White Label Alternatives to MT4 & MT5 for Banks & Brokers

MetaTrader 4 and MT5 dominate retail brokerage, but they're not the only option. This guide reviews the leading white label trading platform alternatives available to banks and brokers in 2026, covering technology, licensing, and key differentiators.

MetaQuotes' MetaTrader 5 - The Dominant Trading Platform Globally

It has been over 2 weeks since LiquidityFinder broke the story on Saturday 24th September that Apple had removed MetaQuotes' MetaTrader 4 (MT4) and MetaTrader 5 (MT5) apps from its App Store. This move by Apple, with still no official explanation from either Apple or MetaQuotes, has left a huge amount of uncertainty in the trading industry, both for brokers and end clients. Metaquotes informed customers that this was a “unilateral decision of Apple which was outside the control of Metaquotes…Metaquotes is taking all the actions required in an effort to restore the Apps the soonest possible.” MT4 and MT5 apps are still available via Google Play, but could the same happen there?

Many platform providers have reported that they are fielding an increase in enquiries from brokers now looking at alternatives to MT4 and MT5. In this article I am going to take a look at how MetaTrader became so dominant in the industry, and what alternatives there are for brokers who may need to look for a Plan B.

MetaTrader 4 (MT4), and subsequently, MetaTrader 5 (MT5) trading platforms from MetaQuotes have been the leading market trading platforms in use by millions of traders globally for several years. Finance Magnates Intelligence reports that MetaQuotes dominates the market for trading platforms, suggesting that 83.8% of retail brokers offer either (or both) of these platforms at the end of Q2 2022. I also see this type of go-to demand for new brokers who speak to me at LiquidityFinder. 90%+ of all conversations with start-up, or existing brokers is around MT4/5. Rarely do we speak about demand for other platforms. (If we do, it is most likely cTrader as the next alternative.)

How did this happen? When asking a new start-up broker why they want MT4/5 they will inevitably say that this is what their clients, the market, wants. What is it that keeps MetaTrader so dominant in the market?

MetaQuotes founded in Russia in 2000, released MetaTrader 4 (MT4) in 2005, and soon became the predominant trading platform in use by FX Retail brokers and their clients worldwide. The success of the platform was due to its stability, functionality and perhaps most significantly, the ability to code custom trading applications in its native MQL4 (MetaQuotes Language for MT4). These are collectively known as Expert Advisors (EAs).

There is a secondary industry around the creation and sale of EAs, which can be viewed here. Some of these are being advertised for thousands of dollars, with one currently advertised for $30,000.

However, there is a paradox here as a significant number of these EAs are scalping or arbitrage strategies which a lot of brokers have little appetite to work with. I regularly receive enquiries from traders who are looking for a new home for their flow as they seem to have burned their relationships with mulitple brokers due to the “toxic” nature of their flow. This seems a bit like chasing the pot of gold at the end of a rainbow. (If any brokers out there are happy to receive this flow, please DO get in touch!)

Once MetaQuotes achieved ‘critical mass’ in the market, MT4 and subsequently MT5, became the go-to platform of choice for any new broker because it makes it easier to capture clients from other brokers. If a retail trader can see another broker, with potentially better trading conditions, on a platform he is familiar with and which would accept the trader’s EA, then it is easy to make the switch.

MetaQuotes has achieved global recognition for its software which makes it the safe choice for any start up or established broker looking to win clients from competitors. Indeed, it is perhaps no exaggeration to say that MetaQuotes has helped grow the whole retail broker industry to where it is today.

At the start of 2018, MetaQuotes announced that it was ending the sale of new MT4 licenses to concentrate on promoting the use of MT5. MT4 was used by FX (“Forex” in retail-speak) traders, but the trading world was moving into a multi-asset environment. MT5 was launched as a way to defend MetaQuotes’ market share in a multi-asset, exchange connected world, and end reliance on FX trading only.

MT5 was actually launched in 2010 but suffered from little initial take up from users due to the stickiness of the EA ecosystem around MT4, and because MT5 is not compatible with MQL4. MT5 allows multi-asset trading, something that all brokers are looking to offer to keep up with their competition, and by launching MT5, MetaQuotes was really trying to keep up with its own competition, as other platforms around it were offering multi-asset trading well before MT5. New MT4 licenses are no longer available direct from MetaQuotes, so if a new broker wants MT4 they must buy an existing firm with an MT4 license, which is tough.

