What is the FED Dot Plot and How to Read it Begginer Guide

ACY Securities - Luca Santos

ACY Securities - Luca SantosWhat Is the Fed Dot Plot?

The Dot Plot is a glimpse inside the minds of the people who control U.S. interest rates. That’s really the simplest way to think about it.

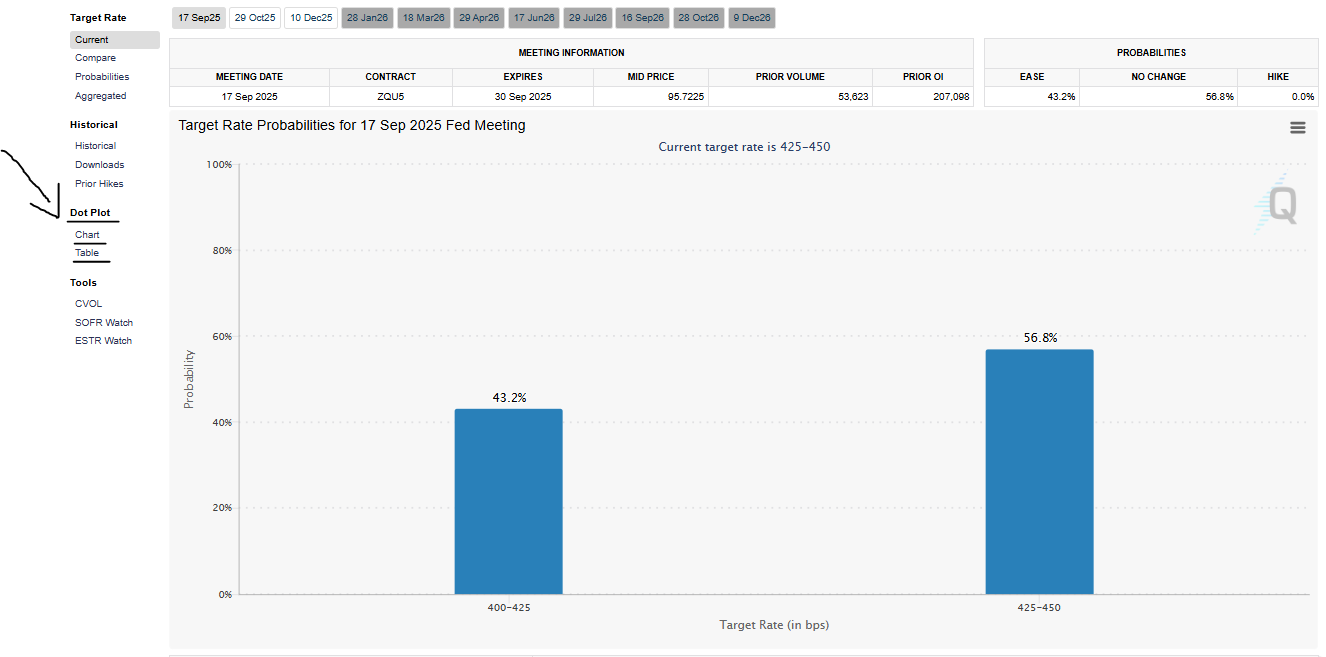

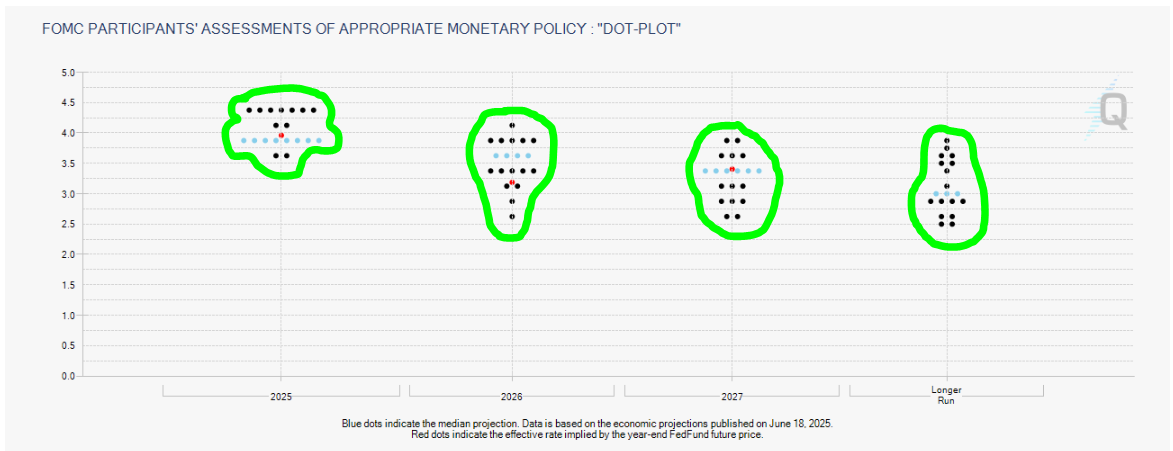

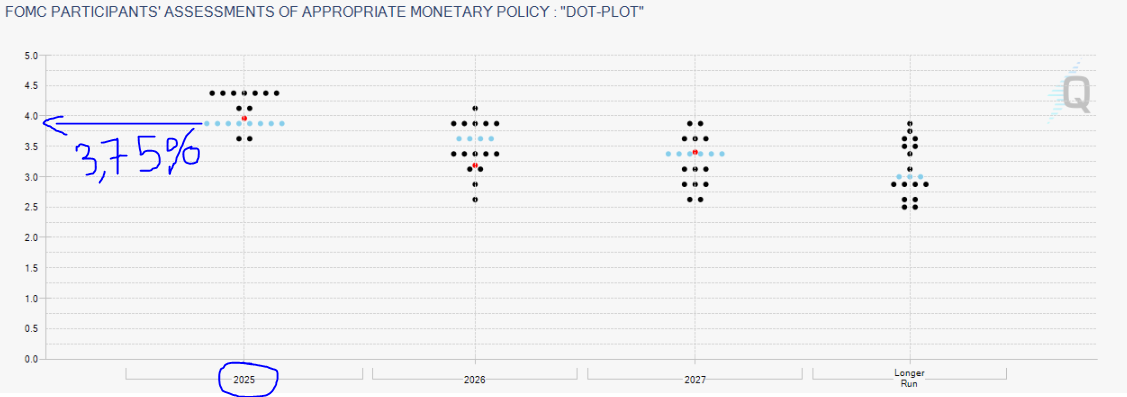

You can get access to the DoPlot using the CME and look for the “Dot Plot” section that will be on the rigth side of the tool.

