What the Yen Is Really Telling Us This Week

ACY Securities - Luca Santos

ACY Securities - Luca SantosI've been closely watching the yen this week, and it's clear we're standing at a critical intersection of geopolitics and macro policy.

What started as a textbook risk-on move driven by headlines of a trade agreement between Japan and the U.S. quickly flipped as political uncertainty crept back in, showing how fragile JPY sentiment remains.

Initially, the yen found some solid footing. A reduced tariff structure on Japanese autos and a sizeable (albeit somewhat vague) investment pledge into the U.S. sparked hopes that Japan’s economic outlook could finally turn a corner.

For a moment, USD/JPY dipped, and it looked like the market was beginning to price in the possibility that the Bank of Japan might finally have the breathing room to continue rate normalization.

Shortly after, local media reports about Prime Minister Ishiba's potential resignation began to circulate. And just like that, the JPY reversed gains.

It wasn’t just the rumor itself it was what the rumor represented. For the market, the idea that Ishiba could step down introduces an entire matrix of unknowns: Who replaces him? What policy stance will they adopt? How will it affect fiscal credibility and the BoJ's path?

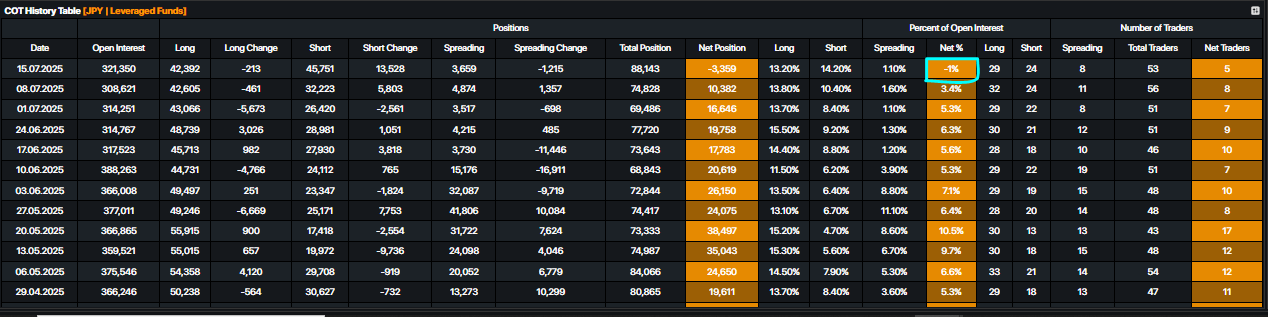

What struck me most was how leveraged funds reacted. Instead of leaning into the yen's earlier strength, they pared back long positions.

This tells me that even institutional players are still treating the JPY more as a trading instrument than a conviction-based macro play. No one wants to get caught on the wrong side of a political pivot.

And here's where it gets interesting.

If figures aligned with legacy Abenomics policies gain traction like Takaichi then we may see renewed speculation that the BoJ could face indirect pressure to pause normalization or even pivot back toward a more accommodative stance.

That alone could unwind a lot of the hawkish repricing we’ve seen in JPY this year.

So where does that leave us?

From my perspective, the yen is no longer just about rate differentials at least not this week. It's a thermometer for political continuity, structural reform, and external confidence.

If domestic stability can’t be re-established soon, the BoJ will be hard-pressed to proceed with rate hikes, no matter how attractive the macro backdrop might look on paper.

For now, I’m staying nimble. USD/JPY above 147 is once again a function of uncertainty rather than a clear signal of dollar strength. The trade deal, while symbolically powerful, won’t provide lasting support if Japan’s leadership landscape remains volatile.

Until we get clarity on Ishiba, on potential successors, and on whether this political storm has real consequences for policy I’ll be treating the yen as a sentiment gauge first, and a fundamental currency second.

Let’s see what the rest of the week brings.

Q1: Why did the yen initially strengthen this week?

A: The yen gained momentum following news that Japan and the U.S. reached a trade agreement. A reduction in tariffs particularly on autos and parts was viewed as a positive for Japan's export-driven economy. This also increased speculation that the BoJ might have space to tighten policy.

Q2: What reversed that JPY strength so quickly?

A: Political instability. Reports emerged that Prime Minister Ishiba might step down, creating uncertainty about who would take over and what policy direction they'd follow. Markets dislike unknowns especially when they involve potential changes to monetary and fiscal policy.

Q3: Why does Ishiba’s potential resignation matter to FX traders?

A: His departure could pave the way for leadership aligned with Abenomics a policy mix favoring prolonged fiscal stimulus and accommodative monetary policy. If markets think the BoJ will be pressured to delay rate hikes, the yen weakens.

Q4: Who are the potential successors to Ishiba?

A: Names circulating include Sanae Takaichi (a strong Abenomics supporter), Shinjiro Koizumi, Toshimitsu Motegi, Hayashi, and Finance Minister Katsunobu Kato. The front-runner could shape policy tone significantly especially around BoJ independence.

Q5: How did leveraged funds react to this week’s developments?

A: They trimmed their long JPY exposure. That’s a strong signal that professional money is uncertain and unwilling to commit to a clear JPY bullish thesis while politics remain in flux.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.