DXY Crashes Below Key Support – Here's Why It's Falling and What’s Next

Alchemy Markets - Zorrays Junaid

Alchemy Markets - Zorrays JunaidWhat’s Going On With the Dollar?

The U.S. Dollar Index (DXY) has taken a sharp dip this week, breaking below key trendline support. One major catalyst behind this movement is a credit rating downgrade by Moody’s, a top-tier credit rating agency. Let's break it down step-by-step so you can understand why this is such a big deal.

Why Did Moody's Downgrade the U.S.?

1. What happened?

Moody’s issued a credit rating downgrade for the U.S. government. Think of this like your personal credit score dropping—from “excellent” to just “very good.” It’s not catastrophic, but it’s a warning sign.

2. Why did they do that?

The U.S. government has over $36 trillion in debt, and with plans for potential tax cuts and increased spending, that number could rise even higher. Moody’s is concerned about how the government plans to manage such a large amount of borrowing.

3. Why does this matter?

When a country's credit rating drops, it's seen as riskier to lend to. Investors then demand higher interest rates to compensate for that risk. That’s why yields on 30-year U.S. Treasury bonds have surged past 5%—a big and fast move.

4. And how does this affect the dollar?

As confidence drops, foreign investors begin to sell U.S. assets—including the dollar. This triggers a decline in dollar value compared to other currencies around the world.

In simple terms:

“The U.S. just got a warning for having too much debt. Investors are now a bit more cautious, so they’re selling U.S. bonds and dollars—which is why the dollar’s been dropping this week.”

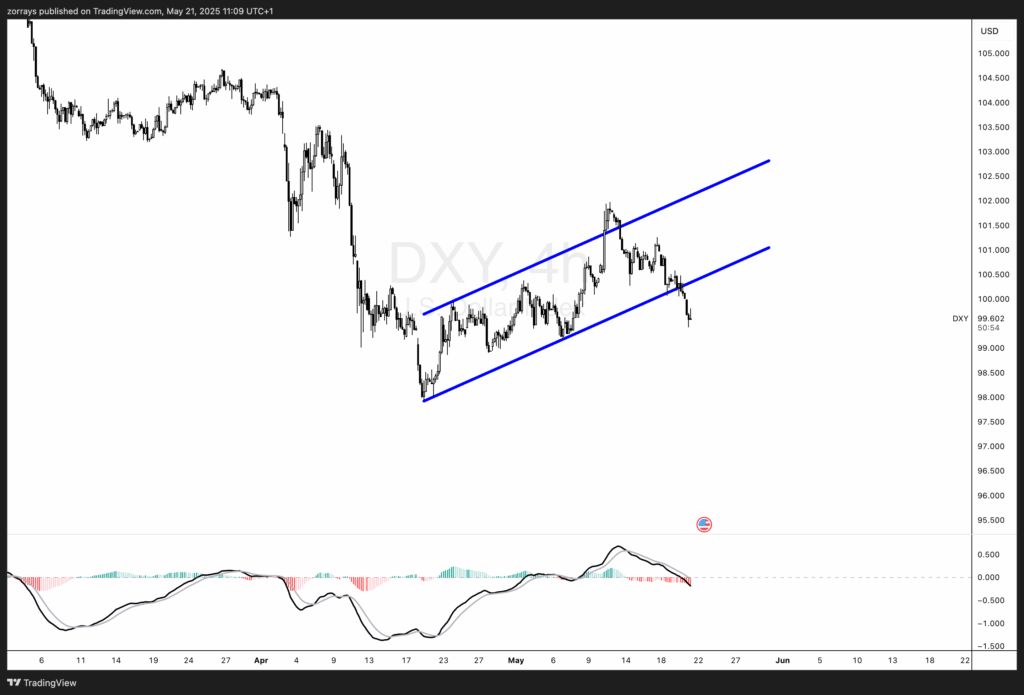

Technical Breakdown: DXY Breaches Trend Channel Support

Looking at the 4-hour chart of the U.S. Dollar Index (DXY), we can see a clear breakdown of the rising channel (marked in blue). Here’s what stands out:

1. Price Structure and Channel Break

- The dollar had been consolidating within a rising channel for most of May.

- That structure was violated to the downside, confirming a bearish breakout.

- Price has cleanly broken below the lower trendline, which often signals continuation of downside momentum.

2. Momentum Indicator: MACD Bearish Crossover

- The MACD (Moving Average Convergence Divergence) has formed a bearish crossover—the signal line has crossed above the MACD line.

- This indicates negative momentum is increasing.

- The histogram is also printing red bars, confirming bearish divergence and loss of bullish pressure.

What to Expect Next: More Downside Likely

Given both the fundamental backdrop (credit rating fears, rising debt concerns) and technical confirmation (channel breakdown + bearish MACD), the dollar is set for further downside in the short to medium term.

Key levels to watch:

- 99.00 – psychological round number and near-term support

- 97.80–98.00 – previous structure support from March/April

- Break below 97.00 – could trigger a deeper decline toward mid-95s

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.