Once you click into the Dot Plot this is what you will be able to see

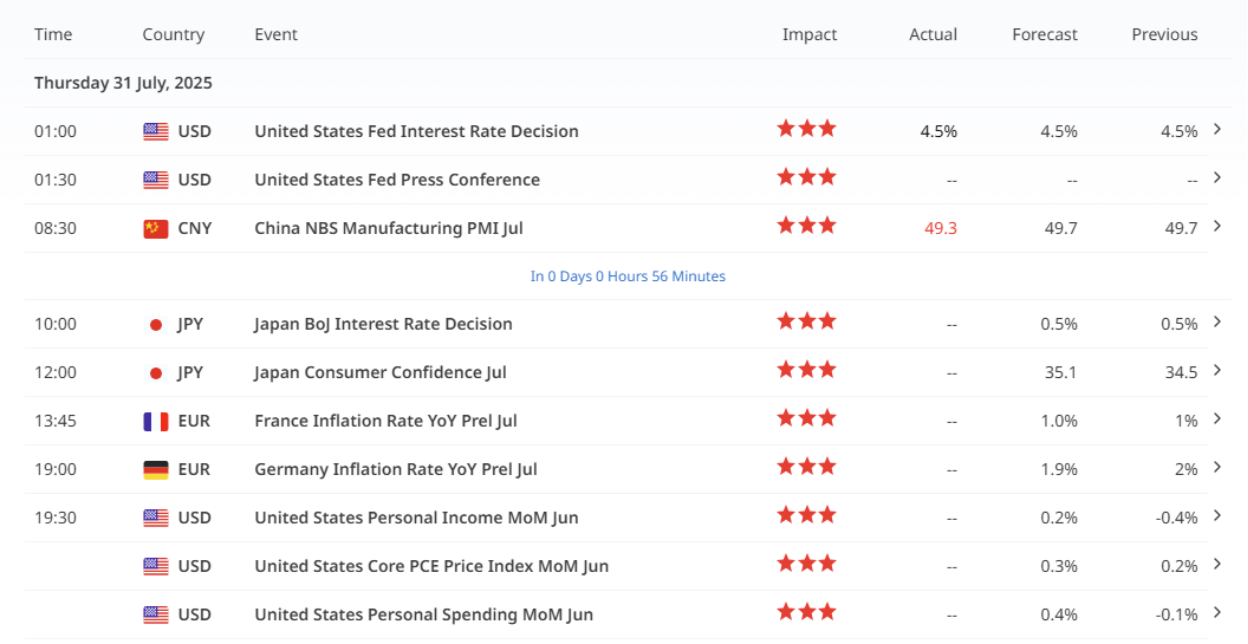

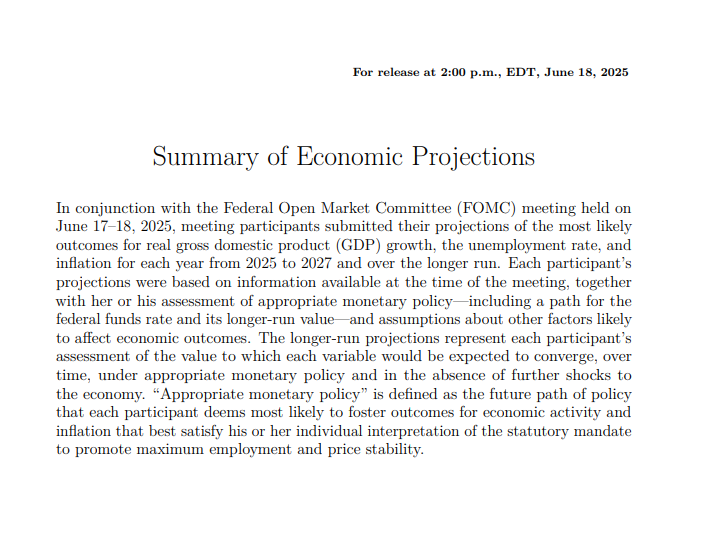

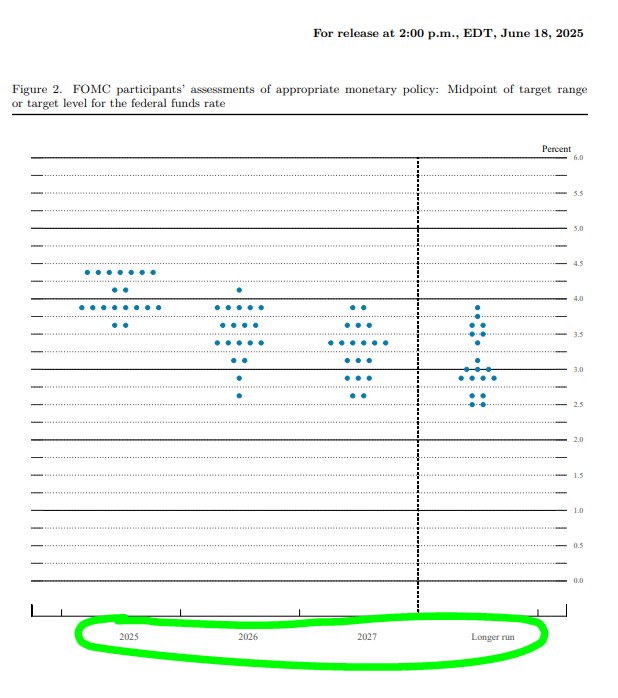

Four times a year, the Federal Reserve publishes a report called the Summary of Economic Projections (SEP).

