The Week Ahead: Tariffs, Central Banks, and a Shifting Dollar Narrative

ACY Securities - Luca Santos

ACY Securities - Luca SantosEvery week, I try to make sense of the noise in the market, and this one is no different. After a strong July for the US dollar, I’m closely monitoring whether that strength has legs, or if we’re starting to see cracks form beneath the surface.

What's Driving the Market Right Now?

The dollar (DXY) surged over 3% in July, its biggest monthly gain since April 2022. That strength came on the back of trade optimism, new tariff deals, and a resilient U.S. economy. But here’s the thing: markets may be overly optimistic about the economic impact of these tariffs.

As of the end of July, the average effective U.S. tariff rate reached 18.4%, a level we haven’t seen since the 1930s.

The real question now is how long that strength can last, especially as we begin to assess the economic fallout. That’s what I’ll be watching this week.

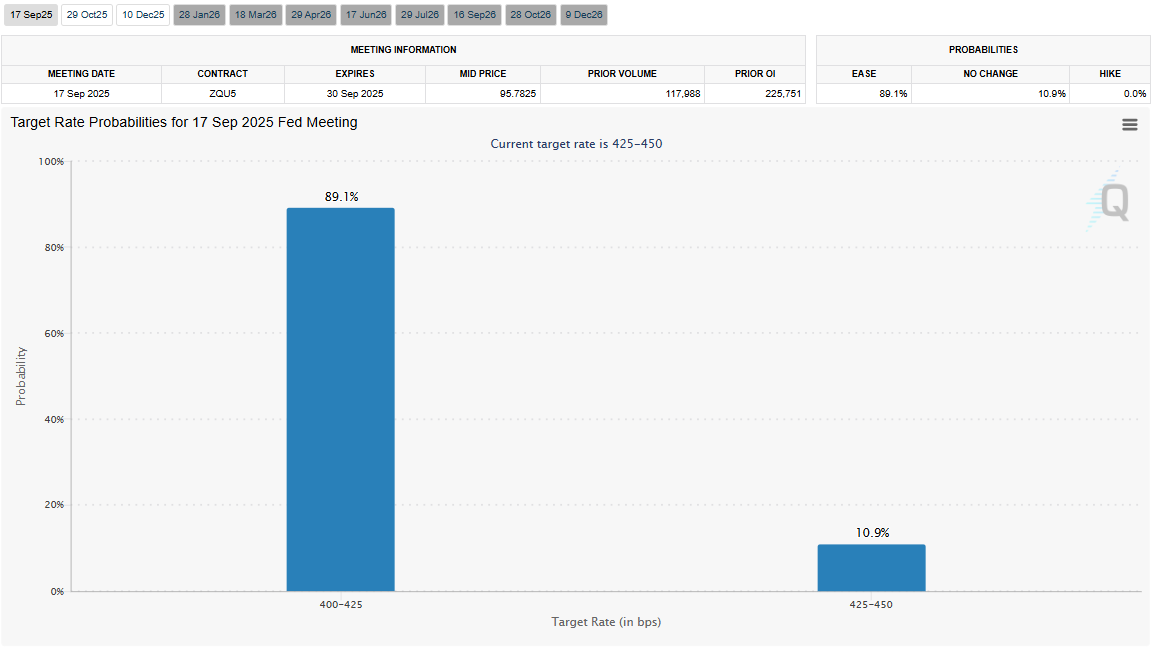

The Fed Is on Pause, But Jackson Hole Looms

There’s no FOMC meeting this month, but don’t think the Fed is out of the picture. All eyes are on the Jackson Hole Symposium (22–24 August), where Powell is expected to give an updated view on policy.

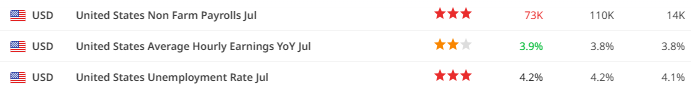

With last week’s non-farm payrolls coming in far weaker than expected, the probability of a September rate cut has increased.

