SHOCK TARIFFS SPARK MARKET TURBULENCE AS GOLD RISES, DOLLAR SINKS, AND STOCKS SLIP

U.S. Tariff Retaliation Triggers Global Shockwaves

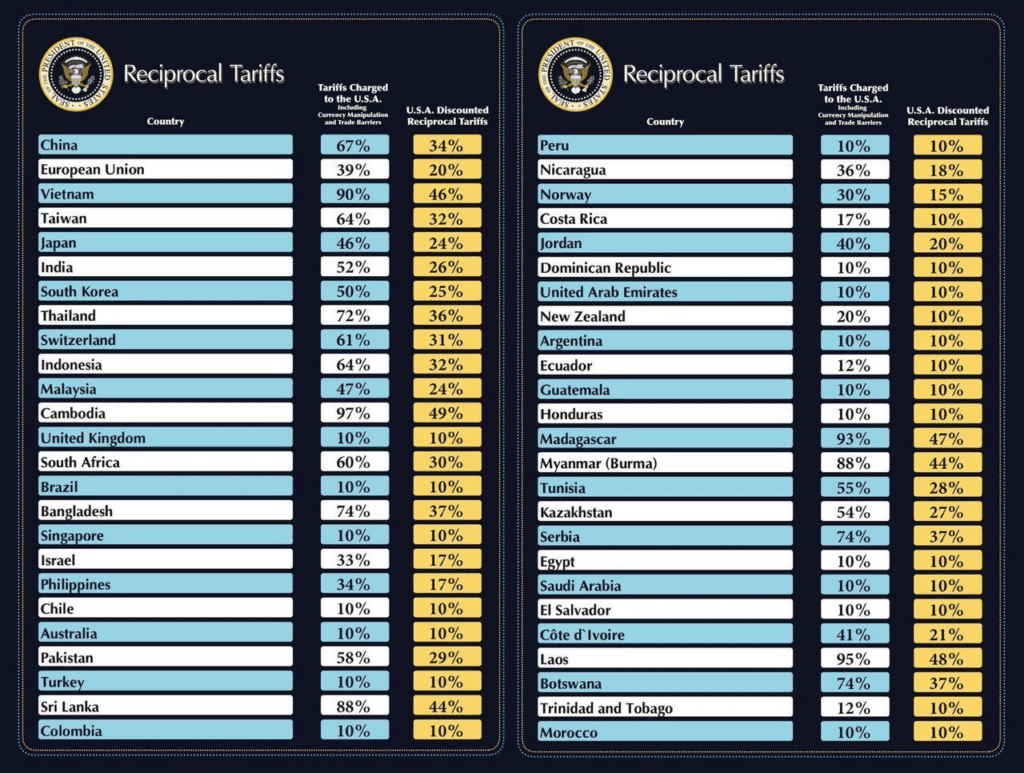

Source: Whitehouse.gov

Yesterday’s announcement of sweeping reciprocal tariffs by the U.S. administration sent ripples through the global financial system. The detailed tariff list, unveiled late Tuesday, was framed as a push for trade balance. It targets countries imposing disproportionately high tariffs on U.S. exports — with Vietnam (90%), Cambodia (97%), and Bangladesh (74%) among the most notable.

The U.S. will now impose its own set of "discounted reciprocal tariffs," with some countries seeing duties as high as 48%. This has major implications for supply chains, U.S. importers, inflation expectations, and ultimately, GDP growth forecasts.

Investors are now reacting swiftly across asset classes — and we’re seeing textbook market psychology play out.

Gold: Safe Haven Flows Power Gold Rally

Fundamentals

- Gold surged as geopolitical and trade uncertainty escalated. As always, in times of expected economic contraction or trade dislocation, capital rotates into safety. The tariff move increases inflationary pressure and economic fragility, both of which are bullish for gold.

- Rising inflation risk makes gold more attractive as a hedge.

- Fears of GDP slowdown reinforce safe-haven demand.

