CPI Numbers Are Out: What It Means for the Commodity Market

ACY Securities - Jasper Osita

ACY Securities - Jasper OsitaOverview:

- USD Reaction to CPI Data:

- CPI figures paint a positive picture for the USD.

- Lack of strong follow-through suggests market caution.

- Gold's Steady Ascent:

- Gold remains attractive as economic uncertainty persists.

- Bounced off key support and is eyeing higher resistance levels.

- Market Sentiment and Economic Signals:

- CPI data is favorable, but employment numbers lag behind expectations.

- Tariff Impact on Natural Gas Prices:

- U.S. tariffs on Canadian imports are temporarily delayed, creating market uncertainty.

- A 25% tariff on all Canadian goods and a 10% tariff on Canadian energy exports could drive up Natural Gas prices.

- Price Levels to Watch:

- Natural Gas is showing bullish momentum, with potential to reach the 4000 & 4200 level.

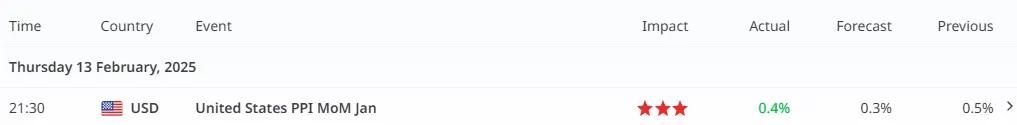

The latest CPI numbers are out, painting a positive picture for the USD. Yet, despite the encouraging data, the Dollar is struggling to gain strong follow-through momentum.

Gold Holds Steady Amid Mixed Economic Signals

Daily Outlook

While the CPI data favors the USD, the employment numbers tell a different story, coming in lower than forecasted. This discrepancy between inflation and employment figures is creating uncertainty in the market.

H4 Outlook

In response, Gold is gaining traction, becoming an attractive asset as investors weigh the mixed economic signals. Gold recently bounced off the 2864 - 2868 support level, reacting positively after testing the 50% retracement of its previous range.

Gold bounced off the 2864 - 2868 level and has reacted positively after testing the 50% level of the previous range. Check out this link prior to this analysis.

With this bullish momentum, Gold could potentially target the 2942.69 level and even approach the 3000 marks soon.

Trading Approach: Navigating CPI Impact on USD and Gold

- Assess USD Momentum

- Monitor for a confirmed bullish follow-through on USD. If momentum builds, consider shorting Gold as a stronger Dollar typically pressures Gold prices.

- If USD remains stagnant despite positive CPI, it signals market hesitation, potentially boosting Gold as a safe-haven asset.

- Gold Key Levels to Watch

- Support Zone: 2864 - 2868 — If Gold holds this level, it suggests strong buying interest.

- Target Levels: 2942.69 and 3000 — These are potential upside targets if USD momentum remains weak.

- Risk Management

- Set tight stop-losses below the 2864 level for long positions on Gold to minimize risk if the USD gains strength.

- For short positions, monitor USD’s follow-through momentum and adjust positions accordingly.

Natural Gas: Still On the Move

Daily

H4

As of February 13, 2025, the United States has imposed tariffs on Canadian imports, but their implementation has been temporarily delayed. On February 1, 2025, President Donald Trump signed executive orders imposing a 25% tariff on all goods from Canada, with a reduced 10% tariff specifically for Canadian energy exports. These tariffs were initially set to take effect on February 4, 2025.

However, following discussions between President Trump and Canadian Prime Minister Justin Trudeau, the implementation of these tariffs has been postponed for 30 days. This delay allows both nations to negotiate and address the concerns that led to the tariff proposals.

In response to the U.S. tariffs, Canada has announced retaliatory measures, including a 25% tariff on $30 billion worth of U.S. goods, effective February 4, 2025.

Market Implications

With the uncertainty surrounding tariffs and potential cost increases on energy exports, Natural Gas prices could see significant movements. If bullish momentum continues, we could see prices reach the 4000 level. Should tariff concerns intensify and supply constraints arise, prices may even overshoot to the 4200 level.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.