If we get more softness in labor data and signs of tariff-induced inflation, that could be the turning point. Until then, expect the Fed to hold the line.

Central Banks in Focus This Week

This week is heavy on G10 central bank decisions:

Bank of England (Aug 7) – A rate cut is almost fully priced in. Inflation is sticky, but growth is soft. Expect internal division at the MPC.

Reserve Bank of Australia (Aug 12 next Tuesday) – After a weak June CPI print, I’m leaning toward a 25bp cut. The RBA seems set to proceed gradually.

Norges Bank and RBNZ (Aug 14 & 20) – Both are likely to hold, though the RBNZ has around an 80% chance of cutting. I’ll be watching their tone closely.

The key theme across all these decisions? Caution. Central banks are moving, but no one wants to go too far too fast.

FX Pairs I'm Watching

EUR/USD: After falling from 1.17 to 1.14 in July, I’m now watching for a base around the 1.14 handle. While the EU-US trade deal brought some EUR selling, I think the worst of the positioning flush is behind us. If US data weakens, this pair could push back toward 1.17 by month-end.

USD/JPY: The yen sold off sharply last month, breaking through 150. That weakness has been driven more by BoJ caution and Japanese political uncertainty than by US strength. If the BoJ continues dragging its feet on tightening, I wouldn’t be surprised to see 152 tested before we see any retracement.

AUD/USD: This pair remains sensitive to global growth sentiment. With the RBA likely to cut but stay cautious, and the US-China trade narrative stabilizing, I’m watching for a potential bounce above 0.65 if risk sentiment stays firm.

USD/CAD: The Canadian dollar has shown resilience, supported by strong jobs data. But weaker PMI numbers and higher inflation complicate the BoC’s path. I see limited upside for the loonie unless we get a meaningful risk-on wave.

Emerging Markets: Focus on China and LatAm

China’s July Politburo meeting didn’t bring the stimulus fireworks many were hoping for. Still, with 5.3% GDP growth in H1 and new childcare subsidies and social programs on the table, I think Beijing is opting for targeted support over broad stimulus.

I’m still cautious on CNY and expect more depreciation pressure unless we see clearer policy shifts in October’s five-year plan announcement.

