EUR/USD – Flag Formation Tightens as Traders Brace for Breakout

Alchemy Markets - Zorrays Junaid

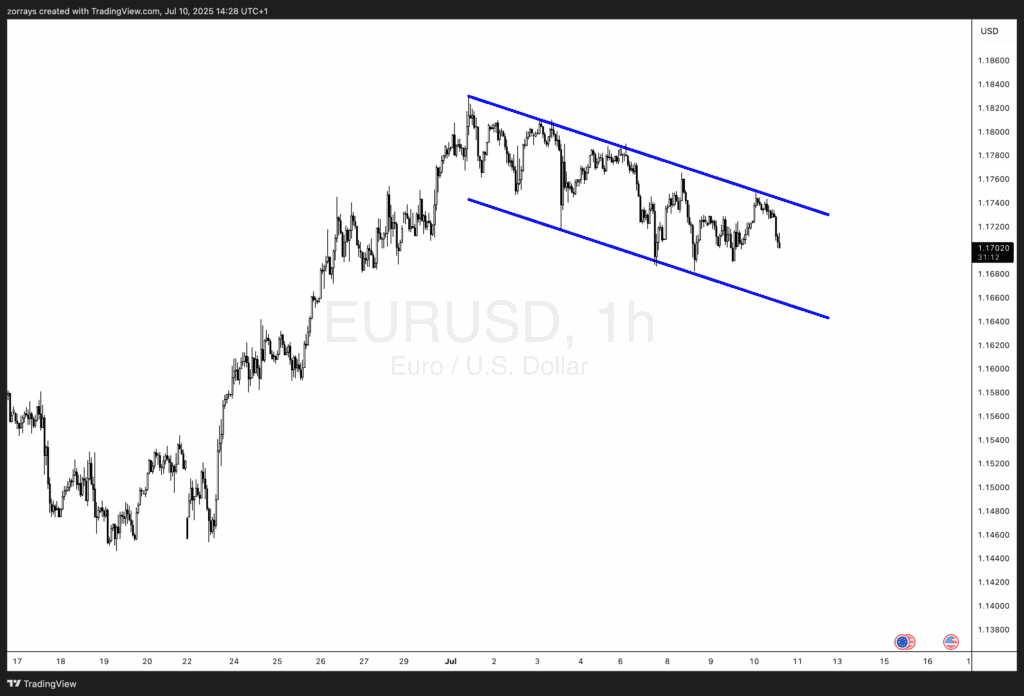

Alchemy Markets - Zorrays JunaidEUR/USD, 1H Chart | July 10, 2025

The EUR/USD pair is currently coiling within a clearly defined descending flag pattern, teasing traders with a breakout as price action narrows between parallel support and resistance lines. With current levels hovering around 1.17030, this pair is at a technical crossroads, poised to either confirm further downside momentum or surprise with a bullish reversal.

Technical Setup:

The chart shows a textbook flag formation, often seen as a continuation pattern. After a steep bullish rally into late June, EUR/USD entered a downward sloping consolidation, forming lower highs and lower lows. Price action remains compressed between parallel blue trend lines, with volatility dropping and a breakout appearing increasingly imminent.

Volatility Compression Signals Imminent Move

A key factor supporting this tightening range is the marked decline in volatility:

- 1-week historical volatility has dipped below 7.0, reflecting extreme caution from market participants.

- This is a sharp contraction from 20 in April, and even from 9.0 just two weeks ago.

This volatility compression often precedes explosive breakouts. With EUR/USD winding tighter inside this flag, the odds are increasing for a sharp move in either direction once the breakout occurs.

Fundamentals: Trump Tariffs and Trade Deal Watch

Traders are on high alert following U.S. tariff noise under Trump’s administration. Despite headline risks, the dollar remains resilient, with the market seemingly underpricing escalation risks.

Meanwhile, headlines surrounding a potential US-EU trade deal are contributing to the calm. Reports suggest a de-escalation via asymmetrical tariffs (likely 10%), a factor that's likely priced in already. With no major surprises expected in the final deal, EUR/USD could remain magnetised to the 1.170–1.175 zone in the short term.

Conclusion:

EUR/USD is caught in a calm-before-the-storm scenario. With volatility scraping lows, risk reversals returning to neutral, and markets glued to trade deal headlines and ECB soundbites, the pair is ripe for a breakout. Traders should keep a close eye on the technical levels of the flag pattern. Whichever way it breaks, the move is likely to be swift and decisive.

LiquidityFinder

LiquidityFinder was created to take the friction out of the process of sourcing Business to Business (B2B) liquidity; to become the central reference point for liquidity in OTC electronic markets, and the means to access them. Our mission is to provide streamlined modern solutions and share valuable insight and knowledge that benefit our users.

If you would like to contribute to our website or wish to contact us, please click here or you can email us directly at press@liquidityfinder.com.