AI for Trading: The 2026 Complete Guide

Artificial Intelligence (AI) has revolutionized the trading world, opening up unprecedented levels of efficiency, accuracy, and speed in financial markets. By 2025, AI will handle almost 89% of the world's trading volume—changing everything from high-frequency equity trading to decentralized crypto ecosystems. This guide explores how AI trading platforms leverage advanced algorithms, machine learning, neural networks, and real-time data analysis to automate trade, reduce human error, and execute trades at a record rate.

TLDR: This comprehensive guide explores how AI is revolutionizing trading in 2025.

Key points:

- AI now drives 89% of global trading volume, leveraging advanced algorithms, machine learning, neural networks and real-time data to automate trades and predict price movements

- The AI trading market is projected to reach $35B by 2030 as demand soars for data-driven insights and optimal trade execution

- AI enables unprecedented efficiency, accuracy and speed, but also raises challenges around regulation, transparency and adaptability to novel market conditions

- Major trends shaping the future of AI trading include deep learning, NLP, quantum computing and decentralized AI

- By 2025, AI is ubiquitous across both institutional and retail trading platforms, from JP Morgan's LOXM system to retail platforms like Trade Ideas

This article provides an in-depth overview of the transformative impact of artificial intelligence on financial markets and trading in 2025. It traces the evolution of AI in trading, explores core technologies and platforms, examines key strategies and performance, and discusses challenges and future directions.

The piece is data-rich, citing market sizing projections, adoption statistics, and real-world examples to illustrate AI's pervasive influence across the trading landscape. It covers applications ranging from sentiment analysis and predictive analytics to portfolio optimization and autonomous trading systems. While bullish on AI's potential to drive efficiency and alpha generation, hurdles relating to data quality, model interpretability, infrastructure resiliency, and regulatory uncertainty are acknowledged. The guide serves as an essential resource for readers seeking to understand and navigate the complex, rapidly evolving world of AI-driven trading in 2025 and beyond.

Platforms, Innovations, and Market Dynamics

1. Introduction: The AI-Driven Trading Revolution

1.1 Introduction

Artificial Intelligence (AI) has revolutionized the trading world, opening up unprecedented levels of efficiency, accuracy, and speed in financial markets. By 2025, AI will handle almost 89% of the world's trading volume—changing everything from high-frequency equity trading to decentralized crypto ecosystems.

The Power of Data-Driven Trading

AI trading platforms leverage vast amounts of data—historical, real-time, and alternative—to identify patterns previously invisible to human traders. By processing datasets that range from news articles and satellite imagery to blockchain transactions, AI-powered systems not only execute trades at record speeds but also predict price movements with eerie accuracy. For instance, JPMorgan's LOXM AI system has optimized trade execution by reducing slippage, while advanced sentiment analysis tools now offer rich insights into market psychology.

Market Impact and Growth Projections

The success of AI trading strategies becomes apparent in their capacity to outperform traditional methods. Algorithmic trading, powered by AI, has transformed trade execution through speed and precision. Current market statistics show that the AI trading market will reach a valuation of $35 billion by 2030, driven by the growing demand for data-driven insights and optimal trade execution. Real-world applications, ranging from hedge funds using sophisticated algorithms to retail platforms democratizing AI for mass investors, show the transformative potential of these technologies.

Challenges, Limitations, and Future Directions

Even with the seemingly positive benefits, AI trading is not without its challenges. Regulatory oversight, model explainability (the "black box" problem), data quality, and the ability to respond to untested market situations are still the largest challenges. Addressing these challenges while taking advantage of future trends like quantum computing and deep reinforcement learning will be key to its long-term growth and implementation in financial markets as AI evolves.

1.2 Global AI Trading Adoption

Artificial intelligence (AI) has revolutionized international trading, disrupted conventional market strategies, and driven innovation in high-frequency and algorithmic trading. Today, AI systems scan humongous datasets in real-time, enabling traders to detect faint market patterns and make trades with breathtaking accuracy. This revolution not only increases the speed and efficiency of trading but also simplifies risk management and portfolio optimization across the globe.

Source: Liquidity Finder, AI adoption rate in trading globally.

Proprietary trading houses and financial institutions are now leveraging machine learning algorithms and natural language processing capabilities to scan structured and unstructured data—everything from price movements and economic indicators to news sentiment and social media buzz. These sophisticated tools provide actionable insights that enable them to predict market volatility and modify trading strategies in real-time.

The impact of AI goes far beyond trade execution; it is an integral component of automated decision-making for credit risk assessment and fraud detection, hence contributing to developing a stronger financial ecosystem.

However, the fast pace of AI adoption in trading also poses risks. Concerns about market volatility, herding, and possible cyber exposures have led regulators to subject AI-powered systems to more stringent scrutiny. Stress tests and enhanced supervision are thus becoming critical tools to contain these risks, ensuring that technological advancements do not compromise financial stability.

