Wall Street’s Volatile Week: Trade War Fears, Liquidity Woes & Tech Turmoil

ACY Securities - Jasper Osita

ACY Securities - Jasper Osita

Overview

The U.S. stock market showed early signs of recovery this week — only to tumble again under the weight of poor liquidity, rising volatility, and renewed geopolitical tensions. The VIX surged, tech stocks led the decline, and macro headlines once again drove intraday market direction.

NAS - Tech Selloff Triggers Sharp Reversal

- Nasdaq reversed after hitting the -62.0 Fibo Extension level (20315), followed by a strong drop post-New York open.

- Tech names like Nvidia and Tesla led the plunge due to regulatory and sales concerns, signaling broader weakness.

- Price dropped below major moving averages, confirming bearish momentum.

- Now testing 19849.43–19766.00 support zone, which aligns with a Fair Value Gap; bounce is possible but not confirmed.

- If NAS fails to hold this support, next downside target lies near the 19600 level.

S&P - Weakness Confirmed as Price Trades Below Key Levels

- After early-week optimism, S&P fell nearly 2% alongside Nasdaq, unable to hold gains.

- Currently trading below key moving averages, showing trend weakness.

- Bulls need a breakout above the 5692.19–5715.98 zone to regain control.

- Otherwise, bears may drive price toward the next support between 5656.49–5681.19.

- With macro pressure and thin liquidity, trend-following strategies are struggling to hold momentum.

DOW - Breakout Fails as Index Slips Into Bearish Sequence

- Dow initially held up better than Nasdaq and S&P but failed to stay above 42650, ending in a fake breakout.

- Tariff concerns and global tensions drove weakness in industrials and cyclicals.

- The index broke below immediate support, indicating further downside risk.

- Unless it reclaims the 42321.90–42493.74 level, bearish continuation is expected.

- Traders watching whether defensives can rotate in to support the broader index.

Early Optimism Fades Fast

Markets kicked off the week with a hopeful tone. On Monday, March 24, durable goods orders surprised to the upside, rising 0.9% against expectations of a decline. The S&P 500, Nasdaq, and Dow all posted modest gains — a breather after recent weakness.

But under the surface, liquidity was already starting to fade. Spreads widened, market depth thinned, and the VIX crept higher to 20.2 on Wednesday.

Liquidity Dries Up — and Risk Surfaces

Tuesday’s mild gains masked something bigger: institutional players were backing off. Bloomberg reported the lowest S&P futures depth since 2020. Traders noticed: fills slowed, volatility increased, and bids began to disappear in size.

By midweek, that fragility turned into a move.

VIX is rising while indexes are falling

- VIX (blue shaded area) moves inversely to equities. As fear increases, the VIX rises — and that's exactly what we see here.

- Starting around late Feb to early March, the VIX breaks out higher while all three equity indexes fall sharply. This aligns with growing volatility, lower liquidity, and trade war fears highlighted this week.

Mini-recovery followed by hesitation

- Around March 18–21, there's a short-lived rebound across all three indexes. But by March 26, all three begin to fade again, showing indecision or loss of momentum.

- VIX remains elevated — suggesting that despite the bounce, fear and caution are still dominant.

Wednesday’s Breakdown: Trade Tensions Return

On March 26, all major indexes slipped. The Nasdaq dropped 2%, the S&P fell 1%, and the Dow shed 130+ points.

The trigger? Renewed trade war rhetoric. President Trump’s announcement of “reciprocal tariffs” on EU and Asian auto imports spooked global markets. Headlines hit fast, and with thin liquidity, the downside accelerated.

Tech Takes the Hit

Big Tech led the drop.

- Nvidia fell 4.6% amid reports of Chinese environmental rules impacting chip sales.

- Tesla dropped 3.2% as EU sales softened and political backlash intensified.

These weren’t just stock-specific — they signaled a potential shift in tech leadership, with institutional outflows following.

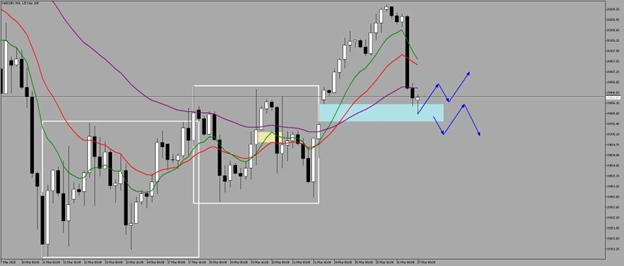

NAS

4-Hour

1-Hour

After hitting our target at -62.0 Fibo Extension at 20315 level, NAS consolidated shortly and after yesterday’s New York market open, NASDAQ fell sharply and broke down the moving averages.

4-Hour Scenario

Currently, we are testing the 19849.43 - 19766.00 level as price seeks support for a potential bounce on the Fair Value Gap.

If NAS fails to show bullish reaction and follow-through, a breakdown could be imminent with potential test of support at 19600 level.

Wall Street vs. Europe: Different Lenses

U.S. analysts called the pullback a dip to buy. European desks weren’t convinced. A Bloomberg roundup showed EU strategists warning of deeper macro risks — tightening credit, weak industrial data, and rising protectionism.

For traders, this divergence offers insight into global flows and sentiment rotation.

S&P: Correction or Structural Shift?

Corrections are normal — since 1980, the S&P 500 has averaged a 14% intra-year drop. But this one comes amid:

- Low liquidity,

- Renewed geopolitical risk,

- And a cautious Federal Reserve.

That combo could change market behavior — especially for trend-following strategies and momentum setups.

S&P

4-Hour

With Nasdaq falling sharply, S&P also fell on the downside for almost -2% from the open.

1-Hour

S&P is currently trading below the MAs which exhibits weakness. Unless we breakout of the MAs and the 5692.19 - 5715.98 level, we could see further downside testing the 5656.49 - 5681.19 level.

Dow Holding, But Watch for Rotation

The Dow held firmer than tech — but under the hood, cyclicals and industrials are losing steam. If defensives can’t carry the baton, broader downside risk grows.

DOW

4-Hour

Dow failed to hold its ground above 42650 level after trying for another push to the upside and turned out to be just a fakeout.

Dow has already broken the immediate support with signs of weakness incoming due to tariff concerns.

1-Hour

We are still in an obvious bearish sequence that could lead to more downside if we fail to breakout at 42321.90 - 42493.74 level. Unless we breakout, further downside could be capitalized for shorts.

What You Should Focus On

- Scale positions for volatility — wider stops, tighter risk.

- Watch volume and leadership — especially in tech and semis.

- Follow macro signals — DXY, 10Y yields, and sector rotation matter more now.

- Look for Technical Confirmations — wait for signs that price is willing to go to a certain direction before taking positions/

This market is driven as much by headlines as it is by fundamentals. Stay nimble, stay informed — and don’t trade in isolation from the bigger picture.

Final Thought

“Price is the effect. Narrative is the cause. Trade both.”

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.