USD Resilience Faces Its Biggest Test Yet Fed Independence in Question

ACY Securities - Luca Santos

ACY Securities - Luca SantosOver the past few days, I’ve been closely monitoring the shifts in FX markets, particularly around the US dollar.

Despite heightened political noise and fresh signals from the Federal Reserve, the greenback has shown an impressive degree of resilience.

But the real question is: how long can that strength last when downside risks are mounting?

The Dollar’s Surprising Stability

After Fed Chair Powell’s dovish remarks at Jackson Hole, the dollar initially sold off sharply. Yet within days, it retraced most of those losses and now sits only slightly lower.

To me, this rebound speaks less about confidence in the Fed’s policy path and more about the market’s hesitation.

Investors are clearly waiting for confirmation from the August Nonfarm Payrolls and inflation data before committing to a decisive USD view.

On the rates side, the picture is less stable. Yields on the 2-year Treasury remain over 10bps lower, a sign that bond traders are more convinced than currency markets that rate cuts are coming.

This divergence between FX resilience and rate market conviction could be a key tension point heading into September.

Political Uncertainty and the Fed’s Independence

The bigger story for me isn’t just monetary policy, it’s the institutional stability of the Fed. President Trump’s decision to dismiss Fed Governor Lisa Cook has opened uncharted territory.

Not only has this never happened before, but it also risks setting a precedent where political influence overrides central bank independence.

The Fed has already indicated it will abide by the courts in Cook’s legal challenge, while Trump openly suggested he wants “a majority of governors” appointed by him. If successful, this could allow the White House to directly shape policy on interest rates, financial regulation, and the Fed’s balance sheet.

For global markets, that is nothing short of seismic. The dollar’s calm response so far feels deceptive to me, it’s as if traders are discounting how destabilizing this could become.

Australia’s CPI Surprise Fails to Lift the Aussie

Meanwhile, here in the Asia-Pacific region, Australia’s July CPI came in hotter than expected, rising to 2.8% from 1.9% in June. The trimmed mean also surprised on the upside.

