The Best Trading Journals for 2025 and How They Help You Control Risk

ACY Securities - Jasper Osita

ACY Securities - Jasper OsitaGoal of This Lesson

To help traders understand that a proper trading journal isn’t just a record-keeping tool—it’s a weapon against two deadly threats:

- Financial risk – losing money unnecessarily

- Personal risk – the risk of failure through repeated mistakes, emotional sabotage, and not learning fast enough

Without a journal, you’re not just risking your account. You’re risking your ability to grow into a consistently profitable trader.

Real-Life Analogy

Imagine a professional athlete preparing for competition. They don’t just practice; they review every performance, every error, and every win. They analyze film, track stats, and make adjustments.

As traders, our “film study” is our journal.

- Without one, you’re playing blind, repeating the same mistakes, and sabotaging your own future.

- With one, you can pinpoint exactly where you’re bleeding capital and identify the habits holding you back.

The Big Picture: Why a Journal Controls Risk

1. You Can’t Improve What You Don’t Track

- Many traders say “I’ll remember this mistake,” but they rarely do.

- Journaling exposes patterns not just in your losses but in your behaviors (e.g., overtrading after news, ignoring stop-losses).

- Once you see the problem clearly, you can fix it before it kills your account or confidence.

2. Journals Reveal “Risk Creep”

- Risk creep = gradually increasing risk per trade without realizing it.

- This doesn’t just lead to financial drawdowns—it erodes your discipline, making it easier to justify even worse mistakes next time.

3. It Protects Against Emotional Self-Sabotage

- Recording how you felt during a trade (“angry, FOMO, pressured”) shows if emotions are driving your decisions.

- Left unchecked, emotional trades can spiral into revenge trading and massive account blow-ups. Your journal catches these patterns early.

4. Journals Build Statistical and Emotional Confidence

- When you have hundreds of logged trades, you know your edge and can trust the math.

- This stops you from abandoning a good system just because of a losing streak, which is one of the biggest causes of trader failure.

What to Track in Your Journal

1. Trade Setup Details

- Date, time, pair/asset

- Entry reason (strategy, confirmation signals, liquidity sweep, etc.)

- Entry price, stop-loss, take-profit

2. Risk Metrics

- Position size & % risked per trade

- Daily/weekly loss running total

- Risk-reward ratio at entry

3. Trade Management

- Adjustments made (moved stop? scaled in or out?)

- Reason for exiting trade

4. Emotional State

- Notes on mindset (calm, revenge trading, FOMO, distracted)

- Scale of 1–10 for confidence

5. Outcome & Lessons

- P/L result in R-multiple (e.g., +2R, -1R)

- What went well / what to improve next time

How to Journal Efficiently

Top Tools for Trading Journals and Their Benefits

1. Google Sheets / Excel

- Benefits:

