Tariffs, Tech & Tension: Market Breakdown on USD, Dow, Nasdaq & S&P 500

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

Overview

The first week of April 2025 opened with a bang as U.S. reciprocal tariffs went live. This triggered volatility across all major asset classes — particularly the U.S. Dollar and U.S. indices. While the USD battled with stagflation fears and range-bound indecision, equity markets became a case study in divergence: Dow Jones showed weakness due to global exposure, Nasdaq 100 showed resilience thanks to tech strength, and the S&P 500 hovered in between, reflecting mixed sentiment and sector rotation.

- US Dollar – Tariff Uncertainty Keeps USD in Check

After briefly rising on risk-off flows, the dollar stalled as growth concerns mounted. The market remains cautious, waiting for clarity on inflation, jobs, and the Fed.

- USD is range-bound between 104.40 – 103.75, reflecting indecision.

- Stagflation risks rising weak job openings, contracting ISM, rising core prices.

2. Dow Jones – Under Pressure from Trade Fallout

The Dow is taking the brunt of the tariff impact due to its heavy exposure to manufacturing and global exporters. Sentiment remains fragile amid fears of foreign retaliation.

- Testing support zones around 41,500–42,200; sellers still in control below 42,200.

- Key multinationals like Caterpillar and Boeing face counter-tariff risks from China and Europe.

3. NASDAQ 100 – Tech Resilience Despite Macro Jitters

Despite being hit early in March, the Nasdaq is bouncing back. Lower yields and investor rotation into tech are helping it stay afloat even as tariffs shake global sentiment.

- Rebounding after a sweep of 19,110 lows; testing key resistance at 19,296–19,737.

- Mega-cap tech names (Tesla, Amazon, Meta) driving momentum on dip buys and earnings optimism.

4. S&P 500 – Caught in the Middle of Sector Rotation

The S&P is reflecting a sector tug-of-war. Defensive names and tech are offsetting declines in cyclicals and trade-sensitive stocks. The index is currently navigating a fair value gap zone.

- Bouncing off 5,502 support; eyeing breakout above 5,700 or breakdown below 5,555–5,500.

- Volatility remains high (VIX > 20) – expect large intraday moves and news-driven swings.

5. Key Data to Watch This Week

- ISM Services PMI

- Non-Farm Payrolls (NFP) – expected to come in softer.

→ A weak NFP could trigger USD downside and bullish equity momentum.

US Dollar Under Pressure

The USD post-tariff price action suggests a cautious tone. The dollar initially caught a safe-haven bid on trade uncertainty, but its gains are capped by concerns that U.S. tariffs will hurt domestic growth

Traders are torn between the greenback’s typical haven status and the fact that this tariff shock originates in the U.S. economy. As a result, sentiment on the Dollar Index is mixed: it’s holding in a range as markets await clarity on how severe the economic fallout from the tariffs will be. As of now, Dollar is still in a range-bound stance since Friday, trading between 104.40 - 103.75.

Key Fundamentals

- Tariff Safe-Haven Flows: The new reciprocal tariffs sparked risk-off moves, but notably yen demand outpaced dollar demand as a haven. Investors see the Japanese yen as safer than the USD right now, since U.S. trade policies may backfire on U.S. growth.

- Growth vs Inflation Mix: Latest data underscore a stagflation risk. U.S. manufacturing contracted in March (ISM < 50) and job openings fell, lower than the previous and forecast, signaling cooling growth.

Daily

The greenback has not recovered since then and is trading in a broad consolidation.

4-Hour

The bias is neutral-to-bullish: the dollar may grind higher on global risk aversion, but significant gains are less likely if U.S. economic data continues to deteriorate (which would fuel Fed rate-cut bets). Unless we break the 103.759 level for downside continuation or create new highs at the break of 104.70, uncertainty on its trajectory is still certain.

How the U.S. Dollar Affects U.S. Indices

1. ⬆️ Stronger Dollar = Headwind for Stocks (Mostly)

- A strong USD makes U.S. exports more expensive abroad → bad for multinational companies in the Dow and S&P 500, which rely heavily on overseas revenue.

- It also reduces the value of profits earned in foreign currencies (when converted back to USD) → hurts earnings.

Most affected:

- US30 (Dow) → lots of exporters & industrials

- US500 (S&P 500) → large-cap global firms

2. ⬇️ Weaker Dollar = Boost for Equities

- A weaker USD generally supports corporate earnings by making exports cheaper and overseas profits more valuable.

- It also tends to ease financial conditions and support risk-on sentiment → good for equities overall.

Especially helps:

- Industrial, materials, and tech stocks with foreign sales

- Small-cap companies that compete with foreign imports

3. USD & Interest Rates Correlation

- A rising USD often reflects rising yields → tighter financial conditions → equity valuations drop (especially growth stocks like in NASDAQ).

- A falling USD often accompanies lower rates or Fed dovishness, which supports tech and growth sectors.

