USD/CAD at Risk: Fed, BoC Rate Cuts and Bearish Head-and-Shoulders Signal Market Shift

Alchemy Markets - Zorrays Junaid

Alchemy Markets - Zorrays JunaidThe coming week is set to be a pivotal one for global markets as the United States, United Kingdom, and Canada all feature crucial monetary policy decisions and economic data releases. With inflationary pressures still lingering but labor markets showing signs of fatigue, central banks are carefully recalibrating their strategies. Investors and policymakers alike will be watching closely for signs of how the Fed, BoE, and BoC intend to navigate the tricky balance between inflation control and economic stability.

United States: Spotlight on the Federal Reserve

Fed Rate Decision (Wednesday)

The Federal Reserve takes center stage this week, with expectations leaning toward a 25 basis point (bp) rate cut. Inflation remains stubbornly high, but the real story lies in the labor market.

Over the past four months, jobs growth has been tepid, and concerningly, recent revisions revealed that over half of the jobs reportedly added in the 12 months to March never actually existed. This softer jobs backdrop, combined with signs of a cooling economy, suggests the Fed now has room to ease policy.

Markets expect the Fed to lower rates from the current 4.5% ceiling toward 3.25% by March 2025, gradually moving away from “somewhat restrictive” policy toward a more neutral stance.

Retail Sales (Tuesday)

Consumer spending momentum is faltering. Retail sales are expected to disappoint due to weak consumer sentiment and a decline in auto sales. Industrial production, meanwhile, looks set for another contraction, supported by subdued manufacturing survey data.

Together, these releases paint a picture of an economy losing steam, reinforcing the Fed’s likely dovish tilt.

United Kingdom: Watching Jobs, Wages, and Inflation

Jobs Report (Tuesday)

The UK labor market remains a wild card for the Bank of England (BoE). Payroll figures will be closely scrutinized for further signs of weakness. Encouragingly, business surveys have started to improve, hinting that the worst may be behind the jobs market.

However, wage growth trends remain a key focus. If pay pressures continue to ease, this will give the BoE further confidence in its rate-cutting cycle.

Inflation Report (Wednesday)

Food inflation remains a thorn in the BoE’s side, likely holding above 5% in the upcoming data. On the positive side, services inflation is expected to edge lower, helping to alleviate some of the pressure.

While this report is unlikely to derail the BoE’s expected path of gradual easing, a significant upside surprise could alter the timing of cuts. For now, November is still viewed as the most probable moment for the next move.

Bank of England Meeting (Thursday)

No policy change is expected at this meeting. Having already cut rates in August, the BoE tends to adjust only once per quarter. Forward guidance will likely reiterate that while cuts are coming, rates are now approaching a more neutral level.

Canada: Bank of Canada to Ease Amid Tariff Pressures

Rate Decision (Wednesday)

The Bank of Canada (BoC) is widely expected to deliver a 25bp rate cut this week, responding to a weakening domestic backdrop.

Canada’s economy is highly exposed to U.S. tariff impacts, and the latest data has been troubling. Output contracted sharply in Q2, while employment fell for the second straight month in August, pushing unemployment up to 7.1%.

With inflation broadly aligned with target, the BoC has space to act. A second rate cut is likely in Q4, bringing policy closer to the bottom of its perceived neutral range.

Global Outlook: Synchronised Easing Cycle

The broader theme across the Fed, BoE, and BoC is one of monetary easing amid cooling economies. Inflation is still sticky in some sectors, but weaker labor markets and softening demand are increasingly shaping central bank decisions.

Investors should prepare for a synchronised global shift toward looser policy, which may provide temporary relief for equity markets but underscores mounting risks of a deeper slowdown.

Technical Analysis: USD/CAD Head-and-Shoulders Formation Signals Potential Reversal

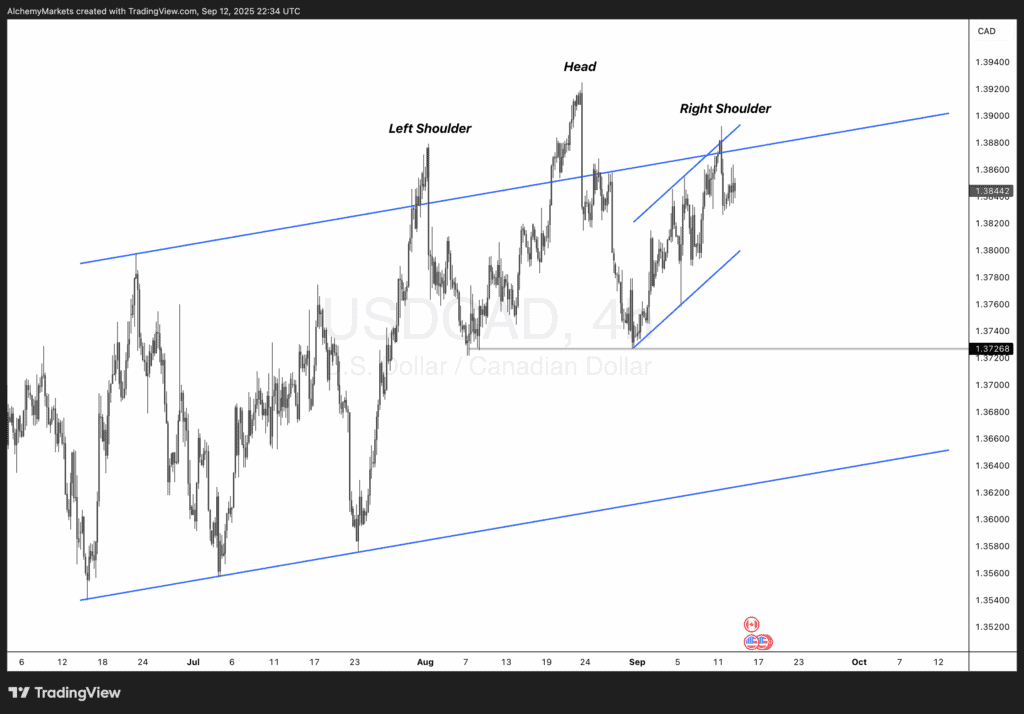

Looking at the USD/CAD 4H chart, the pair is forming a head-and-shoulders pattern, typically viewed as a bearish reversal structure.

- Left Shoulder: Formed in late July with resistance near the 1.3860–1.3880 zone.

- Head: A higher peak into early September near 1.3940, signaling strong bullish exhaustion.

- Right Shoulder: Currently building below the prior highs, showing sellers stepping in earlier, a classic sign of waning momentum.

The neckline support sits around 1.3725, which aligns closely with prior swing lows. A decisive break below this level could open the door for a deeper retracement, potentially targeting 1.3650 and 1.3550.

Fundamental Alignment with Technicals

This technical setup ties neatly into the macro backdrop:

- The Bank of Canada is widely expected to cut rates this week, which would typically pressure the Canadian dollar (bearish CAD, bullish USD/CAD).

- However, the Fed is also expected to cut rates, and given the recent deterioration in U.S. jobs data and weak consumer demand, the Fed may signal a more aggressive easing path than the BoC.

- If U.S. policy easing expectations outpace Canadian cuts, the USD could underperform the CAD, adding weight to the bearish technical scenario.

In other words, while rate cuts on both sides might seem offsetting at first glance, the balance of risks leans toward USD/CAD retracing lower, confirming the technical head-and-shoulders pattern.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.