FXSpotStream Reports December 2021 Volumes, Up 0.25% On December 2020

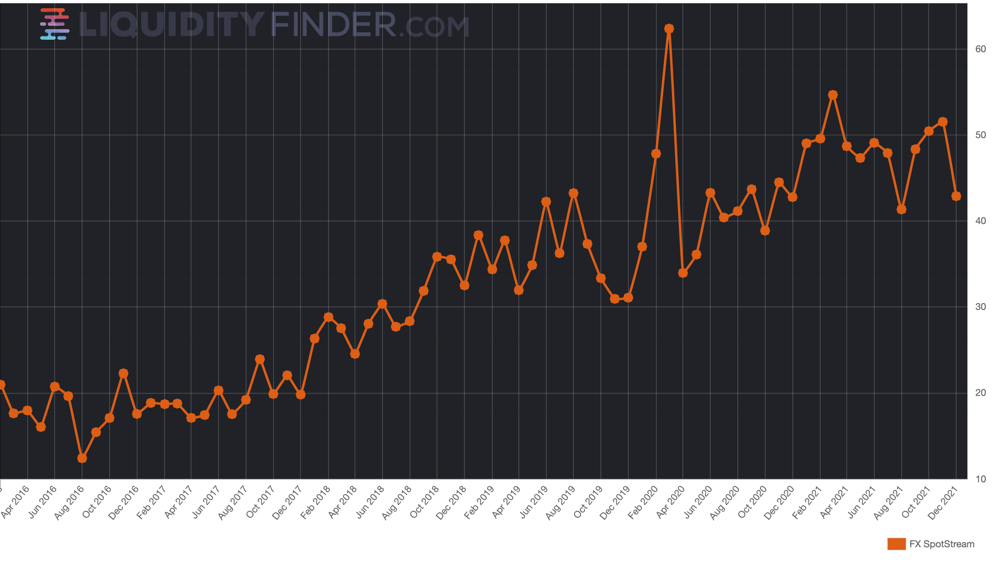

January 05, 2022 - Bank-owned FX and Precious Metals streaming price provider FXSpotStream has released volume figures for December 2021, recording an ADV of $42.894 billion, which represents an increase of 0.25% vs December 2020.

FXSpotStream closed 2021 with an ADV increase of 13.48% over the whole of 2020, which the company says demonstrates that they continue to gain market share.

2021 also saw FXSpotStream surpass the $12 trillion mark for the first time in the company’s history.

FXSpotStream’s ADV Year-on-Year (December 2021 vs December 2020) increased 0.25% to $42.894 billion resulting in a Year-on-Year increase every month in 2021 except one.

FXSpotStream’s ADV Month-on-Month (December 2021 vs November 2021) decreased 16.77% to $42.894 billion, following the company's 3rd highest ever ADV in Nov 2021.

FXSpotStream’s Overall Volume Year-on-Year (December 2021 vs December 2020) increased 4.81% to $986.560 billion.

FXSpotStream’s ADV for the year 2021 (2021 vs 2020) increased 13.48% to $48.397 billion compared to the same period last year.

FXSpotStream Overall Volume Year-on-Year (2021 vs 2020) increased 13.48% to $12.583 trillion, crossing the $12 trillion mark for the first time in the company's history.

2021 proved to be a strong year for FXSpotStream; below are some of the highlights from 2021:

Crossed the USD12trillion mark in terms of Overall Volume supported in 2021, the first time this has been achieved in company history.

Monthly volumes crossed the $1 trillion mark seven times in 2021, compared to just once in previous years.

Registered the second and third highest ADVs in company history in March 2021 ($54.674 billion) and November 2021 ($51.538 billion). These trail only March 2020's ADV of $62.378 billion as volatility around COVID-19 reached its peak.

FXSpotStream’s ADV for the year 2021 increased 13.48% to $48.397 billion when compared to the ADV for the year 2020 ($42.648 billion).

Other notable milestones for the company in 2021 include:

In October, FXSpotStream deployed new micro-second low-latency architecture in New York and London, with Tokyo being rolled out on Q1 2022.

Also in October, leading Japanese industry magazine for financial professionals J-Money, voted FXSpotStream Best Margin FX ECN/Multi bank platform in the J-Money Survey for the 5th consecutive year.

In June, the company went live with algos and allocations functionality over its API.

To contact FXSpotStream's sales team, please use the links below:

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.