The Dollar Stands Firm: How USD Strength Is Shaping the Euro and Pound

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

Overview

USD: Maintains momentum amid rising bond yields and data-driven Fed stance.

EUR: Gains from service sector strength are overshadowed by trade war concerns and lowered ECB growth forecasts.

GBP: Faces volatility ahead of the UK’s spring budget, with commercial hedgers showing strong bearish positioning despite minor speculative support.

As March 2025 draws to a close, global currency markets have been stirred by trade tensions, shifting monetary policies, and fragile economic recoveries. At the center of it all is the US Dollar (USD)—steadfast, resilient, and increasingly influential on the direction of its major counterparts: the Euro (EUR) and the British Pound (GBP).

The Dollar's Grip on Global Sentiment

Throughout the third and fourth weeks of March, the USD has remained strong, supported by a hawkish Federal Reserve and rising US bond yields. Despite speculation about future rate cuts later in the year, the Fed has adopted a “data-dependent” stance, signaling that elevated interest rates may persist until inflation sustainably returns to target levels.

This has led to consistent demand for the dollar as a safe-haven asset, especially as geopolitical tensions rise, and global growth shows signs of strain. The strength of the USD has put downward pressure on both the euro and the pound, reshaping currency pair dynamics across the board.

Eurozone: Between Recovery and Trade Risks

The Euro has seen a modest rebound in March, fueled by surprising strength in services activity. According to flash PMI data, business activity in the Eurozone hit a seven-month high, with signs that the long-running manufacturing slowdown is finally easing.

But beneath the surface, the outlook remains cloudy:

- ECB President Christine Lagarde issued a sharp warning about US trade tariffs, estimating that a 25% tariff on EU goods could shave 0.3% off GDP in the first year, and up to 0.5% if the EU retaliates.

- The ECB’s updated projections reflect this uncertainty, with Eurozone GDP now expected to grow just 0.9% in 2025, down from earlier estimates.

Meanwhile, Germany has moved to approve a historic €500 billion fiscal package, intended to boost defense and infrastructure. While this could support growth, it also challenges EU fiscal discipline and raises questions about long-term debt sustainability.

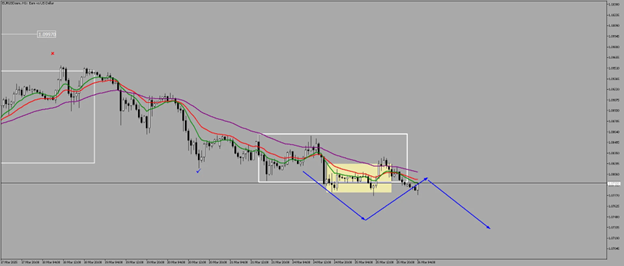

4-Hour

EUR/USD has struggled to hold above the 1.08 level, pulled back by dollar strength and lingering export headwinds.

1-Hour

As Dollar continues to gain traction, and Euro failing to hold inside the 4-hour range, we could see a potential downside as it trades below the 10-20-50 MA.

The Pound's Pre-Budget Pressure and Fragile Recovery

For the British Pound, the second half of March has been marked by volatility and caution. Investors offloaded the GBP at the fastest pace since 2023, bracing for Finance Minister Rachel Reeves’s upcoming spring budget update, which is expected to include £15 billion in spending cuts.

- The UK economy also contracted 0.1% in January, highlighting fragility in the face of inflation and sluggish domestic demand.

- After hitting a two-week low, GBP/USD saw a minor rebound, aided by broader dollar consolidation and tempered risk sentiment.

British Pound: Deepening Bearish Sentiment from Commercials

Net Short Position Still Heavy: Commercial traders continue to hold a strongly bearish stance on the pound, with net positions at -38,744, indicating a strong preference for short exposure.

Short Covering but Still Dominant: Interestingly, there was also a substantial reduction in short positions (-36,818), indicating some profit-taking or reduction in extreme bearish exposure. However, shorts still far exceed longs, maintaining a heavy net short bias.

Market Implication: This shift reflects persistent uncertainty around the UK economy, especially with the upcoming spring statement by Finance Minister Rachel Reeves, which is expected to announce £15 billion in spending cuts. The reduction in both long and short positions could indicate that large players are paring back risk ahead of the announcement.

4-Hour

Pound holds firm despite Dollar traction. Pound is currently trading above the 50% of the range which potentially could send pound to the upside.

Approach:

- For high probability approach, wait for price to break out of the range and look for ranges in the lower timeframe. Once a micro range has been created, look for breakouts on that timeframe.

Sterling's performance is likely to remain capped by fiscal tightening and the Bank of England’s conservative policy approach. With interest rates still at 4.5%, the BoE is walking a tightrope between inflation control and economic stability.

As we move into Q2, the US dollar’s strength remains a key reference point for global markets. Its role in shaping monetary decisions and risk appetite cannot be understated. For both the euro and pound, navigating a path forward will require balancing domestic economic pressures with the external force of a still-dominant greenback.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.