- Free and fully customizable

- Easy to build your own templates and formulas

- Filter and sort trades based on strategy, win rate, or day of week

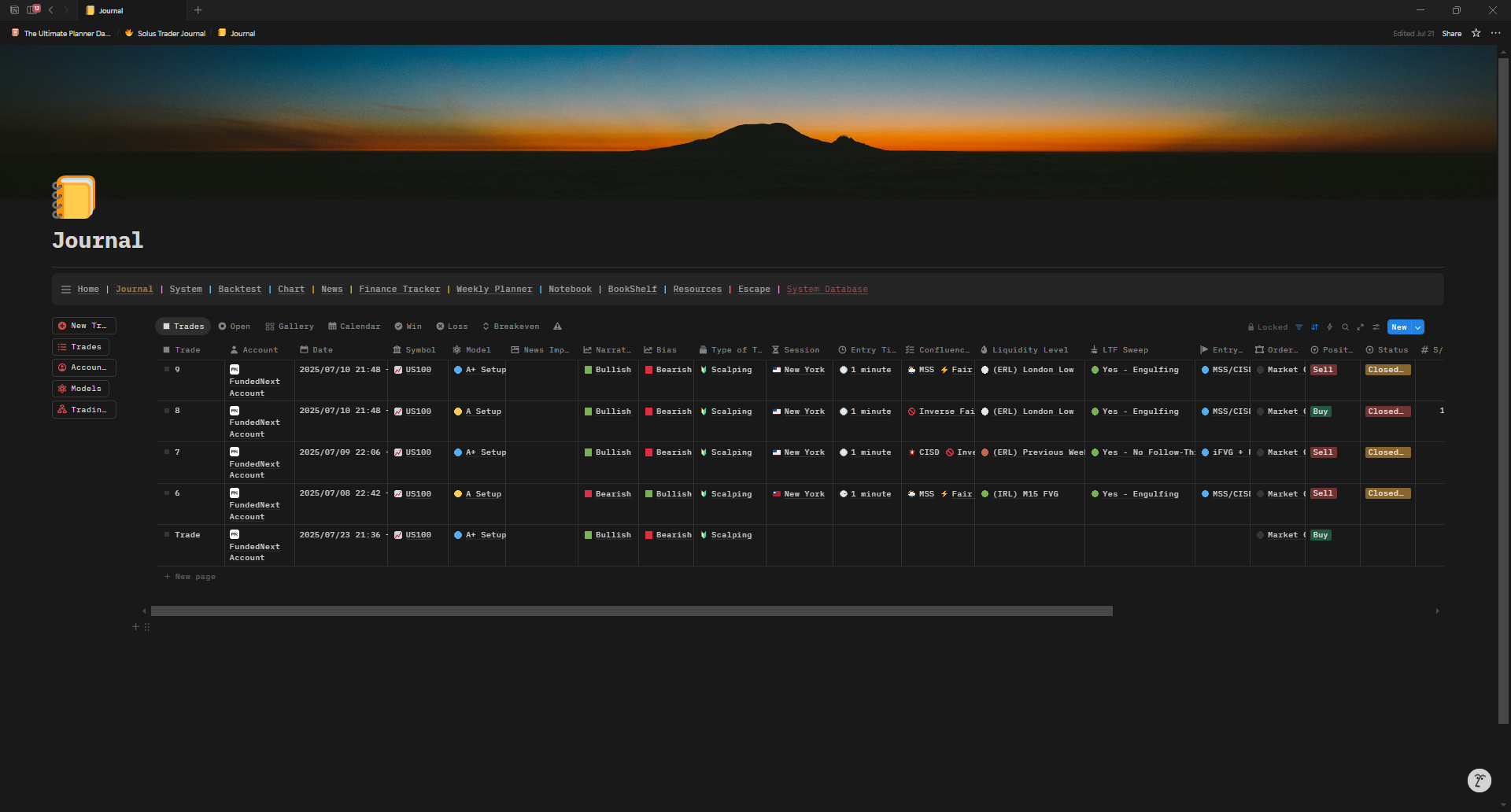

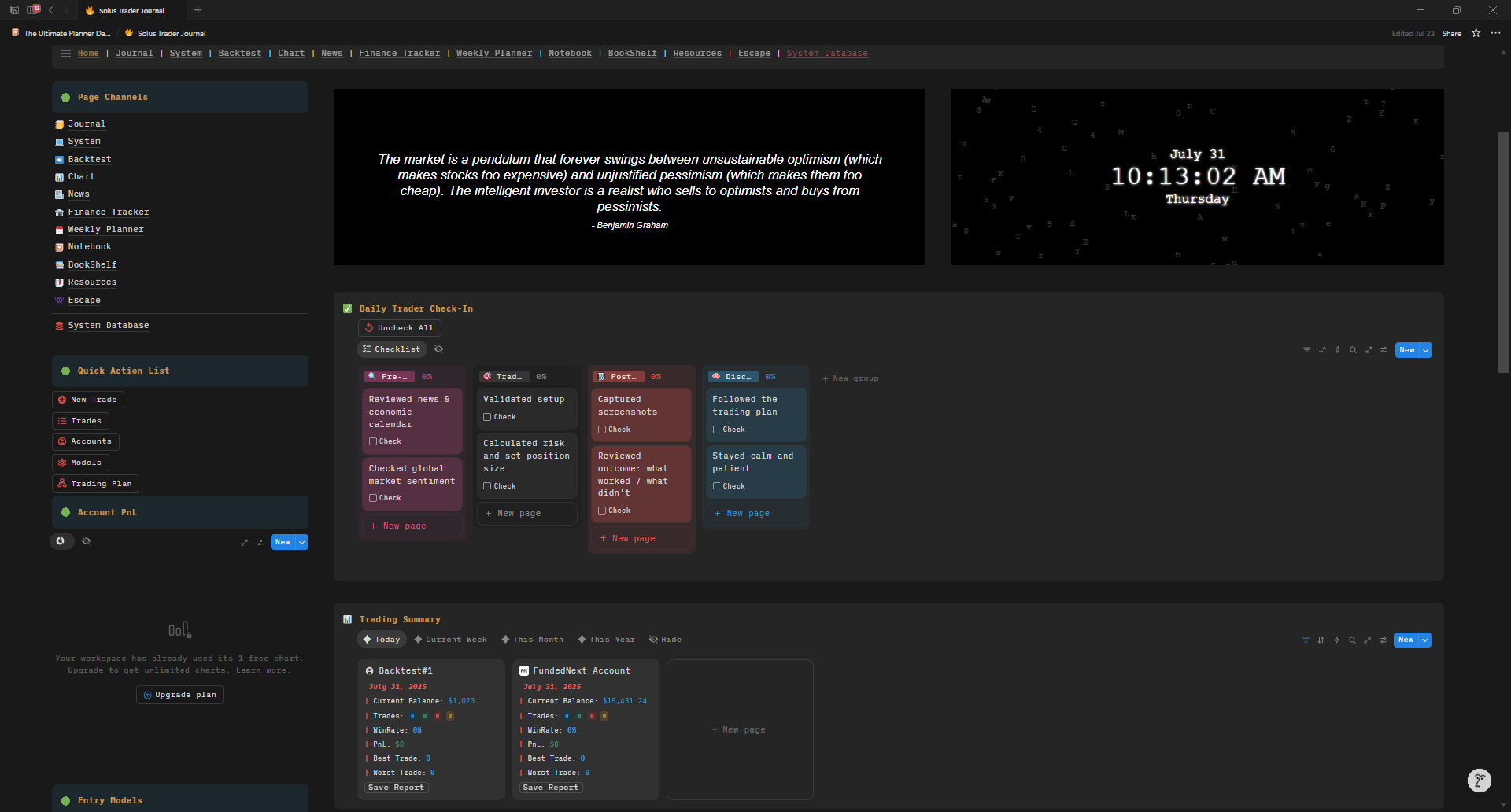

2. Notion

- Benefits:

- Great for traders who want a visual dashboard with charts and notes

- Can integrate images and screenshots directly from trades

- Combines journaling and trade plans in one clean interface

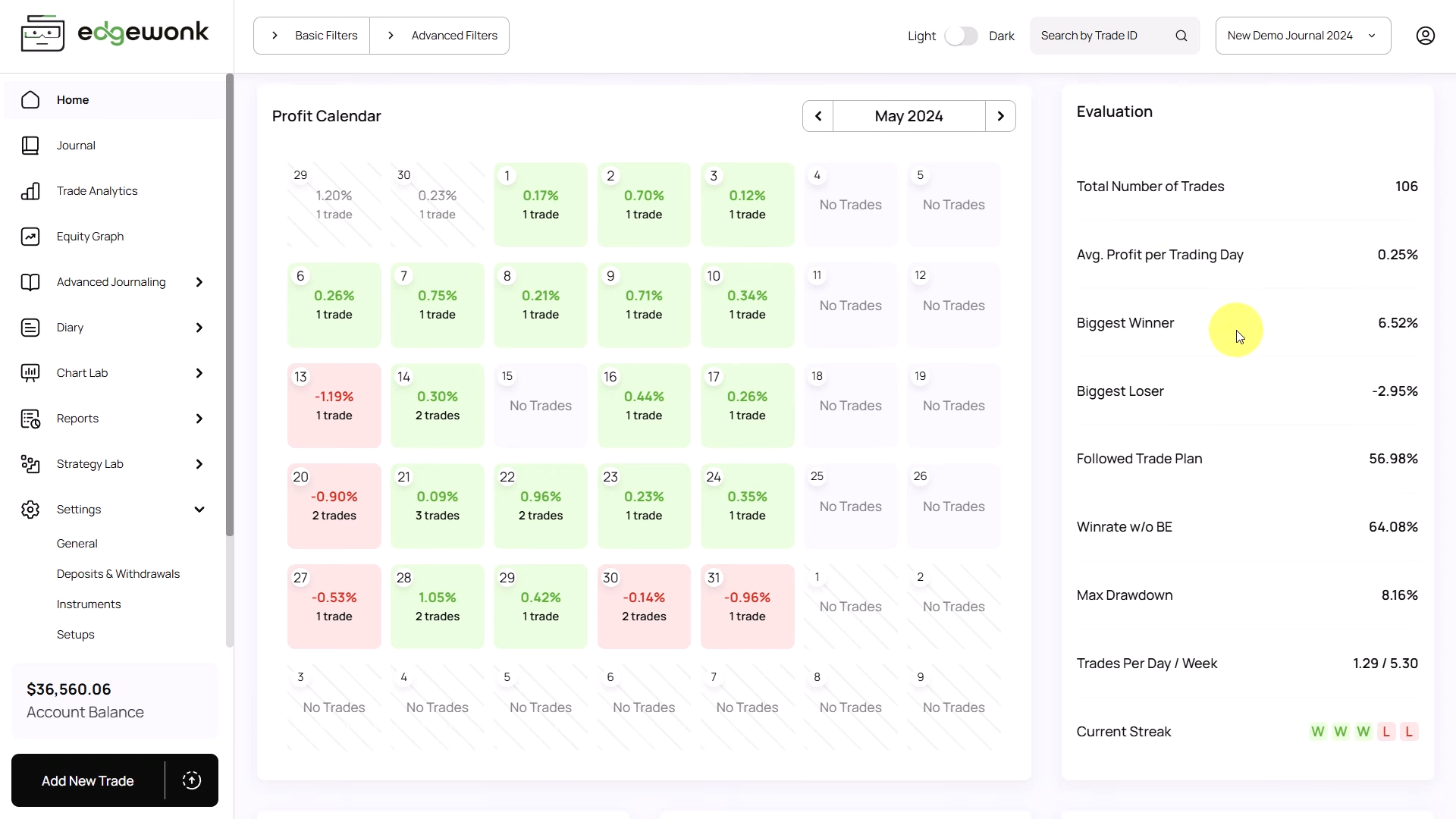

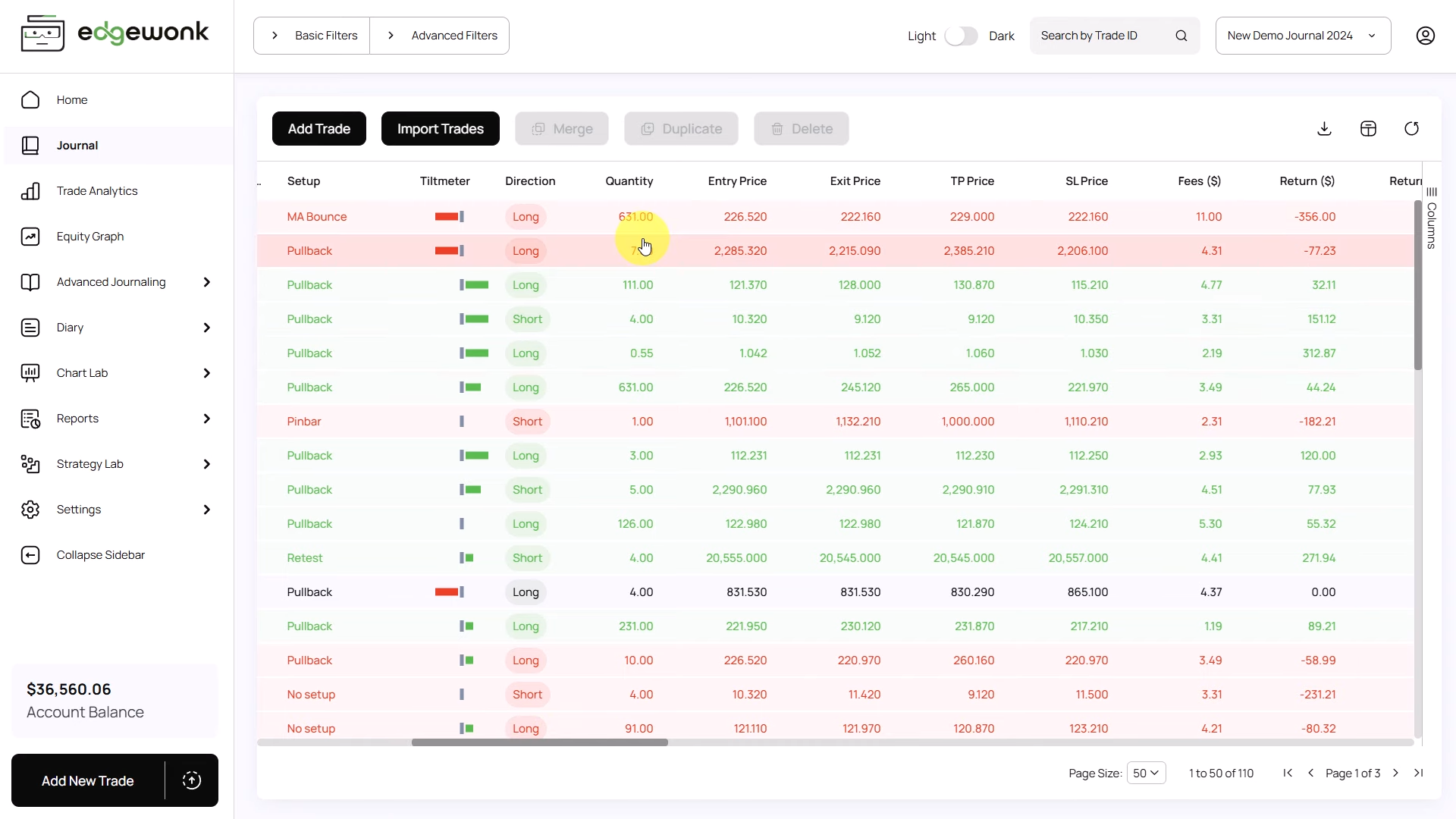

