SGX FX Launches SGX CurrencyNode, Singapore Based OTC FX ECN

September 21, 2022 - Singapore Exchange owned SGX FX has launched its new FX electronic communication network (ECN), SGX CurrencyNode, with trading of non-deliverable forwards (NDFs), after obtaining its Recognised Market Operator (RMO) licence from the Monetary Authority of Singapore (MAS).

The new Central Limit Order Book, centrally cleared and anonymous, trading venue is based in SG1 datacentre, benefitting from a growing FX ecosystem, where a number of Tier-1 market makers now have pricing engines.

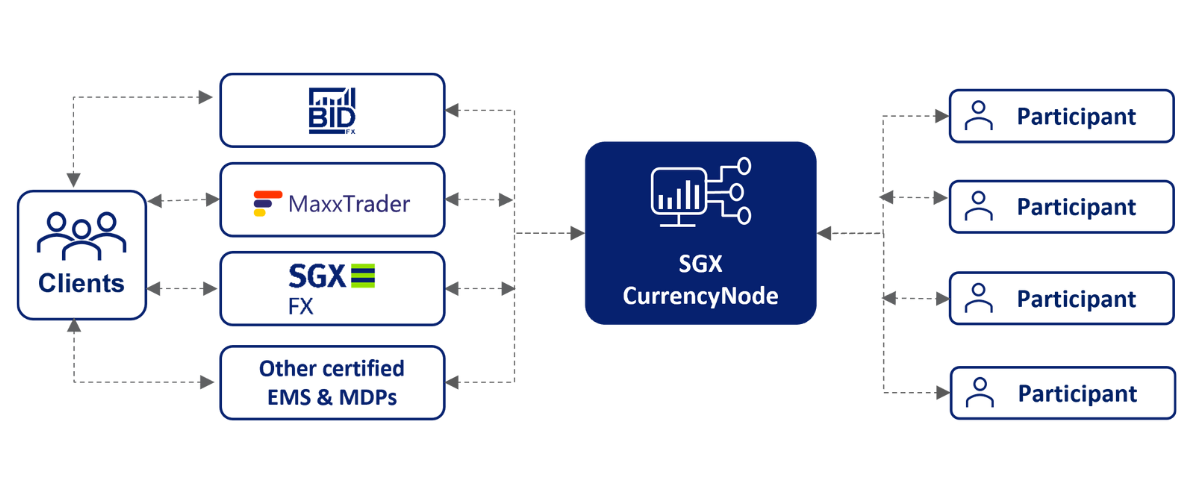

SGX CurrencyNode offers global banks, non-bank liquidity providers, brokers and institutional investors access to multiple sources of OTC FX liquidity anonymously through a single venue.

Using a central prime brokerage model, SGX CurrencyNode currently streams liquidity for FX Spot, Precious Metals and NDFs, with plans to launch FX Swaps and NDF Spreads at a later date. BNP Paribas and Deutsche Bank are the central prime brokers for SGX CurrencyNode.

SGX Group has been making strategic investments to expand its FX business to meet the growing needs of market participants. With SGX Group’s long-standing reputation as the region’s leading FX exchange, SGX CurrencyNode builds on the strengths of BidFX and MaxxTrader, combining OTC buyside and sell-side solutions.

SGX FX hosts Asia’s most liquid FX futures exchange, across major Asian currency pairs. With the launch of SGX CurrencyNode, SGX FX now offers complete OTC FX technology solutions that cater to the electronification and automation needs of market participants, while connecting FX market liquidity providers to SGX FX’s OTC and futures marketplace.

Lee Beng Hong, Head of Fixed Income, Currencies and Commodities (FICC), SGX Group, said, “This launch is an important step in enhancing the price discovery, efficiency and liquidity for Asian currencies. Our goal is to create a best-in-class FX marketplace that elevates market participants’ access to both OTC and listed futures, aggregating market liquidity and serving all their FX hedging and trading needs with strong efficiency and liquidity. Our FX offering is now complete with the launch of SGX CurrencyNode, and we thank MAS for its support and industry partners for their active participation.”

Lim Cheng Khai, Executive Director, Financial Markets Development Department, MAS, said, “MAS welcomes the debut of SGX CurrencyNode – a key addition to Singapore’s vibrant FX e-trading ecosystem. With global regulatory developments in margin requirements affecting the FX industry, there will be an increasing need for venues that seamlessly integrate OTC FX and listed futures. SGX Group’s investment in capabilities to meet this demand will further enhance Singapore’s value to market participants in the Asian timezone.”

Olivia Frieser, Head of Global Markets, Southeast Asia, India & Australia, BNP Paribas, said, “BNP Paribas is delighted to participate in the growth of FX markets in Singapore. We see the Singapore hub rising in importance for FX markets and expect SGX CurrencyNode to support volume growth. We look forward to supporting SGX CurrencyNode as prime broker, with our leading franchise in FX spot and NDF and extensive currency coverage.”

Darren Boulos, Co-Head of Global FX for Asia Pacific, Deutsche Bank, said, “Connectivity and deep credit relationships are central to a well-functioning electronic communication network. Being able to supply SGX CurrencyNode with key FX participants underscores the scale of our network, and more importantly, the performance and consistency that our forex business delivers year after year. From provisioning liquidity in spot markets to innovative solutions across the full product spectrum, we will continue to serve and cater to wide-ranging needs of our clients and partners.”

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.