The Yen’s Fragile Foundation Amid Global Policy Realignments

ACY Securities - Luca Santos

ACY Securities - Luca Santos

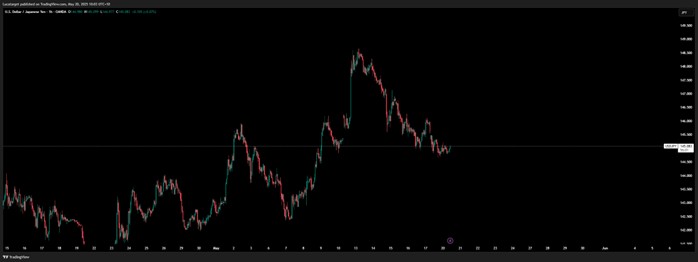

The recent retreat in USD/JPY, which erased the pair’s earlier gains this week, underscores how sensitive global FX markets remain to fleeting shifts in sentiment. Monday’s optimism around easing trade tensions fizzled quickly, taking with it the short-lived surge in front-end US yields. Meanwhile, U.S. retail control group sales came in softer than expected, and producer prices fell short of forecasts a sequence that pressured Treasury yields and gave the yen a chance to stabilize.

USDJPY H1 Chart

But make no mistake: this rebound in the yen isn’t being powered by domestic strength. Quite the opposite. Japan’s Q1 GDP data, showing a 0.7% contraction (SAAR), confirms the country remains deeply exposed to external fragilities and internal inertia. Export activity shrank despite tariff concerns, while household consumption stagnated. Inflation might be off its highs, but the underlying cost-of-living crisis continues to dampen domestic demand.

Japan Q1 GDP

This context puts the Bank of Japan in a tricky corner. Even as the rest of the G10 tilts toward easing cycles, the BoJ is reluctant to normalize not because it’s confident, but because it simply doesn’t have room to move. Recent remarks from board member Nakamura, one of the more dovish voices on the policy board, reinforce this point. As his term nears its end, his opposition to rate hikes remains firm, and judging by OIS market pricing (with rate hike expectations by year-end slashed to just 16bps), investors aren’t expecting much from his successor either.

In this environment, the yen's direction will be tethered more closely to external forces especially U.S. yields and global risk appetite. Interestingly, the correlation between the yen and broader market volatility is showing signs of life again, a dynamic worth watching as macro uncertainty builds heading into H2.

On the U.S. side, the Fed is preparing for another evolution of its policy framework. Chair Powell’s participation in this week’s conference signals an intent to address the structural blind spots exposed by the past five years from COVID-19 and supply-chain breakdowns to the inflation super-cycle and geopolitical disruptions. The 2020 framework, which emphasized average inflation targeting, now feels outdated. A reorientation is clearly coming, and Powell has already hinted at removing the average inflation reference altogether.

FED Watch

This may seem academic, but it matters for forward guidance. In a world increasingly shaped by supply-side shocks not just demand shortfalls monetary policy needs to adapt with a different toolkit and tone. The Fed’s next framework will likely strike a more balanced stance between inflation control and growth risk, particularly as labour market softness continues to develop quietly in the background. Jobless claims have been climbing, and anecdotal evidence from sectors like tech and logistics suggests the cooling may be deeper than the NFP headline suggests.

From an FX perspective, this strategic shift will be slow burning but meaningful. The dollar remains vulnerable in the medium term, especially if July or September bring the first cut. While markets have currently priced in September as the more likely turning point, I still think July remains viable if the data deteriorates quickly enough.

In summary, the yen’s recent strength is less a vote of confidence and more a reflection of temporary dollar weakness and risk on repricing. Japan’s own economic backdrop remains too fragile to generate lasting currency appreciation. As global central banks reassess their roles in this new post-pandemic, geo-fragmented world, the Fed’s structural pivot and the BoJ’s inertial caution will continue to define the USD/JPY trajectory.

The broader takeaway? Expect policy divergence to persist, but with diminishing returns. And for the yen as always keep your eyes not just on Tokyo, but on what’s happening in Washington and Wall Street.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.