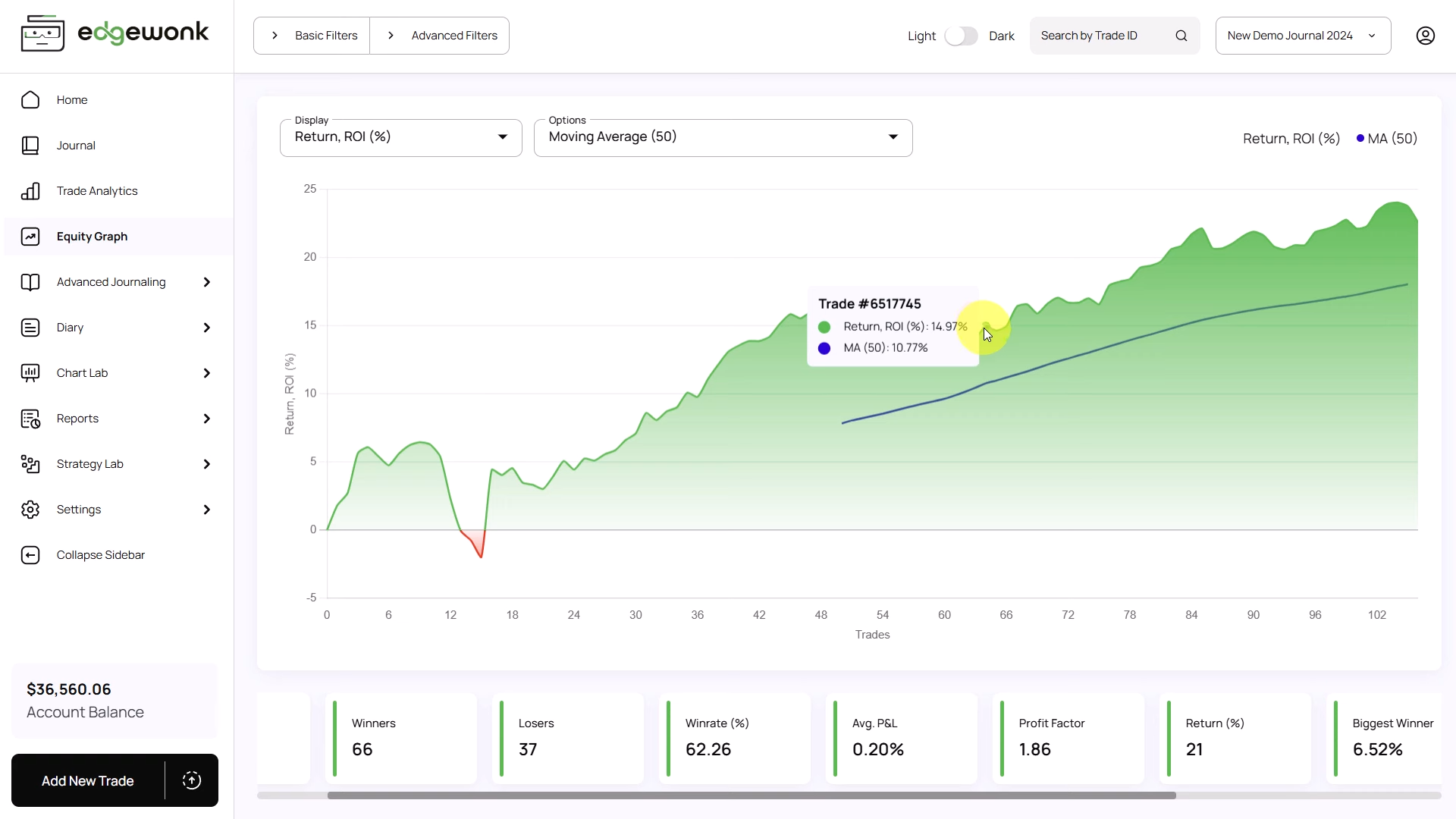

3. Edgewonk (Paid)

- Benefits:

- Purpose-built for traders with detailed analytics

- Features like “Tilt Meter” to detect emotional trading

- Auto-calculates advanced metrics like MAE (Maximum Adverse Excursion) and R-multiples

