EUR/USD Dollar Strength Persists Amid ECB and Inflation Signals

ACY Securities - Luca Santos

ACY Securities - Luca Santos

Dollar Resilience Bolstered by Inflation Data

The U.S. dollar has ended the week on a strong note, buoyed by firmer-than-expected inflation data. Recent figures showed steady price pressures, reinforcing market confidence in the Federal Reserve's current policy stance. Although the upcoming release of the core CPI deflator is projected to be moderate, the broader inflation narrative has kept U.S. Treasury yields supported, further enhancing the dollar’s appeal.

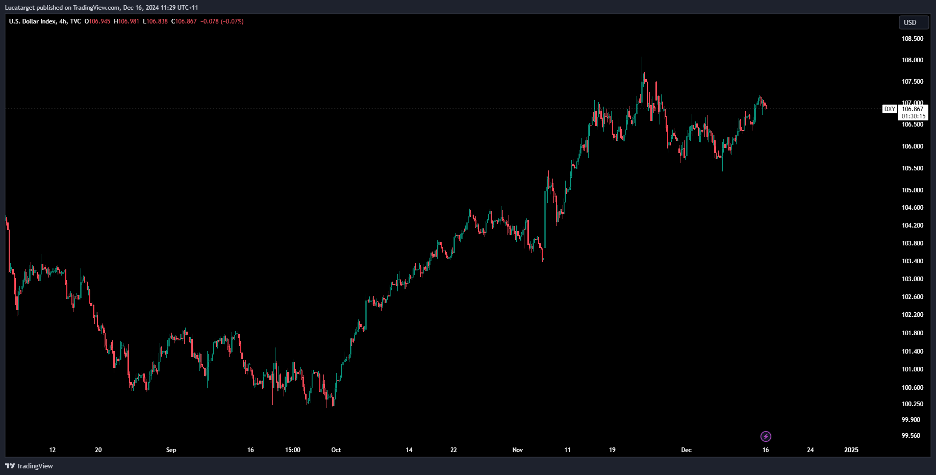

Notably, the dollar index (DXY) has been testing key resistance levels, with quiet market conditions favouring its continued strength. December’s typical seasonal dollar weakness has yet to materialize, providing further encouragement for dollar bulls.

DXY Chart H4

Euro Struggles Against Policy and Market Sentiment

On the European side, the European Central Bank (ECB) recently held its policy meeting, and while ECB President Christine Lagarde struck a less dovish tone than anticipated, the euro still faced headwinds. The broader outlook for eurozone interest rates remains bearish, with indications that the ECB may continue to reduce rates even after reaching the so-called “neutral” zone.

A widening yield spread between Italian and German bonds further reflects investor concerns, though much of this movement appears tied to profit-taking rather than deeper structural fears. Against this backdrop, EUR/USD has remained anchored near the 1.05 mark, with little impetus to move beyond this range in the short term.

EURUSD H4 Chart

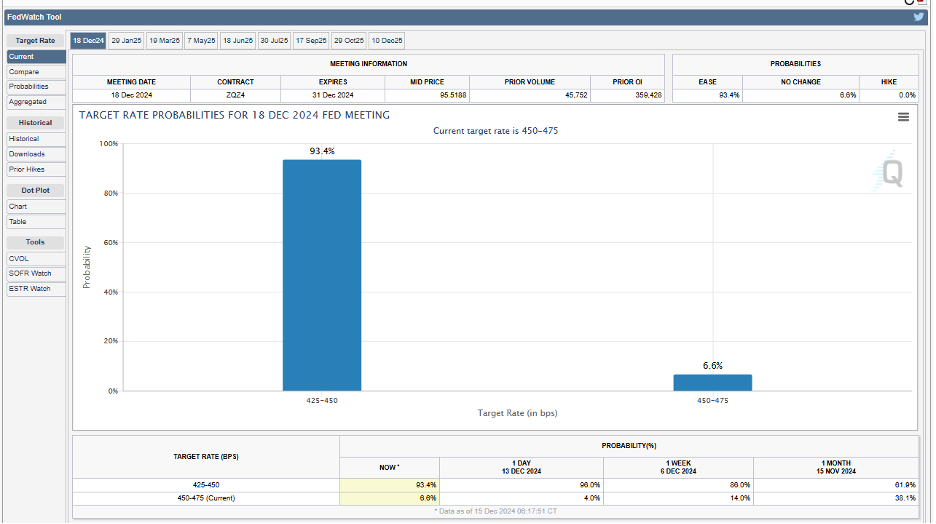

The Next Big Test: U.S. Federal Reserve Meeting

Looking ahead, all eyes are on next week’s Federal Open Market Committee (FOMC) meeting. While the market does not anticipate any drastic policy changes, the event could still serve as a catalyst for the EUR/USD pair. For now, the pair is expected to trade within a narrow range of 1.0450-1.0550, as traders assess the evolving monetary policy landscapes on both sides of the Atlantic.

CME FedWatch Tool

Elsewhere, central bank actions in Switzerland and the Czech Republic have added to the complexity of the global FX landscape. The Swiss National Bank's decision to cut rates more aggressively underscores the diverse monetary policy responses across regions. Meanwhile, muted market reactions in Central and Eastern Europe suggest limited spillover effects from ECB decisions.

What’s Next for EUR/USD?

For euro bears, the near-term outlook appears favourable. With the dollar maintaining its carry advantage and the ECB facing persistent challenges, the EUR/USD pair is unlikely to break higher without a significant shift in fundamentals. However, unforeseen geopolitical or economic developments could always alter this dynamic. I’ve done a video on ECB rate cuts last week you can check it out HERE.

In summary, the EUR/USD remains firmly within its established range, reflecting the broader tug-of-war between a resilient dollar and a struggling euro. As markets head into the holiday season, cautious positioning and close monitoring of key data releases will be critical for traders navigating this landscape.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

Why Is Forex Trading So Difficult?

How To Master MT4 & MT5 - Tips And Tricks For Traders

The Importance Of Fundamental Analysis In Forex Trading

Forex Leverage Explained: Mastering Forex Leverage In Trading & Controlling Margin

The Importance Of Liquidity In Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency And Reduce Stress

Best Currency Pairs To Trade In 2024

Forex Trading Hours: Finding The Best Times To Trade FX

MetaTrader Expert Advisor - The Benefits Of Algorithmic Trading And Forex EAs

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.