Most rate-sensitive:

- NAS100 (Nasdaq) → benefits from weaker dollar and lower yields

4. Dollar Sentiment Signals Global Risk Appetite

- USD strength = risk-off (flight to safety, hurts equities)

As we move deeper into April, expect headline-driven volatility to remain high. The USD’s direction will continue to influence equity flows, and sector rotation will shape index performance. For traders, this environment favors relative strength plays, short-term setups, and macro-awareness over blind trend-following.

Dow Jones Industrial Average

The Dow Jones index, laden with industrial giants and exporters, sits at the epicenter of tariff fallout fears.

After the April 1 tariff implementation, Dow sentiment is skittish – the index has seesawed as investors weigh tariff costs against any potential benefits from domestic protectionism. So far, the damage seems to outweigh the good: the Dow struggled in late March and remains under pressure relative to tech-heavy indexes.

- Global Sentiment and Retaliation: Tariff retaliation risk is casting a long shadow. Key Dow multinationals (Boeing, Caterpillar, Apple, etc.) face the threat of foreign counter-tariffs on U.S. exports or operations. Europe, Canada, and China have all signaled they are prepared to answer U.S. measures in kind

- Macro Data & Earnings: Recent macro data has flashed warning signs for Dow companies. In addition to weaker manufacturing PMIs, the labor market shows hints of cooling (February job openings dropped to ~7.57M

Daily

The Dow had a quick rebound after the week started with price action hovering at the 41996.70 - 42127.41 levels.

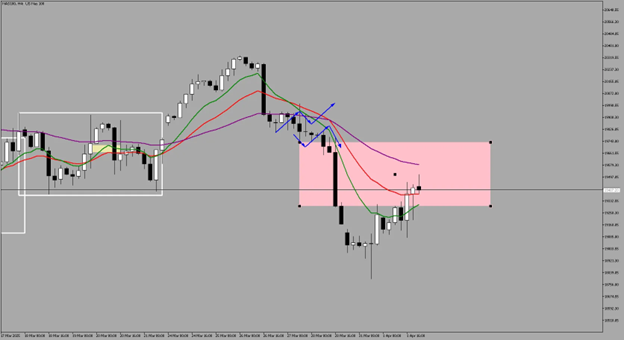

4-Hour

On the 4-Hour timeframe, we are also seeing the fair value gap at 42139.50 - 41614.14 level is currently being tested with potential downside if invalidated by trading through it and closing above it.

Trade Approach:

- If the bearish stance persists by staying below the 42200 level, we could look for breakdown plays below 41500 - 41200 levels.

NASDAQ Performance Amidst Tariffs Concerns - Volatile

The Nasdaq has shown resilience in the face of the trade war news: after being among the hardest hit in early March, it led a late-month short rebound.

- Tech Rebound vs. Tariffs: After a rough start to 2025, mega-cap tech stocks have recently regained footing. In the last week of March, the Nasdaq roared back nearly +0.9% in a single session buoyed by big tech earnings optimism and dip-buying. Names like Tesla, Amazon, Microsoft, and Meta rallied into early April

- Earnings and Innovation: Unlike the Dow, the Nasdaq faces less direct tariff risk on the demand side – consumers aren’t likely to stop using software or cloud services due to tariffs.

Daily

After taking out the liquidity at the most recent low price at 19110.35, NASDAQ took a 2-day rebound.

4-Hour

Currently its testing the equilibrium level at the 19296.70 - 19737.00 level. If the rejection is sustained, we could see further downside for the US tech stocks.

1-Hour

If we see a breakdown of a range for a downside move, we can look for short opportunities, focusing on range breakdowns with stops behind the range.

S&P 500 Uneven Performance

As the benchmark for U.S. equities, the S&P 500 is reflecting the tug-of-war between sectors: trade-sensitive industries are lagging, while defensive and some tech names are cushioning the index. The S&P 500 tariff impact has been evident in the market’s uneven performance – one day risk-off selloffs on tariff headlines, the next day dip-buying in oversold names.

- Sector Divergence & Rotation: With tariffs in play, investors are shifting to durables, communication services and tech stocks as these are the least affected by recent trade wars.

- Volatility and Sentiment: Market volatility is elevated – the VIX surged to roughly 25–30 in late March, the highest level in years, amid the tariff headlines. VIX is still trading above 20 which signals that fears are still lingering in the market.

Daily

With the same correlation with NASDAQ, after bouncing from the previous support priced at 5502 level, S&P is now testing the bearish fair value gap at the 5624.37 - 5669.79 level.

4-Hour

On the 4-Hour chart, S&P is still on a rebound with no signs, yet, of downside continuation.

Trade Approach:

- Unless we break the 5555 down to 5500 level, rebound is still in play.

- We could look for breakdowns below that level.

- For breakouts, look for bullish sequence above the 5700 highs.

Incoming Red Folders this Week

Keep watch on the Services PMI and primarily, the Non-Farm Payroll print for a momentum kick this week. With forecasts lower than the previous, this could be a hint of a weaker USD and can be a bullish potential for US stocks.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.