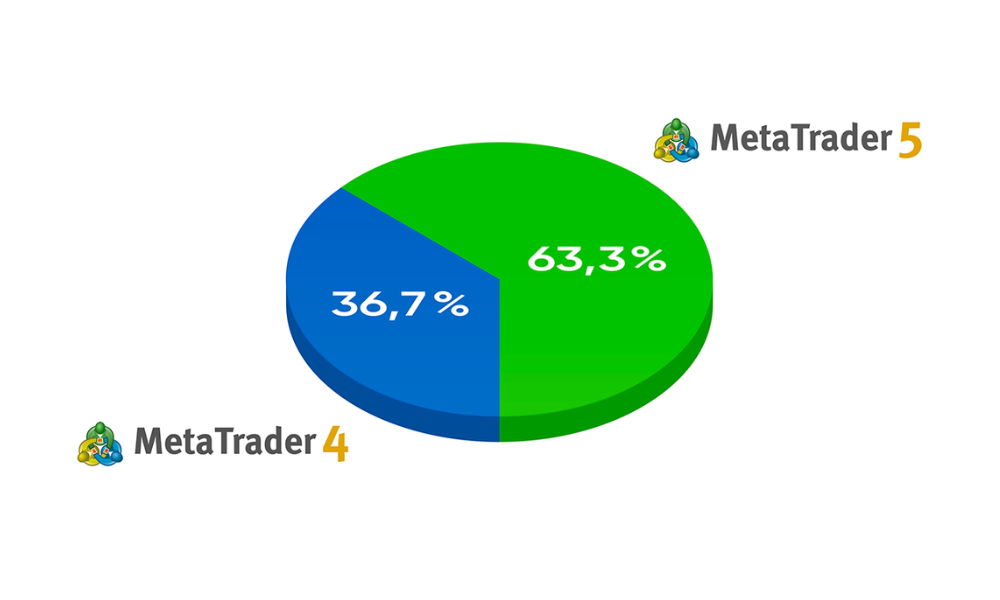

MetaQuotes has reached some significant milestones with MT5. In June 2021, MetaQuotes announced that MT5 had become more popular than MT4 among brokers. The company followed up in November 2021 with another announcement that MT5 has extended its lead over MT4, stating that trading server utilisation by brokers has increased by a factor of 1.5, compared to MT4.

In February this year, MetaQuotes revealed that the MQL5.com community site has 7 million monthly visitors, the MQL5 Market has 21,000 solutions on offer, and has made over 430,000 sales during its 18-year history, with 100,000 of those sales in 2021 alone.

Brokers now looking at alternatives to MT5?

There is a concentration of risk in the retail broker market around one key supplier of trading technology - this much is clear. As recent events have shown, this dependency on one supplier leaves these brokers exposed to forces outside of their control.

The reasons for the removal have not been officially stated. Some are pointing to coverage from Forbes of crypto scams being linked to MetaTrader as something that may have triggered the move.

The vast majority of brokers deploying MT4 and MT5 are reputable businesses and aim to protect their clients. However, there are some brokers, usually unregulated, who cause reputational damage not only to MetaQuotes, but to the industry as a whole. The actions of these unscrupulous brokers can harm all those brokers with a clean business model, if the technology the industry as whole relies on is suddenly made inaccessible due to malpractice amongst the few.

Earlier this year, MetaQuotes tightened the restrictions on the provision of White Labels to unregulated brokers, or more specifically, brokers that cannot demonstrate that they have a corporate bank account in their name. MetaQuotes is distancing itself from bad actors, but this could be a case of closing the stable door after the horse has bolted.

It is quite a well known ‘dark secret’ inside the industry that there are tools available (a plug-in called Virtual Dealer - Google it) in the Management side of MetaTrader that can be used against a broker’s client. For example, it is possible for a broker to erase a client’s trades; it is possible for a broker to change the entry and exit prices of a client’s trades at any time; prices can be manipulated to action stop-losses (in the broker’s favour). Why these tools even exist inside the platform is questionable. This is not to say by any means that all brokers use these tools inside the MT4/5 Manager. Most don’t. But some do, and those that conduct these practises not only tarnish their own reputation, but that of the industry as a whole.

