Trading Hack: Why You Keep Breaking Your Own Rules (And How to Stop)

ACY Securities - Japer Osita

ACY Securities - Japer OsitaThe Real Trading Hack No One Talks About

If you’ve ever looked at your screen after another impulsive trade and thought, “I knew better…” - you’re not alone. Most traders keep hunting for new systems, confluences, or timing tricks, but the leak isn’t on the chart. It’s in the moment you abandon your plan. In other words, it’s self-sabotage.

This feature shows you practical, small-footprint discipline hacks that make your plan executable under pressure. You’ll see how identity drives action, why a simple pause beats most indicators, and how a few tiny guardrails turn chaos into control. For deeper context on structure-first execution, read Trading in the Zone - Thinking in Probabilities and the companion on flow, Flow State Trading.

Why Traders Break Their Own Rules

We all quote “psychology matters,” but here’s the working model: your self-image acts like a thermostat.

If you still see yourself as inconsistent, your behavior will drift back there even after a streak of clean trades. That drift looks like overtrading, chasing, or moving stops.

If you need a primer on how Smart Money thinking frames discipline, start with Why Smart Money Concepts Work and the execution lens in Anatomy of a Perfect Execution.

The Hidden Resistance You Don’t See

Think of self-sabotage like an emotional thermostat.

If you’ve spent months in a pattern of inconsistency, that becomes your “normal.” The moment you start doing better - following rules, stacking wins - your subconscious says, “This isn’t familiar.”

So it finds a way to pull you back down.

You take a reckless trade. You force an entry. You give back your profits.

It’s not stupidity. It’s programming.

And the only way out is not with more data or tools - but with conscious identity rewiring.

You don’t just change your results; you change your story.

If you want a practical way to stabilize behavior, couple this piece with a short routine like 3 Steps to Build a Trading Routine and guard it with robust Risk Management.

Real-Life Analogy - The Rubber Band Effect

Picture a rubber band stretched between two points - your old self and your new self.

The moment you stretch toward growth, the tension builds. That discomfort you feel when following your plan but itching to click “buy” anyway? That’s the stretch.

Your subconscious wants relief, so it pulls you back to what’s familiar: impatience, impulsiveness, chaos.

Unless you learn to sit in that discomfort, the rubber band snaps you back every time you’re close to consistency.

The hack isn’t to stop stretching - it’s to get comfortable staying stretched.

To sharpen your read of price while you practice this, revisit How to Think Like a Price Action Trader.

Trading Hacks That Actually Work

Here’s where we blend psychology with practicality. These aren’t magic tricks - they’re mini-systems you can start tonight to interrupt self-sabotage before it hijacks your trades.

Hack #1 - The 2-Minute Pause Script

Why it works: Emotional urges peak fast and fade fast. Two minutes is all you need to let logic catch up to adrenaline.

How to do it:

Before entering any trade, pause and read this out loud:

“This is a discipline test, not a setup test. If it’s still valid in two minutes, I’ll take it.”

Pair this with session awareness from Mastering the New York Session to avoid knee-jerk entries at volatile opens.

Those 120 seconds create space between impulse and intention - the gap where consistency lives.

Hack #2 - The Pre-Commitment Stamp

Why it works: You can’t reason your way out of an emotion, but you can design around it.

How to do it:

Create a simple rule: No checklist, no trade.

Before any execution, stamp (digitally or physically) a one-liner that includes:

- Setup reason

- Stop loss

- Target

- Risk %

- Time

If it’s not stamped, it’s not valid.

It’s amazing how this one ritual filters 90% of emotional trades.