2. Evolution of AI in Trading: From Algorithms to Autonomous Systems

Historical Milestones and Market Transformation

Trading has evolved significantly from the manual trading floors of the past. Between 1987 and 2010, markets shifted from face-to-face trading to rule-based algorithmic systems. With the advent of the 2020s—and spurred on by post-COVID market conditions—neural networks and reinforcement learning models permitted adaptive, self-refining trading strategies. AI-powered hedge funds have delivered record-breaking annual returns (with examples such as Renaissance Technologies' Medallion Fund delivering returns of up to 66% over several decades), a new era of systematic trading.

Drivers of AI Adoption

🔹 Data Explosion: Markets now produce and process more than 2.5 quintillion bytes of data every day, including news, social media, satellite imagery, and blockchain transactions.

🔹 Speed and Efficiency: AI systems trade in nanoseconds—orders of magnitude quicker than human reaction times.

🔹 Regulatory and Market Shifts: Regulatory bodies, including the SEC, have increasingly legitimized autonomous trading by authorizing new AI-powered order types, while market participants require tools that maximize execution and risk management.

3. Core Technologies Driving AI Trading

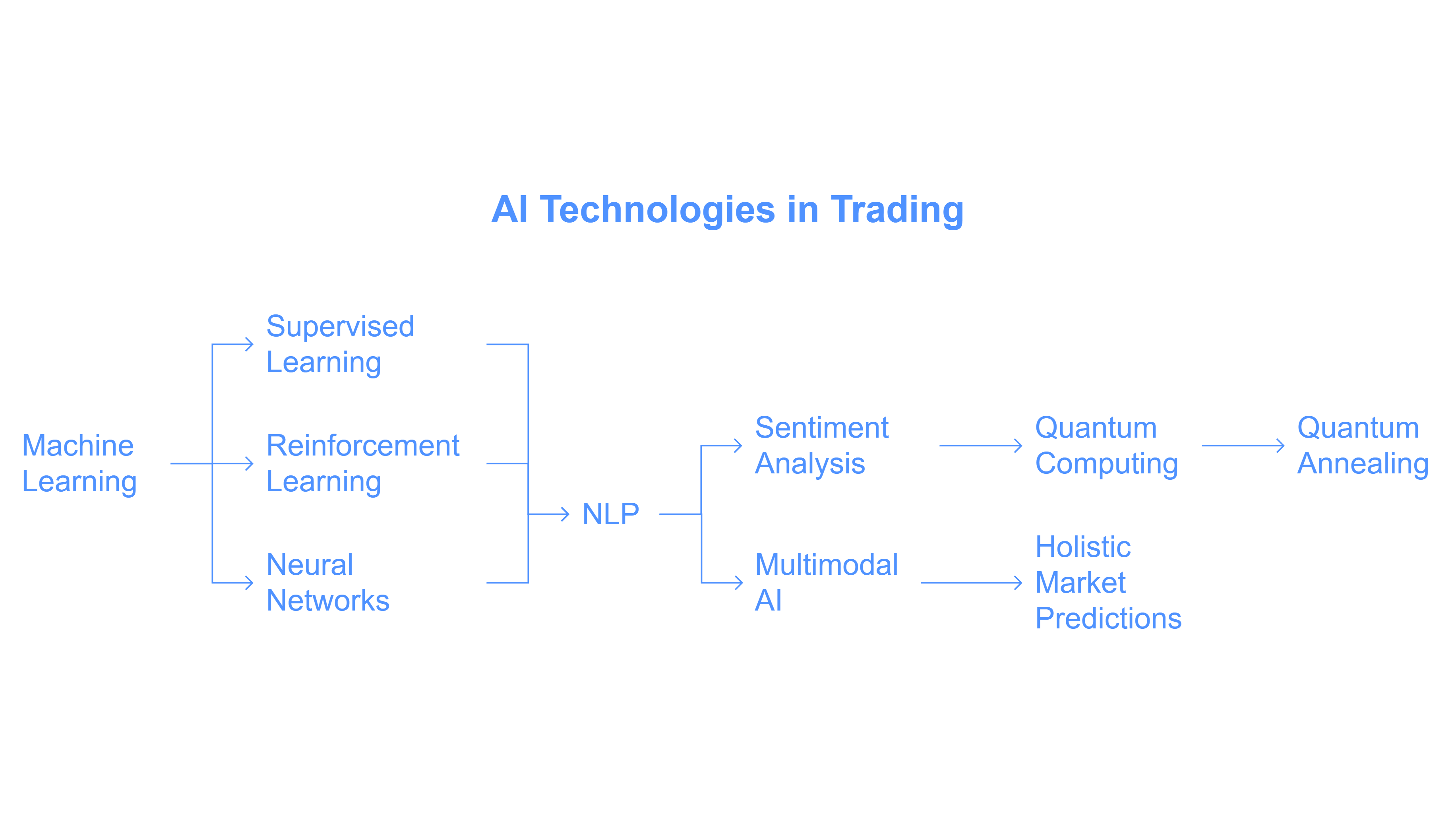

Source: Liquidity Finder, Core AI technologies in trading.

