RBNZ Cuts Rates but Leaves the Kiwi at a Crossroads

ACY Securities - Luca Santos

ACY Securities - Luca Santos

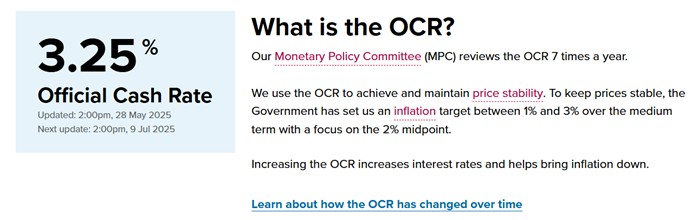

The Reserve Bank of New Zealand has officially entered easing mode, cutting the Official Cash Rate (OCR) by 25 basis points to 3.25% in yesterday’s decision. Markets had fully priced in the move, but the real takeaway came from the tone of the statement, the shape of the new interest rate track, and the split vote that suggests a central bank grappling with rising inflation expectations and falling global momentum simultaneously.

OCR

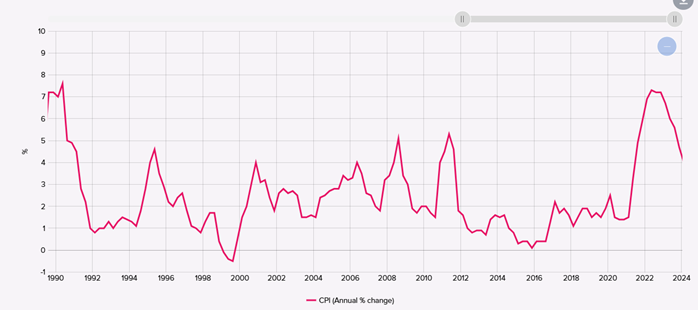

At first glance, the message looked balanced. But dig deeper and it’s clear the RBNZ is preparing for a long road ahead. The revised OCR path now dips to a low of 2.85%, softer than the previous 3.1% trough. That sends a signal: while inflation is currently sitting within the 1–3% band, the Bank is still worried about global headwinds, weak domestic demand, and the risk of a more prolonged disinflationary environment.

New Zealand Inflation

Split Vote, Split Outlook

This wasn’t a unanimous decision. One committee member preferred to hold rates steady, arguing for patience in the face of recent inflation surprises. And while the market focused on the 25bp cut, what mattered more was the profile of the rate path. Rather than a fast or aggressive easing cycle, the RBNZ charted a more gradual descent more "drift" than "drop."

In other words, they want the market to know we’re easing, but we're not rushing.

This cautious tone likely stems from conflicting forces. On one hand, the domestic economy is still recovering after last year’s contraction, with spare capacity and falling wage growth pointing to softer underlying momentum. On the other hand, inflation expectations especially among households have risen. Some of that is tied to global stories: higher food prices, U.S. tariffs, and supply chain uncertainty.

It’s this global uncertainty that keeps popping up in the RBNZ's narrative. They laid out two scenarios: one where tariffs drive imported inflation higher (a supply-side shock), and another where weaker global demand hits New Zealand exports (a demand-side hit). In either case, the implications for rates could be very different. The Bank doesn’t pretend to know which scenario will win out—but they’re making sure they’re positioned to respond either way.

Market Reaction: Kiwi Bounces, But Watch the Path

Interestingly, despite the cut, the NZD nudged higher. Part of that is technical positioning had leaned too far into dovish bets. But it also reflects how the RBNZ's easing path was gentler than some expected. The more gradual slope, plus the fact that one member voted against easing, gave markets a reason to reprice the odds of back-to-back cuts in July or August.

NZDUSD 15m Chart

I’m still leaning toward further easing from here. The economic recovery is fragile, global trade uncertainty remains high, and the RBNZ’s own forecasts hint that more support may be needed to ensure inflation stays anchored. But the message is clear: they’re in no rush. Any further cuts will be conditional on the data and on whether global risks materialise or fade.

Zooming Out: Policy Divergence Matters

In the broader FX context, the RBNZ’s move adds to the growing divergence among major central banks. The Fed remains stuck in wait-and-see mode, with sticky inflation complicating the case for cuts. The ECB is gearing up for a likely June move, while the BoE continues to kick the can on its own tightening bias.

This divergence matters. If the RBNZ continues easing while the Fed holds firm, NZD/USD will come under fresh pressure. But if the Fed finally pivots or if global growth deteriorates rapidly those rate differentials could compress again.

The Kiwi is no longer just about dairy prices and local data. It's now sitting at the intersection of global tariffs, commodity volatility, and a central bank trying to walk a narrow path between credibility and caution.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.