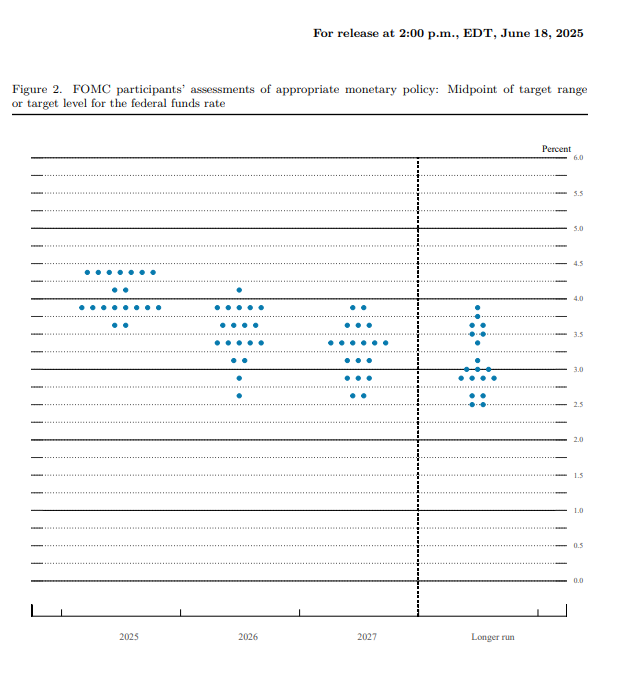

Inside that report is this chart the Dot Plot. Every voting member of the Fed places a dot showing where they personally think interest rates should be at the end of this year, next year, the year after that, and in the longer run.

No names attached. Just opinions, visualized.

So when I look at it, what I’m really seeing is the range of expectations from the people who are literally moving the economy. To me, that’s not noise. That’s a signal.

Who Makes the Dot Plot?

This isn’t just some survey of random economists. The dots come from the Federal Open Market Committee (FOMC) which is made up of:

The 7 members of the Fed’s Board of Governors, and

12 regional Fed bank presidents

That’s the core team that sets U.S. interest rates.

Whether you're a trader, investor, or someone who just wants to understand how this all works these are the people whose opinions actually move markets. When they post those dots, I pay attention, and you should as well!

How to Read the Fed Dot Plot

Okay, this part used to confuse me. But here’s how I broke it down so it actually makes sense:

➡️ The horizontal axis: the years

Each column of dots shows projections for different years, this year, next year, the following year, and the “longer run.”

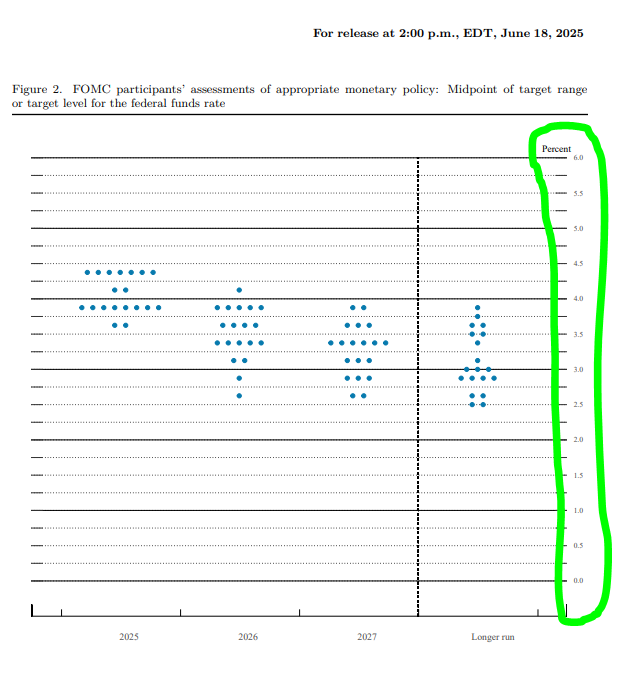

⬆️ The vertical axis: interest rate levels

This tells you where each member thinks the federal funds rate should be basically the interest rate banks charge each other.

🔎 The dots: one per person

Each dot is one person’s forecast. That’s it. They’re anonymous, so you don’t know who said what, but that’s not the point. The power is in the pattern.

So… What do I focus on?

I always look for the clusters. If most dots sit at 4.5% for next year, that’s where consensus is forming. That tells me what the Fed as a whole is leaning toward.

More dots higher than the last release? They’re signaling more hikes ahead.

More dots lower? That could mean cuts are coming.

Flat? They’re saying rates are staying unchanged.

It’s not a promise it’s a projection. But I treat it like an early weather forecast. I’m not planning a beach day off it, but I sure won’t ignore the storm clouds.

How I Actually Use the Dot Plot in My Trading Decisions

This is the part that changed the game for me.

I don’t read the Dot Plot because I’m into monetary theory. I read it because it gives me an edge. It helps me stay ahead of market moves especially during Fed-heavy weeks, when uncertainty is high and volatility is even higher.

