What Is Fundamental Analysis in Forex and Gold Trading? (Beginner Guide)

ACY Securities - Luca Santos

ACY Securities - Luca SantosWhen I first started learning about fundamental analysis in forex and CFD gold trading, I thought it was just about reading economic news maybe checking the unemployment rate or inflation numbers and making a trade based on that.

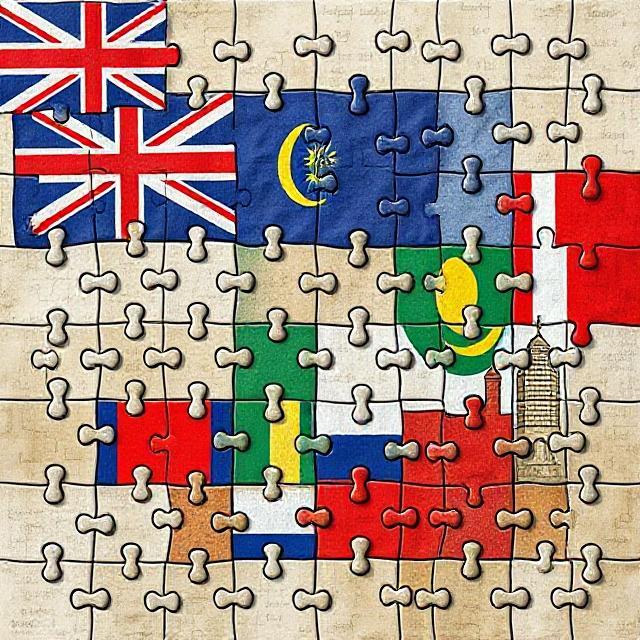

But I quickly realized: that’s just the beginning. Real fundamental analysis is like a puzzle. The economic data? That’s just the pieces. The real skill is putting those pieces together to see the full picture and see the actual context.

Let me walk you through how I personally approach fundamental analysis for forex and gold trading, especially if you’re just starting out.

What Is Fundamental Analysis in Forex?

In simple terms, fundamental analysis is the method I use to understand the why behind price movements. Instead of staring at charts all day (that’s technical analysis), I dig into what’s happening in the world economic health, monetary policy, geopolitical shifts, and more.

So yes, it starts with economic data. Things like:

Employment numbers (like Non-Farm Payrolls in the U.S.)

Inflation reports (CPI, PCE)

Central bank meetings and speeches

But here’s where most beginners stop. And that’s a mistake.

For me, these reports are like raw ingredients. A high inflation number? On its own, that doesn't mean much.

But when I combine that with rising interest rates from the central bank and low unemployment, I start to see a bigger story.

Maybe the USD will strengthen because the Federal Reserve is likely to stay hawkish. That’s the edge I’m looking for.

Real-World Example: How I Analyzed USD Strength

Let’s say we get a report showing U.S. inflation jumped higher than expected. That’s our first piece. Then, the Fed’s tone in its latest meeting is aggressive they’re talking about raising rates again.

That’s our second piece. Finally, job numbers show a tight (higher numbers) labor market.

Now, I connect the dots: if the Fed is likely to raise rates to combat inflation, then the USD becomes more attractive to investors (since higher interest rates usually mean better returns on USD-denominated assets).

I then look at currency pairs like EUR/USD or GBP/USD and position myself based on that narrative.

This is how I turn fundamental analysis from data-watching into decision-making.

And remember, in this case we would be trading USD long so pairs like XXX/USD would be short opportunities and USD/XXX would be long opportunities!

Gold Trading for Beginners: Understanding Fundamentals Without Country Data

Now let’s talk about gold, which is a totally different asset.

Gold doesn’t have a central bank. It’s not tied to a country’s economy. So, how do I use fundamental analysis for gold?

I shift my focus.

Gold prices move based on macro themes, not just economic data. I look at:

Real interest rates (the difference between nominal interest rates and inflation)

USD strength or weakness (since gold is priced in USD)

Inflation expectations

Geopolitical risk (war, instability, elections)

Central bank gold reserves and buying patterns

Real-World Example: Analyzing Gold Through Fundamentals

Let’s say the U.S. inflation rate is high, but real interest rates remain low or negative. That’s a classic bullish setup for gold. Why? Because when real returns on bonds are low, investors look for safe havens just like gold.