It dovetails nicely with the Confirmation Matrix if you want a structured green-light

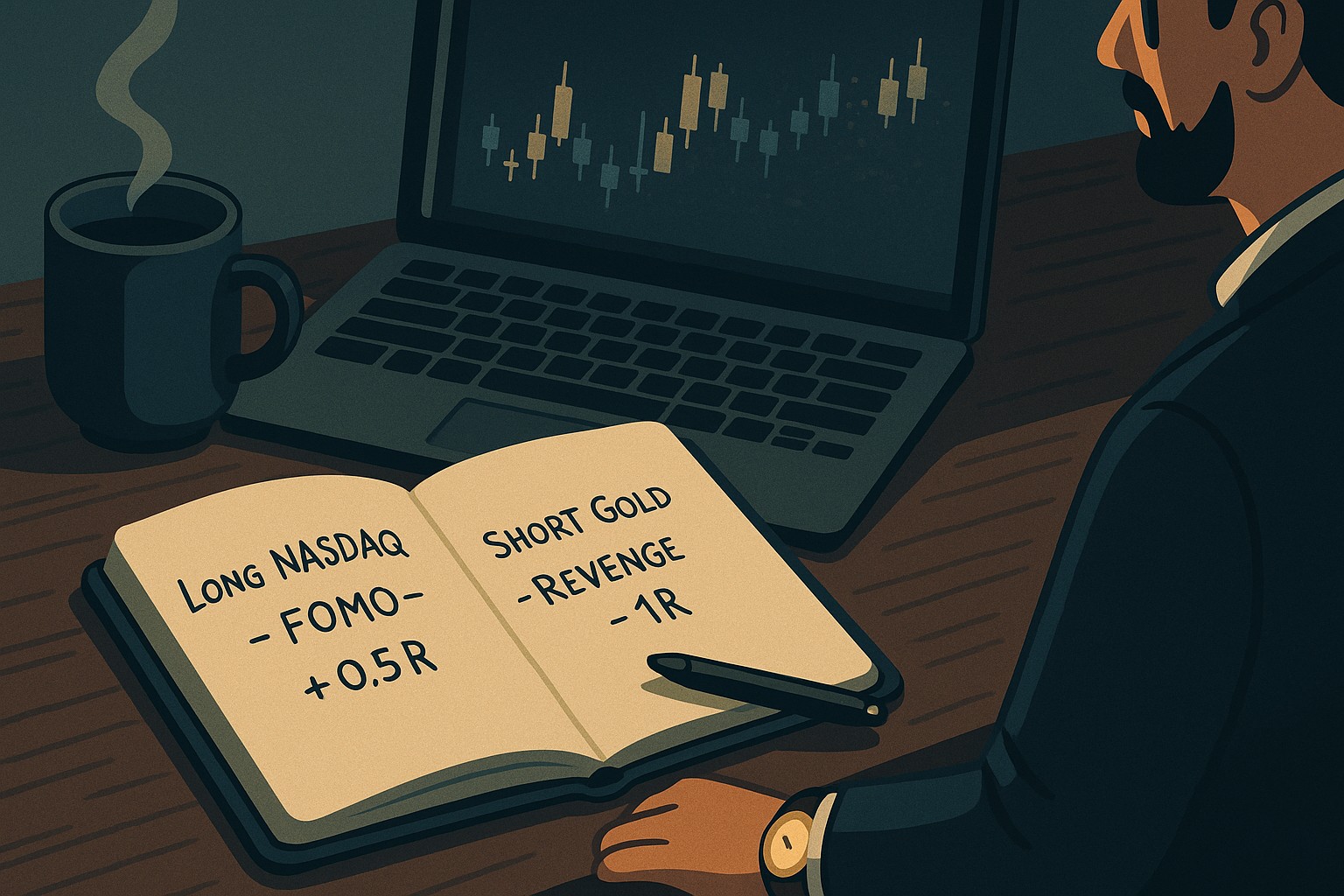

Hack #3 - The One-Line Micro Journal

Why it works: You can’t fix what you don’t see.

After each trade, write one sentence:

“Long NASDAQ - FOMO - +0.5R.”

or

“Short Gold - Impulse - -1R.”

Over a week, patterns will reveal your emotional cycles - boredom trades, revenge trades, greed trades.

That’s data gold you won’t find on TradingView.

This makes sabotage visible. If you don’t have a habit yet, start with Trading Journal and Reflection.

Hack #4 - The Visual Anchor

Why it works: Physical reminders break mental autopilot.

Place a rubber band, bracelet, or small note beside your keyboard.

When you feel the urge to break a rule, glance at it. It represents tension - the space between who you were and who you’re becoming.

