Trump’s Tariffs Spark Global Volatility & Gold Rally

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

Overview:

As geopolitical tensions reignite and inflation risks re-enter the conversation, gold has once again proven its place as the market’s go-to safe haven. With the announcement of reciprocal U.S. tariffs by President Donald Trump on April 2, 2025, dubbed as “Liberation Day”, gold prices have broken historical barriers and drawn renewed attention from investors worldwide.

- President Trump’s reciprocal tariff announcement on April 2 has reignited trade tensions globally, sparking a sharp reaction across major asset classes.

- Gold hits a new all-time high at $3167/oz as investors flee to safety, fueled by inflation fears, central bank accumulation, and U.S. Dollar weakness.

- The U.S. Dollar breaks down through key support at 103.37, with growing signs of global de-dollarization accelerating its decline.

- U.S. stock indices (DOW, NASDAQ, S&P 500) plunge, reflecting broad market weakness as traders react to tariff-induced economic risks.

- Volatility Index (VIX) spikes to fresh highs, confirming a renewed risk-off sentiment in the market.

Dollar Breakdown Raises Disinterest Over the US Market

As tariffs weighed the US market down with looming dissatisfaction and disinterest with its trade partners, Dollar slumped to new lows with no signs of recovery.

De-dollarization is also an increasing threat over the Dollar with continued tensions on trade wars.

- Global Trade Shifts: Nations are increasingly engaging in bilateral trade agreements using local currencies, aiming to diminish the dollar's dominance in global transactions.

- For the U.S.: A reduced global reliance on the dollar could lead to decreased demand, potentially impacting its value and increasing borrowing costs.

- For Global Markets: While de-dollarization promotes financial diversification, it may also introduce currency volatility and require adjustments in international financial systems.

Daily

Dollar now traded to and through the 103.373 level which is not looking good for the greenback.

With Dollar losing appeal, we could see this as a propeller for Gold’s bullish momentum.

Volatility on New Highs: Renewed Fears Amidst US Trade Tensions

With tensions getting heavier over the US’ trade relationships, fears and concerns on the US markets are at new highs after breaking previous resistances.

These new high levels signals a risk-off sentiment in the United States.

US Indices Breakdown

After tariff announcements, the US stock market plunged to new lows with a strong indication of weakness over the US market.

DOW

Before

After

NAS

Before

After

S&P

Before

After

For reference, check out this previous market analysis,

ACY SecuritiesTariffs, Tech & Tension: Market Breakdown on USD, Dow, Nasda…, as forecast is now materializing.

Backdrop: Why Gold Is in Focus

President Trump’s tariff policy, unveiled as a move to protect American manufacturing and correct trade imbalances, has escalated global trade uncertainty. Investors have quickly rotated out of risk-sensitive assets and into safety — pushing gold to new all-time highs.

“This is Liberation Day,” President Trump declared, just before global markets responded with volatility across equities, currencies, and commodities.

Fundamental Drivers Behind Gold's Move

- Institutional Presence: Based on COT report, institutions are still net long on Gold.

- Central Bank Positioning: The increased demand from central banks has contributed to a significant rise in gold prices.

- Inflation Hedging: With tariffs expected to push up prices on consumer goods, gold is gaining as a classic inflation hedge.

- Global Risk Sentiment: The threat of retaliatory tariffs has heightened geopolitical tensions, making gold attractive during uncertain times.

- Dollar Weakness: As the U.S. Dollar declined following the announcement, gold’s inverse correlation to the greenback further fueled buying.

- Bond Yield Pressure: A dip in U.S. bond yields reflects growing caution among investors — another supportive factor for non-yielding assets like gold.

Gold Hits a New All-Time High

Gold rallied to an unprecedented $3149 per ounce on April 1, 2025, just ahead of the official announcement. The rally was driven by expectations that tariffs would disrupt global trade and push inflation higher.

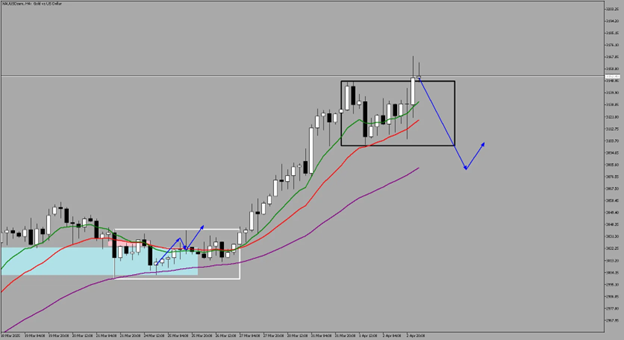

Daily

Following that spike, gold saw a brief pullback on profit-taking but found support and continued trading in elevated ranges breaking the $3149 level with new highs on the horizon.

4-Hour

The previous resistance turned support is now being tested for a sustained upside and for a potential bullish continuation.

What Comes Next: Scenarios to Watch

Bullish Case:

- Continued global trade tensions or retaliatory measures

- Persistent inflation fears and a dovish Fed stance

- Sustained weakness in the U.S. Dollar

Bearish Case:

- Diplomatic resolution to tariffs or easing tone from key global players

- Strong U.S. jobs/inflation data that revives USD demand

- Fed rate hikes or aggressive tightening surprise

Takeaway for Traders and Investors

Gold has reclaimed the spotlight as the safe-haven asset of choice. Whether you’re trading the short-term volatility or positioning for long-term protection, the current environment calls for agility and macro-awareness.

Trade Considerations:

- Look for buy-the-dip opportunities if price revisits strong support levels at:

- Previous Resistances Turned Support

- 50% Equilibrium Level

- Fair Value Gap - 3143.47 - 3147.90

- Use VIX and DXY as confluence tools for directional bias

- Scale into positions around key levels using smaller timeframe confirmation

- Scale in when price breaks out from ranges on lower timeframes like 1-Hour

Markets are now in a risk-off stance, and gold is leading that move. How long this rally lasts will depend on macro developments and central bank reactions — but for now, the yellow metal is shining with confidence under the pressure of President Trump’s bold economic reset.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.