USD, EUR & JPY in the Eye of Economic and Political Shifts

ACY Securities - Luca Santos

ACY Securities - Luca Santos

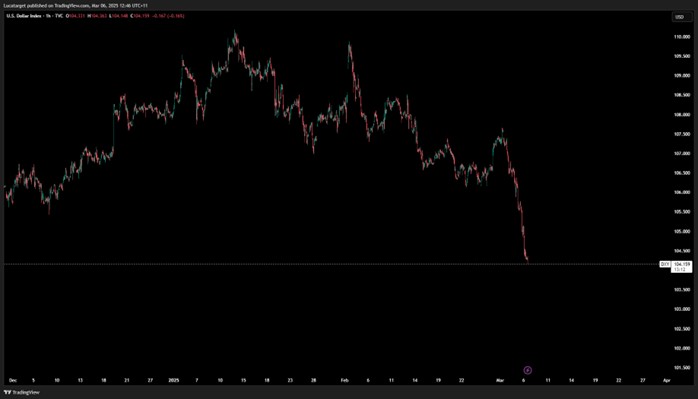

USD Outlook: The Dollar’s Fate Hangs in the Balance

The recent depreciation of the US dollar has raised questions about whether the currency is at a turning point. While I have stepped away from predicting EUR/USD dropping below parity, the broader outlook still leans toward renewed dollar strength. The key driver remains the sharp move in US-Eurozone yield spreads, which has provided short-term resistance for the dollar. The recent 50-basis-point drop in the US-EZ 10-year spread—the most significant since the initial COVID-19 shock in 2020—has bolstered the euro’s rally. However, this momentum may not be sustainable.

DXY H1

EUR/USD: Political and Trade Pressures May Cap Gains

The euro has been the best-performing G10 currency recently, supported by a surge in yield spreads and political developments in Germany. A recent deal between Friedrich Merz’s CDU-CSU and the SPD aims to create off-balance-sheet funds to boost defence and infrastructure spending, potentially unlocking further economic momentum. However, the Greens' stance remains a crucial factor in whether this initiative will pass before the current parliamentary session expires on March 25.

Despite this, the euro’s upside remains limited by trade tensions. Former US President Donald Trump, in a recent address, explicitly targeted the EU for additional tariffs, alongside China, Brazil, India, Mexico, and Canada. Given Trump’s history of erratic trade policies, uncertainty remains high. Reports suggest a potential tariff rollback for Canada and Mexico, but Europe remains firmly in the crosshairs, which could weigh on EUR/USD.

EURUSD H1 Chart

Yen Dynamics: Washington’s Currency Concerns and Policy Shifts

The Japanese yen, which had been benefiting from falling US yields and risk-off sentiment, faced a setback as front-end US rates rebounded. Despite this, Washington’s growing discomfort with currency misalignment adds another layer of complexity. Trump has openly accused Japan and China of devaluing their currencies and has suggested tariffs as a countermeasure. If this rhetoric intensifies, it could discourage speculative yen selling and even encourage yen buying.

USDJPY H1

Japanese authorities are also voicing concerns over excessive yen weakness. Vice Finance Minister Atsushi Mimura warned that a weak yen could hinder real wage growth, reinforcing the view that the government prefers a stronger currency. With Japan’s previous interventions totalling JPY 24.55 trillion (USD 160 billion) in 2022 and 2024, any further weakness may trigger official action.

Looking ahead, the yen’s trajectory will largely depend on US front-end rate movements. If US yields continue to retreat and Trump’s stance on currency intervention gains traction, USD/JPY could shift downward. However, in the short term, the pair's recent rebound suggests a period of consolidation before any decisive move lower.

Traders should monitor several key economic releases and events that could drive FX volatility:

- German Services PMI (Feb): A weaker-than-expected print could weigh on the euro.

- US ISM Non-Manufacturing PMI (Feb): A stronger reading could reinforce USD strength.

- BoE Governor Bailey’s Speech: Any hawkish signals could impact GBP crosses.

- Trump’s Trade Policy Announcements: Further details on EU tariffs could shape market sentiment.

The FX landscape remains highly fluid, with shifting yield spreads, political uncertainty, and trade tensions driving market moves. While the euro has capitalized on recent USD weakness, trade risks and political hurdles could limit further gains. The yen’s outlook remains tied to Washington’s stance on currency policy and front-end US rates. In the coming weeks, expect heightened volatility as traders react to evolving macroeconomic and geopolitical developments.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.