.jpg&w=3840&q=75)

USD Softens as Policy Risk Meets a Dovish FED

ACY Securities - Luca Santos

ACY Securities - Luca SantosThe market walked into Jackson Hole hoping for fireworks and left with something subtler, but more meaningful for FX: a Fed that’s edging toward rate cuts and a new layer of policy risk around central-bank independence.

Together, those forces tilt the risk-reward against the dollar in the near term. I’m positioning accordingly, tactically, not heroically, because crowded trades can still snap back before the trend reasserts.

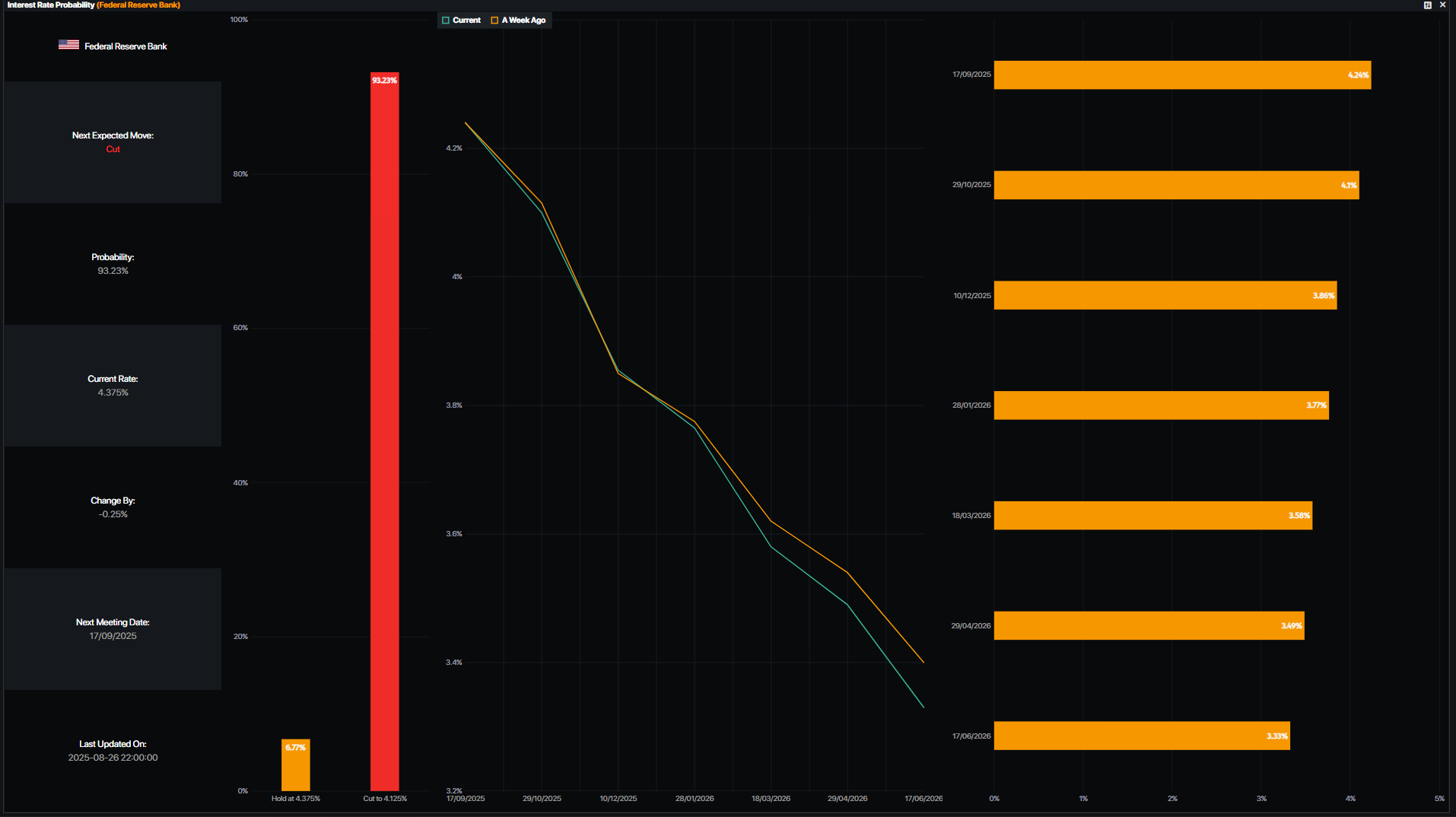

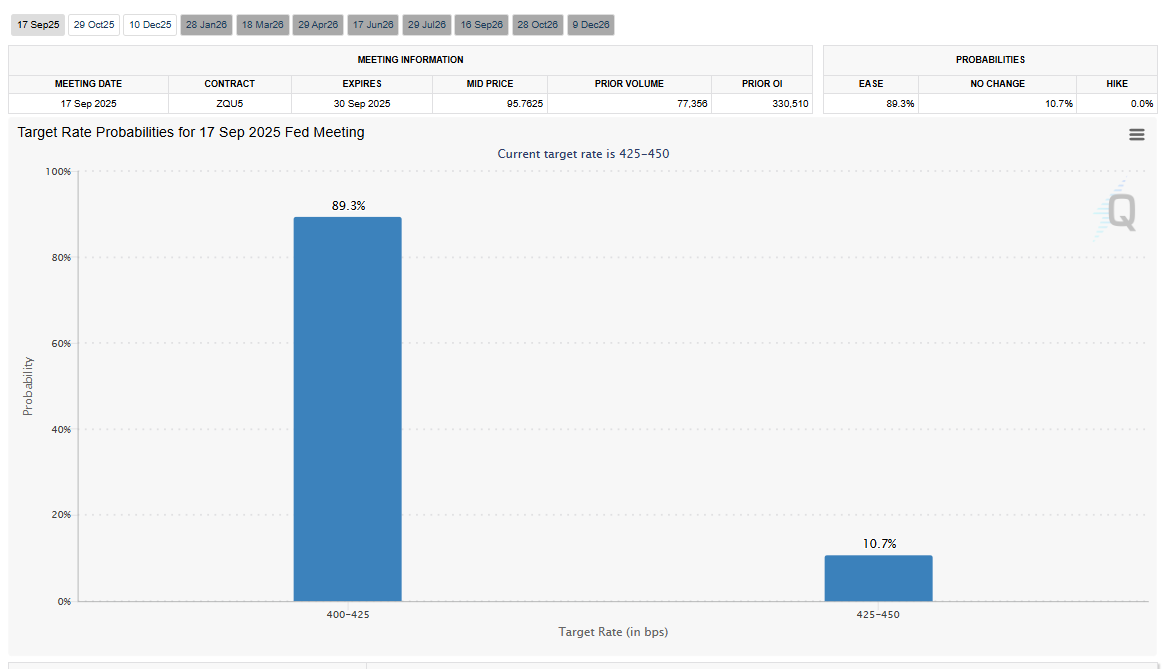

At a high level, Powell essentially said policy is restrictive and the balance of risks is shifting. If incoming labour data don’t surprise on the upside, a 25 bp move in September is now the path of least resistance.

Layer onto that the political noise around attempts to remove a sitting Fed Governor, and you have a softer USD backdrop via two channels: lower front-end yields and a higher risk premium on the institution itself.

