The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

Purpose of This Guide

If you want to dominate gold trading, you need more than just technical indicators or gut feeling.

You need strategic back-testing, simple market understanding, and a liquidity-driven approach that mirrors how institutions move gold.

This guide isn't just about theory — it's a practical roadmap on how to build, test, and trade a Smart Money Concepts-based system for Gold (XAU/USD) like a true professional.

Real-World Analogy: Why You Must Backtest Before Trading Gold

Think about a pilot.

Before flying passengers, they train for hundreds of hours in a simulator — facing every type of storm, failure, and emergency.

Would you trust a pilot who just "felt ready" after reading a few blogs?

No?

Then why should you trust yourself to trade volatile gold markets without testing your plan first?

Backtesting is your trading simulator.

Skipping it is flying blind.

Why Gold (XAU/USD) Behaves Differently

Gold isn't just another asset.

It reacts to fear, greed, political shocks, inflation data, and shifts in global trust.

Major Factors That Drive Gold:

| Factor | Typical Impact |

|---|---|

| Inflation Surges | Gold strengthens |

| Falling Interest Rates | Gold strengthens |

| Stronger US Dollar | Gold weakens |

| Geopolitical Conflicts | Gold strengthens |

| Central Bank Buying | Supports bullish trends |

Gold is sensitive, emotional, and heavily manipulated — the perfect playground for Smart Money Concepts traders.

Simple Smart Money Gold Day Trading Strategy

Institutions and big players don’t randomly buy or sell gold.

They operate around liquidity — engineering fake breakouts, hunting stops, uses news catalysts, and accumulating positions before the real moves begin.

✅ The Smart Money Flow for Gold Trading:

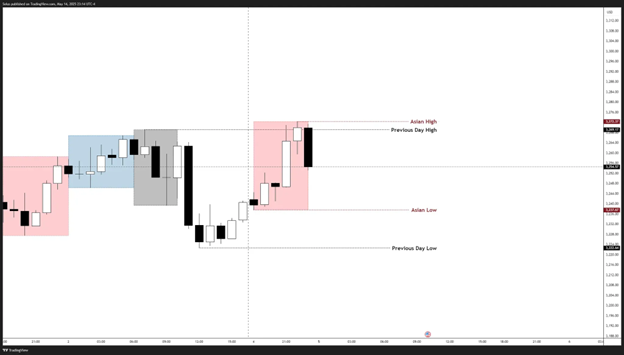

- Identify Untapped Liquidity Zones

- Look for untouched highs/lows from previous sessions.

2. Wait for a Sweep

- Let price sweep those liquidity zones.

3. Confirm Breakout with Fair Value Gap (Displacement)

- A strong impulsive move creates Fair Value Gaps (FVGs).

4. Enter on FVG Retracement

- Precision entries, controlled risks.

5. Trade Only During Session Volatility Windows

- London/NY Open = best moves.

6. Exit at Opposite Liquidity Pools

- Opposing highs/lows, unfilled imbalances.

This flow gives you context, timing, and execution precision — critical for mastering volatile instruments like gold.

The key in this strategy is wait for a potential test of a key level, observe if it's willing to break or fake based on the lower timeframe confirmation.

How to Build and Backtest a Gold Trading System

Building a trading system without back-testing is like building a car and skipping the crash tests.

Here's the Right Sequence:

Step 1: Define a Trading Blueprint

Before you test, define:

- Market: XAU/USD only

- Entry Trigger: Sweep → Displacement → FVG Return

- Risk Management: 0.5%–1% fixed risk per trade

- Session Focus: London AM, NY AM / PM sessions only

- Exit Plan: Next liquidity target

Be objective— no guessing or improvising during testing.

In this case, I already outlined a simple SMC strategy that you can use.

Step 2: Choose the Right Back-testing Method

| Platform | Best For | Notes |

|---|---|---|

| TradingView (Bar Replay) | Manual, Visual Testing | Realistic decision-making practice |

| Forex Tester Online | Lightweight Browser-Based Testing | Quick manual practice without installing software |

| FX Replay | Semi-automated Historical Simulation | Great feel, no future leaks |

| Forex Tester 6 | Deep Tick-Data Testing | Useful if you want intense statistical analysis |

Pro Tip:

Manual back-testing (like Bar Replay) gives the best intuition for Smart Money setups.

Step 3: Simulate the Backtest Properly

During the backtest:

- Hide future candles — simulate true decision-making.

- Mark your liquidity levels before price arrives.

- Only trade confirmed sweeps and displacements.

- Record every trade — entry, stop, TP, outcome, notes.

Track These Metrics:

| Metric | Why It Matters |

|---|---|

| Win Rate | Measures consistency |

| Average RRR | Determines reward scaling |

| Max Drawdown | Assesses survival potential |

| Equity Curve | Evaluates emotional management risks |

| Session Bias | Identifies best times to trade gold |

Check out my previous blog about backtesting:

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

How AI Can Optimize Your Gold Backtests

Backtesting manually shows what you can see.

But AI analysis shows what you missed.

Simple AI Optimization Steps:

- Upload your trade log (Excel/CSV).

- Ask AI to analyze:

- Sessions with best/worst outcomes.

- Impact of different stop-loss sizes.

- Entry setups with higher expectancy.

- Spot unseen statistical patterns.

AI Doesn’t Trade For You — It Sharpens You.

Think of it as trading analytics on steroids.

You can also upload your journal to help how you can improve and what behavioral patterns you need to be aware of.

Execution Discipline — How Smart Traders Operate in Live Markets

Backtesting builds your weapon.

Discipline fires it.

Keys to Gold Execution Mastery:

- Only enter when liquidity sweep + displacement align.

- Stick to kill zones — avoid dead hours.

- Never widen stops emotionally — accept precision losses.

- Don’t overtrade — let setups come to you.

- Use news as a volatility catalyst, not as a prediction engine.

Gold demands structured aggression — waiting for opportunity and striking hard when it appears.

Top Mistakes to Avoid in Gold Day Trading

| Mistake | Solution |

|---|---|

| Jumping into fake breakouts | Wait for liquidity sweeps first |

| Ignoring session timing | Only trade when volume enters |

| Oversizing after losses | Fixed fractional risk only |

| Trading during flat Asian hours | Stick to London and NY |

| Reacting emotionally to news | Trade setups, not headlines |

Final Thoughts: Backtesting Gold Isn’t Just Preparation — It’s Weaponizing Your Edge

In gold trading, you’re competing against billion-dollar funds, central banks, and global speculators.

You can’t just “wing it.”

You must build, test, refine, and execute like a pro.

✅Smart Money Concepts give you the map.

✅ Backtesting gives you the proof.

✅ Discipline gives you the consistency.

Gold doesn’t reward the loudest trader.

It rewards the most prepared.

Your Gold Trading Success Checklist:

- Build your Smart Money Concepts trading plan.

- Backtest using 50–100 historical trades.

- Use AI to sharpen hidden patterns.

- Execute during session peaks only.

- Stay mechanical, not emotional.

Gold is volatile. Gold is beautiful. Gold rewards the patient and prepared.

Check Out Our Market Education

How to Start Day Trading:

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

Learn how to navigate yourself in times of turmoil:

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment — With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents:

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

Follow me on LinkedIn: Jasper Osita

Join me in Discord: The Analyst Guild

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.