3.1 Machine Learning & Deep Learning

Machine learning algorithms that learn from past and real-time data are at the core of AI trading:

- Trained on labeled data, supervised learning algorithms predict direction of price and minimize execution slippage (e.g., JPMorgan's LOXM system).

- Models learn incrementally through trial and error, reinforcement learning (RL) allows funds such as Aidyia Holdings to operate autonomous funds with minimal human oversight.

- With the ability to identify complex, non-linear patterns, neural networks have been a key component of strategies that produce high returns in foreign exchange and commodity markets.

3.2 Natural Language Processing (NLP)

NLP enables AI systems to process and interpret human language by reading earnings calls, financial news, and social media. This ability allows sentiment analysis tools to:

- Detect early warning signs in corporate communication

- Capture shifts in market sentiment long before they are evident in price data

- Offer traders actionable insights that improve strategy creation

3.3 Quantum Computing

Quantum computing is on the horizon as a portfolio optimization game-changer:

- Quantum Annealing: Platforms such as Goldman Sachs' Quantum Studio have proven the ability to minimize bond risk by up to 40%.

- By solving complex optimization problems 100 times faster than classical computers, quantum methods are poised to revolutionize trading strategies in the near term.

3.4 Multimodal AI

Multimodal AI combines data from various sources—audio, text, and on-chain metrics—to produce holistic market predictions. This method allows platforms to improve trading signals by taking advantage of a range of information, thereby improving overall decision accuracy.

4. AI Trading Platforms and Technologies

In 2025, AI trading platforms have become indispensable for both institutional and retail traders. These platforms combine advanced algorithms, machine learning, and real-time analytics to empower traders with automation, precise decision-making, and enhanced risk management.

4.1 Institutional Platforms

These solutions are designed for large financial institutions, hedge funds, and professional investors who require robust, enterprise‐grade tools with deep data integration, advanced analytics, and regulatory-grade risk management.

1. Bloomberg Terminal

Usage: Provides an AI-driven Earnings Call Analyzer, real-time regulatory compliance tools, and extensive market data.

Pricing: Approximately $24,000/year.

Link: Bloomberg

2. Kensho (S&P Global)

Usage: Uses NLP to deliver macroeconomic forecasts and now includes crypto sentiment tracking.

Pricing: Custom pricing (starting at around $50K/year).

Link: kensho

3. SigOpt

Usage: Optimizes hyperparameters for machine learning models used in trading strategies.

Pricing: Approximately $10K/month for enterprise solutions.

Link: sigopt

4. Aidyia Holdings

Usage: An AI-driven hedge fund that uses reinforcement learning for fully autonomous trading.

Pricing: Fee structure typically around 2% management fee + 20% performance fee.

Link: aidyiaholdings.com (if publicly available)

5. Eigen Technologies

Usage: An NLP tool for due diligence, extracting insights from complex financial documents.

Pricing: Approximately $15K/month.

Link: Eigen Technologies

6. AlphaSense

Usage: An enterprise search engine that scans filings, patents, and news to provide actionable insights.

Pricing: Roughly $30K/year.

Link: AlphaSense

7. Two Sigma's Venn

Usage: Offers risk analytics using alternative data such as satellite imagery and supply chain metrics.

Pricing: Institutional pricing (undisclosed).

Link: Two Sigma (Venn product information may be available on request)

8. Sentient Technologies

Usage: Uses evolutionary algorithms to trade forex and commodities, focusing on 24/7 market participation.

Pricing: Typically charges around 1% per trade.

Link: Sentient Trader

9. Renaissance Technologies

Usage: The iconic AI-driven hedge fund known for its highly secretive Medallion Fund, which uses advanced algorithms.

Pricing: Closed to external investors.

Link: Renaissance Technologies

10. QuantBot Pro (New)

Usage: A cloud-based quantitative trading platform that enables strategy creation, backtesting, and deployment across multiple assets.

Pricing: Enterprise subscriptions start at approximately $20K/year.

Link: Quant-Bot

11. Trader Sage (New)

Usage: Offers predictive analytics and machine learning-driven execution for optimized trading strategies.

Pricing: Around $10/month but has a Free Baisc plan

Link: Trader Sage

12. TradexAI (New)

Usage: Multi-asset platform using deep learning to generate and execute trading signals in real-time.

Pricing: Custom enterprise plans, starting near $30K/year.

Link: TradeX AI

13. NextGenTrader (New)

Usage: Leverages reinforcement learning to continually optimize trading strategies and improve timing for entries/exits.

Pricing: Starting at about $25K/year.

Link: nextgentrader.com

14. FinBrain (New)

Usage: Deep learning AI driven financial predictions using AI and alternative data

Pricing: $60 p/m for Pro or $120 p/m for Ultimate

Link: FinBrain

15. Quantifi (New)

Usage: Provides quantitative analytics for asset allocation and risk management with an emphasis on precision.

