Week Ahead FX Positioning Through Jackson Hole, PMIs, and Diverging Japan Risk

ACY Securities - Luca Santos

ACY Securities - Luca SantosI’m framing this week around three levers that actually move currencies: how the Fed communicates optionality into Jackson Hole, whether global activity data stabilise (PMIs, U.S. growth prints), and how far the BoJ’s tightening “option” can travel now that Japan’s growth looks sturdier.

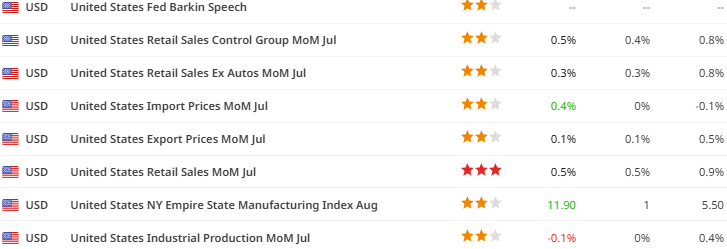

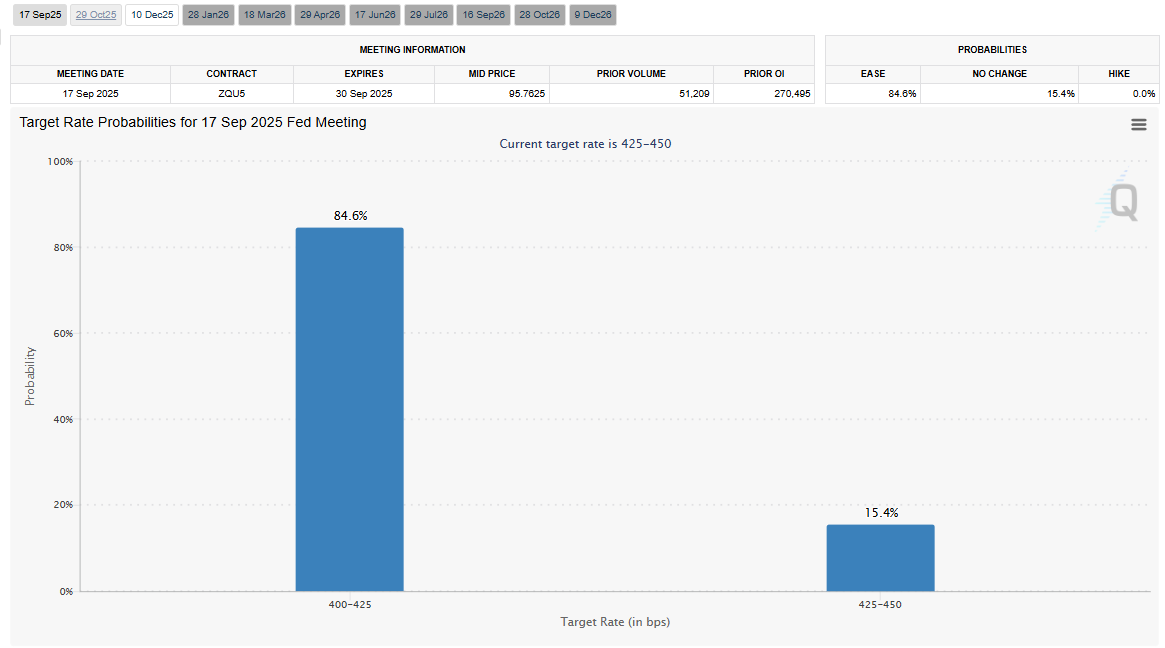

My bias remains that last week’s PPI wobble reset positioning, not the broader path toward gradual Fed easing; the front end firmed, but it didn’t construct a case for hikes. That distinction matters for FX because it tempers conviction, not direction

The core U.S. story into the symposium is that stronger producer prices nudged the market to trim the most aggressive cut expectations, yet left a September step still largely priced.

That dynamic supports a choppy dollar rather than a durable bull trend; the PPI mix added unease about tariff pass-through, but forecasts for the Fed’s preferred inflation gauge were only marginally revised and remain consistent with disinflation that’s slow, not broken.

I’ll respect two-way risk early in the week and re-engage on USD rallies if communication avoids an overt pushback on easing.

Europe is a patience trade. Desk colour late last week highlighted real-money demand on euro dips and flagged that the next euro-specific catalyst is PMIs later this week; in August liquidity, I prefer to buy pullbacks rather than chase strength.

Sterling stays tactically two-way: resilient on crosses when services inflation anxiety lingers, but sensitive to any hawkish read-through in Fed communication via the USD leg. I’m not paying up for momentum here; instead I’m managing ranges and letting the data do the talking.

Japan is the quiet swing factor. The GDP revision cycle shifted the narrative from “fragile” to “resilient,” with Q2 growth firmer and Q1’s contraction revised away.

That improvement lifts the probability that the BoJ resumes hikes before year-end; if the Fed is easing on a glide path while Tokyo normalises, rate-differential gravity starts working for the yen. My plan is simple: fade USD/JPY strength into resistance and re-add JPY on pops rather than chase breaks in thin markets.

How I’m set up

I’m entering the week with a mild, diversified USD-short bias but I’m not running maximum size into the podium. I want the Fed to validate “optional easing” rather than force a hawkish re-price; if they avoid leaning against cuts, the path of least resistance is a softer USD in a low-trend August tape. That’s when I’ll layer into euro on dips (given the PMIs calendar and real-money interest) and re-add yen on strength as BoJ optionality outlives U.S. policy noise

On GBP, I’ll keep it tactical, trade the range and let services-inflation nerves and Fed tone dictate the USD leg rather than pre-commit to a trend week. For beta FX, I’ll keep sizing modest until the front end calms; if it does, I prefer AUD/NZD over CAD for clean anti-USD expression in this window.

This is a week to be patient, not passive. I’m respecting the two-way chop into Jackson Hole, buying EUR weakness, fading USD/JPY strength on the improving Japan-BoJ narrative, and keeping beta FX sized for volatility until the Fed clarifies the cadence of cuts. If the communication simply preserves optionality, the dollar’s path should remain lower by a grind rather than a break, exactly the backdrop where disciplined entry levels and staggered adds pay.

1. What is the main risk for the US dollar this week?

The biggest risk is how the Fed communicates at Jackson Hole. If Chair Powell avoids pushing back on rate-cut expectations, the dollar is likely to weaken gradually. A more hawkish tone, however, could fuel a short-term USD rebound.

2. Why is Japan’s growth data important for FX markets?

Japan’s stronger GDP revisions increase the likelihood of BoJ tightening later this year. If the Fed is easing while the BoJ hikes, the policy divergence favors yen strength, making USD/JPY rallies vulnerable.

3. How should traders approach the euro in August liquidity?

With thin volumes, the euro is better bought on dips rather than chased at highs. Real-money demand has supported EUR/USD on weakness, and this week’s PMI prints will be the next catalyst for direction.

4. What makes sterling more of a range trade right now?

Services-led inflation pressures in the UK complicate the BoE’s easing timeline, which keeps GBP supported at times. However, cable and EUR/GBP are still sensitive to broader USD moves and Fed communication, making it more of a tactical, range-driven play.

5. Which commodity currencies offer the cleanest anti-USD trades?

AUD and NZD are more attractive than CAD in this window. While CAD remains highly sensitive to US growth and oil headlines, AUD/NZD offer better risk/reward if US data softens and the Fed sticks to gradualism.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.