I did speak to an East European stock broker recently, looking for an alternative trading platform as their white label with a US equities broker was ending. MT5 was completely ruled out as being associated with dodgy, unregulated brokers. So for reputational reasons, this broker did not want to go near MT5.

So not only is there distrust amongst end users of MT4 and MT5 platforms, but there is now concern by brokers of the ability of the company to keep delivering the software itself. Apple (still for unconfirmed reasons) removed MT4 and MT5 from their app store last weekend. Now the whole ecosystem looks under threat. While MetaQuotes stated to its clients last week that it is “taking all the actions required in an effort to restore the Apps the soonest possible [sic.]”, brokers, and their end-user clients, are taking a hard look at alternatives.

What alternatives are there to MT4 and MT5?

From my conversations with alternative platform providers, it appears that many brokers are now researching the market for a plan-B, or at least a back-up plan, for to their existing MT4 or MT5 platform.

Hopefully, the below is a useful guide for any broker now looking for around another trading platforms to work with their client base. I am not suggesting that all brokers need to switch, but it may be helpful to know what alternatives are out there, and I hope the below review is useful.

A distinction should be made between trading software providers, and those banks brokers that have invested vast sums in their own proprietary trading platform, and are prepared to allow other banks or brokers to white label this technology. These larger brokers allow their platform to be white labelled, on the condition that their own liquidity supports the platform. Some of these platforms are so robust and reliable that regional banks successfully use them for their own clients. Banks not only piggy-back off the technology spend that their partner has invested, but also their good reputation. I will cover these in a later article.

cTrader

My conversations suggest that the immediate second choice from brokers looking for an independent platform is cTrader, supplied by Spotware Systems. Spotware asserts that cTrader has been founded on a “Traders First” principle. There is no annual license fee, with only a small set up fee. Instead it uses a ‘Platform-as-a-Service (PaaS) model, whereby brokers pay fees based on the volume of turnover of their clients. There should be, therefore, an alignment of interest between Spotware/cTrader and its clients (the brokers) to keep their traders actively trading for as long as possible.

Furthermore, there are no capabilities in the admin side of the system to enable trade manipulation.

cTrader also has an ecosystem of Robo Trading apps, called cBots. There is a community and active market place where some developers can be hired to convert EAs for MT4/MT5 into cAlgo / cBots. There is also an off-the-shelf cBot marketplace , and active Telegram community.

When I asked the CEO and Founder of Spotware Systems, (who develop cTrader), Andrey Pavlov, whether he has seen an upsurge in interest since the news about MT4/MT5’s removal from the Apple App Store, he responded: “Absolutely. cTrader has always been popular with large brokers who care about their reputation and about the end user - the trader. And recently demand for cTrader has grown very significantly. Brokers want a great product, which is both secure and provides multiple competitive advantages.”

TraderEvolution

Another option for brokers that seems to be gaining interest is TraderEvolution. TraderEvolution is a multi-asset independent trading platform which can work with a range of instruments including Equities, Futures, Options, FX, CFDs, Crypto and Fixed Income. TraderEvolution also allows algo trading. TraderEvolution is sold on a license fee basis, with separate modules being sold under additional licenses which can be added on as a business enters new areas.

In a recent LinkedIN post, the Founder of the company, Roman Nalivayko also revealed that the company is receiving a growing number of enquiries after the recent news about MT4 and MT5.

No third-party bridging software is required with TraderEvolution. The company says it has over 60 connections in place with Liquidity Providers, including several stock exchanges.

Brokers can also offer other businesses a white label of their TraderEvolution environment under their own branding.

Roman Nalivayko, CEO and Co-Founder of TraderEvolution Global, commented on the positioning of TraderEvolution in the market in light of the current situation with regards to MetaQuotes, “TraderEvolution software requires a certain level of engagement from brokers, including hosting it on their premises, which makes our platform attractive mainly for mature and regulated investment firms and banks.

“Our delivery model provides every broker with a separate app in the AppStore under their own name and their publisher account. Those two facts protect our partners and their end users from the risks we observe in the current situation.

