Will the BOJ Hike the Rates or is it Another Manipulation?

ACY Securities - Luca Santos

ACY Securities - Luca Santos

The Japanese yen has recently shown strength, trading at higher levels as it enters the third consecutive week of gains against the US dollar, reaching a recent low of 151.94. This uptick comes ahead of crucial policy meetings by the Bank of Japan (BoJ) and the Federal Reserve. Leveraged Funds have significantly reduced their short positions on the yen, dropping from 110,635 contracts to 58,596 within two weeks. This marks the smallest short positions since mid-February. The yen's upward momentum has been bolstered by the liquidation of FX carry trades, outpacing other low-yielding currencies like the Swiss franc, while higher-yielding emerging currencies have underperformed.

In the broader Asian market, currencies such as the South Korean won, Chinese yuan, Malaysian ringgit, and Thai baht have also seen gains, benefiting from similar position liquidations. However, the sentiment towards these currencies remains cautious due to concerns about China's slowing growth and potential future tariffs from a possible Trump presidency.

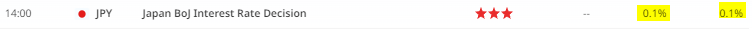

The upcoming BoJ policy meeting is a significant event, with market expectations varying. While some anticipate a 15-basis point rate hike and a slowdown in Japanese Government Bond (JGB) purchases, the lack of recent guidance from BoJ officials has led to uncertainty. If the BoJ opts against a rate hike, the yen could weaken, potentially pushing USD/JPY back above the 155.00 level. Additionally, the timing of future rate hikes may be influenced by political events in Japan and the US.

BOJ rate Decision

GBP: Economic Outlook and BoE Policy Expectations

The British pound has experienced a pullback, losing some of its recent gains as long positions have unwound. Despite this, the UK economy's cyclical momentum remains strong, bolstered by the Labour government's stability and expected fiscal measures to address a reported GBP20 billion spending gap. This backdrop has led to expectations of potential tax hikes in the upcoming budget.

GBPUSD H1

As the Bank of England (BoE) approaches its policy meeting, market participants are divided. Some anticipate a 25-basis point rate cut, based on previous guidance and the balance of opinions among BoE members. However, recent statements from BoE officials suggest a cut may not occur immediately. If the BoE holds rates steady, the pound may strengthen, whereas a rate cut could initially weaken the currency before stabilizing with cautious forward guidance. Despite potential policy easing, UK rates are likely to remain higher compared to other G10 economies.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

Why Is Forex Trading So Difficult?

How To Master MT4 & MT5 - Tips And Tricks For Traders

The Importance Of Fundamental Analysis In Forex Trading

Forex Leverage Explained: Mastering Forex Leverage In Trading & Controlling Margin

The Importance Of Liquidity In Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency And Reduce Stress

Best Currency Pairs To Trade In 2024

Forex Trading Hours: Finding The Best Times To Trade FX

MetaTrader Expert Advisor - The Benefits Of Algorithmic Trading And Forex EAs

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.