USD/JPY Outlook: Tariff Concerns and Rising US Yields Keep Yen Under Pressure

ACY Securities - Luca Santos

ACY Securities - Luca Santos

The Japanese yen has been struggling to maintain recent gains, with USD/JPY climbing to a high of 154.00, well above the February 7th low of 150.93. The pair’s momentum accelerated after breaching the 200-day moving average at approximately 152.75, aligning with a rebound in US Treasury yields.

USDJPY Chart

A key driver behind this shift is the recent uptick in US bond yields, particularly the 10-year Treasury yield, which rose from 4.38% on February 12th to 4.66%—a notable recovery, albeit still below its January 14th peak. This increase follows the stronger-than-expected US nonfarm payrolls report and renewed trade policy uncertainties. Former President Trump’s proposed tariff hikes on steel, aluminum, and other imports have added to the upward pressure on US yields, reinforcing market expectations that the Federal Reserve may hold interest rates higher for longer.

US Bonds 10Y

Fed’s Stance and CPI Data Weigh on Rate Expectations

Fed Chair Jerome Powell’s testimony to Congress reaffirmed a cautious approach to monetary policy adjustments. While he acknowledged that policy is now “significantly less” restrictive than before, Powell stressed that premature easing could jeopardize inflation control. Conversely, delaying rate cuts too long might dampen economic growth. The Fed remains firmly in data-dependent mode, waiting for clear signs before shifting policy.

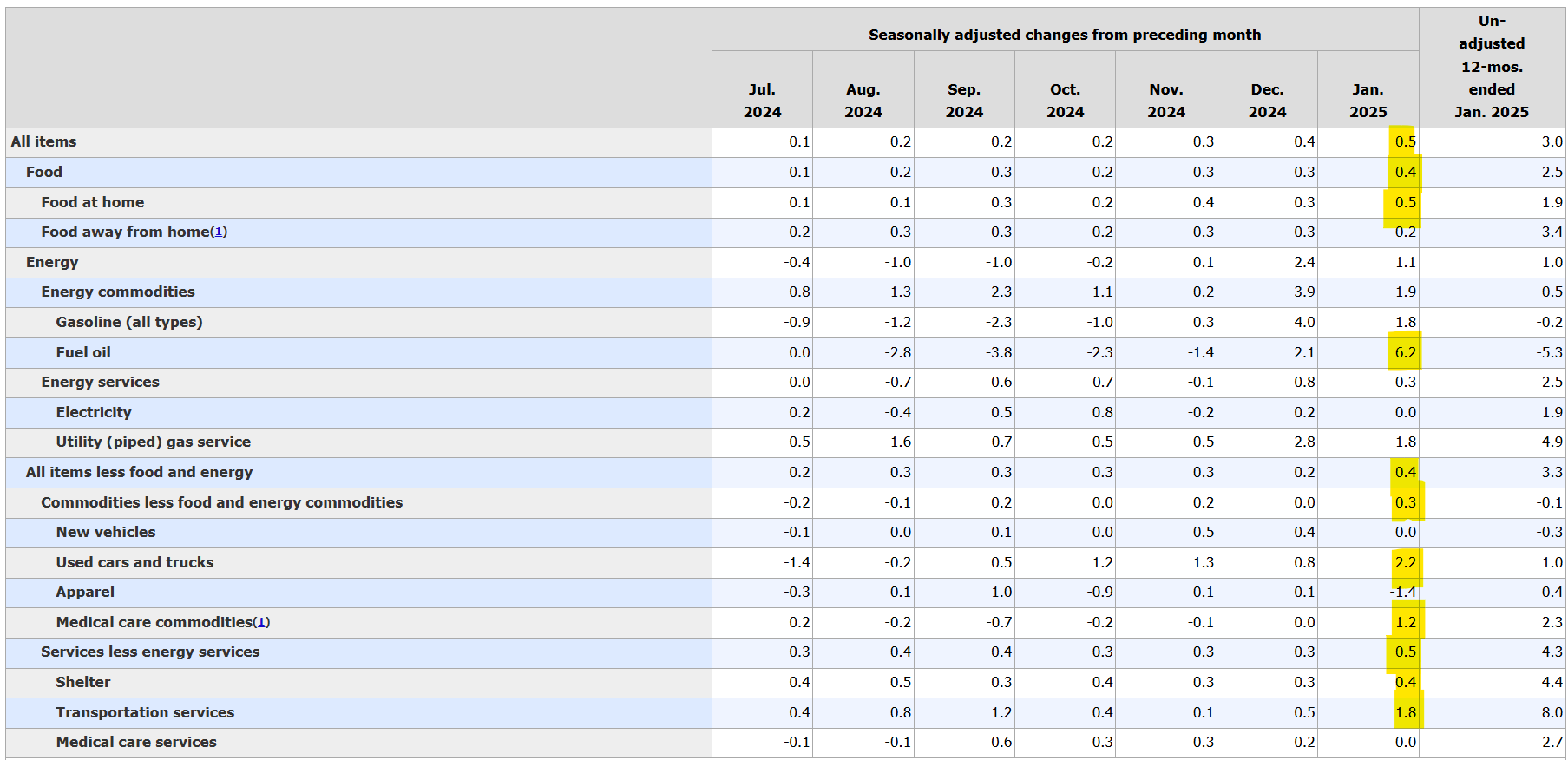

The latest US CPI release, which came in higher than anticipated, further supports the view that inflation remains persistent. This development adds to market scepticism over near-term rate cuts, reinforcing the dollar’s strength against the yen. With inflation failing to show sustained moderation, the Fed is likely to maintain its cautious stance, keeping US yields elevated and limiting downward pressure on USD/JPY.

US CPI Numbers by Sector

Trade Tensions and Japan’s Position

The yen’s recent weakness may also reflect growing concerns over Japan’s economic exposure to US trade policies. Japan accounted for approximately 20.7% of total US steel imports in 2024, up from 18.6% in 2020. Given its role as a major supplier, Japan has reportedly urged Washington to exempt its steel and aluminium industries from the proposed tariffs (I’ve done a blog explaining all about these tariffs you can find out more HERE). Japanese Prime Minister Ishiba met with former President Trump last week, expressing optimism that Japan’s status as the largest foreign investor in the US might help secure favourable treatment. However, uncertainty remains, especially as Trump continues to push for a reduction in Japan’s trade surplus with the US, which stood at $68.5 billion last year.

While no direct discussions on auto tariffs have been confirmed, Ishiba has highlighted potential investment areas—including liquefied natural gas, AI, and autos—as Japan seeks to mitigate risks from shifting US trade policies.

Given the latest CPI surprise and the Fed’s cautious rhetoric, the case for early rate cuts is weakening. (I’ve mentioned that on my yesterday blog you can find out more HERE) With US yields rebounding and trade policy uncertainty lingering, USD/JPY remains poised for further gains unless a significant shift in macroeconomic conditions prompts a policy rethink. Markets will closely monitor upcoming US economic data and any developments in US-Japan trade negotiations, as both factors will play a crucial role in shaping the yen’s trajectory in the coming weeks.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

Why Is Forex Trading So Difficult?

How To Master MT4 & MT5 - Tips And Tricks For Traders

The Importance Of Fundamental Analysis In Forex Trading

Forex Leverage Explained: Mastering Forex Leverage In Trading & Controlling Margin

The Importance Of Liquidity In Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency And Reduce Stress

Best Currency Pairs To Trade In 2024

Forex Trading Hours: Finding The Best Times To Trade FX

MetaTrader Expert Advisor - The Benefits Of Algorithmic Trading And Forex EAs

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.