Why the U.S. Dollar Keeps Climbing Despite the Chaos

ACY Securities - Luca Santos

ACY Securities - Luca SantosThe U.S. dollar is doing something counterintuitive it’s getting stronger in the face of growing uncertainty.

After nine consecutive days of gains, the greenback is sending a loud signal to the markets: risk may be rising, but liquidity still has a home.

Trump’s Tariff Gambit: A Volatile Game of Chicken

The latest surge in the dollar stems from geopolitical friction. President Trump has revived his aggressive trade rhetoric, threatening 30% tariffs on European and Mexican goods.

The impact on Mexico may be muted thanks to compliance with USMCA (United States-Mexico-Canada Agreement) standards but Europe’s export-heavy economies are in the crosshairs.

What’s keeping the euro from collapsing? The EU is stalling retaliation, aiming to negotiate before the August 1 deadline.

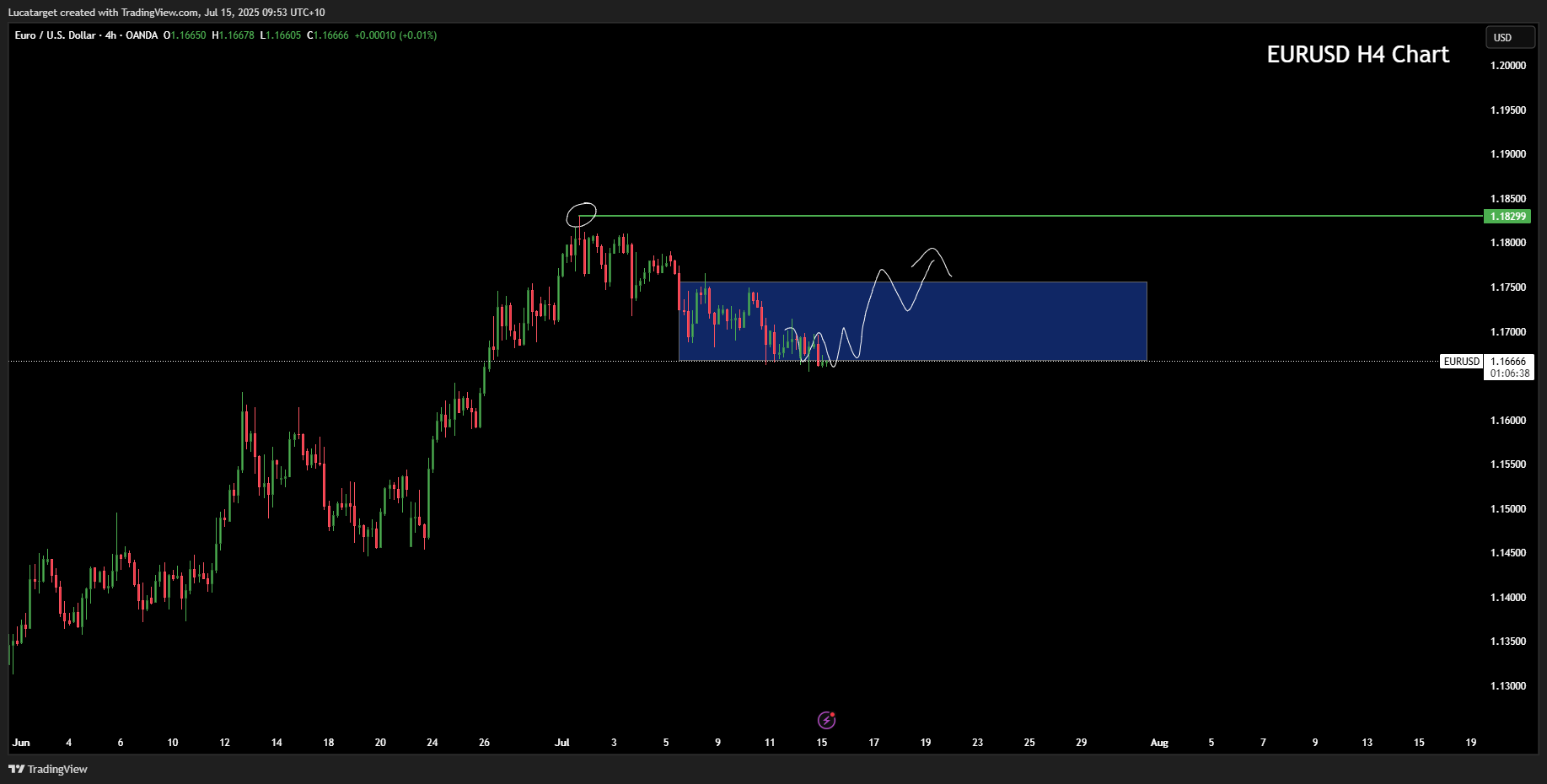

If diplomacy prevails, the euro might find relief. But if talks collapse, prepare for a shockwave in EUR/USD and broader risk assets. But I still believe that we may have a stronger up move on EURUSD above the 1.18300 soon.

