Tariffs Spark Market Turmoil: US Indices Tumble Amid Trade Uncertainty

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

Market Overview:

- Trump reaffirms 25% tariff on Canada and Mexico (March 4).

- Dow Jones, Nasdaq, and S&P 500 tumble as uncertainty rises.

- Consumer goods at risk: Fruits, beer, car parts, lumber, and steel.

- Nvidia crashes (-8.48%), dragging Nasdaq and S&P lower.

- Investor sentiment turns bearish, VIX nears 20, signaling risk-off conditions.

- Technical outlook: Market remains bearish, favoring short opportunities.

Tariffs Shake US Markets

Trump reaffirmed that the 25% tariff on Canada and Mexico remains in effect starting March 4, causing a sharp decline in Dow Jones, Nasdaq, and S&P 500.

Key Consumer Goods at Risk:

- Fruits & Vegetables

- Beer & Tequila

- Car Parts

- Lumber

- Steel

While importers and businesses face the immediate impact, consumers will feel the effects next. The US market had already stalled since February when Trump announced a grace period for the tariff.

Dow Jones

Daily Chart

4-Hour

Previously, we anticipated a reaction off the Daily Fair Value Gap (FVG), signaling further downside. The Dow failed to recover, with the 4-hour chart attempting to push through resistance but lacking strength, confirming weak market sentiment.

Biggest Loser: NVIDIA (-8.48%)

Nvidia plunged from $135.01 to $120.15, leading the Nasdaq and S&P 500 lower as investors offloaded tech stocks.

Nasdaq & S&P 500 Breakdown

Nasdaq

Daily

4-Hour

S&P 500

Daily

4-Hour

A clean breakdown in both indices confirms bearish momentum, increasing the risk of new market lows.

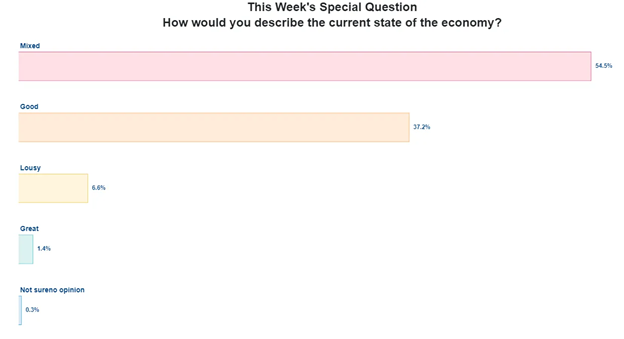

Market Sentiment According to AAII

The American Associate of Individual Investors detailed according to their latest Investor Sentiment Survey what direction the AAII members feel the market will be in the next 6 months:

Pessimism among individual investors about the short-term outlook for stocks increased in the latest AAII Sentiment Survey. Meanwhile, both optimism and neutral sentiment decreased. - AAII

Survey further adds a bearish note on sentimental analysis for the US market and would further increase a risk-off sentiment of the consumers.

Sentiment Synced with the Volatility Index

VIX nearing 20 signals rising uncertainty, reinforcing bearish expectations.

Technical Approach: Short Bias on US Indices

Given the lack of bullish reversal signals, potential short opportunities arise:

✅ Entry: At recent bearish Daily Fair Value Gaps

✅ Confirmation: Wait for 4H or 1H bearish structure

✅ Stop Loss: Above the intraday structure

✅ Target Levels:

Market Outlook:

- Bearish bias remains unless a significant shift in sentiment occurs.

- Watch for Fed or policy responses that may change momentum.

- Short-term rallies could present selling opportunities in line with the broader downtrend.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.