That single look often snaps your awareness back before the click.

Reading Detachment Discipline helps you separate self-worth from any single outcome.

Hack #5 - The “Who Am I” Question

Why it works: Identity drives action. When you trade, you act as either your past self or your upgraded one.

Ask before every trade:

“Who am I being right now - the trader I was, or the trader I’m becoming?”

To reinforce identity-level change, bookmark

If the answer is “old me,” step back.

That question alone can reframe impulsive habits faster than any strategy tweak.

Story Feature - The Trader Who Finally Stopped

He used to say, “I just need to fix my entries.”

But every fix led to another broken promise. Revenge trades, FOMO entries, moving stops - a cycle that felt unbreakable.

Until one night, he tried something different.

He wrote a 2-minute script.

He printed a checklist.

He left a rubber band beside his mouse.

The next day, he felt the urge again - a fast-moving NASDAQ setup calling his name. He paused, read his script, and waited. Two minutes later, the setup vanished.

So did the urge.

He didn’t win that day. But he didn’t lose control either.

That night, for the first time, he wrote in his journal: “Progress - not profit.”

And that was the real win.

Want a roadmap for calm execution under speed? Try this alongside How To Trade and Scalp Indices at the Open Using SMC.

Final Thoughts

Everyone searches for trading hacks - new confluences, new entries, new tools. But the real hack isn’t on the chart. It’s inside you.

You don’t need to add more complexity. You need to remove the patterns that make you betray yourself.

Because your system doesn’t fail - your consistency does.

The traders who last aren’t those who find holy grails. They’re the ones who build invisible habits that stop self-destruction before it starts.

To tighten the loop from intention to execution, study Execution Psychology, then prove your edge with Proving Your Edge - Backtesting Without Bias and lock it in live with Forward Testing in Trading.

Your system isn’t broken - your consistency bridge is. Build it small, repeat it daily, and let your results grow into your identity.

So the next time you ask, “What’s the best trading hack?” -

Remember: it’s not in your indicators.

It’s in your identity.

FAQs

1. What’s the fastest way to stop breaking trading rules?

Use the 2-Minute Pause Script before every trade. It interrupts emotion long enough to let discipline win.

2. Can I use these hacks for swing trading?

Absolutely. These hacks are about behavior, not timeframes. They work for scalpers, swing traders, and even investors.

3. How long until I see change?

Most traders feel improvement within a week of consistent journaling and pre-commitment. The goal isn’t perfection - it’s momentum.

4. Why do I still self-sabotage even after learning these?

Because awareness comes first, then mastery. Stick with the process long enough, and identity will catch up to behavior.

Start Practicing with Confidence - Risk-Free!

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

Looking for step-by-step approaches you can plug straight into the charts? Start here:

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

- Forex Trading Strategy for Beginners

- Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

- How to Use Fibonacci to Set Targets & Stops (Complete Guide)

- RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

- Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

- Gold Trading Stochastics Strategy: How to Trade Gold with 2R - 3R Targets

- RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

- Moving Averages Trading Strategy Playbook

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

- Mastering Price Action at Key Levels - How to Spot, Trade, and Win at the Most Crucial Zones

- Mastering Retests: How to Enter with Confirmation After a Breakout

Indicators / Tools for Trading

Sharpen your edge with proven tools and frameworks:

- The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2025

- Moving Averages Trading Strategy Playbook

- How to Think Like a Price Action Trader

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

News moves markets fast. Learn how to keep pace with SMC-based playbooks:

- Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

- How to Trade NFP Using Smart Money Concepts (SMC) - A Proven Strategy for Forex Traders

- How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

- Learn to Trade News by Backtesting it with Forex Tester

Learn How to Trade US Indices

From NASDAQ opens to DAX trends, here’s how to approach indices like a pro:

- How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

- Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Start Trading Gold

Gold remains one of the most traded assets - here’s how to approach it with confidence:

- How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

- Why Gold Remains the Ultimate Security in a Shifting World

- How to Exit & Take Profits in Trading Gold Like a Pro: Using RSI, Range Breakdowns, and MAs as Your Confluence