Pricing: Approximately $10K/month.

Link: Quantifi

16. IntelliTrade Pro (New)

Usage: An enterprise-grade platform that combines AI, blockchain, and big data for comprehensive trading analytics.

Pricing: Pricing available on request.

Link: intelliTrade

17. FusionTrader (New)

Usage: Integrates diverse data sources—including alternative datasets—for a holistic view and automated trading execution.

Pricing: Around $15K/month.

Link: fusiontrader.ai

18. PrecisionTrade AI (New)

Usage: Focuses on precise, data-driven trade execution and strategy optimization for risk-adjusted returns.

Pricing: Approximately $10K/month. Invite only program.

Link: PrecisionTrade

19. AlphaVantage AI (New)

Usage: Combines alternative data with machine learning to offer predictive models for stock and forex trading. Alpha Vantage provides realtime and historical financial market data through a set of powerful and developer-friendly data APIs and spreadsheets.

Pricing: Tiered pricing starting at around $50/month for smaller accounts.

Link: Alpha Vantage

4.2 Retail Platforms

These platforms cater to individual investors and traders by providing user-friendly interfaces, accessible pricing, and features designed to simplify and enhance trading on a personal level.

1. Trade Ideas

Usage: An AI scanner with the HOLLY bot that offers real-time market alerts, backtesting, and strategy development.

Pricing: Approximately $118–$228/month (depending on the plan).

Link: Trade Ideas

2. Tickeron

Usage: A swing trading assistant that uses AI to generate trading signals and analyze market trends offering AI Traidng Bots and AI Stock Screener

Pricing: Around $49/month.

Link: Tickeron

3. MetaTrader 5 (MT5)

Usage: A multi-asset trading platform offering algorithmic trading, technical analysis, and customizable AI plugins. Available via most retail brokers.

Pricing: Free (with additional paid premium plugins available).

Link: MetaTrader5

4. QuantConnect

Usage: A cloud-based algorithmic trading platform that supports strategy backtesting and live deployment across multiple asset classes.

Pricing: Free to $49/month based on usage and data subscriptions.

Link: Quant Connect

5. Kavout

Usage: Uses the "Kai" AI engine to analyze millions of data points for stock ranking and portfolio insights, also offering paper trading.

Pricing: Freee version available, Pro plan around $20/month.

Link: Kavout

6. Alpaca

Usage: An API-first trading platform that allows developers and retail traders to build and deploy automated trading strategies for stocks, options and crypto trading.

Pricing: Free to $99/month depending on the service tier.

Link: Alpaca

7. Wealthfront

Usage: A robo-advisor that employs AI-driven tax-loss harvesting and portfolio management to optimize investments.

Pricing: Approximately 0.25% annual advisory fee.

Link: Wealthfront

8. Composer

Usage: A no-code platform for creating and deploying AI-driven trading strategies, ideal for those who want to automate without programming.

Pricing: Around $30/month.

Link: Composer

9. TradingView

Usage: A comprehensive charting platform with AI-powered indicators and social trading features.

Pricing: Ranges from $14.95 to $59.95/month.

Link: TradingView

10. eToro

Usage: A social trading platform that allows users to copy trades and access AI-generated market insights.

Pricing: Free to use (spreads apply).

Link: eToro

11. RoboQuant AI (New)

Usage: An automated trading bot designed for multi-asset strategies with easy-to-use interfaces for retail investors, connected to 3rd party brokers.

Pricing: Starting at approximately $29/month.

Link: roboquant

12. TradePilot AI (New)

Usage: Offers an intuitive dashboard that blends manual and automated trading with real-time market analytics for futures trading with a selection of bots, and some new ones in development.

Pricing: From $295 monthly, Annual $1,495 or Lifetime $2,495 per trading bot

Link: Trade Pilot AI

13. TradeWiz AI (New)

Usage: An AI wizard-driven crypto trading tool for creating and deploying personalized trading bots without coding experience.

Pricing: Starting at approximately $29/month.

Link: TradeWiz AI

14. SwiftTrade (New)

Usage: A mobile-first trading app that enables on-the-go trade execution and real-time alerts for retail traders trading via WhatsApp, Telegram, email, voice etc.

Pricing: Free basic version; premium subscription around $9.99/month.

Link: Swifttrade

15. Synapses Technologies

Usage: Provides AI-powered research and insights using their bot ANN, acting as a digital assistant to help traders make informed decisions on FX (Forex), Indices, Commodities, Cryptos

Pricing: Approximately $499/ 6 months for FX or separately for Indices, Commodities, Cryptos, or $749 / 6 months for all..

Link: Synapses Technologies

4.3 Crypto-Focused Platforms

These platforms are tailored for digital asset trading, offering specialized tools for cryptocurrency arbitrage, portfolio management, and blockchain-integrated trading solutions.

