US Dollar Technical Approach: Scenario Mapping for Major Pairs

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

USD Strength and Market Implications: Key Insights & Trading Strategies

The U.S. dollar surged broadly on Thursday following the Federal Reserve’s decision to keep interest rates steady. Fed Chair Jerome Powell signaled no urgency in cutting rates further this year, reinforcing the dollar’s resilience. Meanwhile, global central banks, including the Swiss National Bank (SNB) and the Riksbank, took divergent policy stances, leading to significant currency fluctuations.

Key Market Developments

- U.S. Labor Market Stability: Data showed a slight increase in unemployment claims, yet the labor market remains stable, easing concerns about a sharp economic downturn.

- Sterling Retreats: After hitting a four-month high, the British pound slipped as the Bank of England (BoE) kept rates unchanged at 4.5% and warned against imminent rate cuts.

- Swiss Franc Weakens: The SNB cut its main interest rate to 0.25%, citing uncertainty over global economic conditions.

- Australian and New Zealand Dollar Decline: Weak labor data weighed on the Aussie, while the Kiwi dropped despite an unexpected GDP rebound.

- Bitcoin Dips: The cryptocurrency market saw Bitcoin slide 1.5% to $84,056.

Technical Outlook: Dollar and the Major Pairs

Daily

After reaching the 103.373 level, the dollar has momentarily paused its downward movement. Amid ongoing trade wars and the U.S. withdrawing from various organizations, the dollar has struggled to gain any advantage from these developments.

4-Hour

There is still no clear direction on the 4-Hour timeframe especially that the Fed is still on a dovish outlook but hinting 2 potential rate cuts for this year.

Technical Approach

Since the Dollar is currently in a side-ways market, and there’s still clear direction, we are looking for:

- Dollar at Premium Level (Red Shade 60-100% of the Range)

- Look for LONGS on pairs with USD as the Quote Currency (XXX/USD)

- Look for SHORTS on pairs with USD as the Base Currency (USD/XXX)

2. Dollar at Discount Level (Green Shade 40-0% of the Range)

- Look for SHORTS on pairs with USD as Quote Currency (XXX/USD

- Look for LONGS on pairs with USD as the Base Currency

Strategic Approach for Majors: Trading in Favor of the Dollar

IF the U.S. dollar appreciates, align your trades accordingly:

- Go short on pairs where the dollar is the quote currency (e.g., EUR/USD, GBP/USD).

- Go long on pairs where the dollar is the base currency (e.g., USD/JPY, USD/CAD).

Execution Strategy

- Identify a Range on Lower Timeframes (4H - 1H)

- Look for a consolidation or range-bound price action.

- Wait for a Breakout or Breakdown

- Short on Breakdown: If price breaks below the range, enter short with stops placed above the range.

- Caution on Breakout: If price breaks above, be wary as resistance may be nearby.

- Confirm at Candle Close

- Enter the trade only after the candle closes beyond the range to avoid fakeouts.

Strategic Approach for Majors: Trading Against the Dollar

IF the U.S. dollar depreciates, adjust your trades accordingly:

- Go long on pairs where the dollar is the quote currency (e.g., EUR/USD, GBP/USD).

- Go short on pairs where the dollar is the base currency (e.g., USD/JPY, USD/CAD).

Execution Strategy

- Identify a Range on Lower Timeframes (4H - 1H)

- Look for consolidation or range-bound price action.

- Wait for a Breakout or Breakdown

- Long on Breakout: If price breaks above the range, enter long with stops placed below the range.

- Caution on Breakdown: If price breaks below, be wary as support may be nearby.

- Confirm at Candle Close

- Enter the trade only after the candle closes beyond the range to avoid fakeouts.

USDJPY

4-Hour

USD gains traction vs the Yen as Japan’s CPI print came out lower hinting a dovish stance, benefiting USD.

In technical, we are seeing USDJPY on a bullish sequence.

