USD/JPY: The Fast Mover of Forex and How to Trade It Right

ACY Securities - Jasper Osita

ACY Securities - Jasper OsitaSome currency pairs offer rhythm. Others offer range. But USD/JPY? It offers velocity. Known for its explosive moves, sharp reactions to yields, and unique behavior across sessions, USD/JPY is a go-to pair for traders who thrive in fast-moving conditions.

In this guide, you'll learn why it moves the way it does, when to catch its best trades, and how to align macro fundamentals with technical setups for high-probability entries.

What Is USD/JPY?

USD/JPY tells you how many Japanese Yen it takes to buy one U.S. Dollar. Buying the pair means you're going long on the Dollar and short on the Yen. Both the U.S. and Japan are economic heavyweights, and their central banks, the Federal Reserve and the Bank of Japan, play critical roles in this pair’s movement.

- Base currency: USD (U.S. Dollar)

- Quote currency: JPY (Japanese Yen)

- Key drivers: Interest rate differentials, bond yields, central bank policy, and risk sentiment

Why USD/JPY Is So Unique

This pair doesn’t move like EUR/USD or GBP/USD. Its heartbeat is driven by macro dynamics more than intraday sentiment.

- Interest rate divergence is everything. USD/JPY tracks the difference between U.S. and Japanese yields, especially the 10-Year Treasury

- It's sensitive to BoJ language. The Bank of Japan often intervenes verbally and sometimes directly when price climbs too quickly

- Risk sentiment matters. When markets are calm, USD/JPY rallies. When fear enters, the Yen strengthens and the pair drops

- U.S. data hits harder. CPI, NFP, and Fed commentary often move USD/JPY with force, especially during the New York session

When Is the Best Time to Trade USD/JPY?

Knowing when to engage this pair is part of the edge.

- Tokyo session (7 PM to 4 AM EST): You'll see accumulation, clean ranges, and structure forming

- London–New York overlap (8 AM to 12 PM EST): This is where most explosive moves unfold, especially during U.S. data releases

- Avoid thin markets: Late New York and Sunday gaps are riskier, with potential whipsaws and unreliable price behavior

How to Trade USD/JPY with High Probability

Trading this pair demands discipline and understanding of both price action and macro conditions.