Powell Under Pressure: Political Heat on the Fed

Fueling the USD’s resilience is an escalating war of words between Trump and Fed Chair Jerome Powell. Trump’s criticism ranging from renovation expenses to monetary policy missteps has turned personal.

Yet markets remain calm. Why?

Because traders don’t believe Powell is going anywhere at least not yet. However, this introduces a simmering risk: if Powell were forced out, it would spark institutional uncertainty and raise questions about the Fed’s independence, which could jolt both bonds and the dollar.

What Should Traders Watch:

USD could remain supported in the short term.

Keep an eye on Powell’s public appearances any slip could be catalytic.

A surprise resignation or Trump-appointed replacement may spike volatility across USD crosses and Treasuries.

Yen Weakens Even as Yields Rise: What Gives?

The Japanese yen, traditionally a safe haven, is underperforming. USD/JPY broke above 147.50, and it’s not just a dollar story. Japanese long-dated bond yields are rising hinting at inflation risks but the BoJ is holding the line.

Why? The upcoming Upper House election on July 20 could shift fiscal policy (I've done a blog on how to trade forex around major elections, you can check it out HERE).

If the ruling coalition loses ground, markets may price in looser policies, including stimulus or rate suppression. On top of that, Trump’s 25% tariff threat on Japanese goods adds external pressure.

Not a guarantee, but here’s a scenario matrix:

| Trigger | Impact on Carry Trade | USD/JPY Effect | Stock Market Effect |

|---|---|---|---|

| Trump shocks tariffs or FX war | Massive unwind | JPY strengthens sharply | Risk assets drop fast |

| Japanese election surprises with fiscal shift | Mixed (initial unwind) | Depends on yield curve steepening | Mild risk-off |

| Fed signals more dovish than expected | Carry unwinds slowly | USD weakens; JPY may strengthen | Stocks may rise short-term |

| No surprises; low volatility | Carry persists | JPY stays weak or flat | Stocks grind higher |

Trade Implication:

Traders are betting against the yen. But if election outcomes surprise or the BoJ tweaks inflation forecasts aggressively later this month, we could see sharp reversals.

Volatility is quietly building under the surface of USD/JPY.

Markets are stuck in a limbo of diplomacy and political noise. The dollar’s strength is a function of positioning and relative resilience but that can flip fast.

The closer we get to August 1 without a trade resolution, the more fragile this stability becomes.

In this environment, flexibility beats conviction. Traders should consider:

Hedging USD longs into potential resolution headlines.

Watching EUR/USD for breakout potential around 1.165 to the down side or 1.17600 to the upside if tariffs are avoided.

Monitoring JPY as an asymmetric play around the Upper House elections.

Q1: Why is the U.S. dollar strengthening despite rising geopolitical risks?

A1: The dollar is benefiting from safe-haven flows as policy uncertainty grows, particularly due to Trump’s tariff threats and political pressure on the Fed. While risks are high, global liquidity still favors USD assets, especially amid weak alternatives.

Q2: What are the key risks surrounding Trump’s latest trade threats?

A2: Trump’s proposed 30% tariffs on EU and Mexican goods could disrupt trade if implemented. While Mexico is largely shielded via USMCA compliance, Europe faces a bigger threat. A failure to reach a deal by August 1 could severely impact the euro and broader sentiment.

Q3: How is political pressure on Jerome Powell affecting markets?

A3: Although Trump’s verbal attacks on Fed Chair Powell have intensified, markets aren’t pricing in his removal yet. If Powell were forced to resign, it would introduce institutional instability and likely spike volatility in both bonds and the U.S. dollar.

Q4: Why is the Japanese yen weakening even as yields in Japan rise?

A4: The yen is under pressure due to a mix of domestic election risk, cautious BoJ policy, and external tariff threats from the U.S. Even though long-term yields are rising, political uncertainty and dovish central bank signals are deterring yen demand.

Q5: What trades make sense in this macro environment?

A5: Consider hedging long USD positions ahead of the August 1 deadline. Monitor EUR/USD for a potential relief rally if a deal is struck, and watch JPY as a contrarian play around the Japanese Upper House election and BoJ inflation guidance later this month.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.