Scenarios

- Bullish

- USD Strength

- Dovish BoJ

- Break of Equilibrium 149.20 level

2. Bearish

- USD Weakness

- Hawkish BoJ

- Break of 148.183

AUDUSD

4-Hour

Aussie is currently on a bearish sequence with price going back from the previous range’s discount level.

Scenarios

- Bullish

- US Dollar Breakdown

- Break of 0.63136

- Break of MAs

- Momentum Gauge: Bullish AUDNZD

2. Bearish

- US Dollar Breakout

- Break of 0.62712

- Break of 0.62586

- Momentum Gauge: Bearish AUDNZD

NZDUSD

4-Hour

After breaking down the range, we are currently testing the Fair Value Gap with a potential downside move unless US dollar weakens.

Scenarios

- Bullish

- Dollar Weakness (Breakdown)

- Break of 0.57620 - 0.57865

- Break of MAs

- Momentum Gauge: Bearish AUDNZD

Price must stay above for a sustained breakout.

2. Bearish

- Dollar Strength (Breakout)

- 0.57620 - 0.57865 acting as resistance

- MA resistance

- Break of 0.57729 level

- Momentum Gauge: Bullish AUDNZD

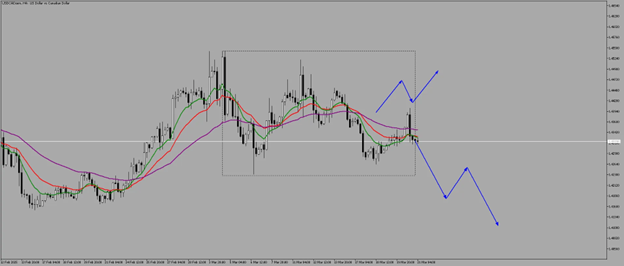

EURUSD

4-Hour

EUR failed to have a follow-through at the 1.09470 after attempting to break the level for a potential draw on 1.09970 level.

Dollar is also on a uncertain direction as we wait for a strong bullish follow-through.

Scenarios

- Bullish

- Dollar Weakness

- 1.08147 must remain intact

- Trade to and through 1.08689 - 1.09003

- Break of MAs

- Momentum Gauge: Bullish EURGBP

2. Bearish

- Dollar Strength

- 1.08689 - 1.09003 level must act as a resistance

- Break of 1.08147

- Momentum Gauge: Bearish EURGBP

GBPUSD

4-Hour

Compared to AUD, NZD, EUR, GBP is holding its ground with no large downside swings.

Scenarios

- Bullish

- Dollar Weakness

- Break of 1.29795

- Break of 1.30147

- Momentum Gauge: Bearish EURGBP

2. Bearish

- Dollar Strength

- Break of 1.29360

- Break of 1.29111

- Break of MAs

- Momentum Gauge: Bullish EURGBP

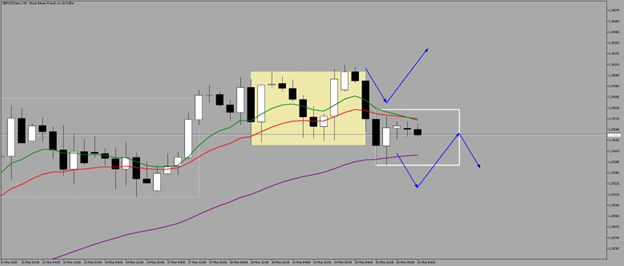

USDCAD

4-Hour

Canadian Dollar remains in a slump as it trades below the equilibrium level of the range, a bearish territory for CAD.

Scenarios

- Bullish

- USD Strength

- Break of the middle or 50% of the range

- 50% acting as support

- Break of 1.45428

2. Bearish

- Stay below equilibrium

- Fundamentals: Suffer from Tariffs

- Break of 1.42389

USDCHF

4-Hour

After SNB cut rates, Swissie falls and we are looking for USDCHF to gain traction against the franc.

Scenario

- Bullish

- Dollar Strength

- Stay above MAs

- Break of 0.88247 - 0.88640

2. Bearish

- Dollar weakness

- Break of 0.88070 support

- Break of 0.87558

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.