Simple Moving Average Strategy: For Entries, Exits, and Trend Confirmation

ACY Securities - Jasper Osita

ACY Securities - Jasper OsitaThis is Part 4 of our Moving Averages Series

If you’re just joining, start with:

- Part 1: Moving Averages for Beginners

- Part 2: Best Moving Average Settings for Your Trading Style

- Part 3: How to Use Moving Averages as Dynamic Support and Resistance Zones

Goal of This Lesson

To help you confidently apply the 20 EMA and 50 SMA in real-time trading - not just as lines on your chart, but as trend filters, entry frameworks, stop anchors, and trail guides - all paired with the one tool that never lags: price action.

Quick Recap from Part 3

In Part 3, you learned:

- The 20 EMA reacts quickly to short-term momentum

- The 50 SMA offers smoother trend structure confirmation

- Different combinations suit different trader types

Now let’s use them in live setups - the simple way.

Reminder: MAs Are Tools, Not Signals - Use Them in Trends Only

Moving averages only provide value when the market is moving with direction.

When price is ranging, they give confusing and false signals.

Avoid using MAs when:

- 20 EMA and 50 SMA are flat or crossing repeatedly

- Price is cutting through both with no clear HH/HL or LH/LL

- Structure is unclear and the market feels indecisive

Let the market tip its hand first. MAs work best after the breakout - not before it.

The Role of the 20 EMA and 50 SMA - Together

| MA | What It Does | Best Use |

|---|---|---|

| 20 EMA | Reacts to short-term shifts | Entry timing + dynamic support/resistance |

| 50 SMA | Filters larger trend direction | Trend bias + structural confirmation |

Used together:

- 20 EMA = trigger zone

- 50 SMA = trend filter + reset zone

Why Price Action Confirmation Still Comes First

Here’s what most beginners miss:

Moving averages are not predictive. They follow price - not lead it.

Even the 20 EMA, which feels responsive, is still built on previous candles.

That’s why:

- MAs should act as supportive tools, not entry signals by themselves

- Price action is still the real-time confirmation you need to pull the trigger

Think of it like this:

- MAs show you where trades might happen

- Price action tells you when it’s time to act

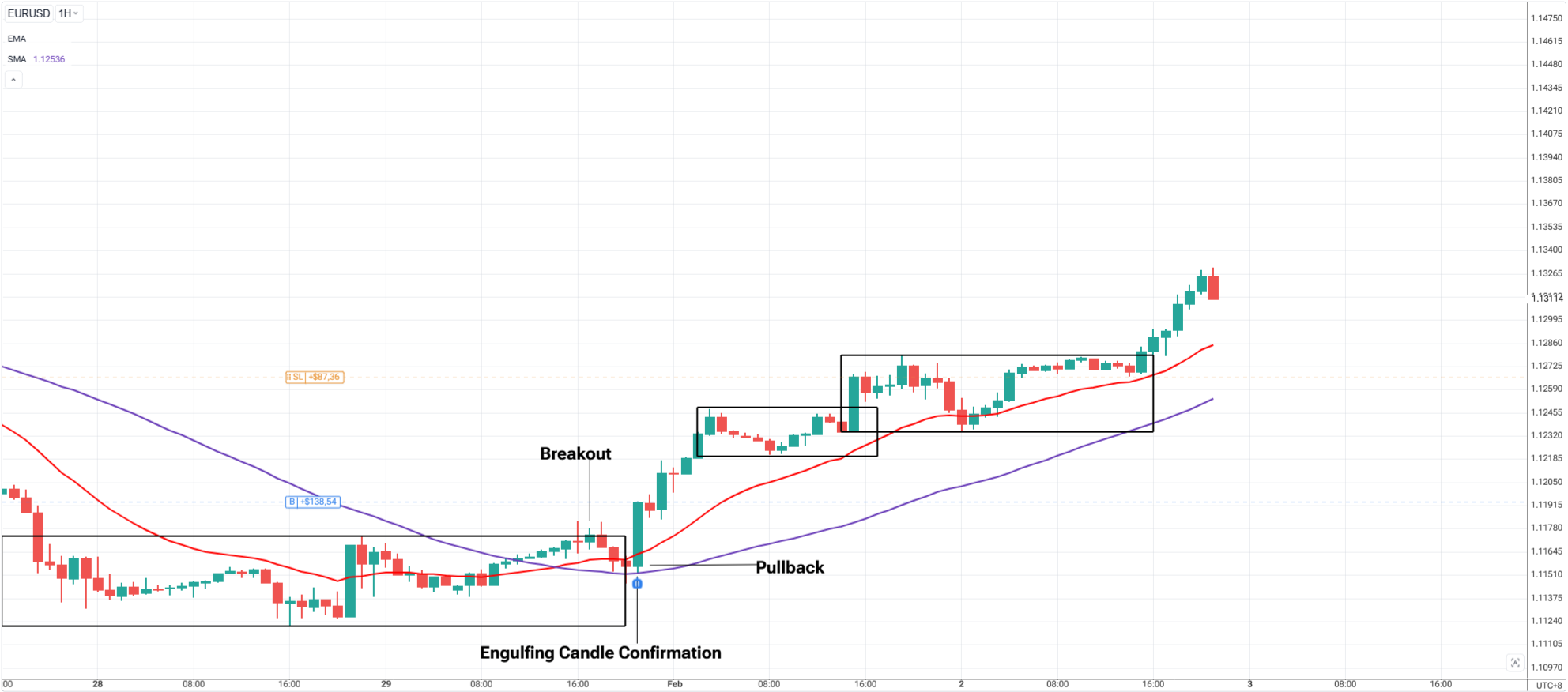

The Strategy: Break and Retest Entry + Stops Using 20 EMA + 50 SMA

Step 1: Identify the Trend

- Is price Ranging? Trending?

- 50 SMA sloping up/down = higher timeframe trend

- 20 EMA sloping with it = momentum and flow

- Price above both = bullish trend (look for buys)

- Price below both = bearish trend (look for sells)

If MAs are aligned and structure agrees, bias confirmed.

If Price is ranging, wait.

Step 2: Wait for Price to Breakout and Pullback

- 20 EMA = quicker pullback, shorter-term setup

- 50 SMA = deeper pullback, more conservative/trend reset

Bonus if price pulls into a prior OB, FVG, or S/R level near the MAs

Step 3: Use Price Action as the Entry Trigger

Examples:

- Bullish or bearish engulfing/piercing candle/s at the MAs

- Wick rejection and close above/below

- BOS or CHoCH near the moving averages

- Liquidity sweep + strong reaction + fair value gap

Enter on candle close if price confirms direction and structure still favors the trend

Stop-Loss Placement Logic

| Type of Entry | Suggested Stop |

|---|---|

| 20 EMA bounce | Below last swing + below EMA wick |

| 50 SMA pullback | Below previous structure or consolidation |

| Aggressive confirmation | Below entry candle or minor structure |

Always give the trade space below the MA zone - don’t put stops right on the line.

Trail Your Position Using the EMAs

Method 1: Price-Structure Trail

- Trail SL below each higher low (in uptrend) or lower high (in downtrend)

- Use 2 ranges for invalidation of the trend, set SLs behind

Method 2: EMA-Based + Price Action Trail

- As long as price stays above the 20 EMA, hold the trade

- If price closes below the 20 and breaks structure, exit

Use the 50 SMA as a deeper trailing reference for swing trades.

Spotting a Trend Shift With the 20 EMA + 50 SMA

Want to know if the trend is fading or reversing?

Look for this combo:

1. Crossover

- 20 EMA crosses below 50 SMA = bearish momentum building

- 20 EMA crosses above 50 SMA = bullish shift

2. Price Confirmation

- Bullish: Price closes above both MAs and forms HH/HL

- Bearish: Price closes below both MAs and forms LH/LL

- Watch for CHoCH, FVG, or aggressive rejection wicks

Crossover alone is not a trade signal.

Confirmation through price action is still required.

Quick Checklist: 20 EMA + 50 SMA Confluence Entry System

✅ 50 SMA confirms overall trend

✅ 20 EMA sloping with momentum

✅ Price pulls into either MA

✅ Price action triggers confirmation (engulfing, rejection, CHoCH)

✅ Stop below EMA or swing

✅ Trail below HL/LH or 20 EMA

✅ Exit on structure break or close beyond both MAs

Final Thought

The 20 EMA and 50 SMA give you rhythm, flow, and context.

But they’re still based on past price.

The market moves first — and your job is to read it in real time.

Price action is the only real-time indicator.

Use MAs as filters, not signals.

Combine structure + MAs + a price confirmation — and you’ll stop chasing trades… and start catching cleaner trends.

Call to Action

Here’s your practical drill:

- Add 20 EMA and 50 SMA to your chart

- Identify 3 trending setups this week

- Wait for pullback to either MA

- Confirm with price action (engulfing, wick, break)

- Log:

- Trend bias

- Entry candle

- Stop logic

- Exit reason

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.