.jpg&w=3840&q=75)

US Recession Odds vs Record SPX Rally

Alchemy Markets - Zorrays Junaid

Alchemy Markets - Zorrays JunaidWeekly Market Outlook: 2 Key US Data Points and What Charts Are Telling Us

As we head into the third week of May, market participants are weighing a mix of bullish price action against stubborn economic risks. Next week’s US economic calendar is headlined by two pivotal updates: fresh housing data amid ongoing affordability concerns, and April’s inflation report—a release known for surprising markets.

While stocks, particularly the S&P 500, have powered through resistance levels in recent weeks, there’s a growing disconnect between market optimism and underlying fundamentals. This week’s data could be a wake-up call.

Let’s break it all down…

Housing Data: Affordability Still a Serious Drag

The upcoming housing report will provide the latest snapshot of a sector still struggling under the weight of high financing costs. With the 30-year mortgage rate lingering just below 7%, the average new mortgage taken out for home purchases—about $450,000—equates to monthly payments nearing $3,000. That’s simply unaffordable for most Americans.

This affordability squeeze explains why mortgage applications remain historically low, despite a modest bump in new purchase applications. More importantly, sentiment among builders is collapsing. The National Association of Home Builders (NAHB) index fell sharply in May, underscoring a gloomy outlook among those closest to the action. Builders are reacting not only to pricing pressure but also to buyer hesitation triggered by recent volatility across financial markets.

With the housing market showing little sign of revival, even marginally weaker data could reinforce a broader economic slowdown narrative.

April Inflation Print (Wednesday): Services in the Spotlight

April inflation data—especially on the services side—has historically been a market-mover. That’s because April often sees annual increases in service-sector costs like healthcare, travel, insurance, and other stickier inflation categories.

In both 2023 and 2024, April’s CPI report came in hotter than expected, causing notable reactions in rates and equities. This time, there’s cautious optimism that services inflation could come in cooler—below the Bank of England’s 5% forecast.

If that’s the case, it won’t necessarily trigger a rate cut at the Fed’s June meeting, but it would help solidify expectations for policy easing later in the summer, potentially in August. For rate-sensitive sectors like housing, a more dovish tilt could offer some badly needed relief.

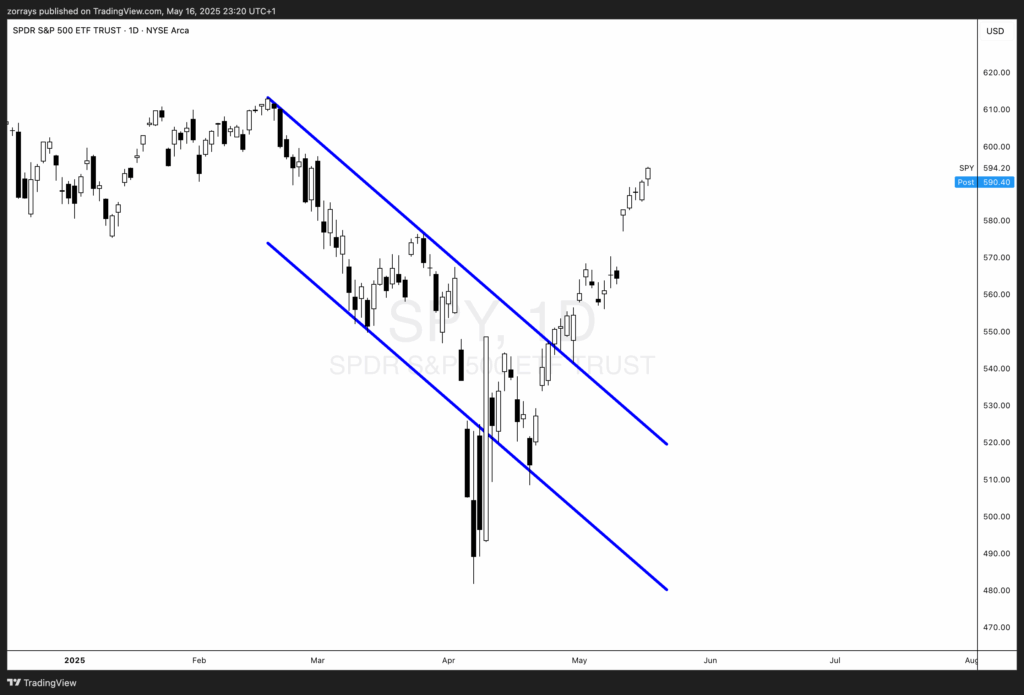

Chart of the Week: SPX Logs Fastest Rally on Record

From a technical standpoint, the S&P 500’s recent performance has been stunning. After bottoming out in April, the index has broken out of a descending channel in dramatic fashion—posting one of its fastest rallies ever over such a short period.

Momentum remains strong, and short-term breadth indicators suggest little resistance up to all-time highs. But is this momentum sustainable?

Not everyone thinks so. And a look beneath the surface reveals that some market participants may be mispricing risk.

Still a 37% Recession Chance in 2025: Markets May Be Too Complacent

Source: Polymarket.com

While equity markets seem euphoric, prediction markets are still pricing in a 37% chance of a US recession before year-end. That number has dropped significantly since the recent 90-day pause on new tariffs, which initially spooked investors earlier this year.

However, it’s crucial to note that this pause is just that—a temporary deferral, not a resolution. The structural trade issues between the US and China remain unresolved, and any flare-up could reintroduce significant downside risks for growth.

In short, while the immediate threat has eased, the underlying fragility of the macro backdrop hasn’t gone away. The divergence between rising stock prices and sustained recession probabilities suggests either optimism is warranted—or investors are being lulled into a false sense of security.

Wrapping It Up: Eyes Wide Open

Next week’s data on housing and inflation will offer timely insights into the real economy—beyond the headlines of new stock market highs. The S&P 500’s record-breaking rally may seem unstoppable, but with affordability collapsing in the housing sector and recession risks still elevated, caution is warranted.

For traders, investors, and policymakers alike, this week presents a reality check: the economy and the market may not be singing the same tune. Stay vigilant, stay informed.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.