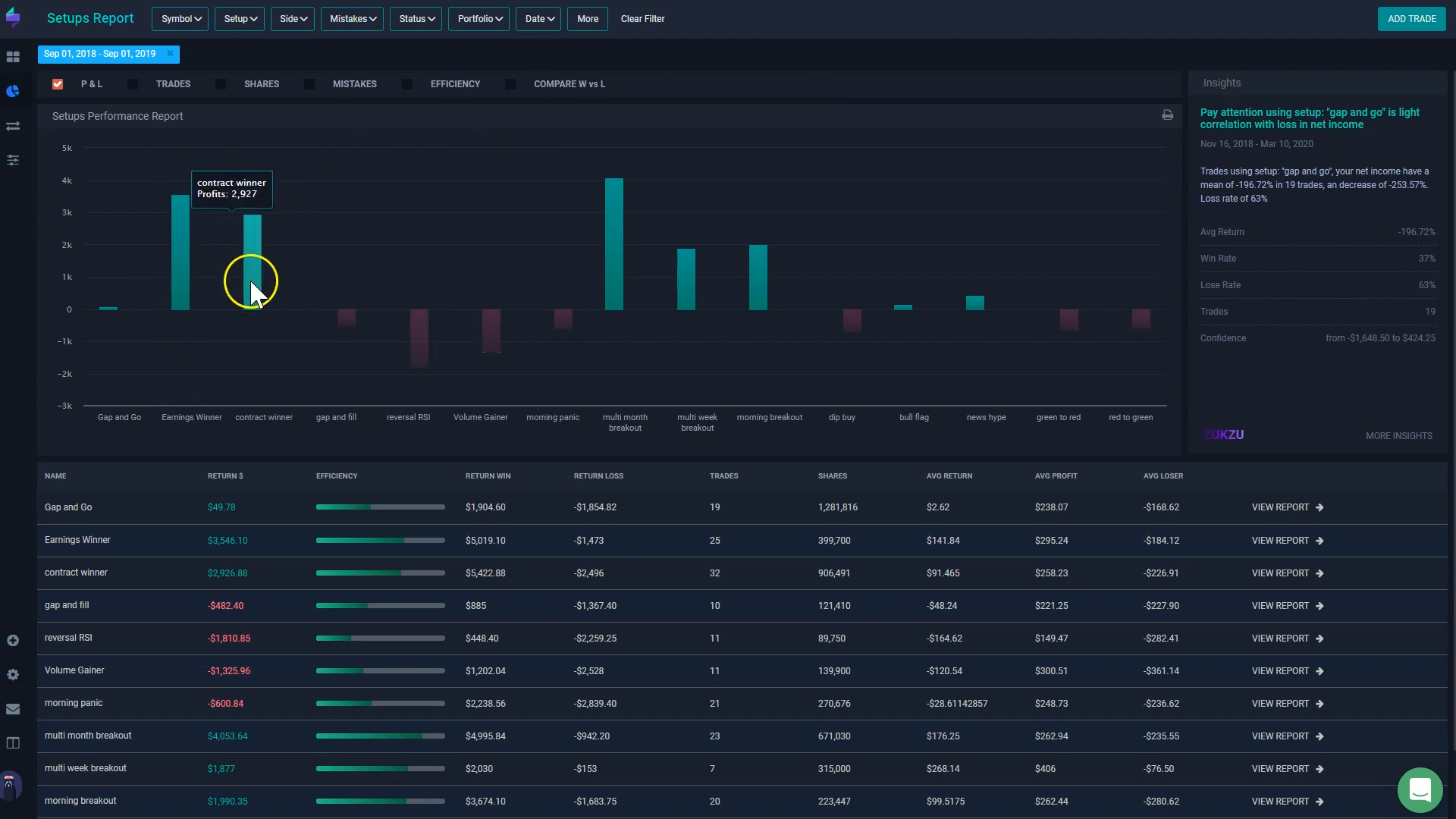

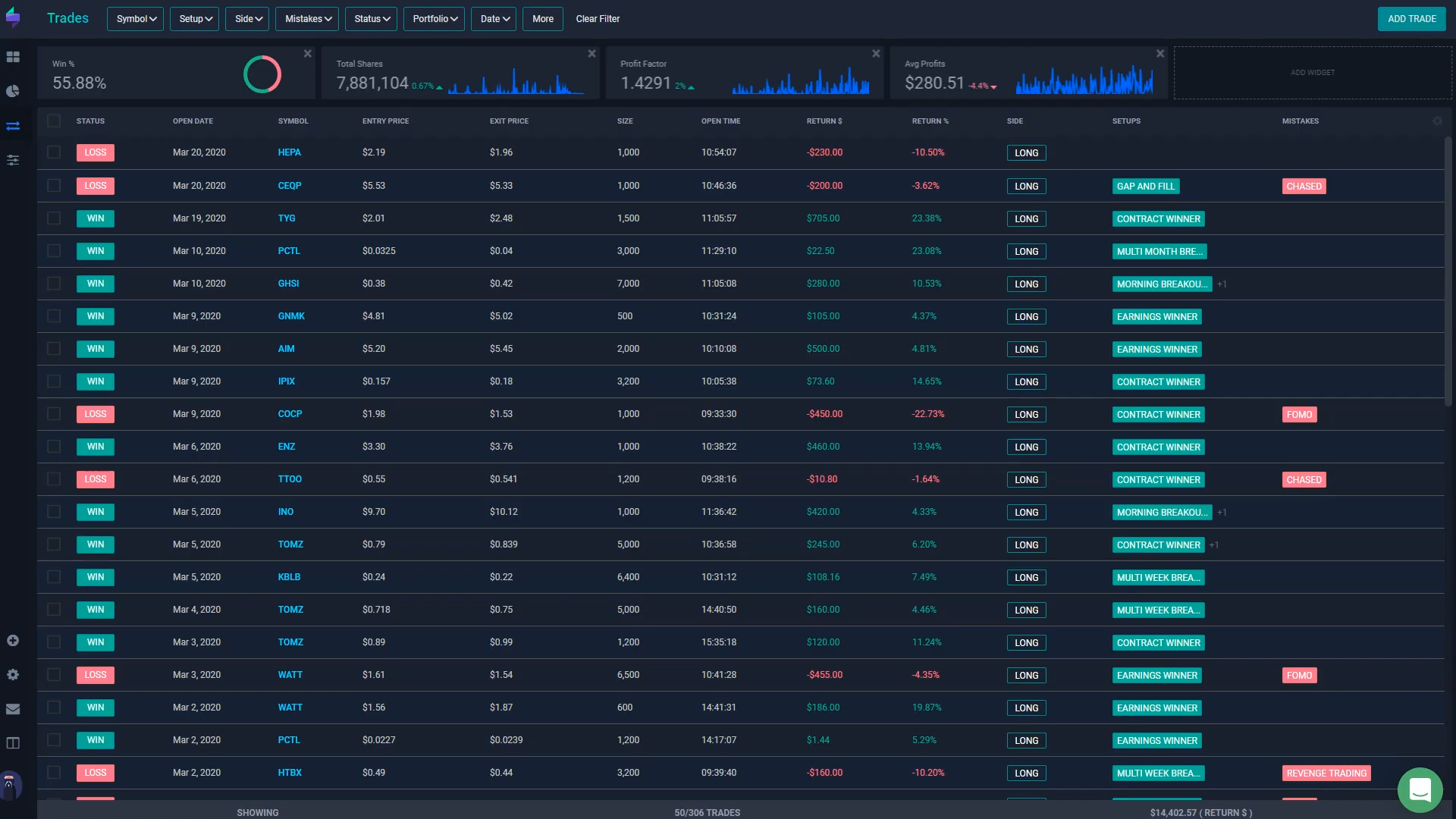

4. TraderSync (Paid)

- Benefits:

- Can import trades directly from most brokers (saves time)