1. Track U.S. bond yields. If the 10-Year is rising, expect bullish pressure on USD/JPY

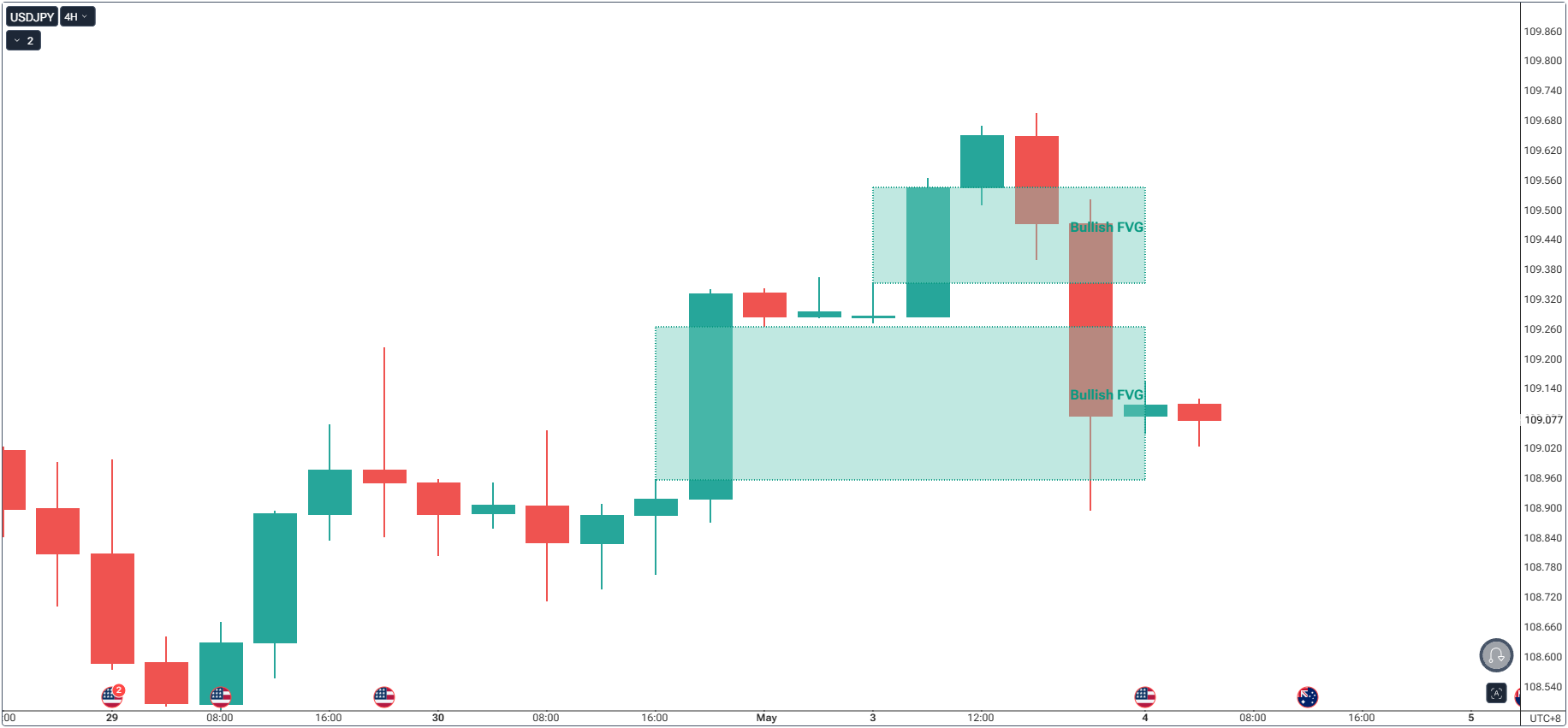

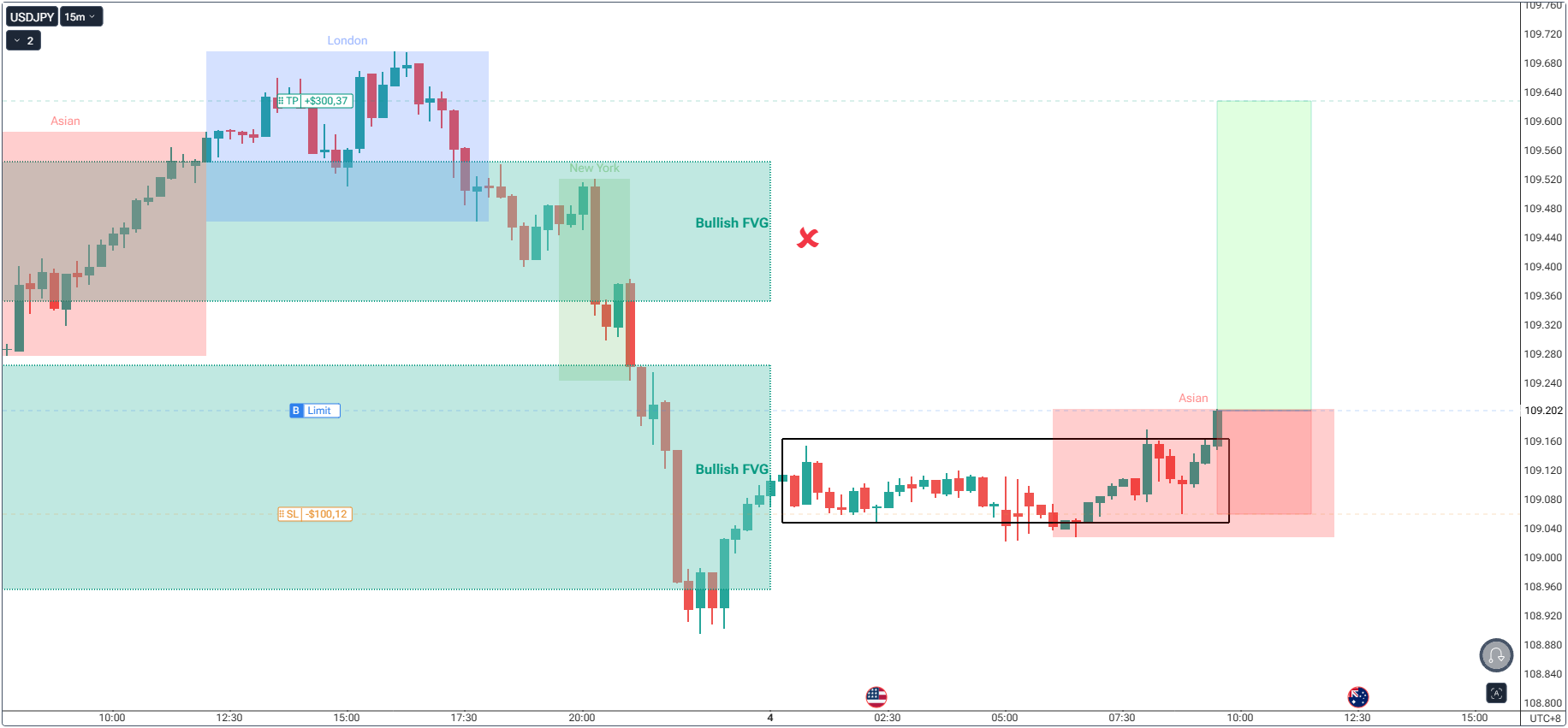

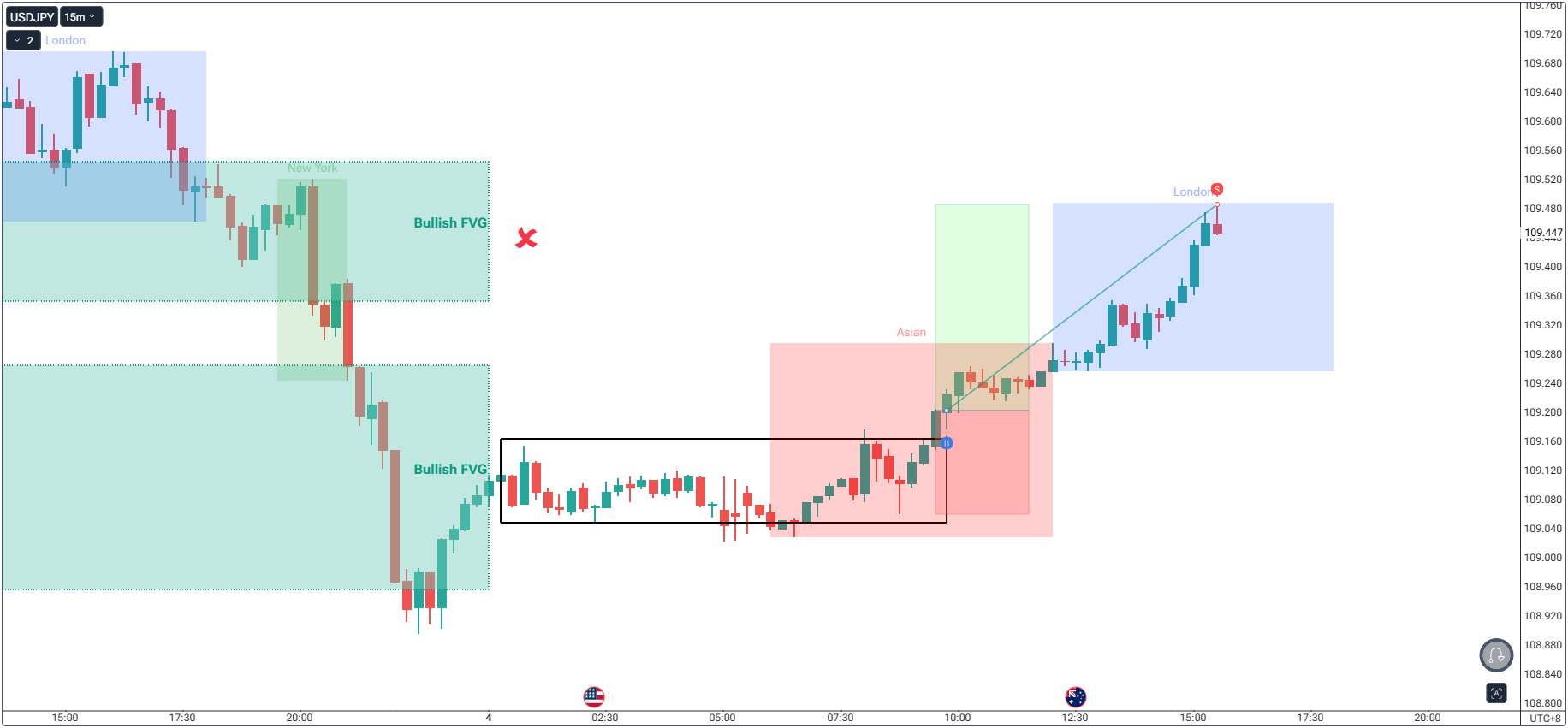

2. Mark your Key Levels: Support & Resistances, Volume Imbalances (Fair Value Gaps), Previous Swing Highs and Lows

For Day Trades: Mark Asian High and Low + Higher Timeframe (1-Hour, 4-Hour+ FVGs).

3. Wait for price to reach Key Levels. This ensures highest probability as it is anchored on a higher timeframe liquidity level.

4. Confirm with structure. Look for market structure shifts in the lower timeframe and fair value gaps that overlap with macro catalysts.

Note: We did not look for trades on the 1st layer of FVG. The reason for this is, its already much later during the day where the Japanese pairs does not thrive much compared to Asian session.

5. Execute at Confirmation (Breakdowns or Pullbacks) with a minimum of 2R-Multiple.

Exits:

- Static 2R-3R

- MA-20 Trail + Range Breakdown

Technicals and Fundamentals in Playing - Driving the Gopher

Most traders approach USD/JPY like any other pair, but it's fundamentally different. It’s not about overbought or oversold. It’s about where yields are going, what the Fed says, and how the BoJ reacts. Treating it like a typical technical setup without considering the macro landscape is one of the fastest ways to lose consistency.