USD: The Two-Step Drag, Rates First, Governance Second

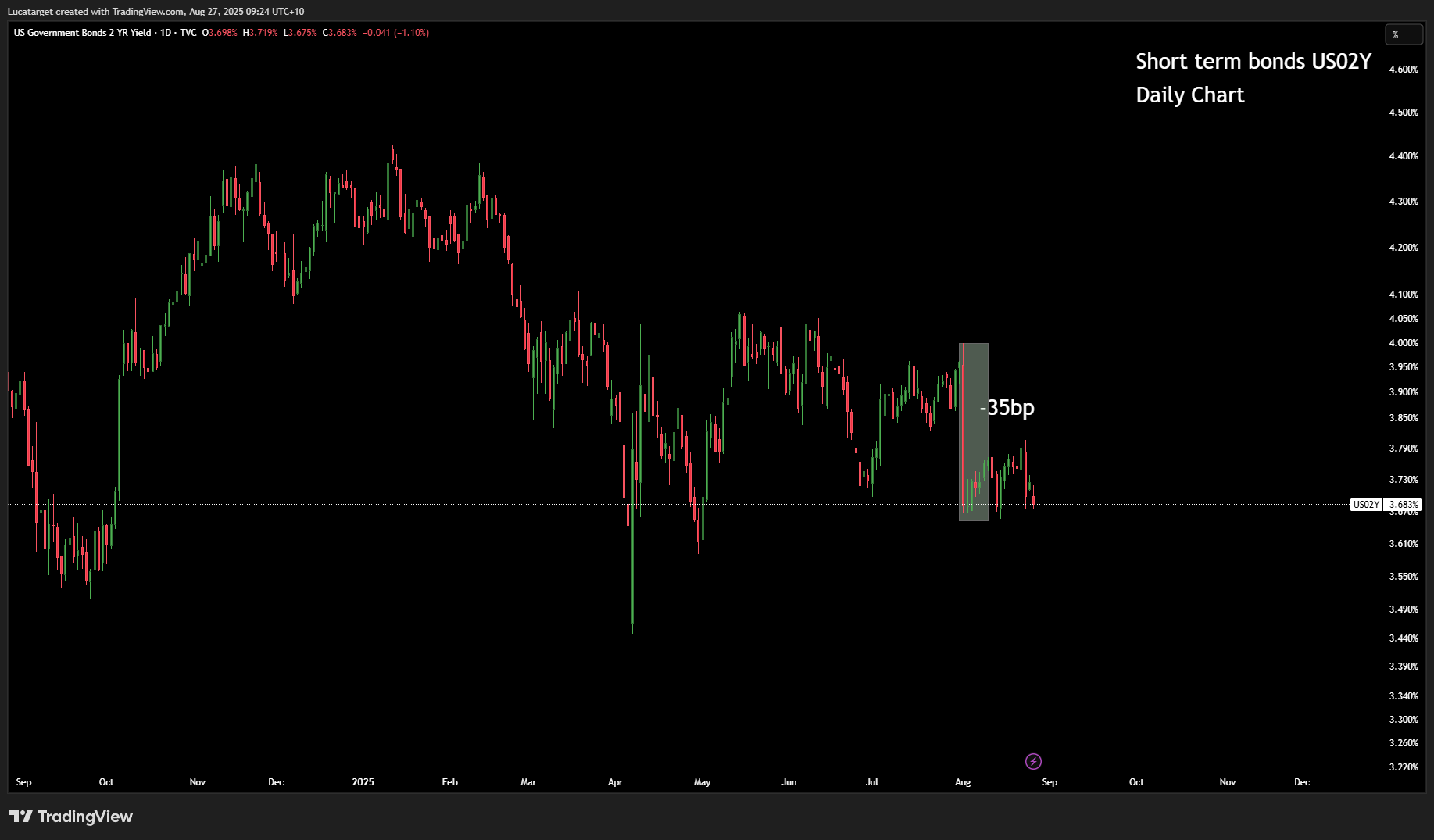

Rates: Powell’s message implies easing is close if jobs hold weak. In practice, that compresses U.S. short-tenor carry and reduces the dollar’s cushion on spikes in risk aversion.

The market will treat any upside surprise in NFP as tradable noise rather than a trend change unless it’s big enough to challenge the “restrictive” diagnosis.

Governance risk: Markets dislike uncertainty around rules of the game. Heightened contestation of the Fed’s independence nudges term premia and adds a discount to USD assets at the margin. None of this guarantees a straight line down for the DXY, but it does change the skew: hawkish data are now “fade-able,” while dovish data extend the path of least resistance.

How I’m trading it:

I prefer selling USD on strength into known data, especially where the local story is improving (EUR on fiscal clarity, AUD on resilient activity, CAD if BoC guidance stabilises). So looking for longs on EURUSD, AUDUSD and shorts on USDCAD.

EUR: Politics Complicate, but the USD Driver Dominates

France’s early parliamentary return and a confidence vote headline the euro’s near-term narrative. Wider OAT-Bund spreads tell you risk premium is rebuilding, which can cap EUR on rallies.

But in a world where U.S. policy eases and the USD’s governance premium cheapens, idiosyncratic European risk needs to be large to overpower the USD impulse.

My base case: EURUSD rallies are choppy, not linear, with political headlines providing intraday dips to add.

Three forward-looking signals I’m watching

U.S. labour data breadth (diffusion, full-time vs part-time). A soft, broad-based print validates September easing; a strong but narrow print is a fade into Powell’s “restrictive” frame.

Short-end rate spreads (2y UST vs G10). If spreads keep compressing (going lower), USD bounces should stall quicker; if they re-widen, I’ll throttle back risk, not reverse the thesis.

10y bond spread trajectory. A move back toward last year’s wides without budget clarity would justify EUR underperformance against CHF/GBP even if EURUSD holds up on USD weakness.

1. Why is the U.S. dollar softening right now?

The dollar is under pressure from two fronts: the Fed signaling it’s close to cutting rates, which compresses U.S. short-term yields, and political noise that raises doubts around the Fed’s independence. Together, these factors reduce the dollar’s appeal as both a yield and a safe-haven play.

2. How do Fed rate cuts impact FX markets?

Lower rates reduce the return on U.S. assets and shrink the dollar’s carry advantage against G10 peers. This means even if risk sentiment wobbles, the dollar has less cushion, making rallies short-lived and encouraging investors to rotate into currencies with stronger fundamentals or cleaner political risk.

3. What role does European politics play in EURUSD?

French budget debates and the confidence vote create risk for EUR, particularly visible in OAT-Bund spreads. However, unless political turmoil escalates dramatically, the USD side of the equation, softer Fed and governance risk, dominates. That’s why EURUSD can still grind higher despite choppy European headlines.

4. Which FX trades look most attractive in the current environment?

I’m favoring EURUSD and AUDUSD long positions on dips, using options for convex exposure. For Europe-specific risks, EURCHF shorts provide a cleaner way to express political stress without fighting the USD’s broader softness. Meanwhile, USDJPY downside via puts is appealing given narrowing yield differentials.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.