US February Payrolls: Resilient, Yet Signs of Uncertainty

ACY Securities - Luca Santos

ACY Securities - Luca Santos

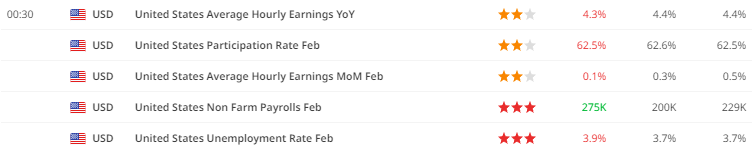

In the latest release on US February payrolls last Friday, the numbers paint a mixed picture of the labour market. Nonfarm payrolls surpassed expectations, surging by an impressive 275,000, well above the estimated 100,000 required to accommodate population growth. However, the sheen of this robust performance was dimmed by a substantial downward revision of 167,000 to the prior two months' payrolls.

USA NFP

Job gains in February were primarily attributed to sectors like private education & health (+85,000), leisure & hospitality (+58,000), and government (+52,000). Notably, private education & health and government roles, which tend to be less cyclical, collectively contributed to around half of the total payroll growth. Conversely, the manufacturing and wholesale trade sectors, sensitive to economic cycles and interest rates, experienced job losses during the month.

While payroll growth maintained its solidity, other indicators in the employment report suggest a potential softening of the labour market. The unemployment rate saw a 0.2 percentage point increase to 3.9%, marking its highest level in over two years. Despite the strong payroll growth, the unchanged participation rate at 62.5% and a 184,000 decline in the household survey measure of employment added a layer of complexity. The household measure, considering self-employed individuals, farm workers, and business dynamics, introduces uncertainty about the true health of the labour market.

Average hourly earnings (AHE) rose by a modest 0.1% month-on-month in February, falling below expectations. AHE growth in the previous month (January) was also revised slightly downward to 0.5% from 0.6%. The Federal Reserve's preference for AHE to be within the 3-3.5% range was challenged, as year-on-year AHE growth eased to 4.3% in February.

For the Federal Reserve, the February employment report presents a mixed bag. While the welcomed correction in AHE was anticipated, the central bank closely monitors the Employment Cost Index and Atlanta Fed Wage Growth Tracker, both indicating a continued easing trend. The strong payroll growth may provide room for cautious optimism, influencing the Fed's stance on rate cuts.

In the bigger picture, the February employment report might not drastically alter the Fed's perspective, but there is a nuanced dovish undertone. Importantly, private surveys are signalling a softening in hiring intentions and an uptick in layoffs, factors that likely contributed to Fed Chair Powell's recent comments about being "not far" from considering rate cuts. The central bank, he noted, requires "a little bit more" data to gain confidence in inflation moving sustainably down to the 2% target.

Chart 1 illustrates the substantial rise of 275,000 in nonfarm payrolls for February, with revisions showing a solid three-month average payroll gain at 265,000 and a six-month average at 231,000, signalling resilience amid underlying uncertainties.

Insights Inspired by UniCredit: Credit to Their Analysis for Shaping Some Aspects of This TextTop of Form

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.