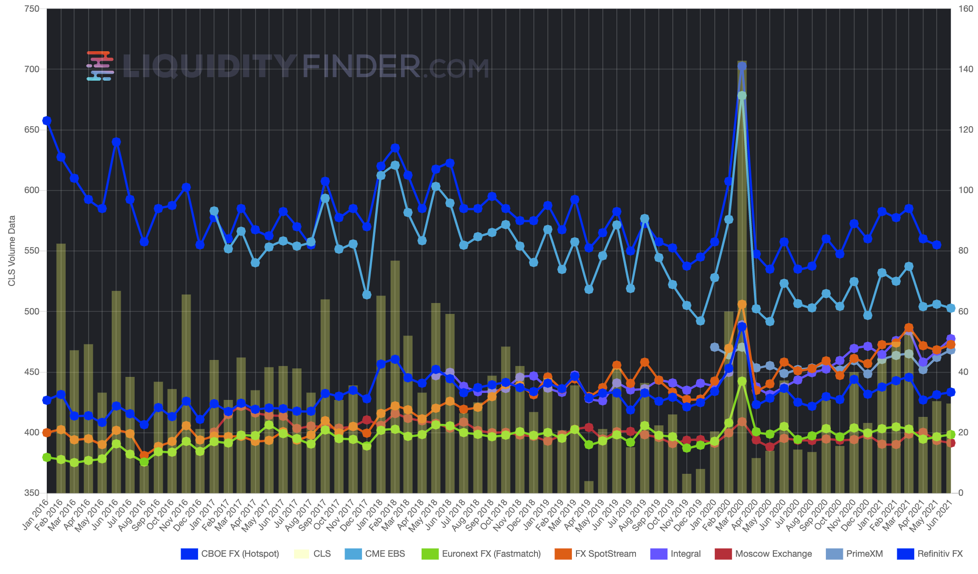

View the recent ADV history of MaxxTrader's at US$17 billion compared to other trading venues, on the LiquidityFinder Market Volumes page here:

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.