Should we Continue to Short USDJPY?

ACY Securities - Luca Santos

ACY Securities - Luca Santos

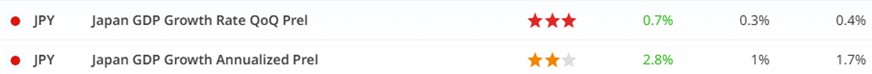

Japan's economic performance in the final quarter of 2024 has exceeded expectations, fuelling speculation that the Bank of Japan (BoJ) might accelerate its monetary policy normalization. With GDP expanding by 0.7% quarter-over-quarter—beating both market forecasts and prior estimates—the economic momentum appears stronger than anticipated. This growth was largely driven by robust external demand, particularly in the semiconductor sector, which contributed to a surge in exports and capital expenditures.

USDJPY Chart H1

Japan GDP Higher than Expected

While domestic consumption showed signs of moderation, it remained resilient. Private consumption edged up by 0.1%, defying expectations of a contraction. Notably, real wage growth turned positive, supporting household spending on both durable goods and services. However, inflationary pressures continue to mount, with the Consumer Price Index (CPI) reaching 2.93% year-over-year in Q4, compared to 2.77% in the previous quarter. This suggests that rising prices may weigh on consumer sentiment moving forward.

The BoJ has been cautious in its approach to monetary tightening, but the latest economic indicators may compel it to act sooner than markets currently anticipate. Current market pricing suggests a rate hike in July 2025 but given the strength of wage negotiations—like last year’s Shunto agreements—the central bank may move as early as May. Inflation is expected to remain elevated, with headline prices likely surpassing 4% year-over-year in January. This persistent inflationary environment strengthens the case for policy normalization.

However, geopolitical and trade risks could complicate the BoJ’s outlook. The possibility of tougher trade policies from the U.S., particularly under a potential second Trump administration, may introduce headwinds for Japanese exports. If reciprocal tariffs are imposed, the external demand that has been a key driver of growth could face challenges. Despite this uncertainty, the BoJ’s primary focus remains on containing inflationary pressures, reinforcing the likelihood of rate hikes in both May and October 2025, with an additional move in 2026.

As global markets continue to assess Japan’s trajectory, all eyes will be on the BoJ’s next steps. Should inflation persist and wage growth maintain its upward trend, an earlier-than-expected rate hike could provide much-needed support to the yen, which has faced depreciation pressures in recent months. For investors and policymakers alike, Japan’s evolving monetary landscape presents both opportunities and risks, setting the stage for a pivotal year in Japanese economic policy. I’m still shorting USDJPY for now.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.