1. 3Commas

Usage: Provides AI-driven arbitrage bots and automated trading tools for cryptocurrencies across 18+ exchanges.

Pricing: Free for single bots, Pro $37 p/m for multiple bots, Expert $59 p/m for unlimted Active SmartTrades and many more bots. There is an Asset Manager multi-client option for $374 p/m

Link: 3Commas

2. Coinrule

Usage: A no-code platform that enables users to create automated crypto trading strategies with predefined "if-then" rules.

Pricing: Ranges from $29 to $749/month.

Link: Coinrule

3. Cryptohopper

Usage: A marketplace for crypto trading bots that offers backtesting, paper trading, and signal generation tools.

Pricing: Approximately $19–$99/month.

Link: Cryptohopper

4. HaasOnline

Usage: Offers advanced, customizable crypto bots using HaasScript for algorithmic trading across multiple digital assets.

Pricing: Starting at around $149/month.

Link: Haasonline

5. Pionex

Usage: Features built-in grid trading bots designed for efficient, automated cryptocurrency trading with minimal manual intervention.

Pricing: Minimal fees (~0.05% per trade).

Link: Pionex

6. Bitsgap

Usage: Uses AI for crypto arbitrage and portfolio rebalancing, delivering high win rates during bull markets.

Pricing: Ranges from $21 to $135/month.

Link: Bitsgap

7. QuadTerminal

Usage: A unified dashboard for multi-exchange crypto trading that integrates advanced portfolio management and risk controls .

Pricing: Approximately $19–$299/month.

Link: QuadTerminal

8. CryptoQuant AI (New)

Usage: Specializes in cryptocurrency market analytics using on-chain and market data analytics for intituionaql and professional crypto investors, with portfolio rebalancing, and arbitrage detection using AI-driven insights.

Pricing: Free plan with paid plans astarting at $29/month up to $799/ month (billed annually).

Link: CryptoQuant

9. AI ArbitrageX (New)

Usage: An AI-powered arbitrage bot designed to spot cross-market discrepancies in crypto asset pricing and execute trades automatically.

Pricing: Approximately $39/month.

Link: AI Arbitrage X

10. blockresearch AI (New)

Usage: Combines blockchain technology with AI to facilitate secure, decentralized trading and enhanced liquidity management for digital assets, making institutional-level trading accessible to individual investors.

Pricing: Build an indicator at no cost, vyn/ premium with a fully automated TradingView strategy from $1,999 and Fully automated Quant Trading Strategy $4,449. Institutional packages available on request.

Link: blockresearch

4.4 Alternative Data and Sentiment Analysis

These solutions provide alternative data and sentiment analytics to assist in decision making.

1. Acuity Trading

Usage: Uses cutting edge AI technology to provide meaningful, data-driven insights into financial markets, including sentiment data. natural language processing to analyze ESG-related news and social media sentiment, offering insights for sustainable investing.Sentiment Analysis, Topic Modelling and Corporatew Data.

Pricing: On request or available through brokers who provide the serivice to their clients.

Link: Acuity Trading

2. MarketMind AI (New)

Usage: A collaborative platform that aggregates crowd-sourced market insights, including sustainability metrics, to help investors analyse any company, product or industry.

Pricing: On request; enterprise pricing available.

Link: MarketMind

5. AI Trading Strategies

Sophisticated machine learning combined with predictive analytics and neural networks enables AI trading strategies to optimize financial trade decisions in modern markets. The strategies vary from quantitative to algorithmic trading as well as sentiment analysis and reinforcement learning to maximize returns and manage market risks.

Source: Liquidity Finder, AI trading strategies.

Quantitative and Algorithmic Trading

- Core Concept: Mathematical models combined with statistical techniques operate to execute trading transactions automatically.

- Example: The Medallion Fund by Renaissance Technologies maintains complex algorithms that have traditionally delivered remarkable financial returns.

- Learning Path: Students following the AI Trading Strategies Nanodegree at Udacity receive comprehensive instruction through model development and backtesting as well as optimization training.

Sentiment Analysis-Based Trading

- Overview: AI systems employ natural language processing to analyze social media and news feeds alongside earnings calls for market sentiment understanding.

- Impact: Traders can anticipate market movements and adjust their positions early using this strategy before traditional indicators show these changes.

Predictive Analytics and Reinforcement Learning

- Mechanism: These models study past data and use ongoing learning from new information to make future price predictions.

- Advantage: Adaptive trading strategies adapt in real-time to minimize drawdowns during volatile market conditions.

Hybrid and Adaptive Strategies

- Integration: Technical analysis alongside fundamental data and alternative data sources (including satellite imagery and blockchain data) are combined to create comprehensive predictions.

- Example: Trader users of Composer together with TrendSpider can merge multiple methodologies into customized "symphony" strategies to optimize both their entry and exit points.

Performance Metrics and Backtesting

- Key Metrics: Return on Investment (ROI), Alpha, Beta, Sharpe Ratio, and Drawdown.