- Built-in performance dashboards and equity curve visuals

- Helps pinpoint best/worst strategies with one click

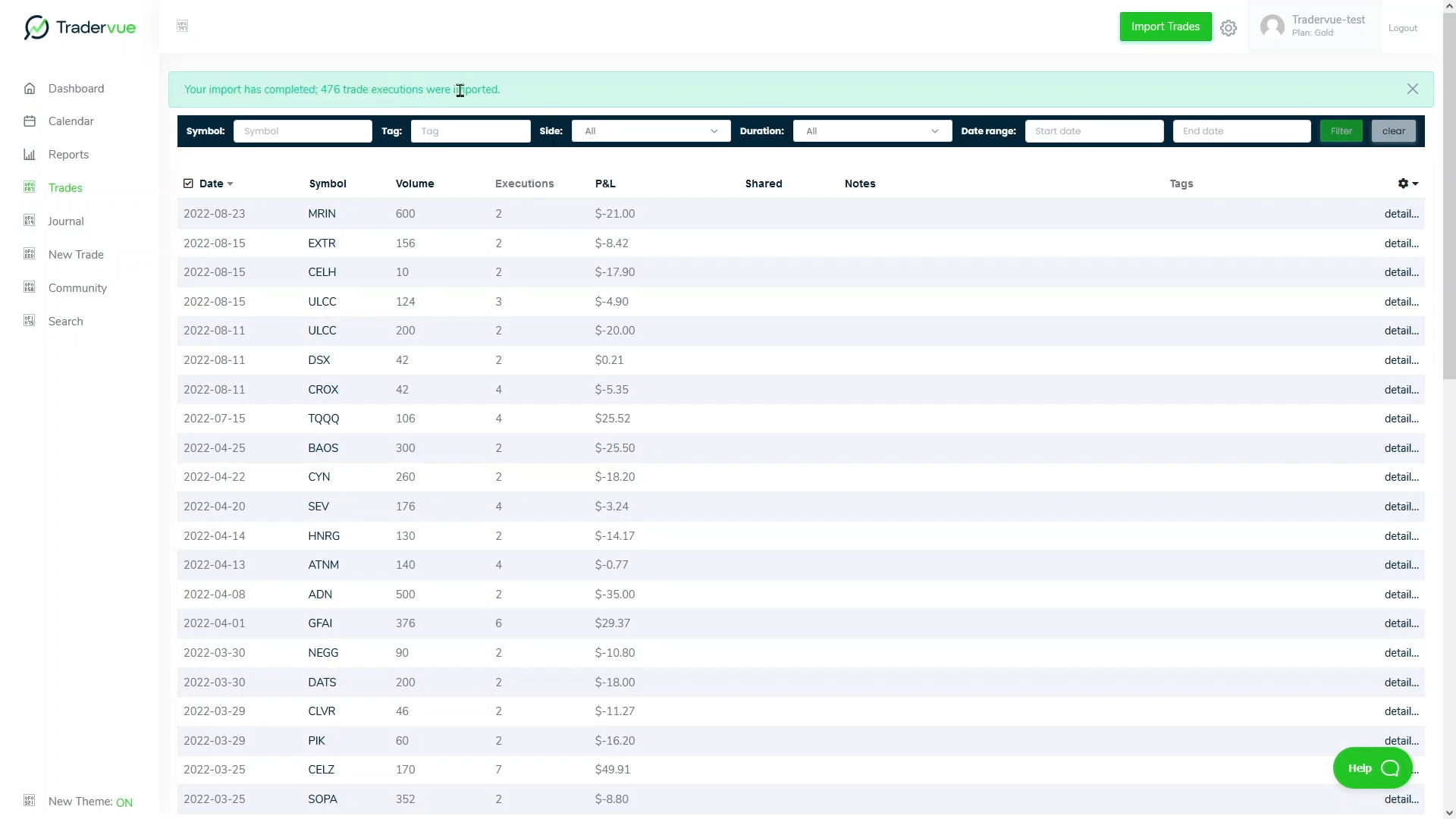