“Naturally, we are receiving many inquiries about replacing MetaTrader apps, however, most of them are not exactly cases for us. We do not provide a single front end only, but a whole front-to-back solution tailored to the client’s business. In that sense using TraderEvolution software would be a strategical choice for an investment firm, not just a tactical change of a single component in the park.”

Devexperts

A further, highly regarded, independent platform provider is Devexperts. Devexperts have been building custom trading solutions for 20 years, with over 8 million traders using their technology daily.

I spoke to Evgeny Sorokin, the SVP of Software Engineering at Devexperts, who stated that the company has also seen a sudden interest in their platforms, “Now that many mono-platform brokers realised the impact of moves by app stores or the vendor itself with regard to the white-labels, we see a booming interest in our DXtrade-based solutions.

“The variety of trading solutions and our readiness to implement any customisations to help the client stand-out, have always been appreciated by big-name brokers. Besides being very flexible and welcoming client’s custom requests, we always took maintenance and support upon ourselves.

“This is what stands us apart, we let brokers focus on their core business, and leave the technology part to Devexperts. No headache with connecting liquidity providers, as DXtrade offers easy connectivity through the industry APIs, no extra tools such as bridges, meaning no extra costs for unnecessary plugins; single tenant deployment. We honour the independence of brokers and don’t try to impose our circumstances, like locking them into a single liquidity hub, or making them dependent on 3rd party plug-ins.

“In the CFD world we mostly worked with those who wouldn’t settle for MT alone and were looking for a strategic alternative: an in-house platform or a deal that mitigates the vendor-related risks.”

Devexperts portfolio features 100+ unique projects delivered to financial companies around the globe, besides FX and CFD brokers they serve stock & options brokers, wealth-management companies, and launch exchanges.

Devexperts have a full suite of platforms for brokers ranging from start-ups to the established. The company says that the main difference from other platform providers is the built-in protection against vendor lock-in: the company offers brokers the opportunity for additional customisations according to their business processes, as well as the option to buy out the source code to continue development in-house. I believe this is a fairly unique proposition.

The Devexperts range of trading platforms includes: DXtrade CFD - This platform enables brokers to offer FX, CFDs, Spread bets and Crypto. Giving brokers a direct alternative to MetaTrader and cTrader. DXtrade Crypto - This platform is targeted at Crypto brokers wanting to offer both Spot and Margin Crypto trading. DXtrade XT](https://dx.trade/dxtrade-xt/dxtrade-xt-overview/) - This platform is for brokers wanting to offer exchange traded securities and derivatives including stocks, options, futures, mutual funds and bonds.

Sorokin summarised why a broker should choose to work with Devexperts and their DXtrade platform:

What do brokers get?

- Their own branded web and mobile trading apps.

- Dealing and management tools that allow brokers to proactively manage their risk and to take

- Full control of their brokerage operations

- Free integration to an LP of their choice (no need for bridges)

- A suite of APIs to integrate 3rd parties

- A dedicated account manager you can actually speak to

- Secure, tried and tested financial grade technology

Why DXtrade?

- Low setup and running cost

- Native iOS/Android apps in the stores under the brokers account

- Maintained, monitored and supported 24/7 by Devexperts

- Liquidity agnostic, choose any LP

- Flexible licensing models

- Single tenant deployment

Devexperts offer several flexible licensing options, which enables every platform to grow as the broker does:

SaaS - Starting $5k per month the platform is deployed instantly in AWS, LPs connected, broker tools provided and web & mobile apps branded. Maintenance & support services included and provided by Devexperts.

Enterprise - Take DXtrade and make it your own with Devexperts team of engineers. Deploy it anywhere and customize anything, from the UI colors to the client’s workflow.

Full SCL - Bring DXtrade in house and avoid vendor lock-in

The vast majority of the accounts that work with Devexperts are under NDA so the company is unable to publicly disclose most of the big names. However, some gave their permission to mention them:

- AvaTrade

- Benzinga

- Rostro

- Alpha Capital Markets

Some of the DXtrade clients:

- Deriv

- SolidusX

- Rostro

- Freestoxx

- Eagletrade

- Binomo

Some case studies of companies working with Dvexperts can be viewed on their website here.