Then, let’s say there’s rising geopolitical tension maybe a conflict breaks out, or there’s uncertainty around elections. Investors often flee to safety, and gold has historically been the go-to.

Now, imagine at the same time the USD is weakening due to dovish comments from the Fed. That adds another layer of support for gold prices to go up.

So even though gold doesn’t have its own GDP report or unemployment rate, it’s still fundamentally driven it’s just driven by global narratives rather than national ones.

The Secret Sauce: Interpretation Over Information

If you take just one thing away from this guide, let it be this:

Fundamental analysis is NOT about reading the data it's about interpreting it!!!!!

You can open any economic calendar and see the numbers. But what do they mean together? How do they interact? That’s where the real skill lies.

Over time, I’ve trained myself to look at data not as isolated events, but as signals within a larger story. If a central bank surprises the market with a rate hike why did they do it? What were they reacting to? What does that say about the months ahead?

And that’s why I love fundamental analysis in forex and gold trading, because it makes me think like an economist, a detective, and a strategist all at once.

Getting Started with Fundamentals

If you're just starting your journey, here are a few practical steps I took that helped me build confidence:

Choose 1-2 currency pairs or assets to follow. Don’t try to analyze everything. I started with EUR/USD and gold.

Follow central banks. The Federal Reserve, ECB, and BOE are key players. Their policies shape everything. I've done heaps of blogs about this topics, and you can find them all here!!! For free!!

Build context over time. It’s not about reacting to one data point; it’s about learning the patterns.

Track your hypotheses. Write down your reasoning before and after a trade. It’ll sharpen your thinking.

What is fundamental analysis in forex trading?

Fundamental analysis in forex trading is how I understand the why behind currency movements. Instead of just looking at charts, I look at the economic health of a country things like interest rates, employment, and inflation to figure out where a currency might be headed. But for me, it’s never just about the data; it’s about connecting the dots to tell the full story.

How do I start using fundamental analysis as a beginner?

I always recommend starting small. Pick one or two currency pairs (I started with EUR/USD), follow the economic calendar, and read central bank updates. Then, practice interpreting the data: ask yourself why a currency is reacting a certain way. It’s all about building that “economic story” in your mind.

Does gold follow the same fundamental rules as forex?

Not exactly. Gold isn’t tied to a single country, so I look at global factors instead like real interest rates, USD strength, inflation fears, and geopolitical risk. Gold trading for beginners is really about understanding macroeconomic themes more than specific country data.

What’s the difference between technical and fundamental analysis?

Technical analysis is all about the charts price patterns, indicators, trends. But fundamental analysis, which is what I focus on in this guide, is about understanding what’s actually moving the market underneath. I often use both, but I always start with the fundamentals to build my thesis.

Can I trade gold and forex using only fundamental analysis?

Yes, and many traders do. I personally use fundamental analysis to form my overall bias whether I want to buy or sell and then sometimes I use technicals for entry and exit points. But if I had to choose just one method to understand long-term trends, it would always be the fundamentals.

Further Reading: Deepen Your Trading Knowledge

Continue sharpening your market analysis and trading strategies with these hand-picked guides across gold, macroeconomics, risk sentiment, and trading psychology that I’ve wrote!

Gold Trading & Strategy

- Gold in War Times – XAUUSD Historical Guide

- Gold & CPI/NFP – Sentiment and Trader Insights

- XAUUSD Forecast: CPI, NFP and Outlook

- When to Trade XAU/USD – Time Zones & Sessions

- Why Fundamentals Matter in Gold Trading

- XAUUSD vs Cryptocurrency – Safe Haven Comparison

- China Reserves, Basel III and the XAUUSD Structure

- Geopolitical Conflicts and Gold in 2025

- XAUUSD in Market Crashes and Surge Conditions

Economic Data & Macro Strategy

- Commitment of Traders (COT) Report – Full Guide

- Leading vs Lagging Economic Indicators

- Soft Data vs Hard Data – Trader’s Guide

- How Inflation Data Impacts Markets

- Mastering CPI Inflation – Key to Forex Success

- Fundamental Analysis for Forex Trading

- Understanding Inflation and Forex Impact

- GDP Reports and Their Impact on FX Markets

- PMI Data and the US Dollar Reaction

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.