Tradefeedr Goes Live With FX Data Analytics Platform

22 June, 2021 - FX data and analytics provider Tradefeedr has announced today that the company has now launched its FX analytics platform.

Tradefeedr said that it provides a much clearer picture of the whole market’s data and analytics than currently exists by delivering a unified framework for sharing information. Tradefeedr has created a common and independent FX trading database allowing market participants across the sell-side, buy-side, regional banks, hedge funds, brokers and central banks to connect, analyse their trading data and collaborate.

The company has signed up and is rolling out its solution to more than 15 sell-side and more than 20 buy-side participants, all global leading institutions. A further 20 others are in the pipeline and as the community of participants grow, the company says tha this will create a powerful network effect as more and more users join.

Seth Johnson, Chairman of Tradefeedr said, “We are delighted by the overwhelmingly positive response from major FX participants who have now joined the Tradefeedr community. This demonstrates that there is a real need in foreign exchange to trade using correct and standardised data, allowing faster and more accurate flows. It also reflects the benefits of a system that allows much better decision making and better relationships, while also adhering to the FX Global Code’s principles of transparency and effective communication that supports a robust, fair, open, liquid, and appropriately transparent FX market.”

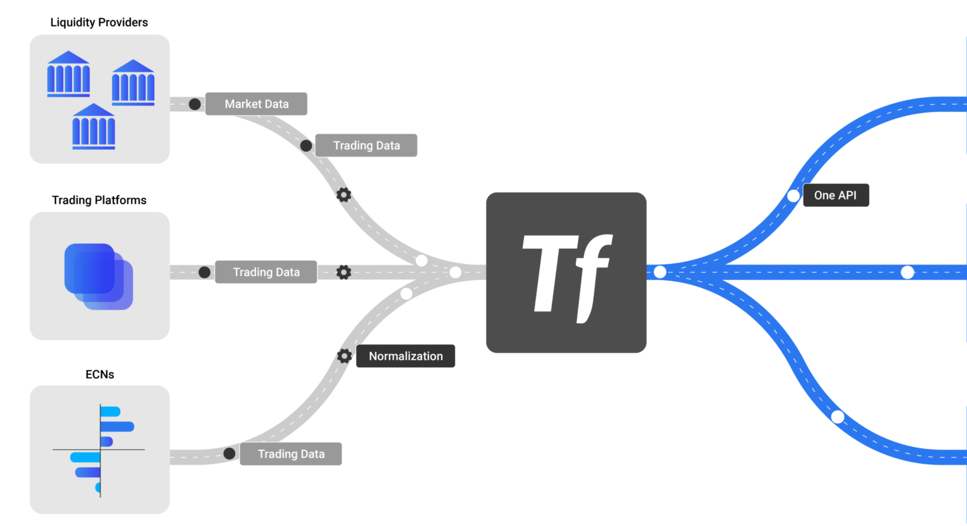

Balraj Bassi, Co-Founder of Tradefeedr, added: “Since our inception, Tradefeedr’s vision has been to deliver superior data transfer across the global FX trading community. We are excited to now roll out the platform amongst our leading liquidity providers and consumers who will be able to submit and receive their trading data amongst each other and with ECNs & trading venues over a single API.”

“FX trading data and analytics are currently siloed between venues and the sell and buy side, added Alexei Jiltsov, also a Co-Founder of Tradefeedr. “Users rely upon incomplete, inaccurate data, and before Tradefeedr, there has not been any method to work together with trading flows based on a common set of data. The significant adoption we have witnessed is a testament to the support for our vision and business model focused on transforming the FX marketplace for the benefit of all participants.”

Richard Elston, Head of Institutional at CMC Markets Connect, is quoted on Tradefeedr's website with the following statement about the service, ""By using Tradefeedr’s technology, not only are we able to improve the liquidity that’s on offer to our clients, but it also allows us to strengthen our relationships with the liquidity providers themselves. This allows us to facilitate the best levels of service with all our counterparties, something which sits very much at the core of the CMC Markets ethos.”

Tradefeedr was established in 2018 by Balraj Bassi and Alexei Jiltsov, who had previously worked together at Lehman Brothers and launched Blacktree, a macro systematic hedge fund. In December 2020 the company received $3 million in funding from IPGL, the private investment company owned by Lord Michael Spencer, the founder of global markets company, ICAP plc and subsequently financial technology business, NEX plc. Seth Johnson, former CEO of NEX Markets, also supported the fund raising and was appointed as Tradefeedr's Chairman.

Tradefeedr aims to level the trading analytics playing field by allowing the sell-side to submit trading data on behalf of their buy-side clients. With better-standardised data, Tradefeedr transforms the way in which market participants interact with each other and deliver new insights and better decision making for all users.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.