Here’s how it fits into my actual decision-making:

1. I trade the expectations vs. reality gap

Markets don’t move just on what the Fed says they move on whether that message is more hawkish or dovish than expected.

So if the market is expecting rate cuts, but the dot plot doesn’t show that? That’s a shock. And shocks = opportunity.

I’ve made trades just by being on the right side of that gap.

2. I use it to position before macro swings

If I see a shift in the longer-term dots especially the “longer run” column that tells me something about how the Fed views the economy and inflation long term.

That helps me decide whether to lean risk-on (stocks, growth, crypto) or risk-off (bonds, cash, defensives).

3. I manage my risk around release days

If the Dot Plot is being released, I treat it like earnings season for interest rates. I know markets might whipsaw. I size down. I wait for clarity. I don’t try to be a hero.

Tips I’ve Learned from Experience

Just a few lessons I’ve picked up from reading this chart over the years:

1. Don’t fixate on outlier (extremes) dots

There’s always one or two people predicting extreme moves. Unless that becomes a trend across meetings, I ignore them.

2. Compare it to the last release

The story isn’t in a single chart it’s in how the chart is evolving. I always pull up the previous Dot Plot and look at what changed. Are dots moving up? Down? Flattening? That’s the Fed shifting its tone.

3. Zoom out

I don’t use the Dot Plot in isolation. I pair it with inflation reports, unemployment data, and earnings. But it is a critical piece of the puzzle, especially for macro-sensitive assets like gold, rates, and tech stocks.

The Fed Dot Plot isn’t about being fancy. It’s about being informed.

I use it because I want to know where the people who set policy think we’re headed. I want to be ahead of the curve not reacting once the market already priced it in. The Dot Plot helps me do that.

It’s not a crystal ball. But it’s one of the clearest windows we get into the Fed’s collective brain and if I’m trying to make smart trades, why wouldn’t I look through that window?

Q: Is the Fed Dot Plot a prediction or a promise?

A: It’s not a promise just a projection. It shows where each Fed member thinks rates should go based on what they know right now. Things change. The Dot Plot gives us insight into their mindset, not a locked-in path.

Q: How often is the Dot Plot released?

A: It’s released four times a year March, June, September, and December right after the Fed’s FOMC meeting. Those are the dates I circle on my calendar because I know markets are watching closely too.

Q: What does it mean when the dots are spread out?

A: Great question. A wide spread means there’s disagreement inside the Fed not everyone sees the future the same way. That usually signals uncertainty and can lead to more volatile market reactions. I pay even closer attention when I see a messy Dot Plot.

Q: Can I trade the Dot Plot by itself?

A: I wouldn’t. It’s powerful, but I always use it together with other data like inflation reports, job numbers, and what the Fed Chair actually says in the press conference. The Dot Plot sets the stage, but the whole performance includes more than just one chart.

Q: What should I do if I don’t understand all the dots yet?

A: Honestly? That’s totally normal. It took me a few meetings to really get the hang of it. Start by focusing on the overall trend and where the majority of dots are landing. Keep it simple at first. The more you follow it, the more natural it becomes.

Further Reading: Deepen Your Trading Knowledge

Continue sharpening your market analysis and trading strategies with these hand-picked guides across gold, macroeconomics, risk sentiment, and trading psychology that I’ve wrote!

Economic Data & Macro Strategy

- Commitment of Traders (COT) Report – Full Guide

- Leading vs Lagging Economic Indicators

- Soft Data vs Hard Data – Trader’s Guide

- How Inflation Data Impacts Markets

- Mastering CPI Inflation – Key to Forex Success

- Fundamental Analysis for Forex Trading

- Understanding Inflation and Forex Impact

- GDP Reports and Their Impact on FX Markets

- PMI Data and the US Dollar Reaction

Trading Skills & Execution

- Risk Management – Stop Loss, Sizing & Strategy

- How to Use an Economic Calendar for Trading

- Central Bank Announcements – Trading Strategies

- How to Trade Interest Rate Decisions

- CPI Trading – A Beginner's Guide

- Mastering Carry Trade in Forex

- Dovish vs Hawkish Comments – FX Impact

- Top Strategies to Trade NFP Events

- Mastering Forex Entry Points

- How to Swing Trade in Forex

- Understanding Market Trends and Price Action

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.