USD Rally Explained Key Drivers & Outlook

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

Overview

- DXY Recovery: Sharp 10% rebound in three days, approaching key resistance at 50% retracement of the drop.

- Geopolitical Risks: U.S.-Ukraine peace talks collapsed, escalating global uncertainty.

- Key Market Drivers: PMI and NFP data, alongside RBA rate decision, expected to drive volatility.

- AUD: Bearish bias as price rejects Daily FVG, plus China’s economic slowdown adding pressure.

- NZD: Weakness persists, hovering near 0.55160 support, with potential short setups below Daily FVG.

- EUR: Facing resistance at 1.04411 - 1.04638, USD strength keeping it under pressure.

- GBP: Stuck in consolidation, but UK’s £1.6B Ukraine aid package could influence sentiment.

- CAD: Oil price support vs. USD strength creates mixed signals; resistance at 1.3560.

- CHF: Strengthening as safe-haven flows increase, but USD dominance limits upside potential.

Key Market Themes

- Dollar strength driving market direction.

- Geopolitical instability influencing risk sentiment.

- NFP, PMI, critical for next moves.

The US Dollar exhibited a strong recovery after weeks of weakness, closing near the 50% mark of its monthly range. Key geopolitical events, including US-Ukraine negotiations, European support for Ukraine, and shifting trade policies, have played a crucial role in influencing market sentiment. This week, traders will closely monitor key economic data, including PMI and NFP, as potential catalysts for further Dollar strength.

Monthly

Despite experiencing consistent weakness for over 80% of the month, the U.S. Dollar staged a strong comeback, recovering more than 10% in the last three days. It closed near the 50% level of the monthly trading range, signaling resilience despite ongoing geopolitical uncertainties and volatile U.S. political activities.

Key support levels of 106.663 - 107.348 (previous resistance turned support) have held firm, indicating that the Dollar remains a strong contender in global markets.

Is the Dollar Out of the Woods?

The Dollar’s three-day winning streak suggests growing bullish momentum. With U.S. tariffs still in play, we anticipate continued strength in the Greenback as economic stimulus from tariffs supports its valuation.

Geopolitical Turmoil: No U.S.-Ukraine Deal

Tensions flared last week as Trump, Vance, and Zelenskiy met in the Oval Office on February 28. The talks ended without any deals, particularly concerning Ukraine’s minerals agreement, a key element in the U.S.'s strategy to end the ongoing conflict.

Treasury Secretary Scott Bessent criticised President Zelenskiy for jeopardising economic negotiations by attempting to renegotiate terms mid-meeting. This strain on U.S.-Ukraine relations has sparked concerns among U.S. politicians, with some suggesting new leadership in Ukraine may be necessary to move peace talks forward.

Dollar Trend Shift: Breaking Key Levels

Daily

Following the failed U.S.-Ukraine negotiations, uncertainty in the European zone has further strengthened the Dollar. The Greenback recently broke above the key resistance level of 107.381, showing signs of continued upward momentum.

4-Hour

To confirm sustained strength, traders are watching for: ✅ A retracement to the Fair Value Gap (FVG) ✅ A bullish structure with higher highs and higher lows

Currently, the Dollar is pulling back, and traders are waiting for a reaction before entering long positions.

Potential Scenarios for the Dollar

Daily

4-Hour

- Bullish Scenario

- Pullback to the Fair Value Gap

- Bullish continuation with higher highs and higher lows

- Strong economic data, with NFP (Non-Farm Payroll) as the key catalyst

2. Bearish Scenario

- The Fair Value Gap is invalidated by a close below it

- No bullish structure develops

- A break below 106.726, leading to further downside

Dollar Catalyst This Week

This week’s main market movers include PMI numbers and the NFP report. If these reports beat forecasts, we could see further bullish momentum for the Dollar.

Impact on Majors: Continued Weakness as Dollar Strengthens

AUD: Sustained Weakness

Daily

The Australian Dollar has suffered six consecutive days of losses, erasing nearly two weeks’ worth of gains. The sharp decline suggests that the Greenback’s dominance is weighing heavily on the Aussie.

Geopolitical Risks for AUD

Chinese Ships Seen Near Australian Waters

Adding to the pressure, Chinese naval activity near Australian waters has raised concerns, further weakening investor sentiment toward the AUD.

Australia to Limit DeepSeek

Tensions between China and Australia could spark a negative effect on the Australian Dollar as these poses risks and uncertainties.

1-Hour

With the Greenback on a pullback phase, but with a potential bullish reversal, we’d want the Australian Dollar, for short opportunity to react on the Daily Fair Value Gap and create a bearish reversal pattern with lower highs and lows.

Opportunities

- Bullish

- Ride the trend until the Fair Value Gap is reached.

- 2. Bearish

- Wait for a reaction at the Fair Value Gap and seek reversal patterns with lower highs and lower lows.

AUD Mover this Week

RBA will be the main event this week for the Aussie.

NZD: Testing Last Month’s Low

Daily

The New Zealand Dollar has broken below key support levels and is now testing 0.55160, a critical support zone.

1-Hour

Short-Term Trading Strategy:

- If the Dollar weakens, NZD may see a temporary bounce.