Technicals

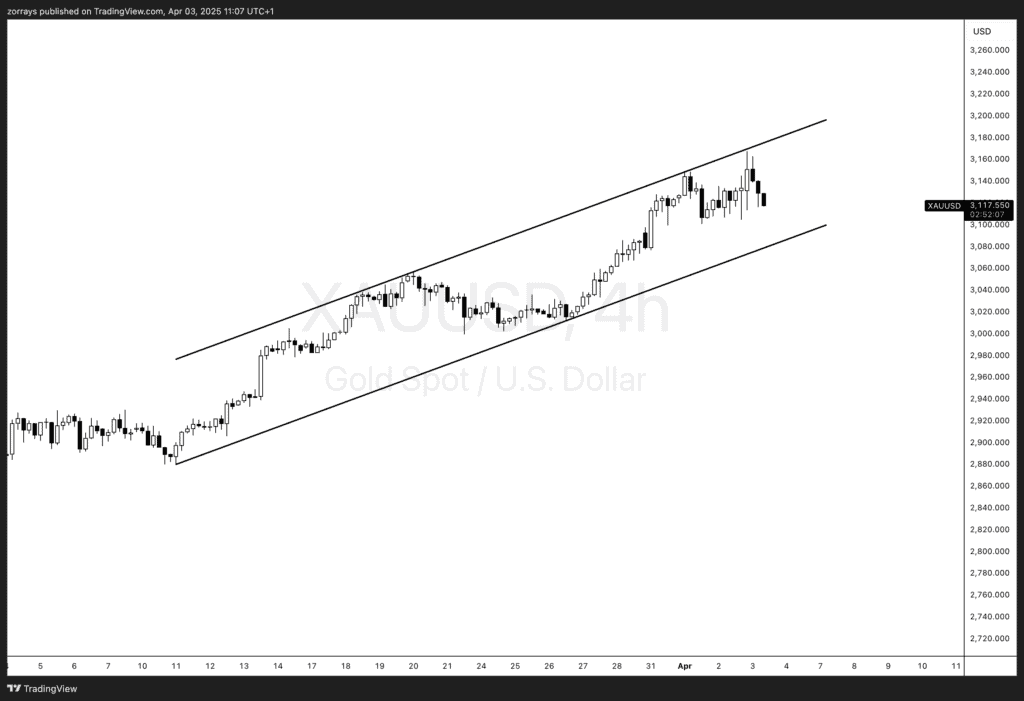

Gold (XAU/USD) continues to trade within an ascending channel. As seen in the chart:

- Price is hovering near the upper bound, suggesting short-term exhaustion.

- A break below could invalidate the bullish structure if positive news eases global tensions.

- However, as of now, momentum remains strong and supports upside continuation.

U.S. Dollar: Buckling Under Its Own Weight

Fundamentals

Despite the dollar’s traditional role as a safe haven, this time it’s directly in the crosshairs.

- These tariffs target countries that contribute significantly to U.S. imports, and retaliation could follow.

- Investors are expecting a drag on U.S. GDP, leading to capital outflows from dollar assets.

- The Fed’s ability to remain hawkish might also be compromised if growth expectations falter.