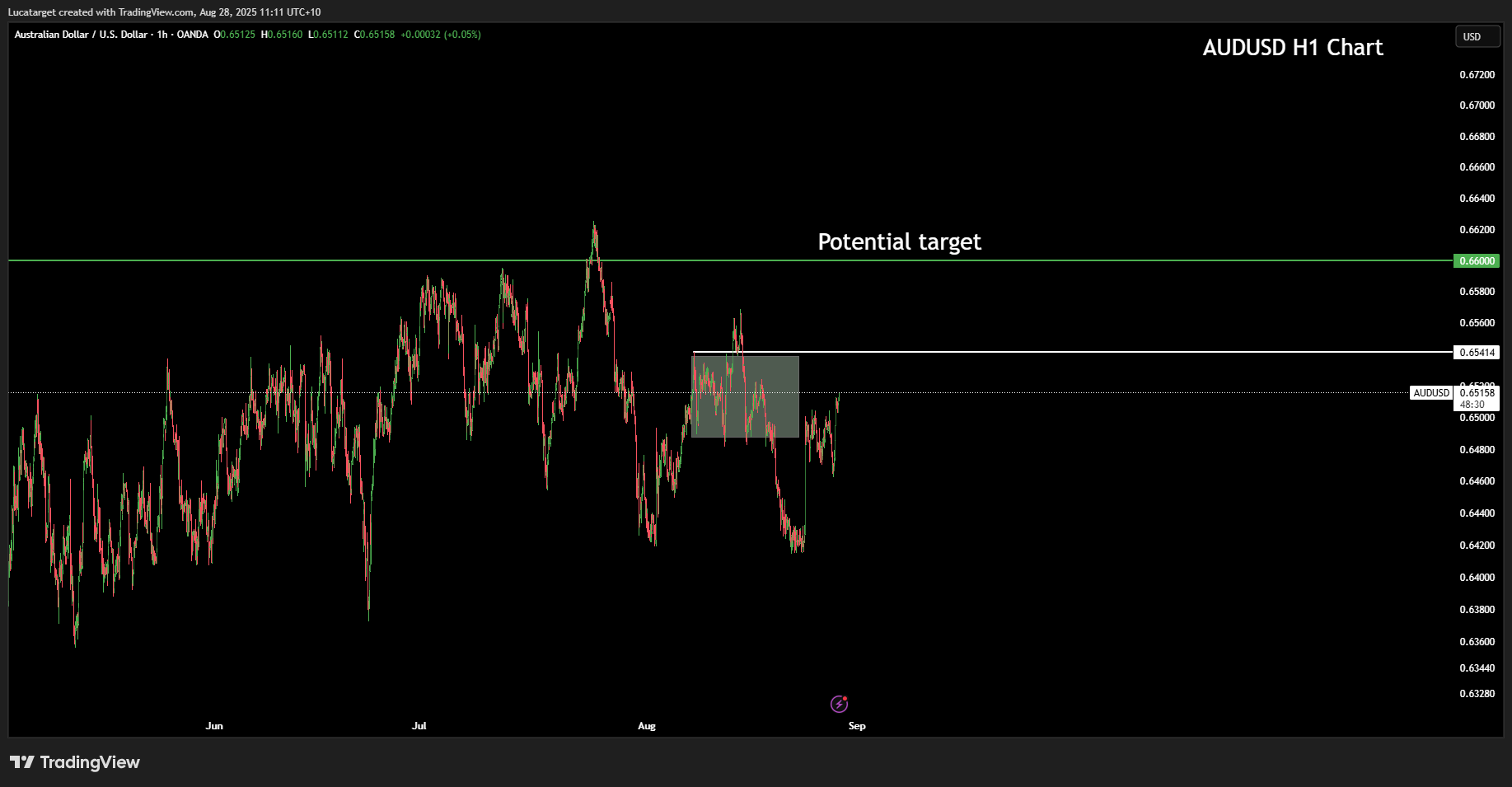

Yet despite this, AUD/USD barely moved, continuing to trade in its well-worn 0.6400–0.6600 range.

The muted reaction makes sense: electricity prices were the main driver of July’s spike, and that jump is expected to reverse in August.

With the Reserve Bank of Australia already leaning toward gradual easing, one hot print isn’t enough to shift the policy outlook. Rate cut expectations for year-end have been trimmed only modestly, leaving the Aussie without fresh momentum.

Looking Ahead

For me, the key near-term catalysts are clear:

- The August US jobs report and CPI release will either validate or challenge the Fed’s dovish pivot.

- The outcome of Governor Cook’s legal challenge will test the limits of the Fed’s independence.

- Australian inflation dynamics remain important, but the bigger driver for AUD/USD will be global risk appetite and the USD narrative.

In short, while the dollar remains steady for now, the risks are skewed to the downside if political and policy uncertainties deepen. I’ll be watching closely, because when the façade of resilience breaks, it rarely does so quietly.

Q1: Why has the USD stayed resilient despite Powell signaling rate cuts?

Because investors want confirmation from upcoming jobs and inflation data before committing to a bearish USD stance.

Q2: What does Trump’s dismissal of Governor Cook mean for markets?

It raises serious concerns about Fed independence, something that could have far-reaching effects on rates, regulation, and credibility.

Q3: Why didn’t the AUD rally after the hotter CPI print?

The jump was mainly due to electricity prices and is expected to reverse quickly, leaving little impact on RBA policy expectations.

Q4: What’s the main divergence between FX and rates right now?

Currency markets are holding the USD steady, but bond markets are already pricing in more cuts, suggesting FX could catch up later.

Q5: What’s the most important release to watch next?

The US Nonfarm Payrolls and CPI for August, both could determine whether the Fed cuts rates as early as next month.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.