- Backtesting: Using platforms such as QuantConnect and Zorro Trader, strategies are rigorously tested against historical data to evaluate effectiveness and adjust for slippage and commission costs.

6. AI Trading Performance Statistics

The impressive performance of AI trading systems is underscored by robust statistics:

Source: Liquidity Finder, AI trading -- market dynamics.

- Market Growth: The global AI trading market grew from $142.3 billion in 2023 to an expected $184 billion in 2024, with projections reaching $826.70 billion by 2030 at a CAGR of 36.6% (in some estimates).

- Return Examples: The Galileo FX trading robot reportedly achieved a 500% return on a $3,200 investment within a week, with a win rate of 72%.

- Adoption Rates: Over 80% of financial institutions have adopted AI to some extent, with algorithmic trading now accounting for approximately 70% of U.S. stock trading volumes.

- Efficiency Metrics: Consistent amalgamation of AI into platforms proves to deliver a risk management/predictive abilities enhancement of up to 20%, providing traders another means of competitive edge.

7. AI Trading Case Studies

Credit Markets and Systematic Investing

AI tools have become crucial for active credit managers challenging bond ranks, filling the gaps in data that lead to the discovery of attractive opportunities in complex fixed-income markets. Better investment outcomes and improved risk-adjusted returns propelled by enhanced decision-making.

Hedge Fund Innovations

Hedge funds using AI, such as those powered by Renaissance Technologies and High-Flyer Quant (DeepSeek) plug-in algorithms find minute inefficiencies in the market. Most of the Medallion Fund's multi-decade, 66% average annual returns are the result of cutting-edge AI strategies.

Equity Research & Portfolio Management

Companies such as BlackRock use AI (such as their Aladdin platform) to derive sentiment scores from news and social media to drive portfolio allocation and risk management. AI-augmented research has enhanced the accuracy of predictions by as much as 20%, allowing for more targeted asset allocation.

Changes in Retail Trading

Companies such as Trade Ideas and eToro are democratizing trading by helping newbies and retail investors make better choices with their own AI-driven tooling. Increased user confidence and improved trading outcomes are commonly cited by platform users.

8. Challenges and Limitations of AI in Trading

AI trading systems possess substantial potential but face numerous operational challenges.

Source: Liquidity Finder, Challenges and limitations in AI trading.

Data Dependency and Quality Issues

- Reliance on Historical Data: AI models that have a high dependency on historical data struggle to adapt during unusual market events which results in inaccurate forecasts.

- Data Quality: Model performance and risk management become severely compromised when data is inaccurate, incomplete, or outdated.

The Black Box Problem

- Lack of Transparency: AI models function as opaque "black boxes" that prevent traders and regulators from understanding how trading decisions are made.

- Accountability: The lack of transparency in AI models creates major accountability issues especially when they lead to substantial financial losses or unintentionally disrupt market operations.

System Complexity and Technical Failures

- Infrastructure Challenges: Automated systems require robust IT infrastructure. The Knight Capital incident of 2012 that caused a $440 million loss demonstrates how connectivity failures and system malfunctions expose the dangers of depending too much on automated systems.

- Maintenance and Expertise: Smaller firms face obstacles in the development and maintenance of complex AI models due to the necessity of substantial expertise.

Regulatory and Ethical Considerations

- Manipulation Risks: Experts worry about the potential misuse of AI to orchestrate stock market manipulation and intensify market volatility through collective investment patterns.

- Regulatory Oversight: Firms need to constantly adjust their compliance frameworks because of the changing regulatory environment (for example, the upcoming Colorado Artificial Intelligence Act in 2026).

- Bias and Fairness: AI systems have the potential to unintentionally replicate existing biases from their training data which results in biased outcomes and market distortions.

9. Future Trends in AI Trading

Source: Liquidity Finder, Future trends in AI trading.

Predictions of future AI trading between 2026 to 2030 between these various trends are as follows:

More Advanced Technological Integration

- Deep Learning and NLP: Predictive capabilities will certainly be improved by enhanced deep learning and natural language processing, with models becoming ever more accurate and automatic.

- Reinforcement Learning: Dynamic market conditions will lead to AI systems relying more and better on adaptive, reinforced strategies.

Quantum Computing & Data Processing

- Quantum Enhancements: The prophet of yet another shiny new data analysis tool is quantum computing, and quantum annealing can algorithmically solve optimization problems in seconds.

- Expanded Infrastructure: With significant investments by tech giants (e.g. Microsoft and Meta), AI infrastructure will likely also be more capable enabling much lower-latency processing of larger datasets.

Decentralized AI (DeAI)

- Blockchain Integration: Autonomous, trustless trading systems will be created leveraging decentralized platforms or blockchain -which will reduce counterparty risk, and increase transparency for global markets.

- Autonomous AI Agents: These agents are of course going to run on decentralized financial markets, making trades and managing funds with little or no human input.