- Backtest Gold using Forex Tester Online

How to Trade Japanese Candlesticks

Candlesticks are the building blocks of price action. Master the most powerful ones:

- Mastering the Top Japanese Candlesticks: The Top 5 Candlesticks To Trade + Top SMC Candlestick Pattern

- How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

- The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

- Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

- Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

Ready to go intraday? Here’s how to build consistency step by step:

- 5 Steps to Start Day Trading: A Strategic Guide for Beginners

- 8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

- 3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

- The Ultimate Guide to Understanding Market Trends and Price Action

- Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Swing Trading 101

- Introduction to Swing Trading

- The Market Basics for Swing Trading

- Core Principles of Swing Trading

- The Technical Foundations Every Swing Trader Must Master

- Swing Trader’s Toolkit: Multi-Timeframe & Institutional Confluence

- The Psychology of Risk Management in Swing Trading

- Swing Trading Concepts To Know In Trading with Smart Money Concepts

- Becoming a Consistent Swing Trader: Trading Structure & Scaling Strategy

Learn how to navigate yourself in times of turmoil

Markets swing between calm and chaos. Learn to read risk-on vs risk-off like a pro:

- How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

- How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

- The Ultimate Guide to Understanding Market Trends and Price Action

- Metals in Risk-On and Risk-Off Environments: How Sentiment Moves Gold and Commodities

Want to learn how to trade like the Smart Money?

Step inside the playbook of institutional traders with SMC concepts explained:

- Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

- Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

- Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

- The SMC Playbook Series Part 1: What Moves the Markets? Key Drivers Behind Forex, Gold & Stock Indices

- The SMC Playbook Series Part 2: How to Spot Liquidity Pools in Trading - Internal vs External Liquidity Explained

- Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

- Accumulation, Manipulation, Distribution: The Hidden Cycle That Runs Every Market

- Institutional Order Flow - Reading the Market Through the Eyes of the Big Players

- London Session Trading Secrets: How Smart Money Sets the High & Low of the Day

- Mastering the New York Session - Smart Money Concepts Guide

- Anatomy of a Perfect Execution: How SMC Traders Trade with Precision

- Step-by-Step Trading Confirmation Guide for Precise Execution

- Execution Psychology: Turning Hesitation into Confidence

Master the World’s Most Popular Forex Pairs

Forex pairs aren’t created equal - some are stable, some are volatile, others tied to commodities or sessions.

- The Top 5 All-Time Best Forex Pairs to Trade

- Top Forex Pairs Beyond the Big Five

- EUR/USD: The King of Forex

- USD/JPY: The Fast Mover

- GBP/USD: The Volatile Cable

- AUD/USD: The Commodity Currency

- USD/CAD: The Oil-Backed Pair

- GBP/JPY: How to Trade The Beast

- Asian & London Session Secrets

- Mastering the New York Session

Metals Trading

- Metals Trading: Why Gold and Metals Are Rising Again

- Silver Trading: The Underdog with Dual Identity

- Gold vs Silver: Institutional Demand Breakdown Explained

- How to Day Trade Silver Like a Pro: Smart Money Tactics for XAG/USD

- Platinum & Palladium: The Quiet Power Duo of Industrial Metals

- How to Trade Metals with SMC and Fundamentals - Gold Trading Strategy

- Metals in Risk-On and Risk-Off Environments: How Sentiment Moves Gold and Commodities

- Future of Metals Market: Gold Forecast 2026 & Long-Term Commodities Outlook

Stop Hunting 101

If you’ve ever been stopped out right before the market reverses - this is why:

- Stop Hunting 101: How Swing Highs and Lows Become Liquidity Traps

- Outsmarting Stop Hunts: The Psychology Behind the Trap

- How to Lessen Risk From Stop Hunts in Trading

- How Stop Hunts Trigger Revenge Trading - Breaking the Pain Cycle

- How to Accept Stop Hunts Without Losing Discipline - Shifting From Frustration to Focus

Trading Psychology

Mindset is the deciding factor between growth and blowups. Explore these essentials:

- The Mental Game of Execution - Debunking the Common Trading Psychology

- Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

- The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

- Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

- Top 10 Habits Profitable Traders Follow Daily to Stay Consistent

- Top 10 Trading Rules of the Most Successful Traders

- Top 10 Ways to Prevent Emotional Trading and Stay Disciplined in the Markets

- Why Most Traders Fail - Trading Psychology & The Hidden Mental Game

- Emotional Awareness in Trading - Naming Your Triggers

- Discipline vs. Impulse in Trading - Step-by Step Guide How to Build Control

- Trading Journal & Reflection - The Trader’s Mirror

- Overcoming FOMO & Revenge Trading in Forex - Why Patience Pays

- Risk of Ruin in Trading - Respect the Math of Survival

- Identity-Based Trading: Become Your Trading System for Consistency

- Trading Psychology: Aligning Emotions with Your System

- Mastering Fear in Trading: Turn Doubt into a Protective Signal

- Mastering Greed in Trading: Turn Ambition into Controlled Growth

- Mastering Boredom in Trading: From Restless Clicking to Patient Precision

- Mastering Doubt in Trading: Building Confidence Through Backtesting and Pattern Recognition

- Mastering Impatience in Trading: Turn Patience Into Profit

- Mastering Frustration in Trading: Turning Losses Into Lessons

- Mastering Hope in Trading: Replacing Denial With Discipline

- When to Quit on Trading - Read This!

- The Math of Compounding in Trading

- Why Daily Wins Matter More Than Big Wins

- Scaling in Trading: When & How to Increase Lot Sizes

- Why Patience in Trading Fuels the Compounding Growth

- Step-by-Step Guide on How to Manage Losses for Compounding Growth

- The Daily Habits of Profitable Traders: Building Your Compounding Routine

- Trading Edge: Definition, Misconceptions & Casino Analogy

- Finding Your Edge: From Chaos to Clarity

- Proving Your Edge: Backtesting Without Bias

- Forward Testing in Trading: How to Prove Your Edge Live

- Measuring Your Edge: Metrics That Matter

- Refining Your Edge: Iteration Without Overfitting

- The EDGE Framework: Knowing When and How to Evolve as a Trader

- Scaling Your Edge: From Small Account to Consistency

- Trading in the Zone: Execution Through Habit and Structure

- Trading in the Zone: Thinking in Probabilities

- The Inner War: Fear, Greed, and the Illusion of Control

- Detachment Discipline in Trading: How to Let Go of the Need to Be Right

Market Drivers

- Central Banks and Interest Rates: How They Move Your Trades

- Inflation & Economic Data: CPI Trading Strategy and PPI Indicator Guide

- Geopolitical Risks & Safe Havens in Trading (Gold, USD, JPY, CHF)

- Jobs, Growth & Recession Fears: NFP, GDP & Unemployment in Trading

- Commodities & Global Trade: Oil, Gold, and Forex Explained

- Market Correlations & Intermarket Analysis for Traders

Risk Management

The real edge in trading isn’t strategy - it’s how you protect your capital:

- Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

- Why Risk Management Is the Only Edge That Lasts

- How Much Should You Risk per Trade? (1%, 2%, or Less?)

- The Ultimate Risk Management Plan for Prop Firm Traders - Updated 2025

- Mastering Position Sizing: Automate or Calculate Your Risk Like a Pro

- Martingale Strategy in Trading: Compounding Power or Double-Edged Sword?

- How to Add to Winners Using Cost Averaging and Martingale Principle with Price Confirmation

- Managing Imperfect Entries in Trading - How Professionals Stay Composed

Suggested Learning Path

If you’re not sure where to start, follow this roadmap:

- 1. Start with Trading Psychology → Build the mindset first.

- 2. Move into Risk Management → Learn how to protect capital.

- 3. Explore Strategies & Tools → Candlesticks, Fibonacci, MAs, Indicators.

- 4. Apply to Assets → Gold, Indices, Forex sessions.

- 5. Advance to Smart Money Concepts (SMC) → Learn how institutions trade.

- 6. Specialize → Stop Hunts, News Trading, Turmoil Navigation.

This way, you’ll grow from foundation → application → mastery, instead of jumping around randomly.

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.