- If the Dollar strengthens, watch for short opportunities below the Daily Fair Value Gap.

As of now, NZD is retracing to the upside, but its long-term outlook remains bearish.

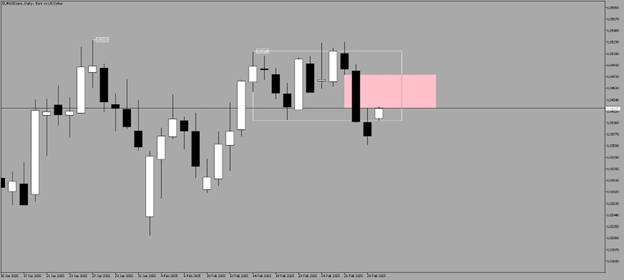

EUR: Holding Ground Amid EU-Ukraine Support

Geopolitical Developments Favoring the Euro

European Leaders, Canada in London Summit “Securing Our Future”

Following the failed U.S.-Ukraine talks, European leaders, alongside Canada, held the “Securing Our Future” summit in London to reaffirm their support for Ukraine emphasising military aid and economic pressure on Russia. This political backing may help stabilise the Euro in the short term.

Daily

Technical Outlook:

- The EUR/USD remains under pressure, with resistance at 1.04411 - 1.04638.

- If the Dollar’s recovery continues, the Euro could see further downside.

4-Hour

For a bearish opportunity, we’d like to look for shorts at the 1.04411 - 1.04638 level.

STOXX: Gaining Ground

Daily

GBP: Range Motion but Not Weak, Holding Steady

Keir Starmer, Prime Minister of the United Kingdom said, “Not all the nations are willing to contribute but does not mean we don’t do anything. Europe must do the heavy lifting.”

As the US support for Ukraine are diminishing after the Trump-Zelenskiy discussion, Starmer, prime minister of UK, commits to support Ukraine with a £1.6 billion worth of air defense missiles.

FTSE: At All-Time High Levels

Despite geopolitical tensions, European indices (STOXX & FTSE 100) are rising as Europe unites behind Ukraine.

FTSE 100: All-Time Highs

- The FTSE 100 is now approaching 8900 - 9000, an all-time high range.

- UK Prime Minister Keir Starmer has pledged £1.6 billion in air defense missiles for Ukraine, reinforcing the UK’s leadership in the geopolitical arena.

Daily

The Pound, despite geopolitical concerns, is still holding steady at the support level as the we had a lot of positive progression on the Europe side in terms of aiding Ukraine.

4-Hour

While the GBP/USD remains in a consolidation phase, it has avoided the severe weakness seen in other major currencies.

Key Catalysts for GBP:

- UK’s continued support for Ukraine

- Geopolitical stability within Europe

- FTSE 100 strength

Technical Outlook:

- GBP/USD remains range-bound but could break lower if Dollar strength persists.

CAD: CAD Confirmed Shift to Bullish Environment

Daily

We are in an obvious trend after USD overcame CAD by breaking the 1.43791 level. We could see a further upside as the tariffs in Canada commences this week, March 4.

4-Hour

With the 4-Hour timeframe, we are not seeing any signs of reversal in favor of CAD.

Based on this trend, we’d like price to breakout of this range and continue to strengthen.

CHF: Swissie Still on a Weak Side

Daily

With the Swiss Dollar, we are still not breaking the 0.90544 level for a shift from bearish to bullish.

We are yet to see further strength with Dollar as the red folders are coming up this week.

Key Takeaways

✅ The Dollar closed near 50% of the monthly range, signaling strength. ✅ U.S.-Ukraine negotiations collapsed, adding to geopolitical uncertainty. ✅ Major market catalysts this week: PMI, NFP, and RBA decision. ✅ AUD, NZD, and EUR remain under pressure, while GBP is holding steady. ✅ Stock markets (FTSE & STOXX) continue to climb despite global tensions.

Final Thoughts

The U.S. Dollar’s recent recovery and geopolitical dominance have reinforced its strength across markets. This week’s key events, including the NFP report, will determine whether the Dollar can continue its rally or if it will face another round of selling pressure.

Trading Quote

"It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong." – George Soros

📌 Key Takeaways:

- Risk Management is King – Focus on limiting losses and maximising gains.

- Win Rate Matters Less Than Risk-Reward – A 40% win rate can still be highly profitable with proper risk-reward ratios.

- Cut Losses Quickly, Let Profits Run – Exit bad trades fast, and hold winning trades with a trailing stop.

- Adapt to Market Conditions – Don’t get emotionally attached to predictions; react to price action.

🎯 Actionable Approach:

✅ Set Clear Stop-Loss & Take-Profit – Define risk before entering a trade (e.g., 1:3 risk-reward ratio).

✅ Journal Every Trade – Track mistakes, improvements, and learn from past decisions.

✅ Detach Emotionally – Follow a system, not gut feelings. Losses are part of the game.

✅ Analyse Institutional Flow – Align trades with big money movements for higher probability setups.

✅ Stay Flexible & Adaptive – If market conditions shift, adjust your strategy, don’t force trades.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.