AI Advisors in Your Backyard

Create Specific Trading Turf: Personalized AI advisors who will know the preferences of an individual and automatically adjust strategies for portfolio management.

Integration of ESG Strategies

Emerging AI Tools will contain a lot of ESG data, leading to more sustainable and socially responsible investing.

The Rise of Open-Source and Collaborative Platforms

Open-source AI frameworks and collaborative platforms are democratizing access to advanced trading algorithms. This trend will enable smaller firms and independent traders to develop bespoke solutions without the prohibitive costs typically associated with proprietary systems.

Regulatory Evolution

Increased Oversight and Transparency: Increased transparency & accountability of AI systems (E.g. Colorado Artificial Intelligence Act) From the EU, we have a draft law on AI in agreement with the problems the European Parliament believes the regulation should not create.

10. Setting Up AI-based Trading

If you are just poking your head in, as a newcomer to AI trading it can be like stepping into the world of high tech. However, the following beginner's guide will walk you through a pretty straightforward process to being started:

Source: Liquidity Finder, getting started with AI-based trading

Step 1: Acquire Your Background Knowledge

- Learn The basics: Start with the trade fundamentals and basics of trading like market types, strategies & fundamental risk management

- Know more about AI and Machine Learning: Enroll in Educational Courses: Platforms like Coursera, edX, and Udacity offer beginner-friendly courses that cover Python programming, data analysis, and machine learning algorithms for trading.

- Understand AI Applications in Finance: Explore how predictive analytics, sentiment analysis, and pattern recognition are transforming traditional trading paradigms.

Step 2: Pick a Platform

- Select the Friendly UI: Platforms such as 3Commas, Gunbot and Bybit's Aurora are well known for their newbie-friendly interfaces.

- Security vs Exchange Multi-Exchange access: ensure that the platform you select has a strong security setup and also the ability to trade across more than one exchanges

Step 3: Strategy Development and Backtesting

- Strategy development: Use historical data and backtesting tools (QuantConnect, Zorro Trader) to simulate your trading systems.

- Integrate AI tools: Use apps such as Trade Ideas and Composer to plug in AI-generated signals that evolve strategies through iteration.

Step 4: In Small Quantities and Grow Gradually

- Low Exposure of Capital: Test your strategy as a real player Save the fat with minimal amount.

- Monitor and Adapt: Constantly monitor results, and modify as you go if needed. Have demo accounts and paper trading first before placing real money.

Step 5: Strike Out and Contribute to The Community, Learn More

- Forums and Webinars: Get involved in communities, such as r/algotrading or trade ideas educational webinars

- Ongoing Learning: Keep oneself updated on the latest technological progressions, regulatory changes, and market changes in order to refine strategies.

11. Opinions of Experts in AI Trading

The majority of trade industry leaders are aware that the change of AI in trading is quite a shift:

Industry Leaders' Perspectives

Laurence Fink (CEO of BlackRock)

"AI, Aggregating All The Information"

Michael McCarthy (moomoo CCO)

Emphasizing that AI tools shine unique market insights, monitoring stock-price patterns, and alerting traders of potential exposures leading in general to market efficiency.

Innovation and Technology

DeepSeek and Quant Adventurers

The rapid ascendancy of types such as DeepSeek (that are claimed to be close copies of Western models) evidences the competitive benefit AI provides and suggests that norms of AI need review.

Regulatory Perspective

Regulators' Views

Transparency and extensive control are at the center of the attention, as emphasized by regulators from SEC to CNMV. New AI regulations for AI are coming to Colorado, heralding stricter standards of accountability.

Expert comments reinforce the importance of ongoing innovation and balance in regulation given that AI becomes ever more prevalent in key areas of functions.

Industry Groups

The BIS (Bank for International Settlements who's mission is "Promoting global monetary & financial stability" published a 42-page report in July 2024 Intelligent financial system: how AI is transforming finance with the following finding and recommendations:

"While every generation of AI has boosted the efficiency of the financial system, the risks and challenges associated with the use of AI have also become increasingly complex. AI has enhanced information processing, data analysis, pattern recognition and predictive power in the financial system. At the same time, it can exacerbate data privacy concerns, risk of algorithmic discrimination, market concentration and network interconnectedness. To address the transformative impact of AI advances on the financial system, we propose a framework for upgrading regulation based on general principles for AI governance, emphasising transparency, accountability, fairness, safety and human oversight. We also highlight the need for international coordination."

The UK's Investment Association (the trade association and industry voice for UK investment managers) has been running a series of podcasts on AI in Investment Management over the past few months covering the implementation of artificial intelligence within the sector. Starting in May 2023 and ending in December 2024, the podcasts are hiughly recommended to understand industry leaders perspectives on the implementastion of AI for the buyside.

This episode is highly recommended, where Rebecca Healey (see below) discusses her latest research on the impact or AI on trading:

Rebecca Healey from Redlap Consulting has established Mindful Markets, a resource hub focused on education, collaboration and personal well-being with a mission "to support a balanced, sustainable transition to AI-driven capital markets while empowering individuals and organizations to thrive." More details can be found here.