Netdania

Netdania is another independent trading platform provider that is one of the early pioneers of streaming price technology. Founded in 1998, the company provides solutions to Global Tier-1 banks, brokers and currency managers. Two years ago the company was purchased by Christian Frahm’s United Fintech, its first acquisition. The co-CEO of Netdania, Rasmus Bagger-Petersen also recently appealed to brokers who may be looking for an alternative to MetaQuotes’ platforms. In a LinkedIN post he stated,

I spoke to Rasmus while researching this article, and he commented that the company has seen a spike in interest in their platform. "NetDania has seen a surge in interest from brokerage firms around the world since it was announced that the Meta Quote App was to be removed from the AppStore. Brokers are engaging us to discuss a replacement for their current Meta Quote setup but also sourcing alternative back-end solutions. Netdania has an easy plug-and-play solution for all brokers looking for alternatives, it can be fully white-labeled and delivered within 10 days at a very transparent license fee model."

Match-Trade Technologies

Match-Trade Technologies is another independent platform provider that is seeing an increase in interest in their multi-asset trading solution, with their Match-Trader multi-asset platform able to be fully white-labelled under any broker’s branding

Michał Karczewski, the CEO of Match-Trade Technologies commented on the increase in interest in their platform, “Recent events in the forex market have shown that running a business with just one trading platform can jeopardise the business continuity of Brokers and White Label platform providers. No surprise that our sales team is breaking records for platform presentations and offers sent.

"From the beginning, we assumed that the Match-Trader system would be an open environment that Brokers could expand and adapt to their needs. And now, this is exactly what they are looking for - an alternative platform they can easily add to the system they have already configured for their business. Also, the Match-Trader platform is one of the few trading platforms available as an independent server”

For the purposes of this article, I asked the team at Match-Trade Technologies to answer some questions about their platform:

Does Match-Trader allow for algo trading? Yes, it does. We provide an API that allows connecting any trading algorithm. But for, let’s say, less-skilled traders, there’s a Social Feed and Copy Trading mechanism built into the Match-Trader. It allows traders to follow the money manager’s (signal provider’s) strategy with a selected budget or copy selected trades from multiple professional traders. They can, of course, verify the historical performance of money managers to check their profitability and unfollow their accounts at any time.

Is the Match-Trader platform independent of liquidity providers? Yes, of course. Match-Trader’s ecosystem is open and very flexible. We provide multiple APIs to ensure hassle-free integration with any kind of CRM, bridge or other 3rd party solution. And we are already integrated with major distribution systems.

Can you please explain how the Match-Trader license fee works? Match-Trader is offered in a SaaS (Software-as-a-Servce) model with a fixed fee for active accounts (both server license and White Labels). This year we have removed other fees based on setup, deposit or Broker’s turnover from our offer to keep our pricing more transparent and provide customers with predictable costs.

With a full server, Brokers gain sole control over the setup, and they can configure the system according to their preferences using our APIs. Also, a server can be hosted in one of the most reliable and secured data centres chosen by the client (Microsoft Azure or Amazon Web Server). What’s essential, we allow Brokers to host their database on their own server, which is then connected to the platform itself.

The base offer for a server license is $10,000 monthly for 30,000 live trading accounts (and that also includes things like branded apps, market news feed & calendar, unlimited number of instruments etc.), and it can be customised by adding multiple options (for example upgrading accounts package). The cost is fixed, there are no setup/deposit nor turnover fees.

Fortex

Jake Zhi, Managing Director at Fortex also confirmed recent increase in interest in their multi-asset trading platform, "At Fortex, we have seen a significant increase of inquiries about our XForce multi-asset trading platform after the MetaQuotes mobile apps being pulled from Apple App Store lately, as many e-trading service provider are actively seeking for alternatives and diversification on trading platform to negate the impact and to differentiate their business."

The platform is fixed monthly minimum fee, typically around $3,000 - $5,000, based on the package. There is also a platform transaction fee from $2 per USD million traded based on different asset classes, like FX/CFD, or on-exchange futures and equities. Fortex says that they offer flexible commercial terms to help their client grow.