The Power of Seasonality in USD/JPY

Historical seasonality shows:

- March to May: Tends to favor USD/JPY upside due to fiscal year-end flows in Japan and rising U.S. activity

- August to October: More volatile and reactive to central bank positioning and equity market shocks

- December: Thin liquidity can create large, erratic moves with less follow-through

Swing vs Scalping: How USD/JPY Behaves

- Swing trades: Tend to align better with macro direction. Use H1 or H4 confirmation with fundamental bias

- Scalping: Works well during Tokyo and early New York. FVGs and quick sweeps of session highs/lows are common intraday setups

- Trap behavior: USD/JPY frequently creates false breakouts. Confirmation via momentum and order flow is critical

Correlated Markets That Confirm USD/JPY Moves

- U.S. 10-Year Treasury Yield: Often leads USD/JPY direction

- Nikkei 225: Rising Nikkei often supports USD/JPY upside

- Gold and VIX: Sharp rises in gold or VIX signal risk-off sentiment, usually dragging USD/JPY lower

Trading Tips and Mistakes to Avoid

Tips:

- Overlay U.S. 10-Year yields on your chart for directional confidence

- Mark key psychological levels and past BoJ intervention areas

- Use Key Levels for POI or Point-Of-Interest

Mistakes:

- Trading without watching bonds or news

- Getting caught in reversals after major sessions without confirmation

- Ignoring risk-off sentiment during global uncertainty

- Not waiting for technical confirmation

Real-Life Analogy: The Bullet Train That Changes Tracks

Trading USD/JPY is like riding Japan’s Shinkansen. It’s sleek, fast, and can cover massive ground quickly. But unlike other routes, this one changes tracks based on who’s driving, whether it’s the Fed, the BoJ, or shifting risk sentiment. If you’re prepared and understand the signals, it’s a powerful ride. If not, you’ll find yourself off balance at the next curve.

Challenge for This Week

Open your USD/JPY chart and plot the Tokyo session high and low for the past three days. Overlay the U.S. 10-Year Yield and observe how often direction follows. Wait for a sweep of session liquidity, then look for MSS or a fair value gap to confirm direction. Whether you trade it or not, log the result and score yourself based on process, not outcome.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading – A Complete Compilation for 2025

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology – Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.