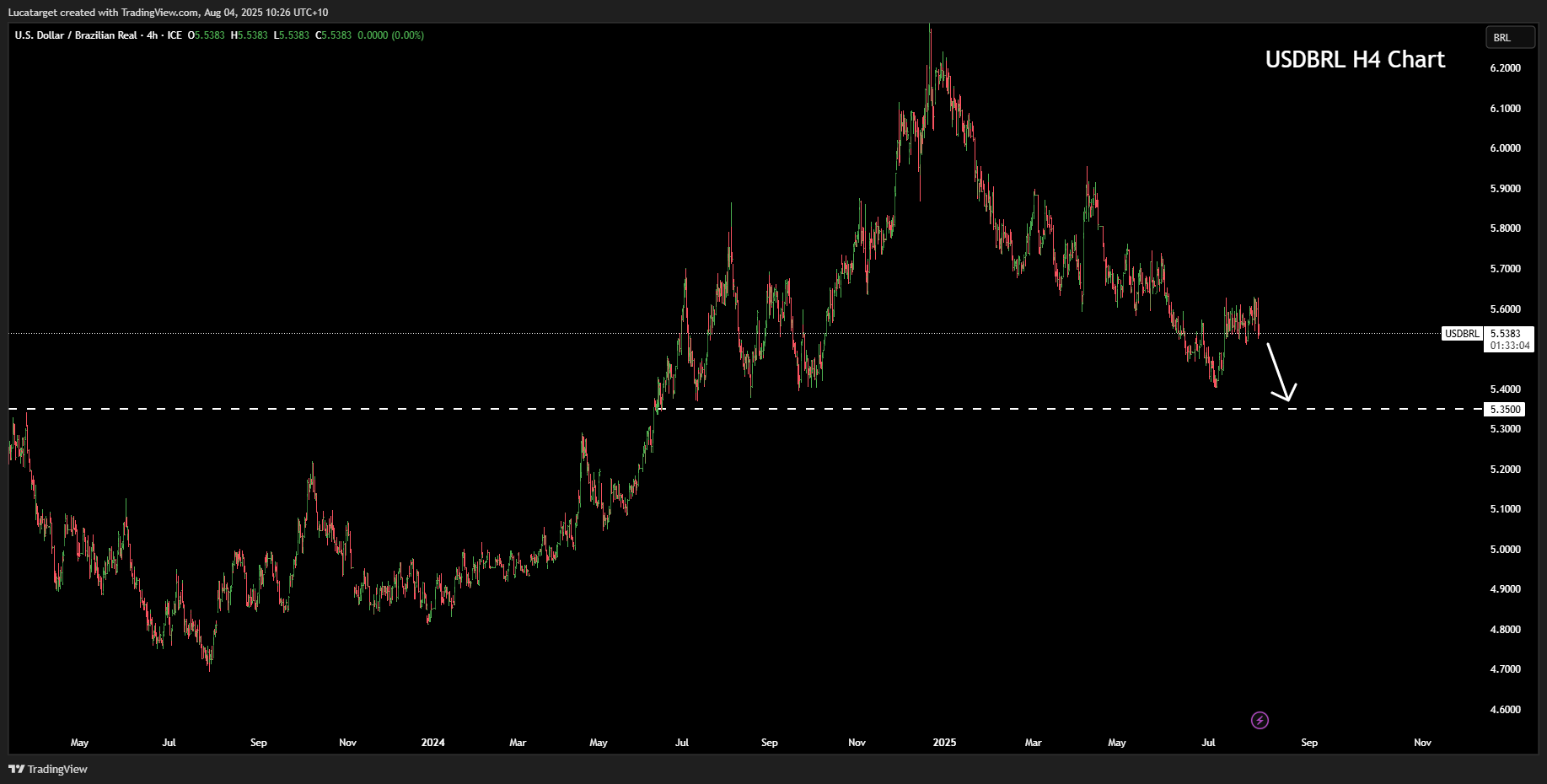

In LatAm, the Brazilian real is catching my attention again. With a spot rate of 5.53 and MUFG forecasting a gradual move toward 5.35, I think BRL still has room to recover, especially if commodities stabilize and political noise stays contained.

We’re in a market driven more by perception than fundamentals right now. The trade deals look good on paper, but the real impact, especially on inflation and global demand, has yet to be felt. If the data starts turning, so will the trades.

Until then, I’m staying nimble, focusing on data surprises, and watching rate differentials more than headlines. As always, it’s not just about what the central banks say, it’s about what the market hears.

Let’s see how the week plays out.

1. What is driving the US dollar strength in August 2025?

The US dollar has surged due to stronger-than-expected economic resilience, optimism over recent trade deals, and delayed expectations for Fed rate cuts. However, with weaker job data emerging, this trend may soon reverse if the Fed signals easing.

2. Why is EUR/USD under pressure despite a US-EU trade deal?

Although the deal reduced tariff risks, excessive long positioning and strong US economic data led to a correction in EUR/USD. The pair could recover if the Fed leans dovish and US data weakens further.

3. What central bank decisions should traders watch this week?

Key rate decisions from the Bank of England (Aug 7) and Reserve Bank of Australia (Aug 12) are in focus. Both are expected to cut, but forward guidance and economic projections will likely drive the currencies more than the cut itself.

4. Is the Australian dollar expected to strengthen or weaken?

AUD may gradually appreciate if risk sentiment remains stable and the RBA maintains a cautious tone. A potential US-China trade resolution would also support AUD in the medium term.

5. How does Jackson Hole impact forex trading?

The Jackson Hole Symposium (Aug 22–24) is closely watched for Fed Chair Powell’s policy guidance. Any shift toward dovish language or mention of labor market softness could significantly influence USD pairs.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.