The Fortex platform is provided as stand-alone software and is not bundled with any LP. A Fortex XForce broker can use whichever LP via the built-in Fortex LP aggregator. Further, a broker can tailor-make and distribute its own liquidity to others, like institutions, hedge funds, money managers and enterprises leveraging the Fortex margin and credit account system, and clearing and settlement technologies.

It is possible to trade on the Fortex environment via an algo. Besides FIX API 4.4, Fortex XForce provides a WebSocket API and RESTful API, which is commonly used by the crypto-exchange industry where a significant number of algo market-makers and HFTs all use this new industry form to trade, and for the algo trader to program their strategies. Zhi comments that, “the available APIs enable faster execution, support sophisticated strategies and yield better scalability”.

Fortex reference clients include Advanced Markets Group, Tier1FX Group, OKX.com. The company says that it also has non-bank LPs, licensed broker/dealers, crypto exchanges, and others that they are not at liberty to name.

FDCTech

FDCTech is another independent provider, through their Condor multi-asset trading platform. Founder of FDCTech, Mitch Eaglestein, set up the company in June 2016. Eaglestein commented on how recent events at MetaQuotes have resulted in more interest in their technology:

“It is remarkable, we received more interest in the Condor platform for the last month, than we had in the past several years. MQ has left a huge void in the market. In the long term brokers will benefit from becoming more technology independent and by utilising bespoke technology solutions”.

Commenting on their commercial model, Eaglestein explained, “We want brokers to use all our software so all our software modules are included with the license. There are two options for the all inclusive full SAAS Condor Multi Asset Trading Platform solution (platform, price feed. backend, LP Bridge, basic CRM, mobile apps, webtrader, institutional desktop, APIs, & hosting, all included): 1. No Volume Fee Pricing. $7,500 setup, $5,500 per month support 2. Standard pricing $5,000 setup , $3,500 per month support and $.50 to $3 per million on STP trades. First white-label is free; each additional white label is $2,500 to setup and $1,500 per month to support. Custom development is also available.”

“One of the benefits of the FDCTech platform is that the Condor platform name can be completely hidden and firms can name, change and market Condor as their own platform. We give smaller brokers the opportunity to market their own version of the trading platform in such a way they will never lose clients to brokers using the exact same system with better spreads or commissions.

“Another unique benefit of Condor is that we are the only trading platform which has built-in tools to support Prop Challenges, a new popular niche in space. Reference clients for both Brokerages and Prop Challenge firms can be provided to interested companies.”

Asked to comment on the neutrality of the Condor system, Eaglestein elaborated that, “unlike MetaQuotes, Condor has it’s own LP gateway which comes with the license. Condor is also integrated with Take Profit, PrimeXM, OneZero and Celera so brokers can choose from hundreds of LPs. We also are integrated with leading multi-platform CRM providers such as FXBackoffice and Skale.”

Trading View

Last year, Trading View, best known for its technical analysis package and its community of traders sharing ideas, was reported to have over 550 million unique users. This reach dwarfs MetaTrader and could be the platform to watch. Trading View is a front end only, and some brokers are now connected to Trading View for trading - see the list here - but they still have to have a back end to connect to Trading View. As mentioned above, platform providers like TraderEvolution provide this connection. Trading View, and its unique place in the market, will be covered separately in a later article.

Other independent platform providers, X Open Hub, ACT Trader, Leverate (Sirix), UTIP, Hybrid Solutions (VertexFX) were unreachable before publication of this article. I will also cover these, and the White Label trading solutions from the larger brokers and banks, in a subsequent article.

So, judging by the comments from the various platform providers, it does seem as if there is a "disturbance in the force" and brokers are looking at alternative platform providers to mitigate the potential risk of being tied to MT5. This is not to say that MT5 has had its day, but any broker would be wise to research a plan-B, in the same way that any broker should never be reliant on one liquidity provider.

I would be happy to assist anyone with any further questions around the choice of trading platform, or of course liquidity for their business. Please do get in touch. For now, we await further clarity from MetaQuotes and Apple as to the status of MT4 and MT5 on the Apple App Store.

Author

|

Sam Low is the Founder of LiquidityFinder. With over 18 years in working with FX trading technology, Sam has deep experience in the FX (forex) trading industry, working with brokers, liquidity providers and end traders themselves. You can message Sam directly here. |