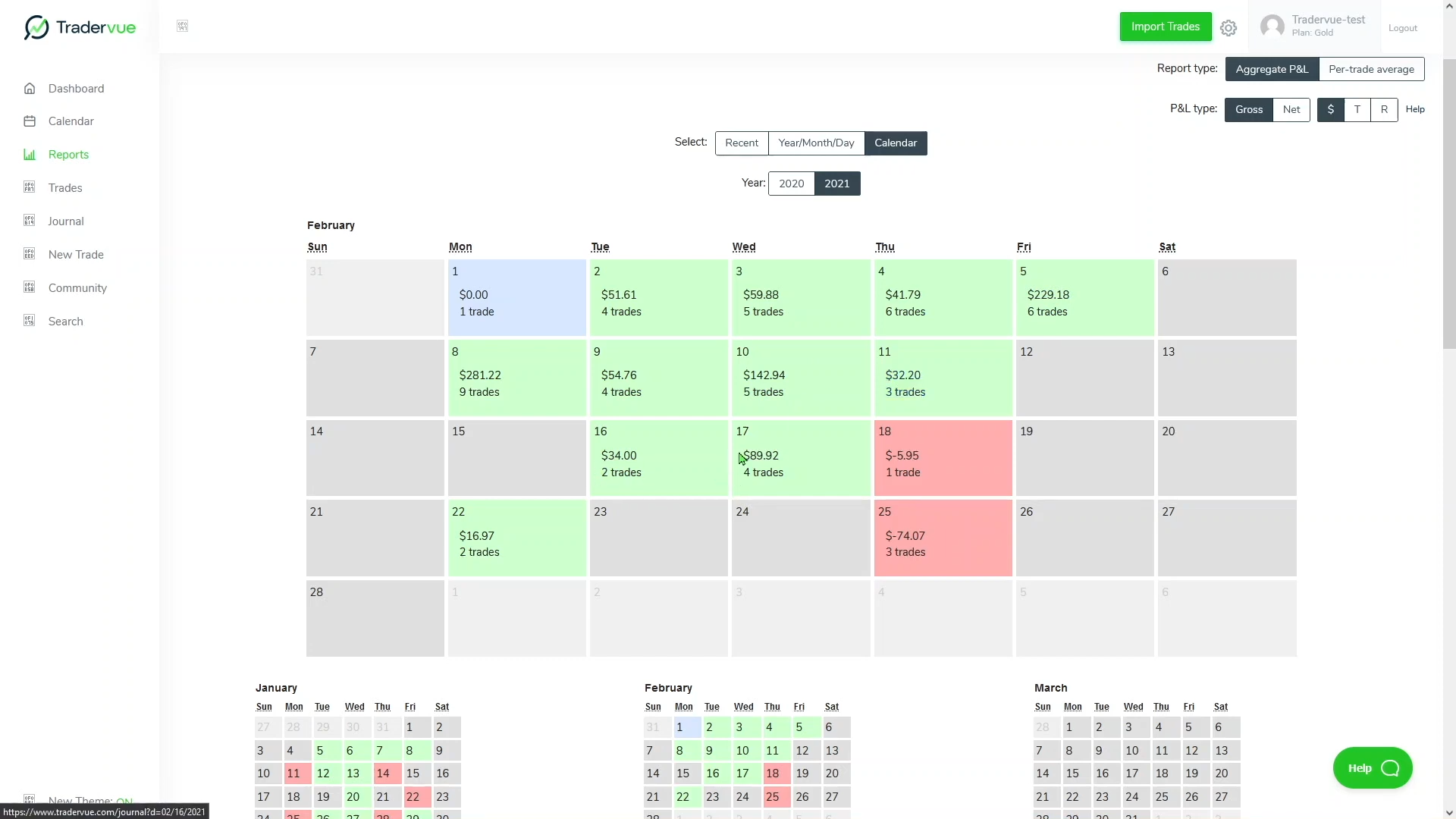

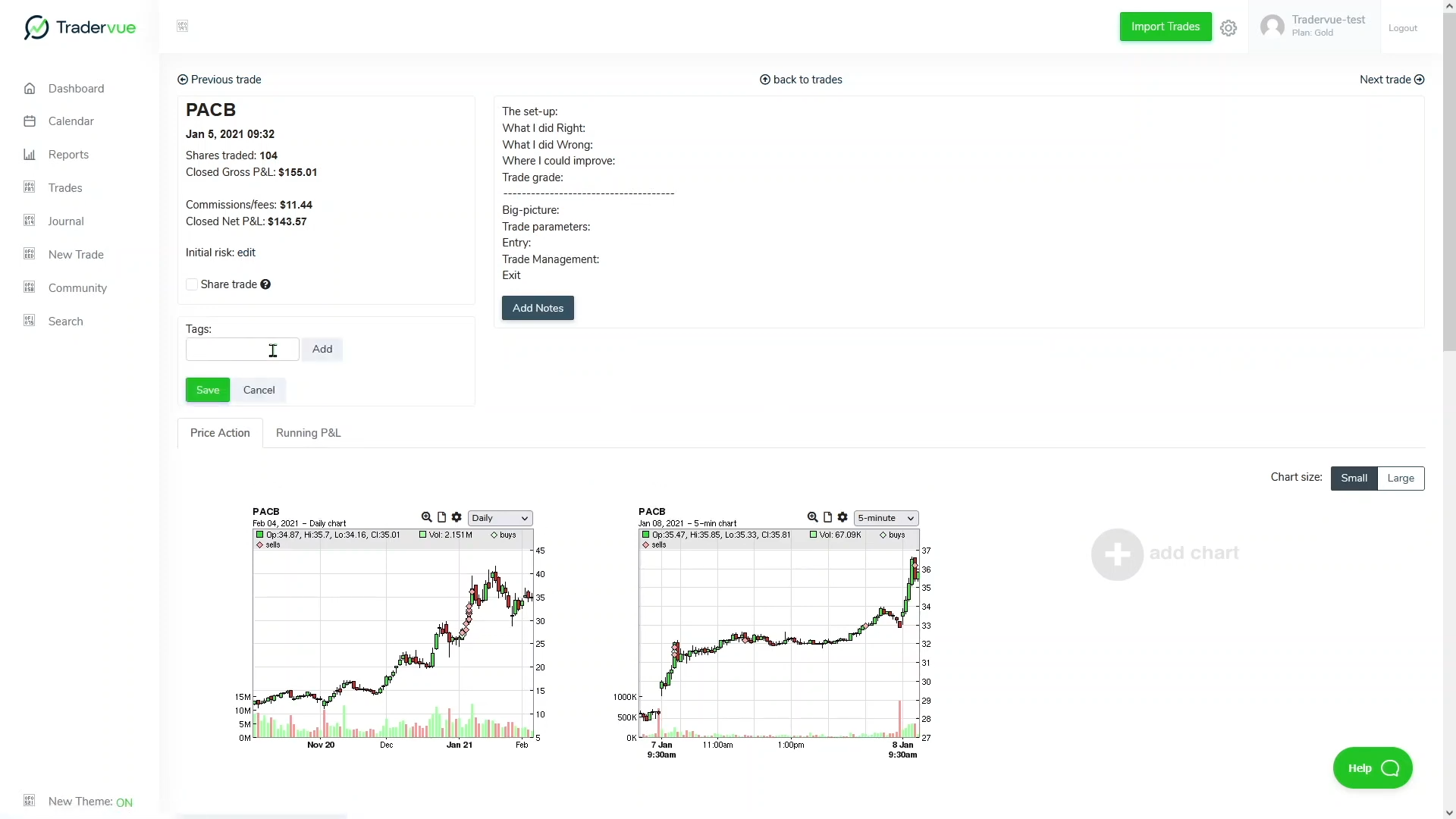

5. Tradervue (Free + Paid tiers)

- Benefits:

- Fast import from brokers

- Community feature allows sharing trades privately with mentors

- Excellent for options and futures traders who need detailed fill tracking

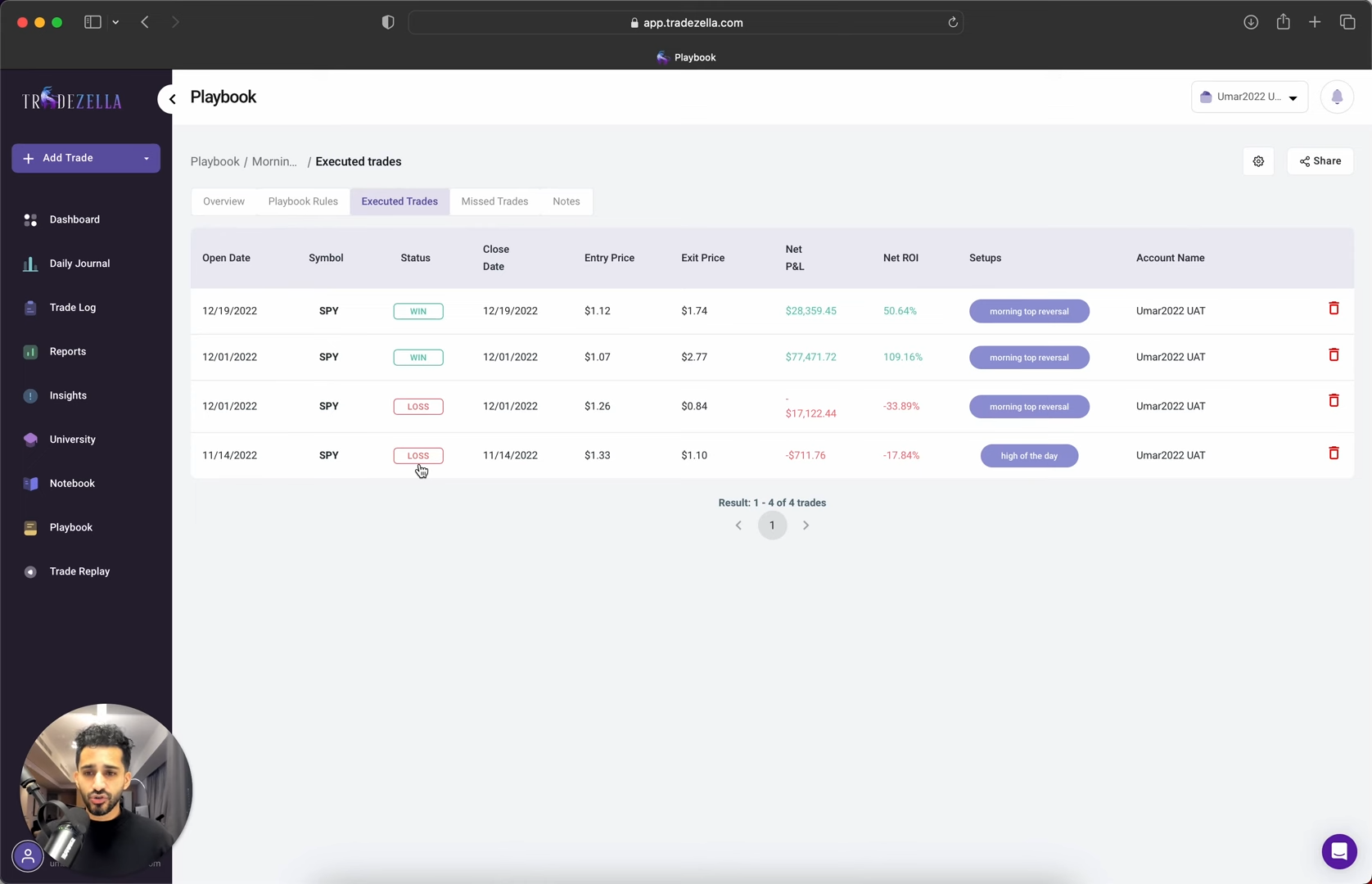

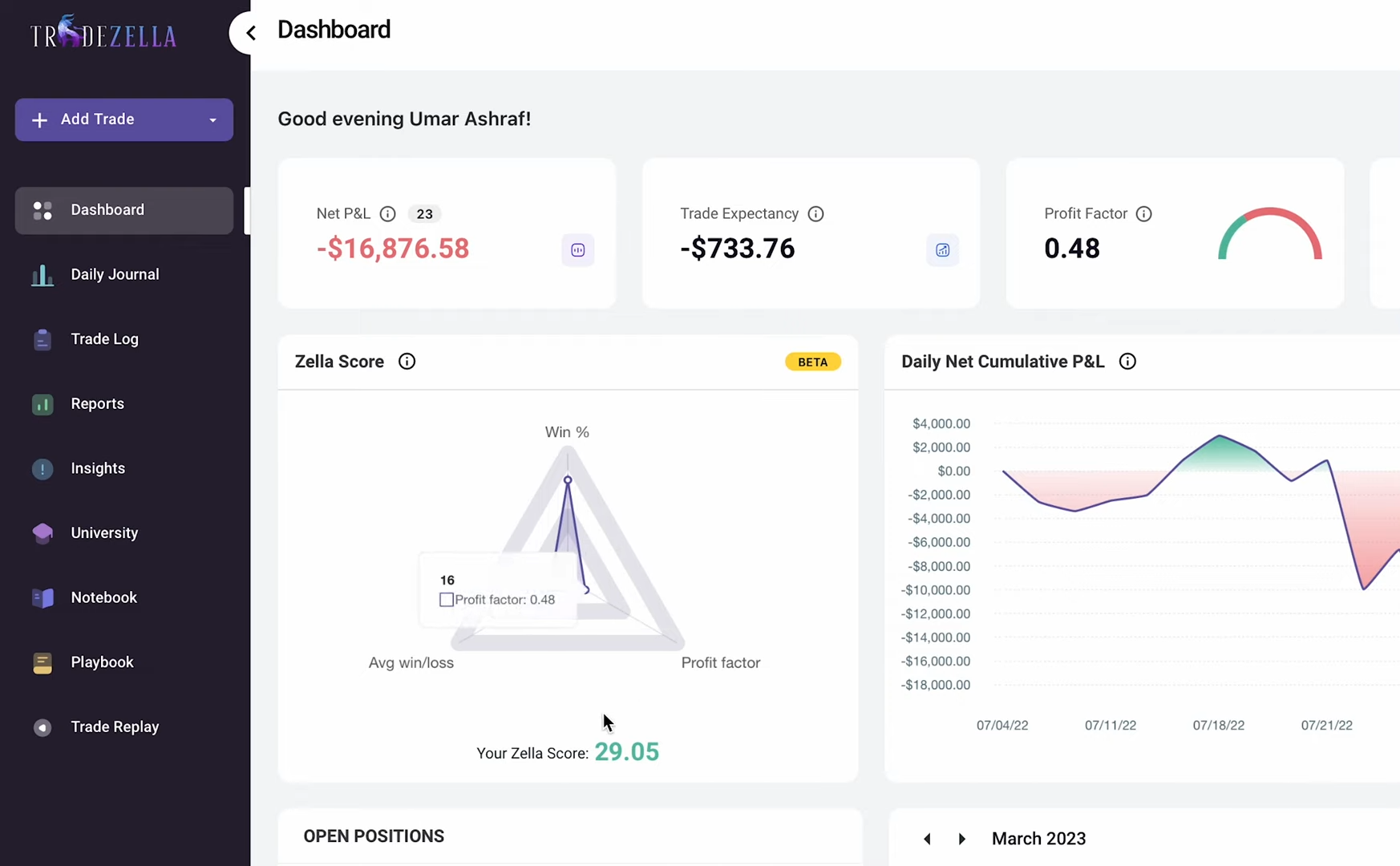

6. TradeZella (Paid)

- Benefits:

- Modern interface with clean analytics and dashboards

- Ability to tag trades by strategy, setup, or market condition

- Built-in calendar view to spot good and bad trading days easily

- Great for traders who want simplicity but also strong performance breakdowns

Disclaimer

We are not affiliated, sponsored, or partnered with any of the tools mentioned above. We simply highlighted some of the most popular trading journal platforms traders commonly use to help you make an informed choice.

Tip: Start with Google Sheets or Notion if you’re just beginning. Once you’re consistent, graduate to advanced tools like Edgewonk or TraderSync for deeper analysis.

2. Automate Where Possible

- Import trades directly from broker to journal (if software supports it)

- Use templates so journaling only takes 3–5 minutes per trade

3. Schedule Weekly Reviews

- Review all trades each weekend and categorize:

- Were losses from strategy failure or discipline failure?

- Were you following your risk rules or self-sabotaging?

- What recurring mistakes need a fix?

Key Takeaway

Your trading journal is a mirror: it reflects the truth about your habits and your risk management.

“The market is a brutal teacher, but your journal is the notebook that turns pain into lessons.”

Risk isn’t just the chance of losing money—it’s the risk of repeating the same mistakes until you fail completely. Your journal protects you from both.

- It catches self-sabotage before it ruins your account.

- It helps you fix the habits holding you back.

- It keeps you accountable to the process, not just the outcome.

Action Step

Create or update your trading journal today.

- Start simple: log setup, risk %, emotional state, and result for every trade.

- Schedule a 30-minute weekly review session.

- Identify one repeat mistake each week and eliminate it.

Remember: the cost of not journaling isn’t just financial. It’s the silent risk of sabotaging your own potential as a trader.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.