Technicals

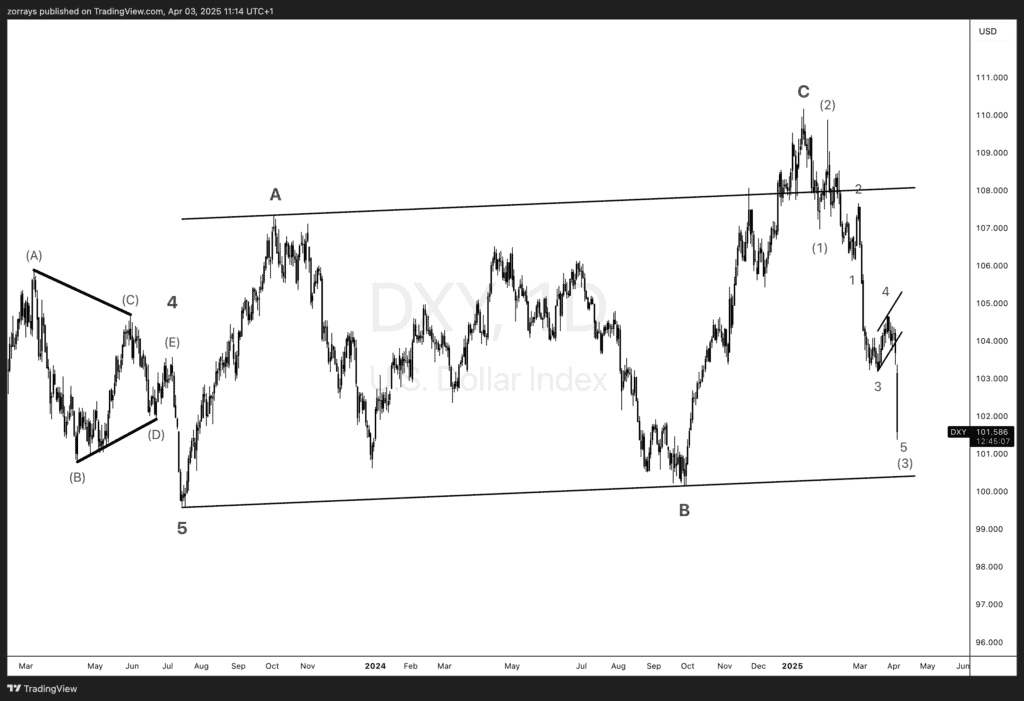

On the DXY chart:

- The dollar is in Wave 5 of a clear Elliott Wave impulse structure.

- It’s rapidly approaching the lower bound of a long-term ascending channel.

- If this zone fails to hold, a major trend reversal may be confirmed, setting the stage for further downside.

S&P 500: Stocks Under Pressure from Growth Fears

Fundamentals

Tariffs create inflation — and inflation slows growth. It’s that simple.

- U.S. corporations facing higher input costs are likely to revise earnings guidance lower.

- Global demand slowdown will impact export-heavy sectors.

- The market is beginning to price in recessionary conditions, or at the very least, a significant GDP slowdown.

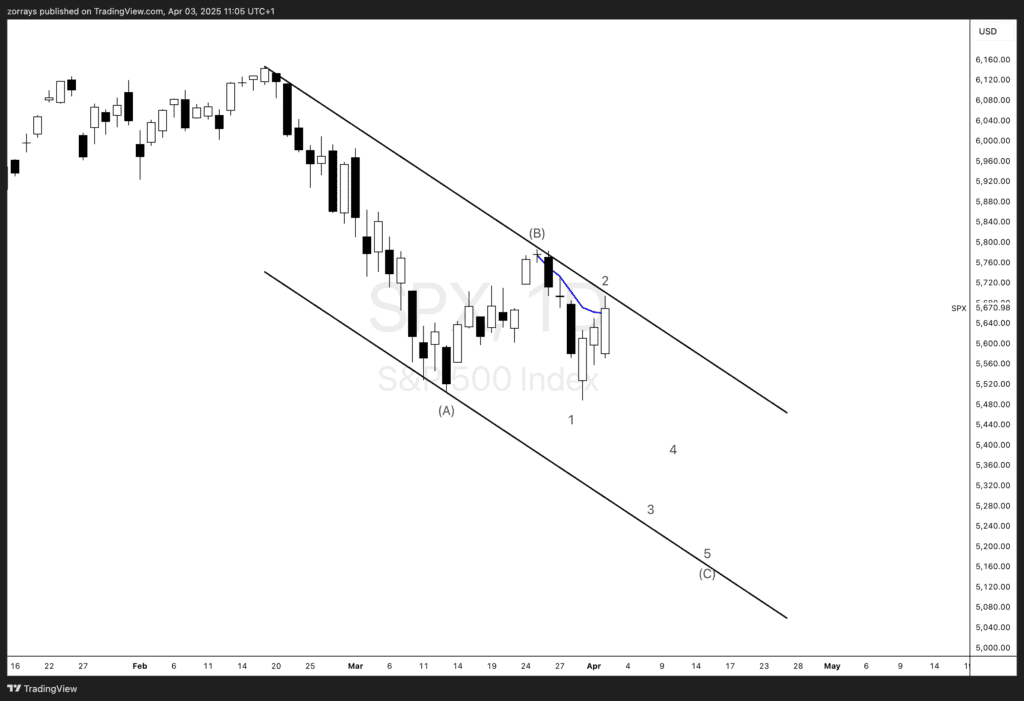

The S&P 500 (SPX) is:

Technicals

- Firmly trading in a descending channel, with the current rally showing signs of exhaustion.