12. AI Trading and Regulatory Wild West: Helping you navigate the turbulent depths

Just as the financial markets have been transformed by artificial intelligence (AI), so too should its regulation need to adjust and mature to address a multiplicity in the challenges of AI-driven trading. The explosive growth of AI-based trading in the wild has both broken boundaries and ignited fundamental questions about accountability, transparency, and ethical practices.

Source: Liquidity Finder, regulatory challenges in AI trading

Global Reg Biology

The regulatory playing field around the globe is shifting rapidly as governments and institutions clamour to create systems that can compete with emerging technologies.

United States

The forthcoming Colorado AI Act, expected to go into effect in 2026 — represents a risk-informed governance of AI. These regulations require much greater transparency, whereby companies must be real about their AI models and show that any black box is not used by firms, based on ethical precautionary principles.

European Union

Meanwhile, the EU is beefing up its regulatory roster with a view to harder Explainable AI (XAI). By requiring that AI systems disclose their decision-making process in an interpretable way, the EU is trying to ease concerns about "black box" models so that algorithms can be easily understood by regulators and stakeholders alike.

These emerging regulations signal the shift from global reactive supervision to proactive, yet at the same time, highlight the regional biases in regulatory philosophy.

Challenges to Compliance

AI trading systems create unique compliance challenges that conventional regulatory tools are not well-suited to solve. Among those challenges:

- Data Quality: Low-quality data can lead to model errors and wrong decisions that further systemic risks.

- Bias in Algorithms: The AI systems, which are trained on historical data, will carry some of the biases present in that dataset. For example, this can lead to discriminatory outcomes or undesired market distortions.

- Model Opacity: Another salt-of-the-earth issue is well described as a black box—where developers might even fail to properly explain complex AI models arriving at their decisions.

With all these factors, it has gotten harder and harder for regulators to monitor AI-driven trading which is a dilemma both for firms, but even more so for the enforcers.

Harmonization-Global Compliance

The universality of financial markets complicates an additional issue in this regard: Regulatory Coherence Across Borders from a global perspective. Yet we also have divergence at the regional level:

- The EU's Markets in Crypto-Assets (MiCA) regulation in particular is an imposition of a hard, blanket standard over digital assets standardized approach for exceptions with examples like USICOX.

- This uncoupling opened the door to regulatory arbitrage — where firms exploit jurisdictional differences to their competitive advantage. On the other hand, this makes it harder to maintain consistent oversight and could diminish investor trust, and stability in markets.

Unfair Trading: A Threat to the Market

Perhaps the most immediate concern associated with AI in trading is the possibility of market manipulation. AI systems that are much faster and less predictable than their human equivalents inadvertently—or notoriously—play a role in manipulative practices.

- Increased concerns that AI may be inadvertently "teaching" algorithms from different companies to imitate collusion, for example, price fixing or bid rigging.

- Manipulative Trading Practices: Reinforcement of trading via AI-powered strategies like spoofing (placing false orders to create the illusion of demand or liquidity) is a threat to the integrity of a market.

As these systems become more sophisticated, the difficulty in detecting and proving such practices grows.

13. Conclusion

Enhanced Functionality Including Ethics and Oversight

AI & the future of the AI trading landscape are changing. State-of-the-art technologies including deep & reinforcement learning, quantum computing & AI on the blockchain, are pushing the boundaries for a dramatic change in trading to be highly efficient, automated, and precise. Platforms that merge these technologies in both cases are facilitating execution enhancement; risk management and superior returns for both Institutional goliaths and retail Investors.

Source: Liquidity Finder, AI Trading - Key Takeaways

But the path is not without obstacles. Data quality, model transparency, system complexity, and regulatory compliance are still critical areas that have to be tackled in every sense. While it is true that raising ethical considerations and supervision are important just because some AI models are “black box” and market manipulation may emerge from such a process.

Future trends like personalized AI advisors, ESG trading, and blockchain-based decentralized trading will take it to another level, as the industry is bound to see further disruptions. With regulatory frameworks more and more aligned, the future of AI trading is bright provided stakeholders are keeping a close eye and consistently working towards ethical practices.

The Takeaway

- Market Projection: The AI trading market will grow to an estimated 35 billion dollars instead of a massive appetite for data-driven insights.

- Specialized Platform Leadership: Top platforms like Cryptohopper, WunderTrading, and Trade Ideas are crossing limits.

- Proven strategies: Models show the near-immortality of AI trading strategies.

- Things that need doing: Data accuracy dependency, algorithmic biases control, and system reliability are key unresolved issues.

- Future Trend: The next big wave will be fueled by deep learning, NLP, quantum computing, and decentralized systems.

- Regulatory Landscape: With upcoming regulations more visible, there will need to be transparency & responsibility for sustainable growth.