- Wave 2 corrective move may be complete, paving the way for Waves 3-5 down in a classic ABC correction pattern.

- Any breakdown below recent lows will confirm bearish continuation and sector-wide re-rating.

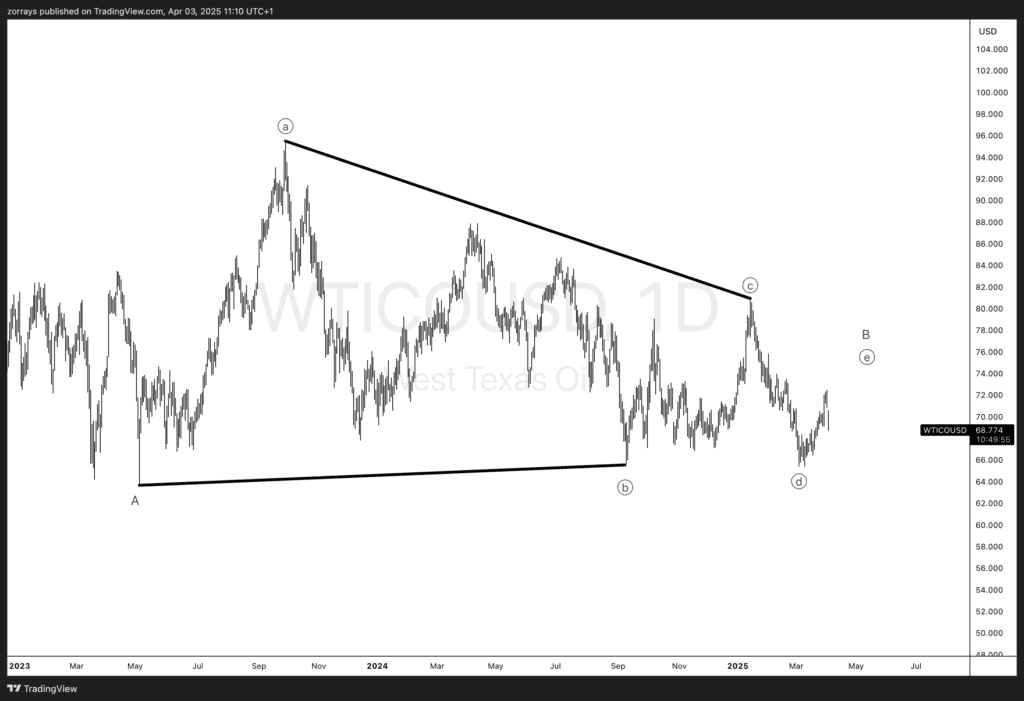

Oil (WTI): All Eyes on Wave E Completion

Fundamentals

Oil prices are likely to weaken despite geopolitical tensions due to the demand-side headwinds:

- Tariffs dampen global manufacturing and consumer spending, reducing crude demand.

- China, a major consumer, is affected by tariffs, indirectly curbing energy demand.

- Rising inventories and easing Middle East tensions also support the bearish oil narrative.

Technicals

WTI crude is:

- Trapped in a contracting triangle pattern, forming a classic ABCDE wave structure.

- Wave E may still be unfolding, but we’re nearing a potential completion.

- Once Wave E wraps, a breakdown is likely to follow, in line with fundamentals.

What to Watch Today

- Any retaliatory tariffs or statements from China/EU could accelerate these trends.

- The ISM Services data and any Fed remarks will shape rate expectations further.

- Technical breakouts or breakdowns in any of the assets above will signal the next big leg in market direction.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.